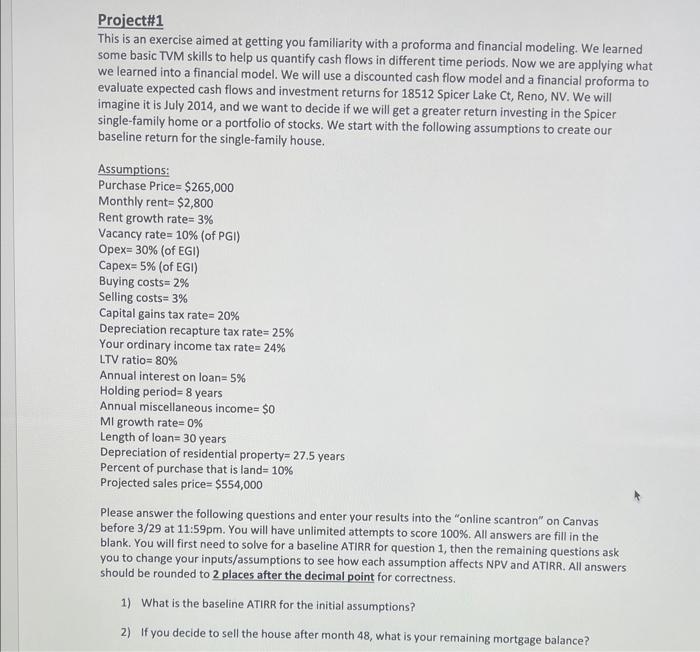

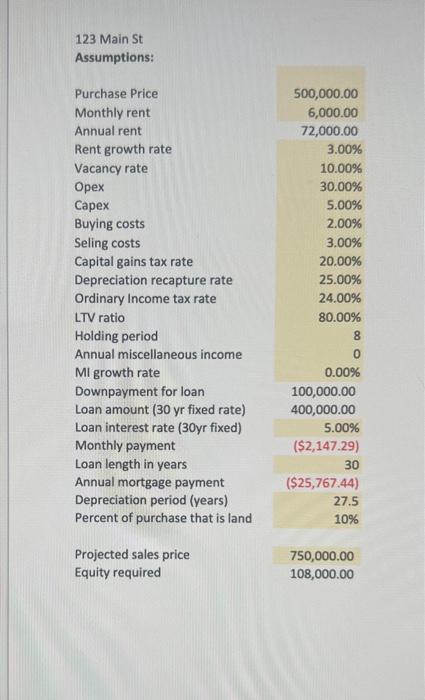

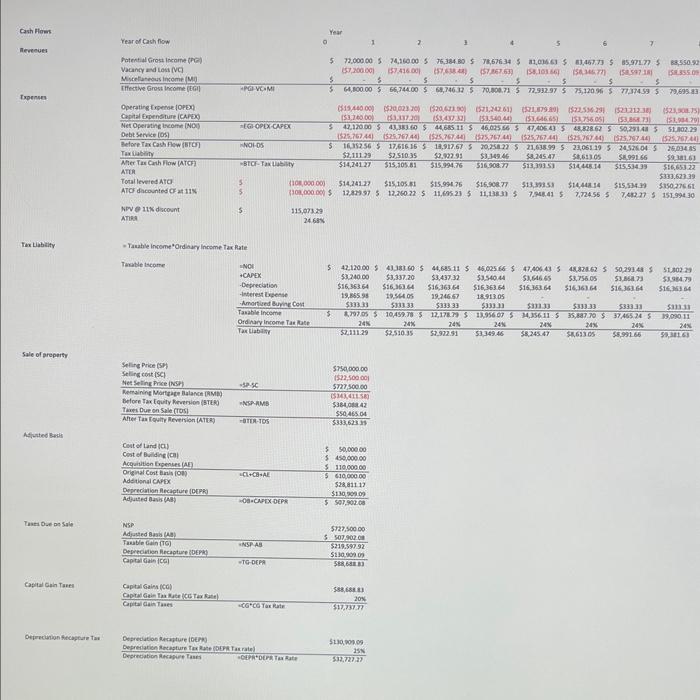

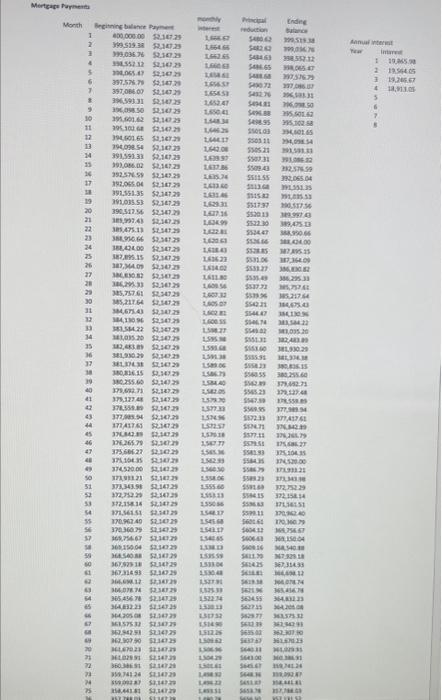

Project\#1 This is an exercise aimed at getting you familiarity with a proforma and financial modeling. We learned some basic TVM skills to help us quantify cash flows in different time periods. Now we are applying what we learned into a financial model. We will use a discounted cash flow model and a financial proforma to evaluate expected cash flows and investment returns for 18512 Spicer Lake Ct, Reno, NV. We will imagine it is July 2014 , and we want to decide if we will get a greater return investing in the Spicer single-family home or a portfolio of stocks. We start with the following assumptions to create our baseline return for the single-family house. Assumptions: Purchase Price =$265,000 Monthly rent =$2,800 Rent growth rate =3% Vacancy rate =10% (of PGI) Opex =30% (of EGI) Capex =5% (of EGI) Buying costs =2% Selling costs =3% Capital gains tax rate =20% Depreciation recapture tax rate =25% Your ordinary income tax rate =24% LTV ratio =80% Annual interest on loan =5% Holding period =8 years Annual miscellaneous income =$0 MI growth rate =0% Length of loan =30 years Depreciation of residential property =27.5 years Percent of purchase that is land =10% Projected sales price =$554,000 Please answer the following questions and enter your results into the "online scantron" on Canvas before 3/29 at 11:59pm. You will have unlimited attempts to score 100%. All answers are fill in the blank. You will first need to solve for a baseline ATIRR for question 1 , then the remaining questions ask you to change your inputs/assumptions to see how each assumption affects NPV and ATIRR. All answers should be rounded to 2 places after the decimal point for correctness. 1) What is the baseline ATIRR for the initial assumptions? 2) If you decide to sell the house after month 48 , what is your remaining mortgage balance? 123 Main St Assumptions: PurchasePriceMonthlyrentAnnualrentRentgrowthrateVacancyrateOpexCapexBuyingcostsSelingcostsCapitalgainstaxrateDepreciationrecapturerateOrdinaryIncometaxrateLTVratioHoldingperiodAnnualmiscellaneousincomeMIgrowthrateDownpaymentforloanLoanamount(30yrfixedrate)Loaninterestrate(30yrfixed)MonthlypaymentLoanlengthinyearsAnnualmortgagepaymentDepreciationperiod(years)PercentofpurchasethatislandOat500,000.006,000.0072,000.003.00%10.00%30.00%5.00%2.00%3.00%20.00%25.00%24.00%80.00%800.00%100,000.00400,000.005.00%($2,147.29)3010%($25,767.44)27.50 Projected sales price Equity required 750,000.00 108,000.00 Sale of arepert Afficted kndi Tuse o.e on sale castal Gen Taue: orirectivion Atecopero tai Project\#1 This is an exercise aimed at getting you familiarity with a proforma and financial modeling. We learned some basic TVM skills to help us quantify cash flows in different time periods. Now we are applying what we learned into a financial model. We will use a discounted cash flow model and a financial proforma to evaluate expected cash flows and investment returns for 18512 Spicer Lake Ct, Reno, NV. We will imagine it is July 2014 , and we want to decide if we will get a greater return investing in the Spicer single-family home or a portfolio of stocks. We start with the following assumptions to create our baseline return for the single-family house. Assumptions: Purchase Price =$265,000 Monthly rent =$2,800 Rent growth rate =3% Vacancy rate =10% (of PGI) Opex =30% (of EGI) Capex =5% (of EGI) Buying costs =2% Selling costs =3% Capital gains tax rate =20% Depreciation recapture tax rate =25% Your ordinary income tax rate =24% LTV ratio =80% Annual interest on loan =5% Holding period =8 years Annual miscellaneous income =$0 MI growth rate =0% Length of loan =30 years Depreciation of residential property =27.5 years Percent of purchase that is land =10% Projected sales price =$554,000 Please answer the following questions and enter your results into the "online scantron" on Canvas before 3/29 at 11:59pm. You will have unlimited attempts to score 100%. All answers are fill in the blank. You will first need to solve for a baseline ATIRR for question 1 , then the remaining questions ask you to change your inputs/assumptions to see how each assumption affects NPV and ATIRR. All answers should be rounded to 2 places after the decimal point for correctness. 1) What is the baseline ATIRR for the initial assumptions? 2) If you decide to sell the house after month 48 , what is your remaining mortgage balance? 123 Main St Assumptions: PurchasePriceMonthlyrentAnnualrentRentgrowthrateVacancyrateOpexCapexBuyingcostsSelingcostsCapitalgainstaxrateDepreciationrecapturerateOrdinaryIncometaxrateLTVratioHoldingperiodAnnualmiscellaneousincomeMIgrowthrateDownpaymentforloanLoanamount(30yrfixedrate)Loaninterestrate(30yrfixed)MonthlypaymentLoanlengthinyearsAnnualmortgagepaymentDepreciationperiod(years)PercentofpurchasethatislandOat500,000.006,000.0072,000.003.00%10.00%30.00%5.00%2.00%3.00%20.00%25.00%24.00%80.00%800.00%100,000.00400,000.005.00%($2,147.29)3010%($25,767.44)27.50 Projected sales price Equity required 750,000.00 108,000.00 Sale of arepert Afficted kndi Tuse o.e on sale castal Gen Taue: orirectivion Atecopero tai