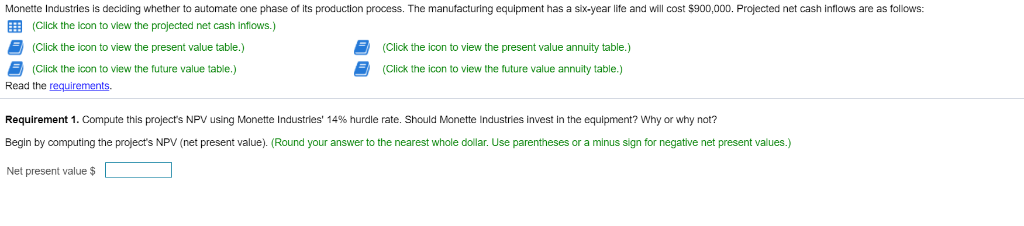

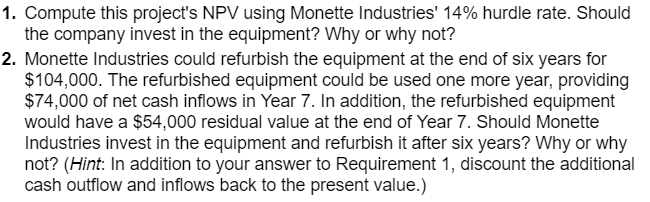

PROJECTED NET CASH FLOW

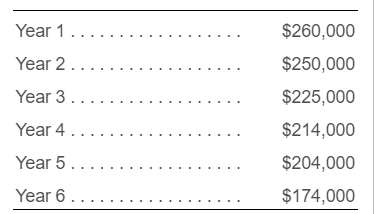

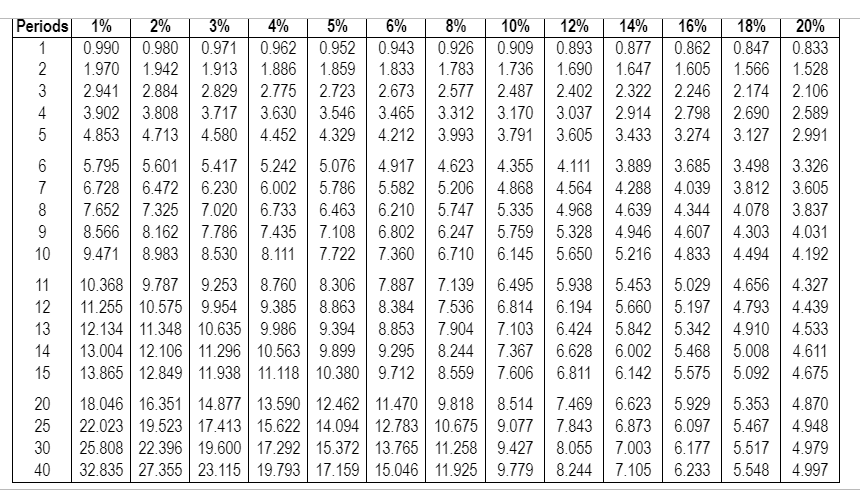

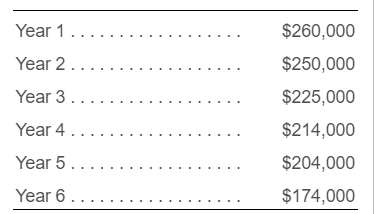

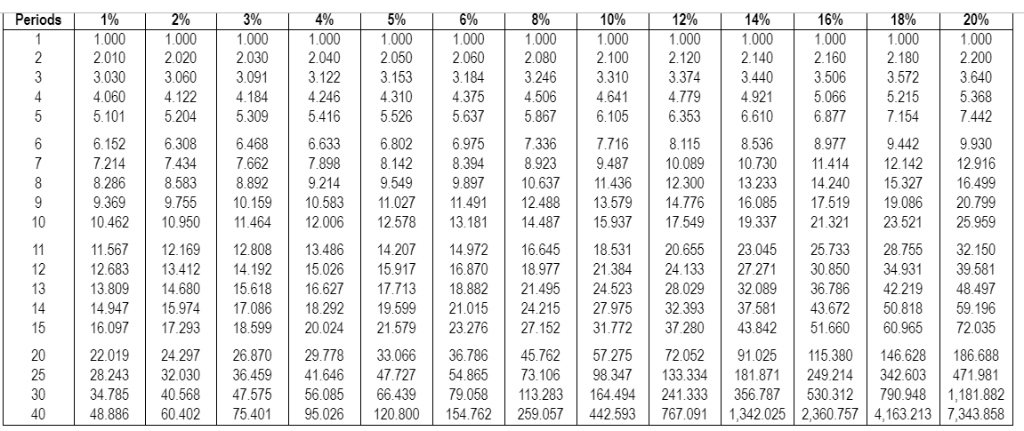

PRESENT VALUE OF $1

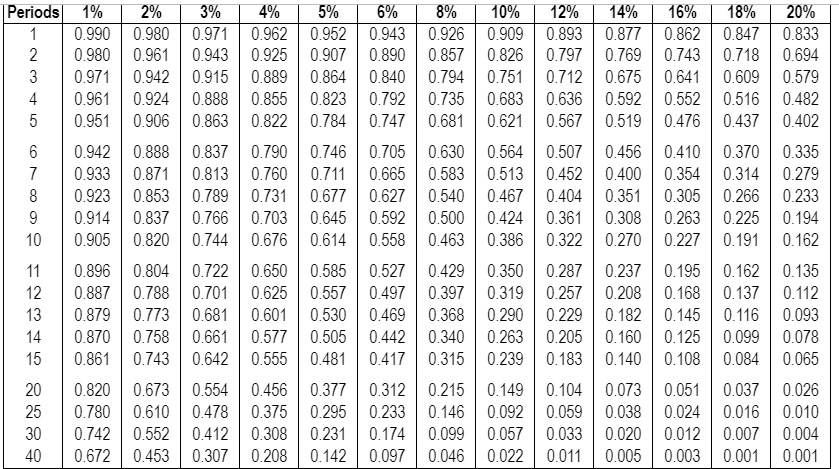

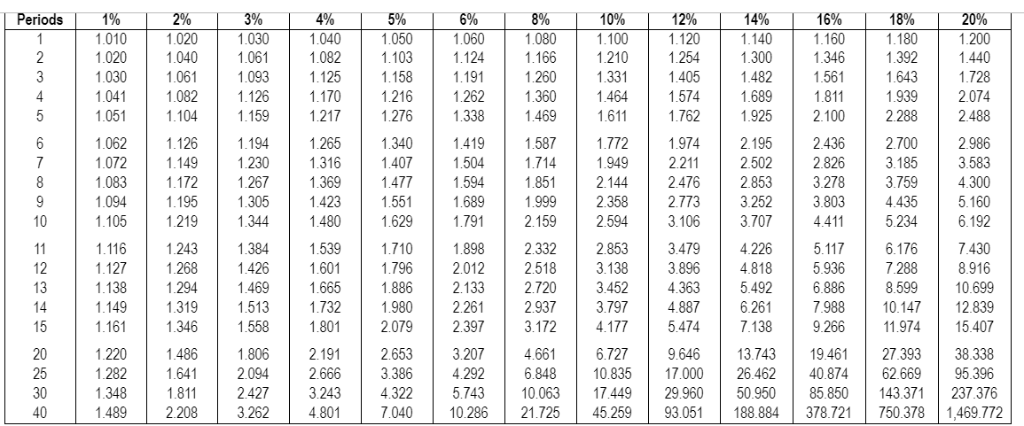

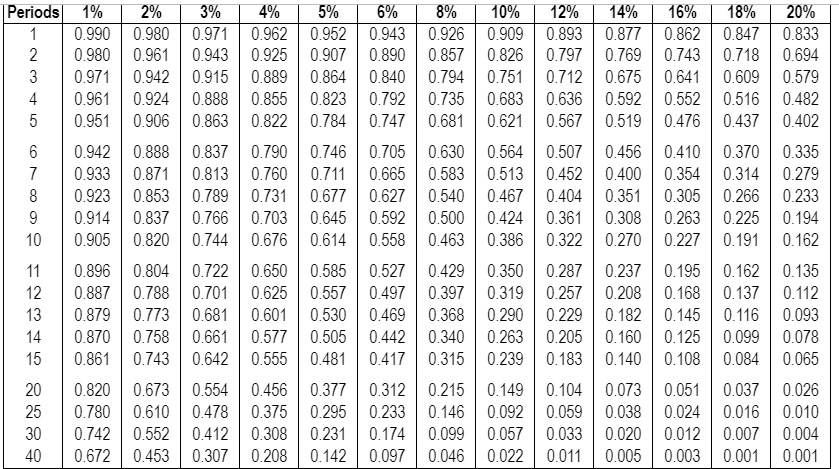

PRESENT VALUE OF ANNUITY OF $1

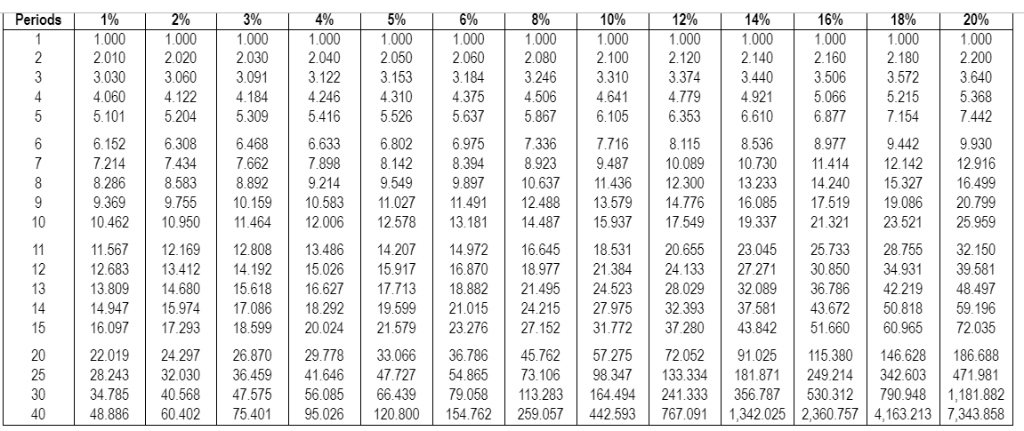

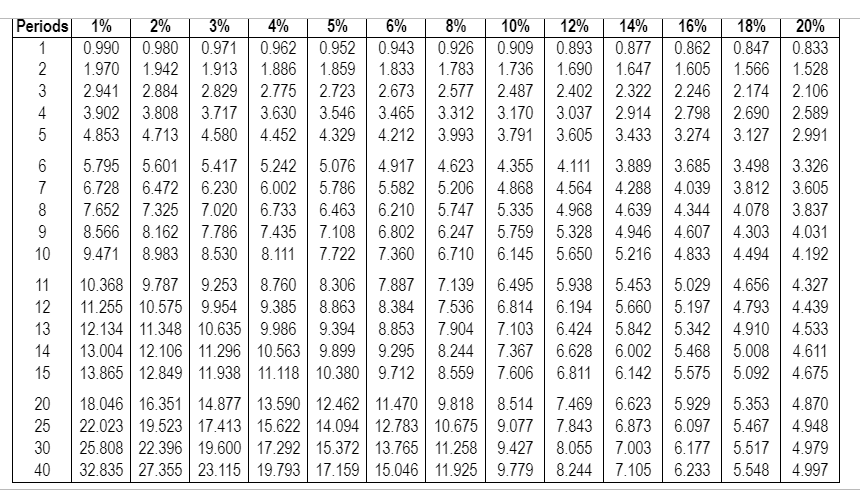

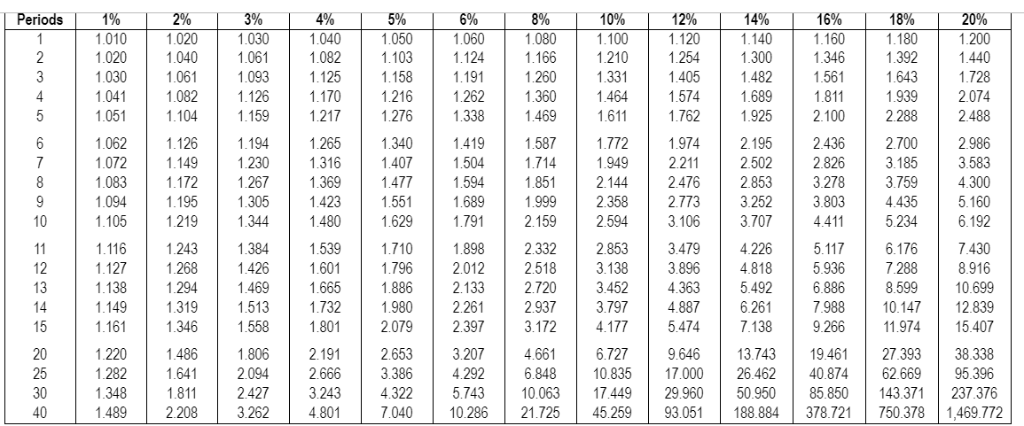

FUTURE VALUE OF $1

FUTURE VALUE OF ANNUITY OF $1

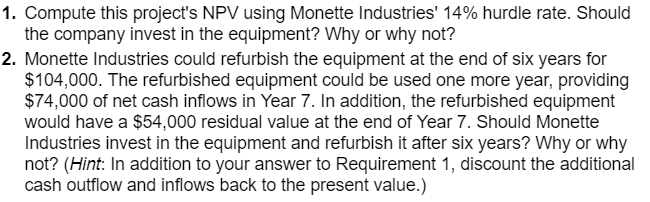

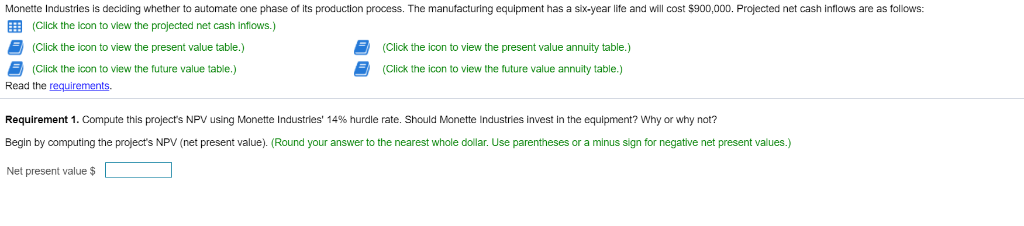

Monette Industries is decicing whether to automate one phase of its production process. The manufacturing equipment has a six-yea life and will cost $900,000. Projected net cash inflows are as follows: E (Click the lcon to view the projected net cash intlows.) (Click the icon to view the present value table.) Click the icon to view the future value table.) (Click the icon to view the present value annuity table.) (Click the icon to view the future value annuity table.) Read the requirements. Requirement 1 Compute this ro ecrs NPv usina Monette Industries' 14% hurdle rate. Should Monette industries invest in the e uipment, wh/or why not? Begin by computing the project's NPV (net present value). (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) Net present value $ 1. Compute this project's NPV using Monette Industries' 14% hurdle rate. Should the company invest in the equipment? Why or why not? 2. Monette Industries could refurbish the equipment at the end of six years for $104,000. The refurbished equipment could be used one more year, providing $74,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $54,000 residual value at the end of Year 7. Should Monette Industries invest in the equipment and refurbish it after six years? Why or why not? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.) Periods 1% 18% | 20% 10.990 0.980 0.971 0.962 0.952 0.9430.926 0.9090.893 0.877 0.862 0.847 0.833 2 0.980 0.961 0.943 0.925 0.9070.8900.8570.826 0.7970.7690.743 0.718 0.694 3 0.971 0.942 0.915 0.889 0.864 0.8400.7940.7510.712 0.675 0.641 0.609 0.579 4 0.961 0.924 0.888 0.855 0.823 0.792 0.7350.683 0.636 0.592 0.5520.516 0.482 5 0.951 0.906 0.863 0.822 0.784 0.7470.6810.621 0.5670.519 0.476 0.437 0.402 6 0.942 0.888 0.837 0.790 0.746 0.7050.6300.5640.5070.456 0.410 0.370 0.335 7 0.933 0.871 0.813 0.760 0.711 0.6650.583 0.513 0.452 0.400 0.354 0.314 0.279 8 0.923 0.853 0.789 0.731 0.6770.6270.5400.467 0.404 0.351 0.305 0.266 0.233 9 0.914 0.837 0.766 0.703 0.645 0.5920.5000.424 0.361 0.308 0.263 0.225 0.194 10 0.905 0.820 0.744 0.676 0.614 0.558 0.463 0.386 0.322 0.270 0.227 0.191 0.162 11 0.896 0.804 0.722 0.650 0.585 0.5270.4290.350 | 0.2870.237 0.195 0.162 0.135 12 0.887 0.788 0.701 0.625 0.557 0.4970.397 0.319 0.257 0.208 0.168 0.137 0.112 13 0.879 0.773 0.681 0.601 0.530 0.469 0.3680.2900.229 0.182 0.145 0.116 0.093 14 0.870 0.758 0.661 0.577 0.505 0.442 0.340 0.2630.2050.160 0.125 0.099 0.078 15 0.861 0.743 0.642 0.555 0.481 0.4170.315 0.2390.183 0.140 0.108 0.084 0.065 20 0.820 0.673 0.554 0.456 0.377 0.312 0.2150.1490.104 0.073 0.051 0.037 0.026 25 0.780 0.610 0.478 0.3750.295 0.233 0.1460.092 0.059 0.038 0.024 0.016 0.010 30 0.742 0.552 0.412 0.308 0.231 0.174 0.0990.0570.033 0.020 0.012 0.007 0.004 40 0.672 0453 0.307 0.208 0.142 0.097 0.046 0,022 0.011 0.005 0.003 0.001 0.001 2% 8 40 5% 8 10 12% | 14% 16 3 91 65712 79 15 0897 339 23 801 34566 8 0-8 5 1 59 3 01222 33344 44444 4444 764 7 8283 3082 3778 161 480 4 679 0 345 01223 33444 44455 5555 25684 59 9-60497 83 6-86272 60 7285 45 9012 01223 34444 55555 5666 68 01 43 98966 30222 3335 13 883 394 826 01223 34445 55566 6677 275 I 481 935 221 6 36 91468 4 01233 44455 56666 7788 595 5437 96701 5 3879 5 7417 38 01233 44556 66777 8999 770 9 727 1 23 3 862 91 9753 01233 45566 77788 9 33352 72020 7 352 0356 786 3761 18106 8 8642 95283 838 7 477 1235 01234 45667 78899 2936 552 6638 7860 2 3 07417 59-987 0 2457 01234 55677 8899 223 265 2 22351 6 2 741 739 01234 56678 899 4 2 01 3579 70 7 |9 9 8 7 5 42075 29 01234 56778 99 011 4793 9 1365 5295 3533 83 12523 7 01 07268 8 887 64319 7 01234 56788 9 269 5 6385 0123 58261 5 92567 8 77654 36 2 1 088 338 01234 56789 2 0 12345 500 12345 6789 0%-200 40 999 009 996 014 400 996 ses 300 160 102 400 211122 23456 78021 85 46 97 519 3 1 1 224 750 -11-12 23345 678 10 11 6% 160 996 ssi 011 100 400 $25 201 800-11 17 SOB 996 998 200 ARI 1-1 1 1 12 22334 55679 19 7 0 91 416 48 250 100 210 33 ASA 011 72 94 14 350 004 ess 38 52 197 77 27 2 075 22 23334 6 8% 000 195 250 360 999 ser con 999 199 32 $15 /20 997 112 001 013 OBO 125 721 1 2 9 91 7 801 2 66 07 17 4456 77890 59-01-22 25 70 17 56 3% 000 001 003 125 199 194 200 201 005 34 34 $25 400 013 ese 006 004 47 202 445 8 16 27 20 6 0 12345 20 25 30 40 no 12345 6789 Periods 14% 3 3 3 5.105.2045.309 5416 5.526 5.637 58676.105 6.353 6.610 6.877.154 7.442 7.214 74347.662 7898 8.142 8.394 8.9239.487 10.089 10.730 11.41412.142 12916 9.549 9.897 10.637 11.436 12.30013.233 14.240 15.327 16.499 9.3699.7550.159 10.583 11.027 11.491 248813579 14.776 16.085 17.51919.086 20.799 10.4620.950 11.464 12.006 12.578 13.181 14.487 15.93717.549 19.337 21.32123.521 25.959 156712.16912.808 13486 14.207 14.97216.645 18.531 20.655 23.045 25.73328.755 32.150 2.68313.412 14.192 15.026 15.917 16.870 18.977 21.38424.133 27.271 30.85034.931 39.581 13.809 14.680 15.618 6.627 17.71318.88221.495 24.523 28.029 32.08936.786 42.219 48.497 4.94715.97417.086 18.292 9599 21.015 24.21527.975 32.393 37.581 43.67250.818 59.196 16.097 17.293 18.599 20.024 21.579 23.27627.152 31.772 37.280 43.84251.660 60.965 72.035 22.01924.29726.870 29.77833.066 36.78645.762 57.27572.052 91.025 115.380146.628 186.688 28.24332.030 36.459 41646 47.727 54.865 73.106 98.347 133.334181.871 249.214 342.603 471.981 34.78540.56847.57556.085 66.439 79.058 113.283 164.494 241.333 356.787530.312 790.948 1,181.882 48.886 60.4027540195.026 120.800 154.762259.057 442.593767.091 1,342.025 2,360.757 4,163.213 7,343.858 1 5