Question

PROJECTED STATEMENT OF FINANCIAL POSITION AS AT 31 OCTOBER 2019 R ASSETS Non-Current assets 1 200 000 Fixed /Tangible assets 1 200 000 Current Assets

| PROJECTED STATEMENT OF FINANCIAL POSITION AS AT 31 OCTOBER 2019 | |

|

| R |

| ASSETS |

|

| Non-Current assets | 1 200 000 |

| Fixed /Tangible assets | 1 200 000 |

| Current Assets | 700 000 |

| Inventories | 500 000 |

| Trade and other receivables | 150 000 |

| Cash and cash equivalents | 50 000 |

| Total assets | 1 900 000 |

|

|

|

| EQUITY AND LIABILITIES |

|

| Shareholders equity | 640 000 |

| Ordinary share capital | 400 000 |

| Retained earnings | 240 000 |

| Non- current liabilities | 280 000 |

| Long-term loan | 280 000 |

| Current Liabilities | 980 000 |

| Trade and other payables | 980 000 |

| Total equity and liabilities | 1900 000 |

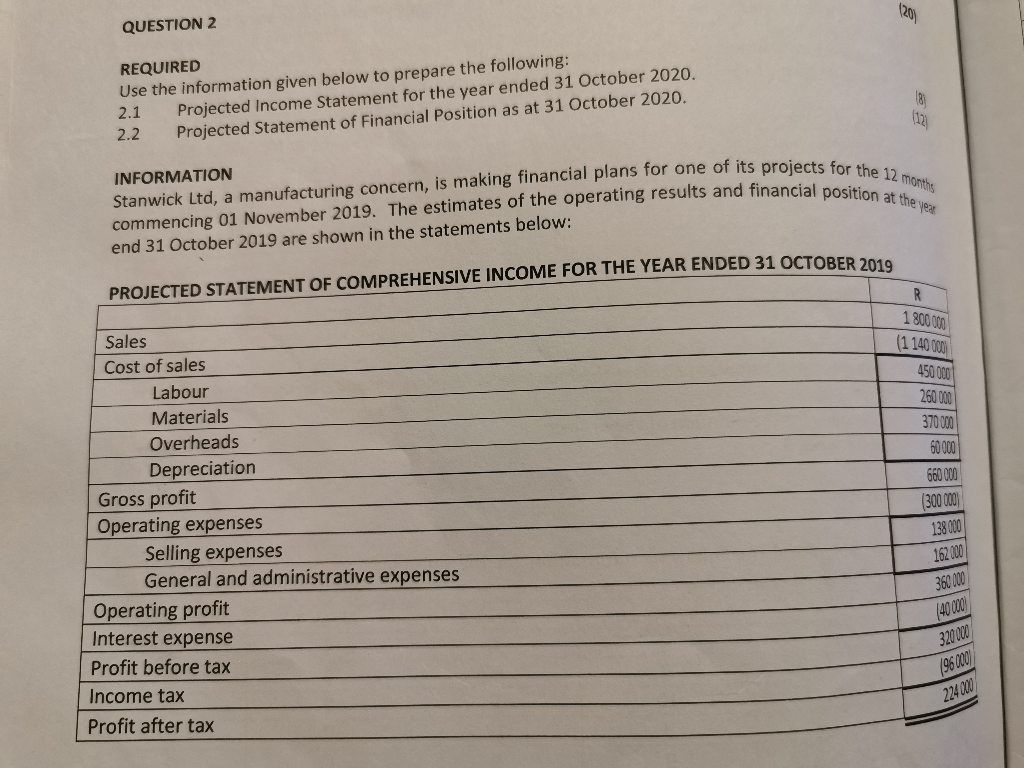

Forecasts, assumptions and additional information for the financial year ending 31 October 2020

- Projected sales are R2 400 000 as compared to the estimated R1 800 000 for the financial year ended 31 October 2019.

- Manufacturing labour will drop to 22% of sales.

- The cost of materials will increase to 16% of sales.

- Overhead costs will rise by 5% over the previous financial year, and additional variable costs will be incurred at a rate of 10% of the incremental sales value.

- New equipment costing R500 000 will be purchased during February 2020, Total depreciation for the year ended 31 October 2020 is estimated at R180 000.

- Selling expenses will rise by R220 000.

- General and administrative expenses as a percentage of sales will be unchanged for the year ended 31 October 2020.

- Interest expense is estimated to be 3% of sales

- Income taxes are estimated at 30% of the pre-tax profits.

- The business maintains a cash balance of R60 000.

- Inventory represents 25% of sales

- Trade and other receivables represent 20% of sales

- Trade and other payables represent 10% of sales

- 60 000 ordinary shares are expected to be issued at R4 each during January 2020

- Dividends of R100 000 are expected to be paid

- Loan repayments totalling R50 000 are expected to be made during the financial year ended 31 October 2020.

- The amount of long-term debt required must be calculated.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started