Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Projecting NOPAT and NOA Using Parsimonious Forecasting Method Following are Target s sales, net operating profit after tax ( NOPAT ) , and net operating

Projecting NOPAT and NOA Using Parsimonious Forecasting Method

Following are Targets sales, net operating profit after tax NOPAT and net operating assets NOA for its year ended February $ millions

Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places.

Financial information

Sales $

Net operating profit after tax NOPAT

Net operating assets NOA

Use the parsimonious method to forecast Targets sales, NOPAT, and NOA for years ended February through using the following assumptions.

Note: Complete the entire question in Excel template provided above Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with two decimal places

Note: When completing the question in Excel, refer directly to the cells containing these assumptions, ie don't type the NOPM number when making a calculation, refer to the cell.

Note: Use negative signs with answers, when appropriate.

Assumptions

Sales growth per year

Net operating profit margin NOPM

Net operating asset turnover NOAT based on NOA at February

$ millions Actual Est. Est. Est. Est.

Sales Answer

Answer

Answer

Answer

NOPAT Answer

Answer

Answer

Answer

NOA Answer

Answer

Answer

Answer

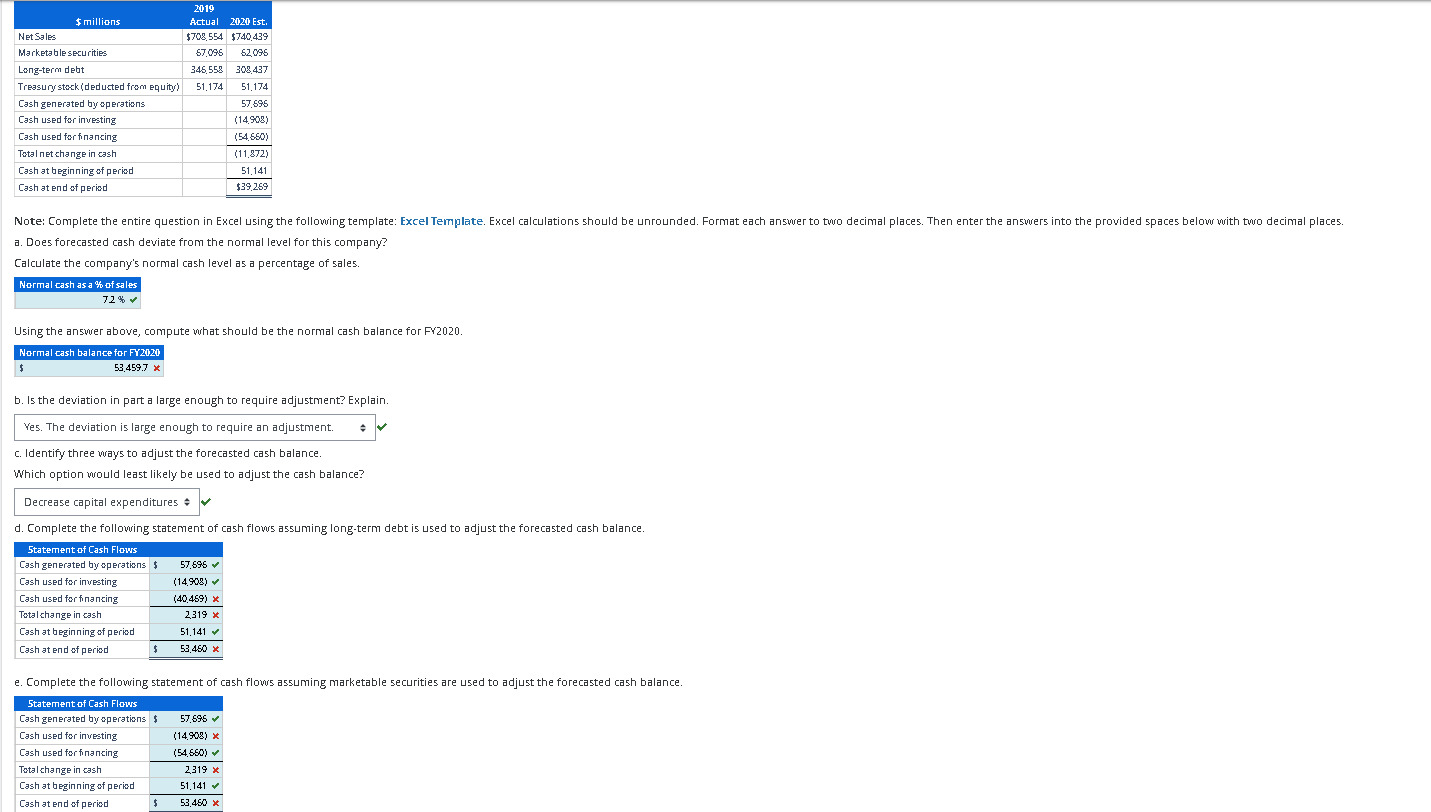

a Does forecasted cash deviate from the normal level for this company?

Calculate the company's normal cash level as a percentage of sales.

Normal cash as a of sales

Using the answer above, compute what should be the normal cash balance for Fv

Normal eash balance for FY

b Is the deviation in part a large enough to require adjustment? Explain.

Yes. The deviation is large enough to require an adjustment.

c Identify three wrays to adjust the forecasted cash balance.

Which option would least likely be used to adjust the cash balance?

d Complete the following statement of cash flows assuming longterm debt is used to adjust the forecasted cash balance.

e Complete the following statement of cash flows assuming marketable securities are used to adjust the forecasted cash balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started