Projections. Based on what you know about Marriotts financial health and performance, forecast its future performance. In particular, you should:

A. Project the organizations likely consolidated financial performance for each of the next three years. Support your analysis with an appendix spreadsheet showing actual results for the most recent year, along with your projections and assumptions.

Modify your projections for the coming year to show a best- and worst-case scenario, based on the potential success factors and risks you identified. As with your initial projections, support your analysis with an appendix spreadsheet, specifying your assumptions and including relevant calculations and disaggregations beyond those in existing financial reports.

Discuss how your assumptions, forecasting methodology, and information gaps affect your projections. Why are your projections appropriate? For example, are they consistent with the organizations mission and priorities? Aggressive but achievable? How would changing your assumptions change your projections?

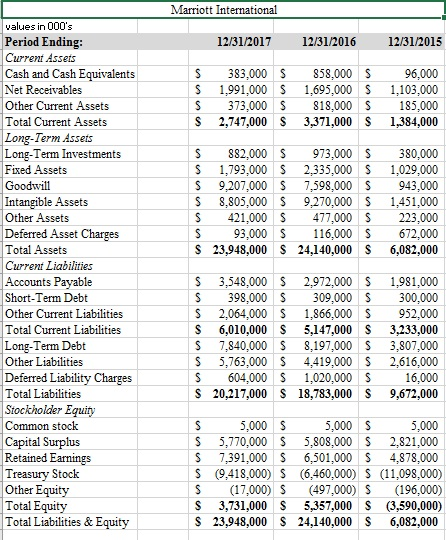

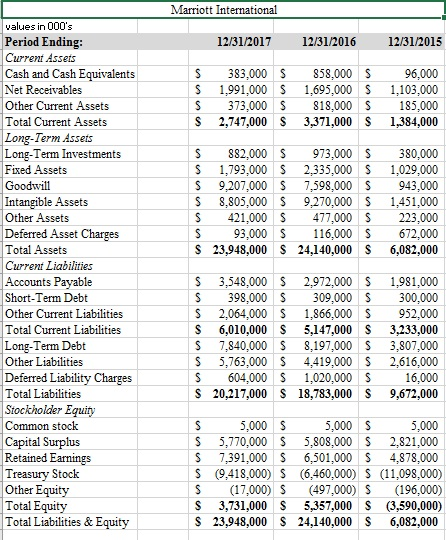

Marriott International yalues in 000's Period Ending Current Assets Cash and Cash Equivalents Net Receivables Other Current Assets Total Current Assets Long-Term Assets Long-Term Investments Fixed Assets 12/31/2017 12/31/2016 12/31/2015 S 383,000 S 858,000 S 1,991,000 S 695,000 S 1,103,000 S 373,000 818,000 S 185,000 S 2,747,000 S 3,371,000 S 1,384,000 S 882,000 973,000 S 380,000 S 1,793,000 S 2,335,000 S 1,029,000 S 9,207,000 S7,598,000 S 943,000 S 8,805,000 9,270,000 1,451,000 S 421,000 S 477,000 S 223,000 S 93,000 S 116,000 672,000 S 23,948,000 24,140,000 S 6,082,000 Intangible Assets Deferred Asset Charges Total Assets Current Liabilities Accounts Payable Short-Term Debt Other Current Liabilities Total Current Liablties Long-Term Debt Other Liabilities S 3,548,000 S 2,972,000 1,981,000 S 398,000 S 309,000 S300,000 S 2,064,000 S 1,866,000 S 952,000 S 6,010,000 S 5147,000 S 3,233,000 S 7,840,000 S8,197,000 S 3,807,000 S 5,763.000 S4,419,000 S 2,616,000 S 604,000 S 1,020,00016,000 S 20,217,000 S 18,783,000 S 9,672,000 Deferred Liablity Charges Total Liabilities Stockholder Equity Common stock Capital Surplus Retained Earnings Treasury Stock 9906 S 5,770,000 S 5,808,000 S 2,821,000 S 7,391,000 S 6,501,000 S 4,878,000 S (9,418,000) S (6,460,000) S (11,098,000) S (17,000) S(497,000) S (196,000) S 3,731,000 S 5,357,000 S (3,590,000) S 23,948,000 24,140,000 S 6,082,000 Total Equity Total Liabilities &Equity Marriott International yalues in 000's Period Ending Current Assets Cash and Cash Equivalents Net Receivables Other Current Assets Total Current Assets Long-Term Assets Long-Term Investments Fixed Assets 12/31/2017 12/31/2016 12/31/2015 S 383,000 S 858,000 S 1,991,000 S 695,000 S 1,103,000 S 373,000 818,000 S 185,000 S 2,747,000 S 3,371,000 S 1,384,000 S 882,000 973,000 S 380,000 S 1,793,000 S 2,335,000 S 1,029,000 S 9,207,000 S7,598,000 S 943,000 S 8,805,000 9,270,000 1,451,000 S 421,000 S 477,000 S 223,000 S 93,000 S 116,000 672,000 S 23,948,000 24,140,000 S 6,082,000 Intangible Assets Deferred Asset Charges Total Assets Current Liabilities Accounts Payable Short-Term Debt Other Current Liabilities Total Current Liablties Long-Term Debt Other Liabilities S 3,548,000 S 2,972,000 1,981,000 S 398,000 S 309,000 S300,000 S 2,064,000 S 1,866,000 S 952,000 S 6,010,000 S 5147,000 S 3,233,000 S 7,840,000 S8,197,000 S 3,807,000 S 5,763.000 S4,419,000 S 2,616,000 S 604,000 S 1,020,00016,000 S 20,217,000 S 18,783,000 S 9,672,000 Deferred Liablity Charges Total Liabilities Stockholder Equity Common stock Capital Surplus Retained Earnings Treasury Stock 9906 S 5,770,000 S 5,808,000 S 2,821,000 S 7,391,000 S 6,501,000 S 4,878,000 S (9,418,000) S (6,460,000) S (11,098,000) S (17,000) S(497,000) S (196,000) S 3,731,000 S 5,357,000 S (3,590,000) S 23,948,000 24,140,000 S 6,082,000 Total Equity Total Liabilities &Equity