Question

Projections. Based on what you know about Marriotts financial health and performance, forecast its future performance. In particular, you should: A. Project the organizations likely

Projections. Based on what you know about Marriotts financial health and performance, forecast its future performance. In particular, you should:

Projections. Based on what you know about Marriotts financial health and performance, forecast its future performance. In particular, you should:

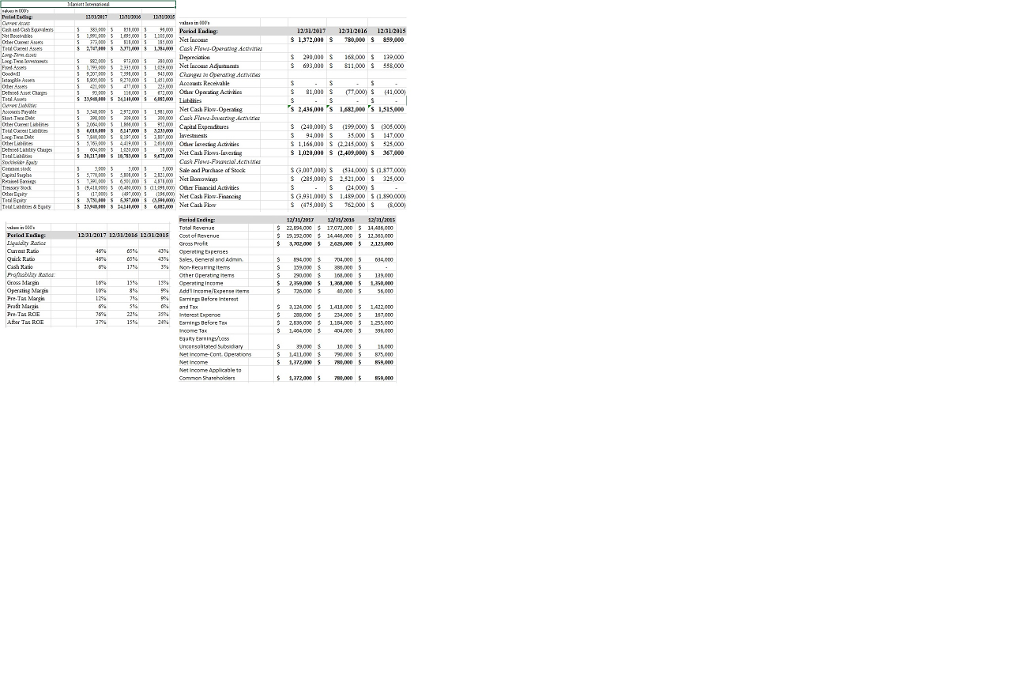

A. Project the organizations likely consolidated financial performance for each of the next three years. Support your analysis with an appendix spreadsheet showing actual results for the most recent year, along with your projections and assumptions.

Modify your projections for the coming year to show a best- and worst-case scenario, based on the potential success factors and risks you identified. As with your initial projections, support your analysis with an appendix spreadsheet, specifying your assumptions and including relevant calculations and disaggregations beyond those in existing financial reports.

Discuss how your assumptions, forecasting methodology, and information gaps affect your projections. Why are your projections appropriate? For example, are they consistent with the organizations mission and priorities? Aggressive but achievable? How would changing your assumptions change your projections?

1372090000 859,000 S 2435 08's 1883 000 5 15500 104.02.00. S 240 (9000) (304,000 3 94.0 3000 5 4T,000 $ 1,166,000 s G-214,000) 524,000 1020S408.000) 36T,000 Cuok Fiuwi-Foaw.tc of Soock 0700534.000)(3.837 000 TRS ,000 ,000 24000) 1489.000 513.890000 Net Cock Flow-Frcg G910 Z2.IAO ? $-17072.000 S 1AA.000 0001443 12 343,000 12312017 12312014 12aL01 Cootof vu Cro Prast as 24.000117, 17% 15% 24% ?r.rp0e6 ve TE" 1372090000 859,000 S 2435 08's 1883 000 5 15500 104.02.00. S 240 (9000) (304,000 3 94.0 3000 5 4T,000 $ 1,166,000 s G-214,000) 524,000 1020S408.000) 36T,000 Cuok Fiuwi-Foaw.tc of Soock 0700534.000)(3.837 000 TRS ,000 ,000 24000) 1489.000 513.890000 Net Cock Flow-Frcg G910 Z2.IAO ? $-17072.000 S 1AA.000 0001443 12 343,000 12312017 12312014 12aL01 Cootof vu Cro Prast as 24.000117, 17% 15% 24% ?r.rp0e6 ve TEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started