Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Projects differ in risk, and risk analysis is a critical component of the capital budgeting process. Consider the case of United Recycling Inc: : United

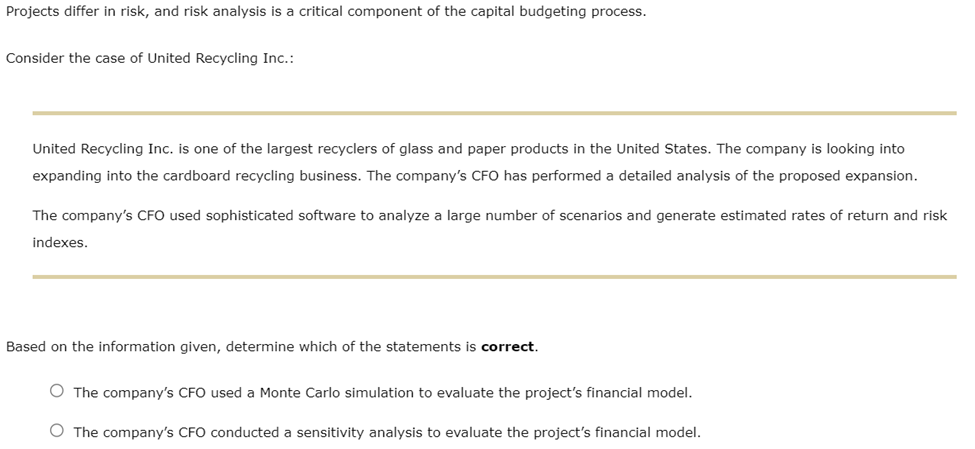

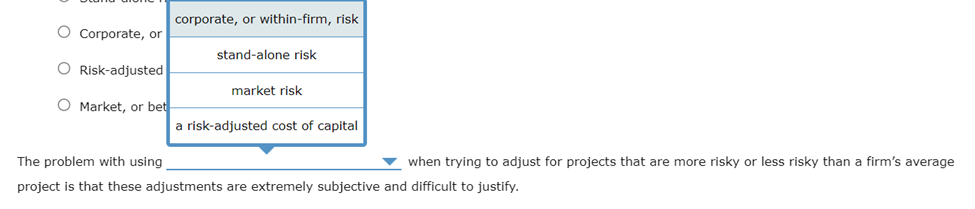

Projects differ in risk, and risk analysis is a critical component of the capital budgeting process. Consider the case of United Recycling Inc: : United Recycling Inc. is one of the largest recyclers of glass and paper products in the United States. The company is looking into expanding into the cardboard recycling business. The company's CFO has performed a detailed analysis of the proposed expansion. The company's CFO used sophisticated software to analyze a large number of scenarios and generate estimated rates of return and risk indexes. Based on the information given, determine which of the statements is correct. The company's CFO used a Monte Carlo simulation to evaluate the project's financial model. The company's CFO conducted a sensitivity analysis to evaluate the project's financial model. Evaluating risk is an important part of the capital budgeting process. Which of the following is measured by its effect on the firm's beta coefficient? Stand-alone risk Corporate, or within-firm, risk Risk-adjusted cost of capital Market, or beta, risk The problem with using when trying to adjust for projects that are more risky or less risky than a firm's average project is that these adjustments are extremely subjective and difficult to justify

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started