Answered step by step

Verified Expert Solution

Question

1 Approved Answer

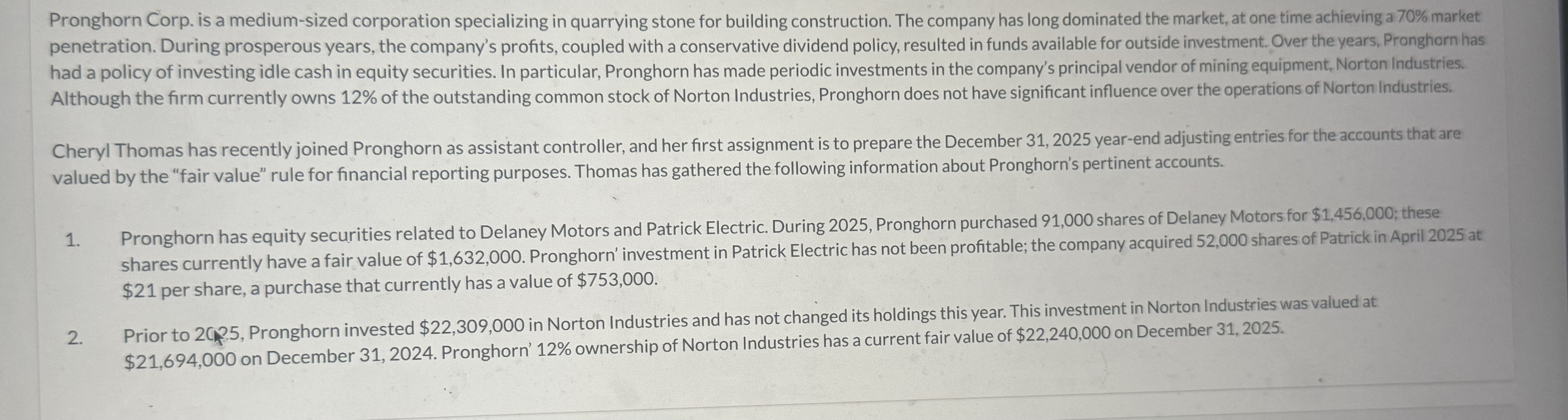

Pronghorn Corp. is a medium - sized corporation specializing in quarrying stone for building construction. The company has long dominated the market, at one time

Pronghorn Corp. is a mediumsized corporation specializing in quarrying stone for building construction. The company has long dominated the market, at one time achieving a market

penetration. During prosperous years, the company's profits, coupled with a conservative dividend policy, resulted in funds available for outside investment. Over the years, Pronghorn has

had a policy of investing idle cash in equity securities In particular, Pronghorn has made periodic investments in the company's principal vendor of mining equipment, Norton Industries.

Although the firm currently owns of the outstanding common stock of Norton Industries, Pronghorn does not have significant influence over the operations of Norton Industries.

Cheryl Thomas has recently joined Pronghorn as assistant controller, and her first assignment is to prepare the December yearend adjusting entries for the accounts that are

valued by the "fair value" rule for financial reporting purposes. Thomas has gathered the following information about Pronghorn's pertinent accounts.

Pronghorn has equity securities related to Delaney Motors and Patrick Electric. During Pronghorn purchased shares of Delaney Motors for $; these

shares currently have a fair value of $ Pronghorn' investment in Patrick Electric has not been profitable; the company acquired shares of Patrick in April at

$ per share, a purchase that currently has a value of $

$ on December Pronghorn' ownership of Norton Industries has a current fair value of $ on December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started