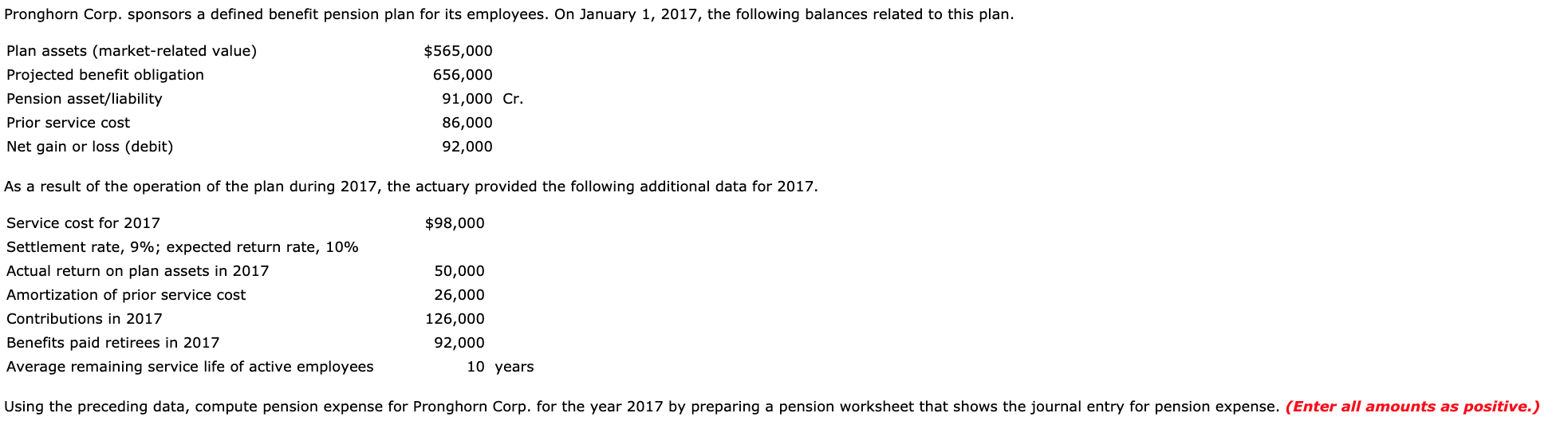

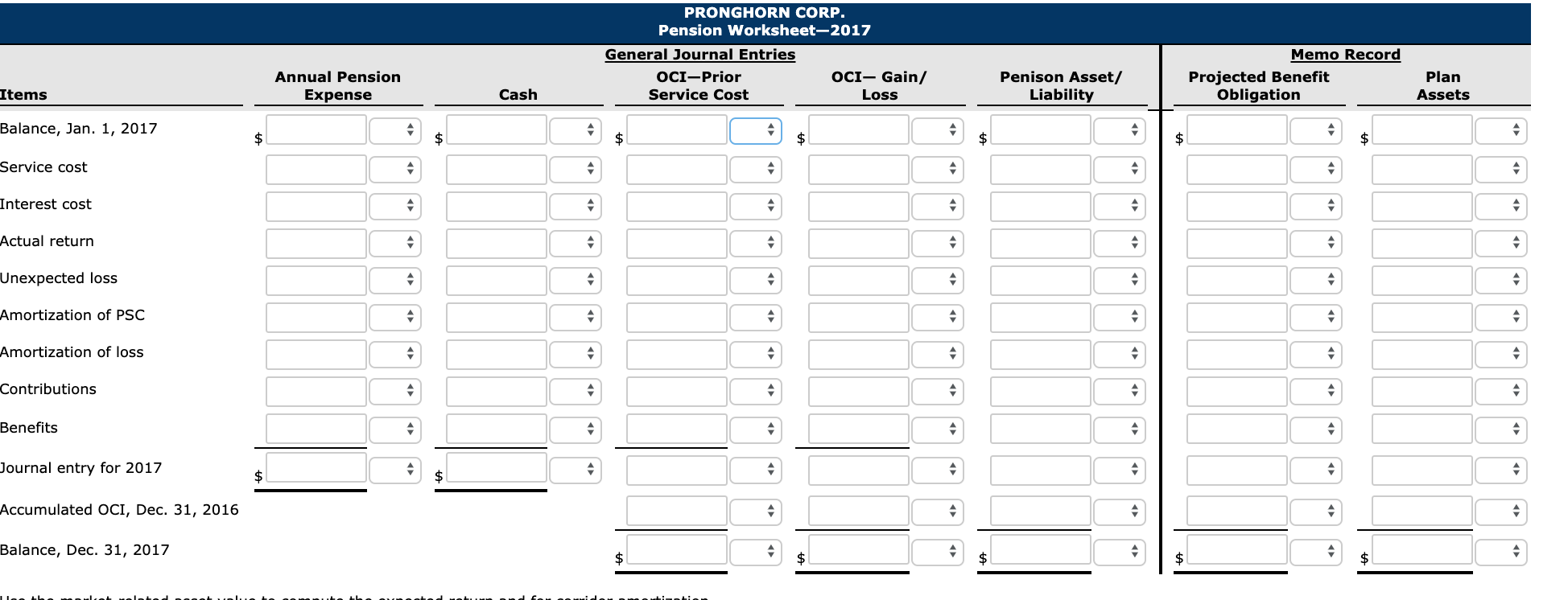

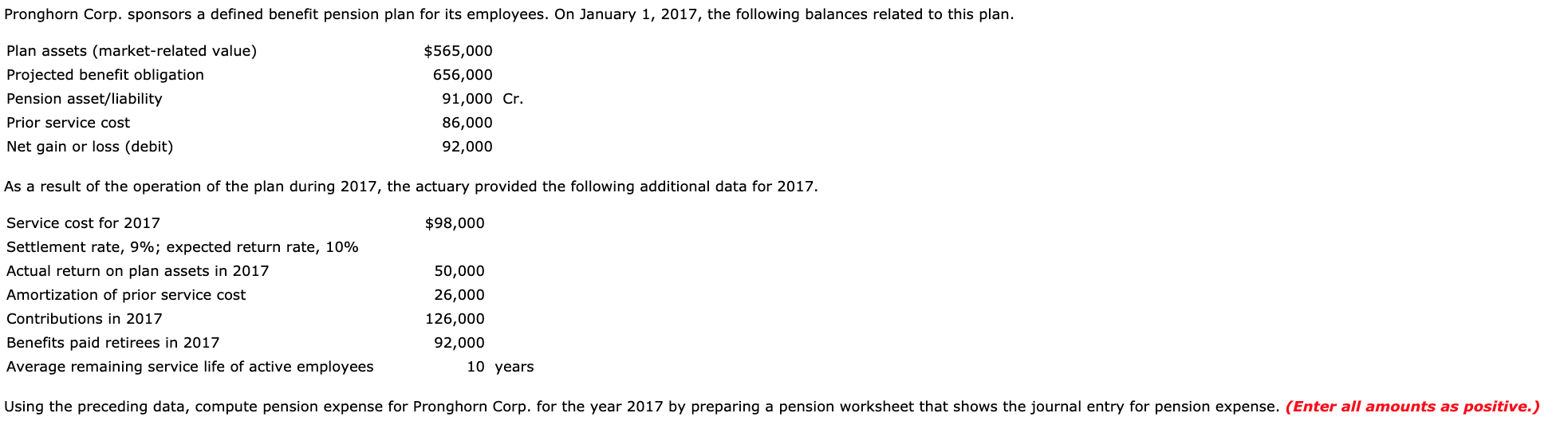

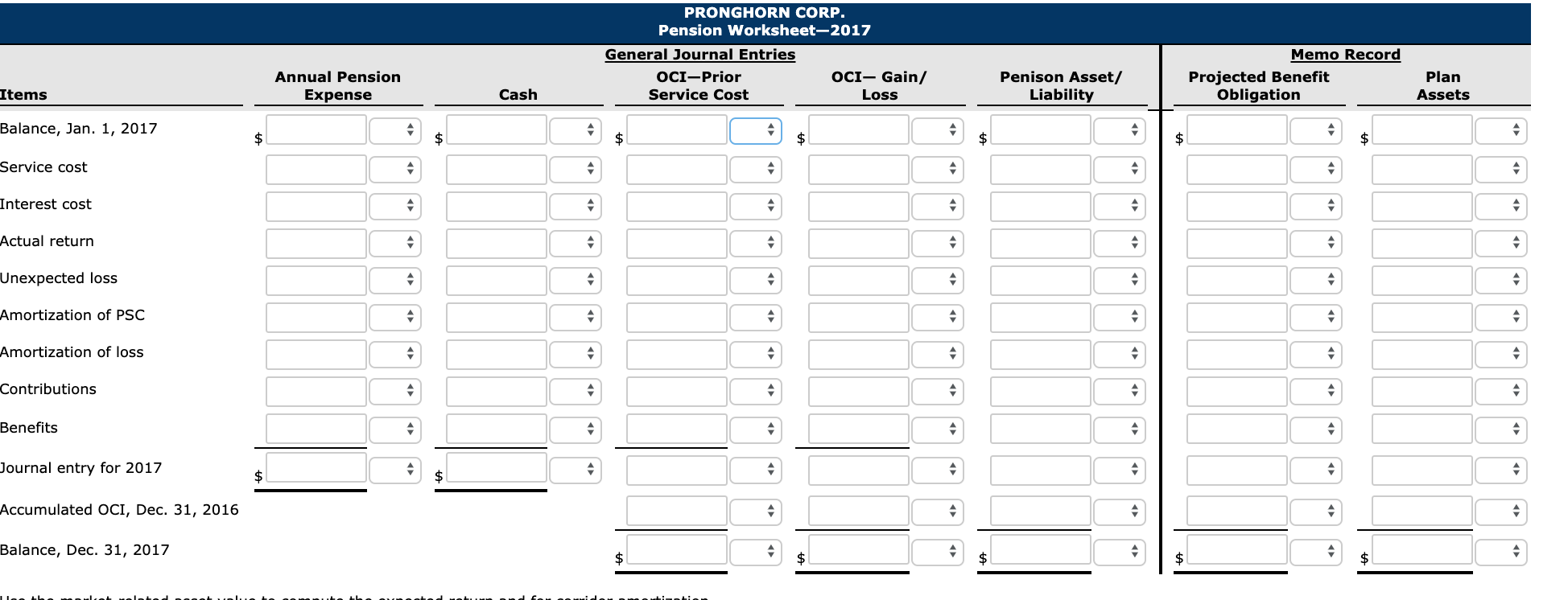

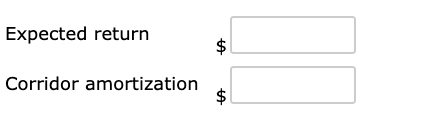

Pronghorn Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2017, the following balances related to this plan. Plan assets (market-related value) Projected benefit obligation Pension asset/liability Prior service cost Net gain or loss (debit) $565,000 656,000 91,000 Cr. 86,000 92,000 As a result of the operation of the plan during 2017, the actuary provided the following additional data for 2017. $98,000 Service cost for 2017 Settlement rate, 9%; expected return rate, 10% Actual return on plan assets in 2017 Amortization of prior service cost Contributions in 2017 Benefits paid retirees in 2017 Average remaining service life of active employees 50,000 26,000 126,000 92,000 10 years Using the preceding data, compute pension expense for Pronghorn Corp. for the year 2017 by preparing a pension worksheet that shows the journal entry for pension expense. (Enter all amounts as positive.) PRONGHORN CORP. Pension Worksheet-2017 General Journal Entries OCI-Prior OCI- Gain/ Service Cost Loss Annual Pension Expense Penison Asset/ Liability Memo Record Projected Benefit Obligation Plan Assets Items Cash Balance, Jan. 1, 2017 Service cost Interest cost Actual return Unexpected loss Amortization of PSC Amortization of loss Contributions Benefits Journal entry for 2017 Accumulated OCI, Dec. 31, 2016 Balance, Dec. 31, 2017 Expected return Corridor amortization Pronghorn Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2017, the following balances related to this plan. Plan assets (market-related value) Projected benefit obligation Pension asset/liability Prior service cost Net gain or loss (debit) $565,000 656,000 91,000 Cr. 86,000 92,000 As a result of the operation of the plan during 2017, the actuary provided the following additional data for 2017. $98,000 Service cost for 2017 Settlement rate, 9%; expected return rate, 10% Actual return on plan assets in 2017 Amortization of prior service cost Contributions in 2017 Benefits paid retirees in 2017 Average remaining service life of active employees 50,000 26,000 126,000 92,000 10 years Using the preceding data, compute pension expense for Pronghorn Corp. for the year 2017 by preparing a pension worksheet that shows the journal entry for pension expense. (Enter all amounts as positive.) PRONGHORN CORP. Pension Worksheet-2017 General Journal Entries OCI-Prior OCI- Gain/ Service Cost Loss Annual Pension Expense Penison Asset/ Liability Memo Record Projected Benefit Obligation Plan Assets Items Cash Balance, Jan. 1, 2017 Service cost Interest cost Actual return Unexpected loss Amortization of PSC Amortization of loss Contributions Benefits Journal entry for 2017 Accumulated OCI, Dec. 31, 2016 Balance, Dec. 31, 2017 Expected return Corridor amortization