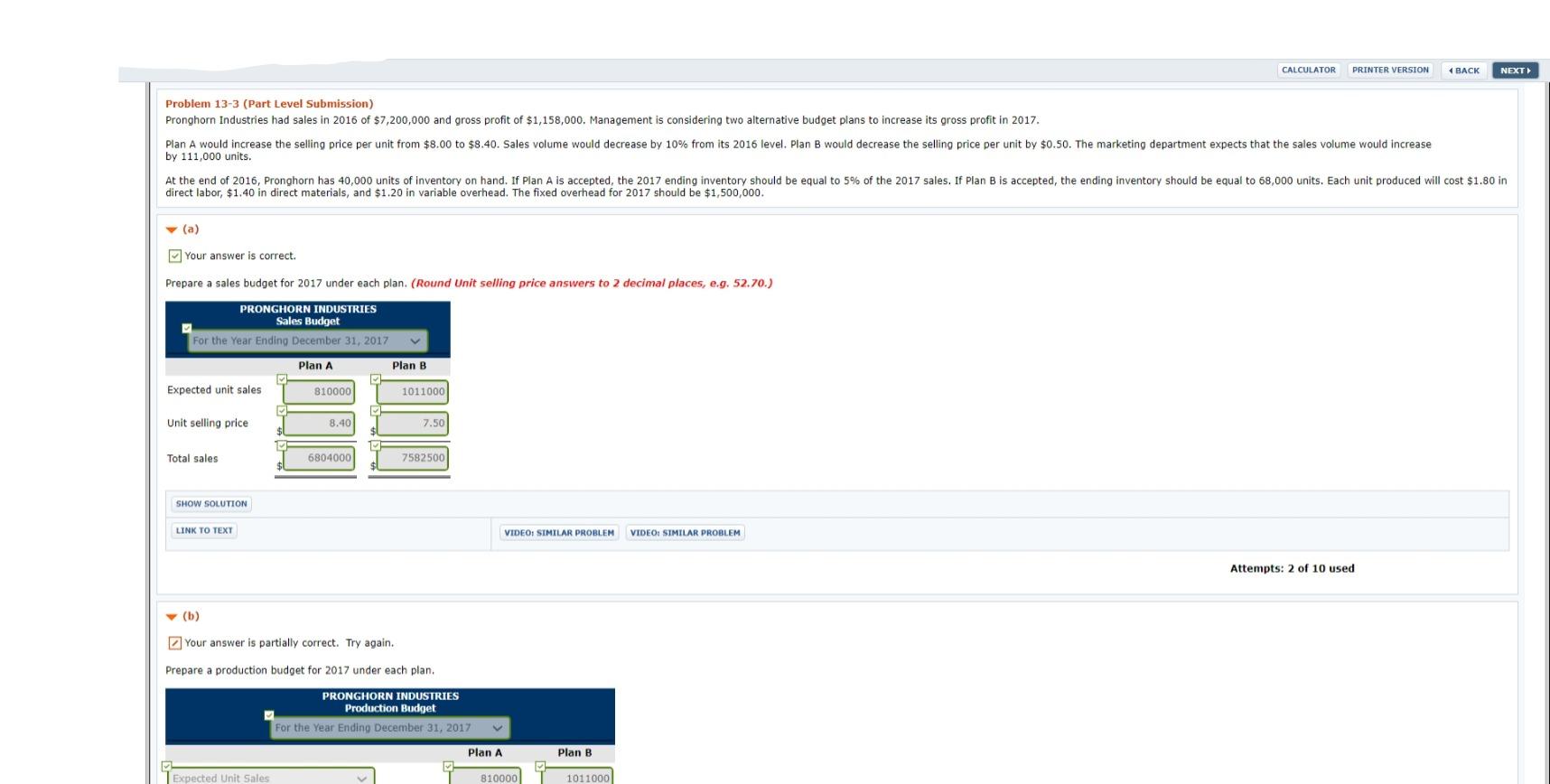

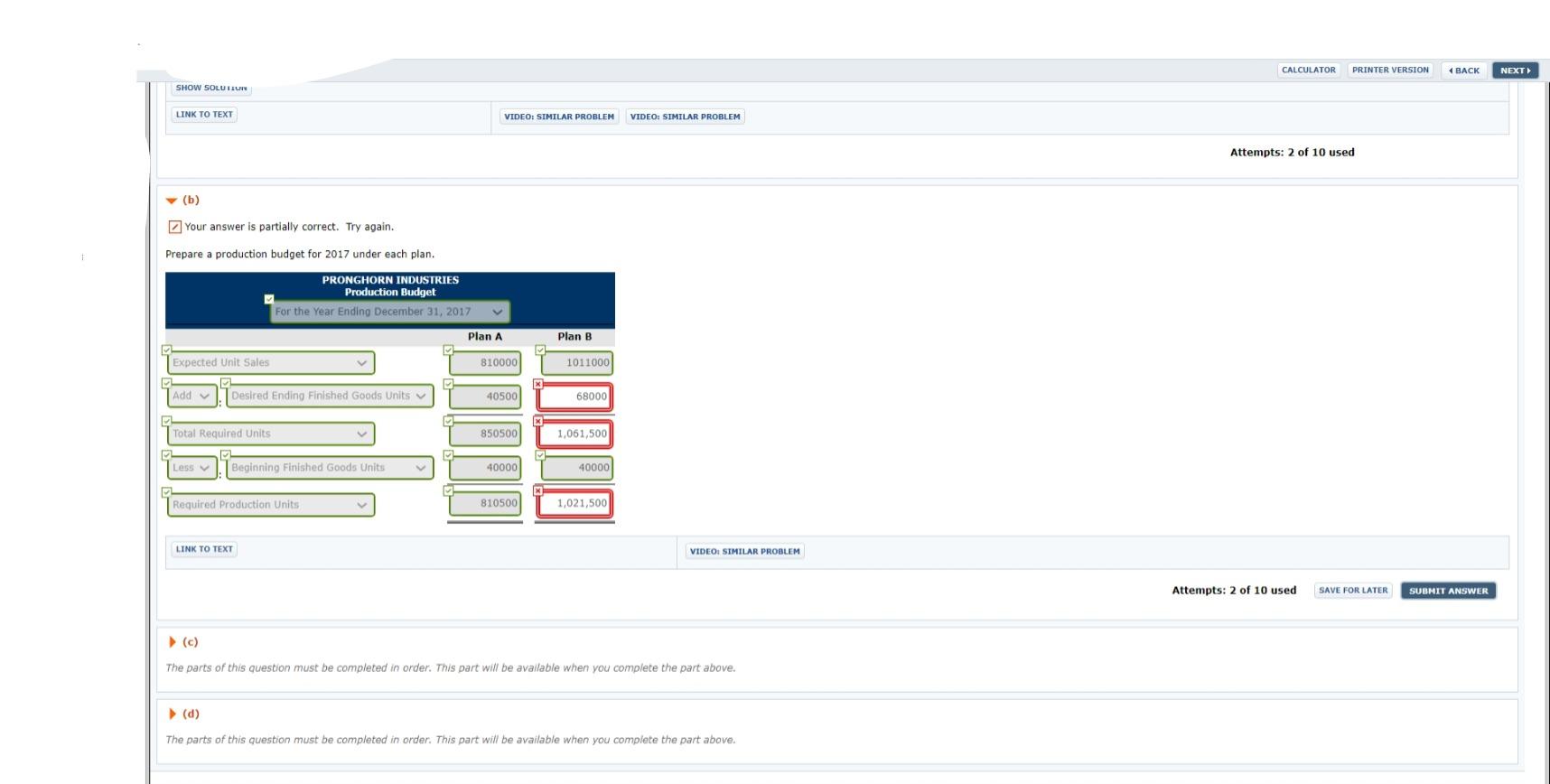

Pronghorn Industries had sales in 2016 of $7,200,000 and gross profit of $1,158,000. Management is considering two alternative budget plans to increase its gross profit in 2017. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2016 level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 111,000 units. At the end of 2016, Pronghorn has 40,000 units of inventory on hand. If Plan A is accepted, the 2017 ending inventory should be equal to 5% of the 2017 sales. If Plan B is accepted, the ending inventory should be equal to 68,000 units. Each unit produced will cost $1.80 in direct labor, $1.40 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2017 should be $1,500,000.

Please tell me *how* you solved these as well. Part c) and d) will be posted in the comments, please help with those too for a great rating if you can!

Please tell me *how* you solved these as well. Part c) and d) will be posted in the comments, please help with those too for a great rating if you can!

CALCULATOR PRINTER VERSION (BACK NEXT Problem 13-3 (Part Level Submission) Pronghorn Industries had sales in 2016 of $7,200,000 and gross profit of $1,158,000. Management is considering two alternative budget plans to increase its gross profit in 2017. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2016 level. Plan would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 111,000 units. At the end of 2016, Pronghorn has 40,000 units of Inventory on hand. If Plan A is accepted, the 2017 ending inventory should be equal to 5% of the 2017 sales. If Plan B is accepted, the ending inventory should be equal to 68,000 units. Each unit produced will cost $1.80 in direct labor, $1.40 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2017 should be $1,500,000. (a) Your answer is correct. Prepare a sales budget for 2017 under each plan. (Round Unit selling price answers to 2 decimal places, e.g. 52.70.) PRONGHORN INDUSTRIES Sales Budget For the Year Ending December 31, 2017 Plan A Plan B Expected unit sales 810000 1011000 Unit selling price 8.40 7.50 1 Total sales 6804000 7582500 SHOW SOLUTION LINK TO TEXT VIDEO: SIMILAR PROBLEM VIDEOSIMILAR PROBLEM Attempts: 2 of 10 used (b) Your answer is partially correct. Try again. Prepare a production budget for 2017 under each plan. PRONGHORN INDUSTRIES Production Budget For the Year Ending December 31, 2017 Plan A Plan B Expected Unit Sales 810000 1011000 CALCULATOR PRINTER VERSION BACK NEXT SHOW SOLUTION LINK TO TEXT VIDEO: SIMILAR PROBLEM VIDEO: SIMILAR PROBLEM Attempts: 2 of 10 used (b) Your answer is partially correct. Try again. Prepare a production budget for 2017 under each plan. PRONGHORN INDUSTRIES Production Budget For the Year Ending December 31, 2017 Plan A Plan B Expected Unit Sales 810000 1011000 Add Desired Ending Finished Goods Units 40500 68000 Total Required Units 850500 1,061,500 Less Beginning Finished Goods Units 40000 40000 Required Production Units 810500 1,021,500 LINK TO TEXT VIDEO: SIMILAR PROBLEM Attempts: 2 of 10 used SAVE FOR LATER SUBMIT ANSWER (c) The parts of this question must be completed in order. This part will be available when you complete the part above. (d) The parts of this question must be completed in order. This part will be available when you complete the part above

Please tell me *how* you solved these as well. Part c) and d) will be posted in the comments, please help with those too for a great rating if you can!

Please tell me *how* you solved these as well. Part c) and d) will be posted in the comments, please help with those too for a great rating if you can!