Property income

Basic rate restriction applies to 75% of finance costs relating to residential properties.

Annual investment allowance

Rate allowance 100%

Expenditure limit 1,000,000

Inheritance tax: tax rates

1 - 325,000 Nil

Excess Lifetime rate 20%

Death rate 40%

Residential nil rate band - 150,000 Nil

Inheritance tax: taper relief

%

Years before death:

Reduction

Over 3 but less than 4 years 20

Over 4 but less than 5 years 40

Over 5 but less than 6 years 60

Over 6 years less than 7 years 80

Capital gains tax

Normal Residential

Rates property

Rate of tax-Lower rate 10% 18%

-Higher rate 20% 28%

Annual exempt amount 12,000

Entrepreneurs relief Lifetime limit 10,000,000

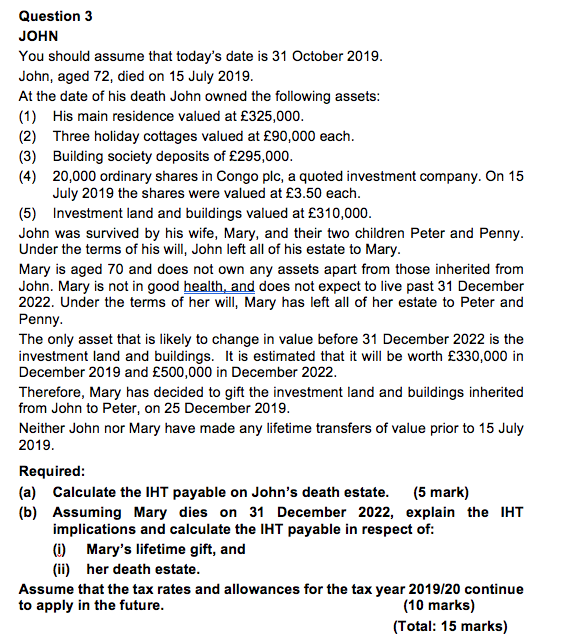

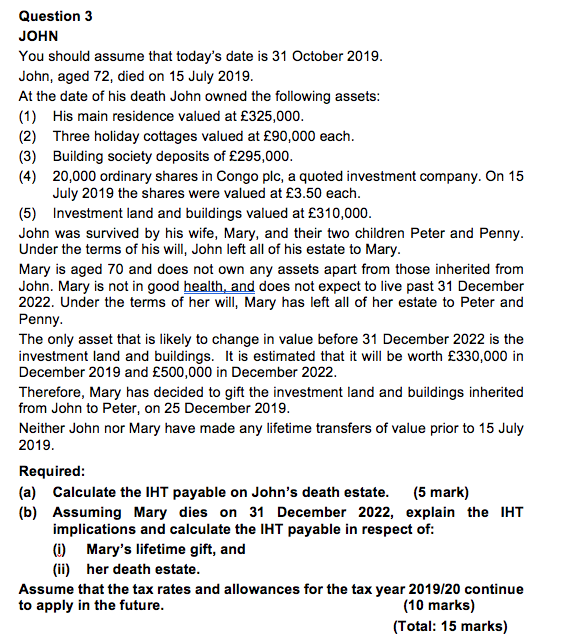

Question 3 JOHN You should assume that today's date is 31 October 2019. John, aged 72, died on 15 July 2019. At the date of his death John owned the following assets: (1) His main residence valued at 325,000. (2) Three holiday cottages valued at 90,000 each. (3) Building society deposits of 295,000. (4) 20,000 ordinary shares in Congo plc, a quoted investment company. On 15 July 2019 the shares were valued at 3.50 each. (5) Investment land and buildings valued at 310,000. John was survived by his wife, Mary, and their two children Peter and Penny. Under the terms of his will, John left all of his estate to Mary. Mary is aged 70 and does not own any assets apart from those inherited from John. Mary is not in good health, and does not expect to live past 31 December 2022. Under the terms of her will, Mary has left all of her estate to Peter and Penny. The only asset that is likely to change in value before 31 December 2022 is the investment land and buildings. It is estimated that it will be worth 330,000 in December 2019 and 500,000 in December 2022. Therefore, Mary has decided to gift the investment land and buildings inherited from John to Peter, on 25 December 2019. Neither John nor Mary have made any lifetime transfers of value prior to 15 July 2019. Required: (a) Calculate the IHT payable on John's death estate. (5 mark) (b) Assuming Mary dies on 31 December 2022, explain the IHT implications and calculate the IHT payable in respect of: (0) Mary's lifetime gift, and (ii) her death estate. Assume that the tax rates and allowances for the tax year 2019/20 continue to apply in the future. (10 marks) (Total: 15 marks) Question 3 JOHN You should assume that today's date is 31 October 2019. John, aged 72, died on 15 July 2019. At the date of his death John owned the following assets: (1) His main residence valued at 325,000. (2) Three holiday cottages valued at 90,000 each. (3) Building society deposits of 295,000. (4) 20,000 ordinary shares in Congo plc, a quoted investment company. On 15 July 2019 the shares were valued at 3.50 each. (5) Investment land and buildings valued at 310,000. John was survived by his wife, Mary, and their two children Peter and Penny. Under the terms of his will, John left all of his estate to Mary. Mary is aged 70 and does not own any assets apart from those inherited from John. Mary is not in good health, and does not expect to live past 31 December 2022. Under the terms of her will, Mary has left all of her estate to Peter and Penny. The only asset that is likely to change in value before 31 December 2022 is the investment land and buildings. It is estimated that it will be worth 330,000 in December 2019 and 500,000 in December 2022. Therefore, Mary has decided to gift the investment land and buildings inherited from John to Peter, on 25 December 2019. Neither John nor Mary have made any lifetime transfers of value prior to 15 July 2019. Required: (a) Calculate the IHT payable on John's death estate. (5 mark) (b) Assuming Mary dies on 31 December 2022, explain the IHT implications and calculate the IHT payable in respect of: (0) Mary's lifetime gift, and (ii) her death estate. Assume that the tax rates and allowances for the tax year 2019/20 continue to apply in the future. (10 marks) (Total: 15 marks)