Answered step by step

Verified Expert Solution

Question

1 Approved Answer

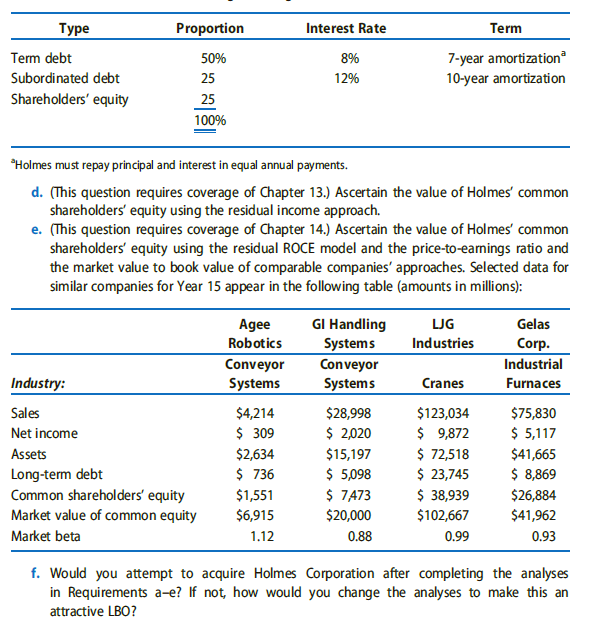

Proportion Interest Rate Term Term debt 50% 8% 7-year amortization Subordinated debt 25 12% 10-year amortization Shareholders' equity 25 100% Holmes must repay principal

Proportion Interest Rate Term Term debt 50% 8% 7-year amortization Subordinated debt 25 12% 10-year amortization Shareholders' equity 25 100% "Holmes must repay principal and interest in equal annual payments. d. (This question requires coverage of Chapter 13.) Ascertain the value of Holmes' common shareholders' equity using the residual income approach. e. (This question requires coverage of Chapter 14.) Ascertain the value of Holmes' common shareholders' equity using the residual ROCE model and the price-to-earnings ratio and the market value to book value of comparable companies' approaches. Selected data for similar companies for Year 15 appear in the following table (amounts in millions): Agee Robotics Gl Handling LJG Gelas Systems Industries Corp. Conveyor Conveyor Industrial Industry: Systems Systems Cranes Furnaces Sales $4,214 $28,998 $123,034 $75,830 Net income $ 309 $ 2,020 $ 9,872 $ 5,117 Assets $2,634 $15,197 $ 72,518 $41,665 Long-term debt $ 736 $ 5,098 $ 23,745 $ 8,869 Common shareholders' equity $1,551 $ 7,473 $ 38,939 $26,884 Market value of common equity $6,915 $20,000 $102,667 $41,962 Market beta 1.12 0.88 0.99 0.93 f. Would you attempt to acquire Holmes Corporation after completing the analyses in Requirements a-e? If not, how would you change the analyses to make this an attractive LBO?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started