Question

Proposal 2 The second proposal well consider is a modified flat-tax plan, where everyone only pays taxes on any income over $20,000. So, everyone in

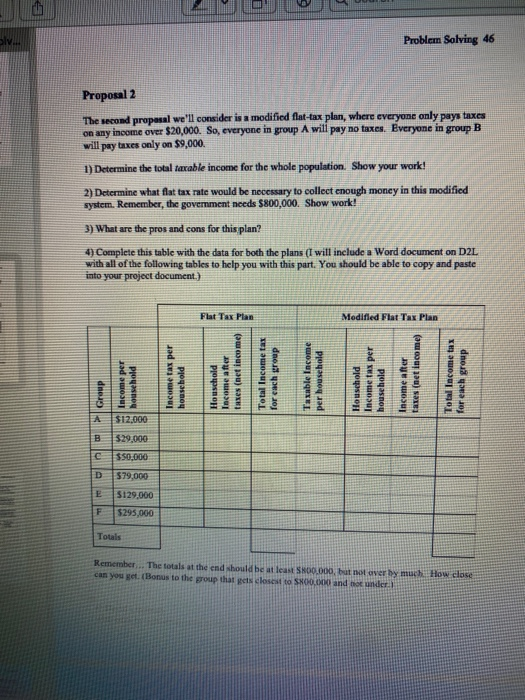

Proposal 2 The second proposal well consider is a modified flat-tax plan, where everyone only pays taxes on any income over $20,000. So, everyone in group A will pay no taxes. Everyone in group B will pay taxes only on $9,000. 1) Determine the total taxable income for the whole population. Show your work! 2) Determine what flat tax rate would be necessary to collect enough money in this modified system. Remember, the government needs $800,000. Show work! 3) What are the pros and cons for this plan? 4) Complete this table with the data for both the plans Problem Solving 46 Flat Tax Plan Modified Flat Tax Plan A $12,000 B $29,000 C $50,000 D $79,000 E $129,000 F $295,000 Totals Remember... The totals at the end should be at least $800,000, but not over by much. How close can you get. Group Income per household Income tax per household Household Income after taxes (net income) Total Income tax for each group Taxable Income per household Household Income tax per household Income after taxes (net income) Total Income tax for each group Proposal 3 The third proposal well consider is a progressive tax, where lower income groups are taxed at a lower percent rate, and higher income groups are taxed at a higher percent rate. The percentage increases as the income increases. For simplicity, were going to assume that a household is taxed at the same rate on all their income; this is different from the current United States system. 1) Set progressive tax rates for each income group to bring in enough money. You need to create a progressive tax... Everyone gets taxed some rate other than 0%, the rate progressively increases. I would like your group to try and come up with a FAIR rate. (yes... groups have tried to only tax the rich and not the poor. This is not a progressive rate. That is a modified flat-rate.) 2) Explain why you think this rate is fair. Your explanation should consider real-life in the United States. There is no one right answer here. I ask that you seriously ponder this question to come up with what your group considers fair. (Food for thought, 10 years from now you will probably be making a higher income.) Your explanation should be at least 250 words. Problem Solving 47 Group Income per household Tax rate (%) Income tax per household Total tax collected for all households Income after taxes per household A $12,000 B $29,000 C $50,000 D $79,000 E $129,000 F $295,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started