Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On Jan 1, 20X1, P company acquired 350,000 shares of the outstanding stock of S company by transferring the title deeds of freehold land

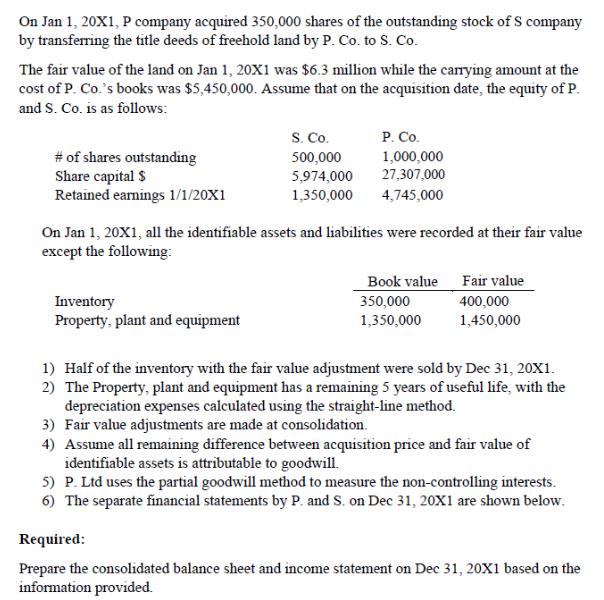

On Jan 1, 20X1, P company acquired 350,000 shares of the outstanding stock of S company by transferring the title deeds of freehold land by P. Co. to S. Co. The fair value of the land on Jan 1, 20X1 was $6.3 million while the carrying amount at the cost of P. Co.'s books was $5,450,000. Assume that on the acquisition date, the equity of P. and S. Co. is as follows: # of shares outstanding Share capital $ Retained earnings 1/1/20X1 S. Co. 500,000 Inventory Property, plant and equipment 5,974,000 1,350,000 P. Co. 1,000,000 27,307,000 4,745,000 On Jan 1, 20X1, all the identifiable assets and liabilities were recorded at their fair value except the following: Book value 350,000 1,350,000 Fair value 400,000 1,450,000 1) Half of the inventory with the fair value adjustment were sold by Dec 31, 20X1. 2) The Property, plant and equipment has a remaining 5 years of useful life, with the depreciation expenses calculated using the straight-line method. 3) Fair value adjustments are made at consolidation. 4) Assume all remaining difference between acquisition price and fair value of identifiable assets is attributable to goodwill. 5) P. Ltd uses the partial goodwill method to measure the non-controlling interests. 6) The separate financial statements by P. and S. on Dec 31, 20X1 are shown below. Required: Prepare the consolidated balance sheet and income statement on Dec 31, 20X1 based on the information provided.

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Balance Sheet Dec 31 20X1 Assets Cash 1860000 Accounts Receivable 1350000 Inventory 415000 Property Plant and Equipment 2800000 Goodwill 1885000 Total Assets 8410000 Liabilities Accounts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started