Propose two adjustments to the Deutsche Bank forecast and prepare a discounted cashflow analysis, explain your results and whether this indicates a buy or sell recommendation.

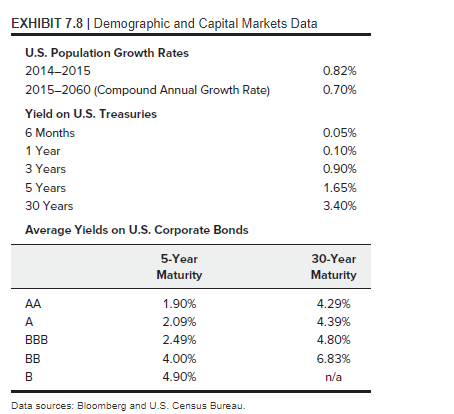

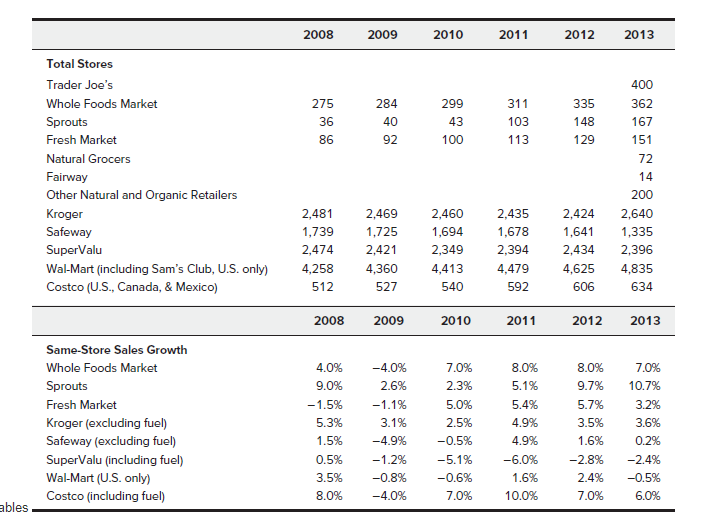

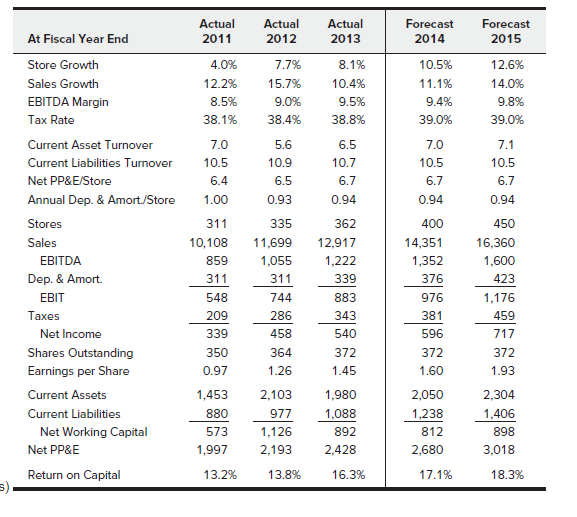

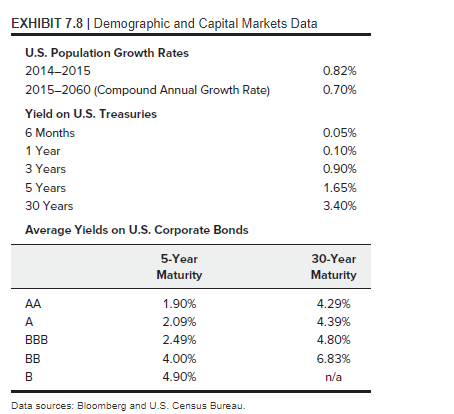

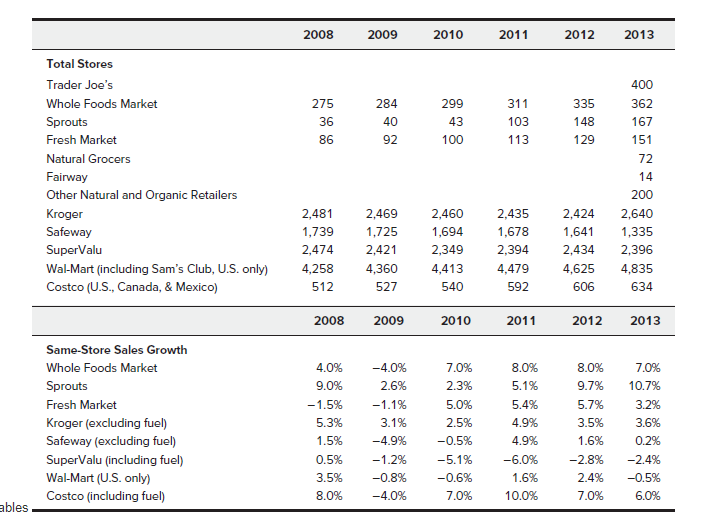

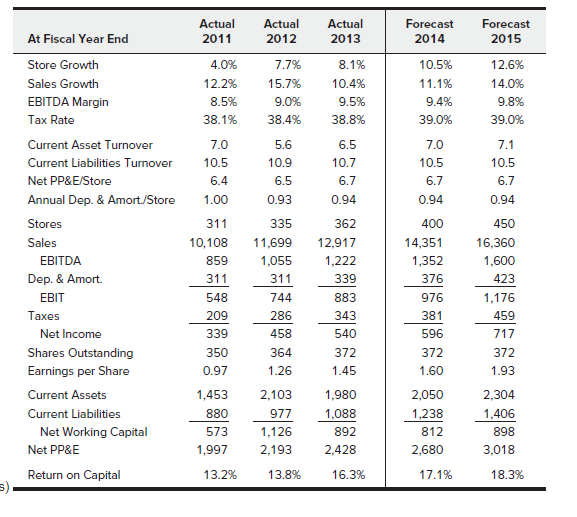

EXHIBIT 7.8 | Demographic and Capital Markets Data U.S. Population Growth Rates 2014-2015 0.82% 2015-2060 (Compound Annual Growth Rate) 0.70% Yield on U.S. Treasures 6 Months 0.05% 1 Year 0.10% 3 Years 0.90% 5 Years 1.65% 30 Years 3.40% Average Yields on U.S. Corporate Bonds 5-Year 30-Year Maturity Maturity AA A BBB 1.90% 2.09% 2.49% 4.00% 4.90% 4.29% 4.39% 4.80% 6.83% n/a BB B Data sources: Bloomberg and U.S. Census Bureau. 2008 2009 2010 2011 2012 2013 275 36 86 284 40 92 299 43 100 311 103 113 335 148 129 Total Stores Trader Joe's Whole Foods Market Sprouts Fresh Market Natural Grocers Fairway Other Natural and Organic Retailers Kroger Safeway SuperValu Wal-Mart (including Sam's Club, U.S. only) Costco (U.S., Canada, & Mexico) 400 362 167 151 72 14 200 2,640 1,335 2,396 4,835 634 2,481 1,739 2,474 4,258 512 2,469 1,725 2,421 4,360 527 2,460 1,694 2,349 4,413 540 2,435 1,678 2,394 4,479 592 2,424 1,641 2,434 4,625 606 2008 2009 2010 2011 2012 2013 7.0% Same-Store Sales Growth Whole Foods Market Sprouts Fresh Market Kroger (excluding fuel) Safeway (excluding fuel) SuperValu (including fuel) Wal-Mart (U.S. only) Costco (including fuel) 4.0% 9.0% -1.5% 5.3% 1.5% 0.5% 3.5% 8.0% -4.0% 2.6% -1.1% 3.1% -4.9% -1.2% -0.8% -4.0% 2.3% 5.0% 2.5% -0.5% -5.1% -0.6% 7.0% 8.0% 5.1% 5.4% 4.9% 4.9% -6.0% 1.6% 10.0% 8.0% 9.7% 5.7% 3.5% 1.6% -2.8% 2.4% 7.0% 7.0% 10.7% 3.2% 3.6% 0.2% -2.4% -0.5% 6.0% ables Actual 2011 Actual 2012 Actual 2013 Forecast 2014 4.0% 12.2% 8.5% 38.1% 7.0 10.5 7.7% 15.7% 9.0% 38.4% 8.1% 10.4% 9.5% 38.8% Forecast 2015 12.6% 14.0% 9.8% 39.0% 7.1 10.5 6.7 0.94 5.6 6.4 10.9 6.5 0.93 6.5 10.7 6.7 0.94 At Fiscal Year End Store Growth Sales Growth EBITDA Margin Tax Rate Current Asset Turnover Current Liabilities Turnover Net PP&E/Store Annual Dep. & Amort./Store Stores Sales EBITDA Dep. & Amort EBIT Taxes Net Income Shares Outstanding Earnings per Share Current Assets Current Liabilities Net Working Capital Net PP&E 10.5% 11.1% 9.4% 39.0% 7.0 10.5 6.7 0.94 400 14,351 1,352 376 976 381 596 372 450 1.00 311 10,108 859 311 548 209 339 350 0.97 1,453 880 573 1,997 335 11,699 1,055 311 744 286 458 364 1.26 362 12,917 1,222 339 883 343 540 372 1.45 16,360 1,600 423 1,176 459 717 372 1.93 2,304 1,406 898 3,018 1.60 2,103 977 1,126 2,193 1,980 1,088 892 2.428 2,050 1,238 812 2.680 Return on Capital 13.2% 13.8% 16.3% 17.1% 18.3% s). EXHIBIT 7.8 | Demographic and Capital Markets Data U.S. Population Growth Rates 2014-2015 0.82% 2015-2060 (Compound Annual Growth Rate) 0.70% Yield on U.S. Treasures 6 Months 0.05% 1 Year 0.10% 3 Years 0.90% 5 Years 1.65% 30 Years 3.40% Average Yields on U.S. Corporate Bonds 5-Year 30-Year Maturity Maturity AA A BBB 1.90% 2.09% 2.49% 4.00% 4.90% 4.29% 4.39% 4.80% 6.83% n/a BB B Data sources: Bloomberg and U.S. Census Bureau. 2008 2009 2010 2011 2012 2013 275 36 86 284 40 92 299 43 100 311 103 113 335 148 129 Total Stores Trader Joe's Whole Foods Market Sprouts Fresh Market Natural Grocers Fairway Other Natural and Organic Retailers Kroger Safeway SuperValu Wal-Mart (including Sam's Club, U.S. only) Costco (U.S., Canada, & Mexico) 400 362 167 151 72 14 200 2,640 1,335 2,396 4,835 634 2,481 1,739 2,474 4,258 512 2,469 1,725 2,421 4,360 527 2,460 1,694 2,349 4,413 540 2,435 1,678 2,394 4,479 592 2,424 1,641 2,434 4,625 606 2008 2009 2010 2011 2012 2013 7.0% Same-Store Sales Growth Whole Foods Market Sprouts Fresh Market Kroger (excluding fuel) Safeway (excluding fuel) SuperValu (including fuel) Wal-Mart (U.S. only) Costco (including fuel) 4.0% 9.0% -1.5% 5.3% 1.5% 0.5% 3.5% 8.0% -4.0% 2.6% -1.1% 3.1% -4.9% -1.2% -0.8% -4.0% 2.3% 5.0% 2.5% -0.5% -5.1% -0.6% 7.0% 8.0% 5.1% 5.4% 4.9% 4.9% -6.0% 1.6% 10.0% 8.0% 9.7% 5.7% 3.5% 1.6% -2.8% 2.4% 7.0% 7.0% 10.7% 3.2% 3.6% 0.2% -2.4% -0.5% 6.0% ables Actual 2011 Actual 2012 Actual 2013 Forecast 2014 4.0% 12.2% 8.5% 38.1% 7.0 10.5 7.7% 15.7% 9.0% 38.4% 8.1% 10.4% 9.5% 38.8% Forecast 2015 12.6% 14.0% 9.8% 39.0% 7.1 10.5 6.7 0.94 5.6 6.4 10.9 6.5 0.93 6.5 10.7 6.7 0.94 At Fiscal Year End Store Growth Sales Growth EBITDA Margin Tax Rate Current Asset Turnover Current Liabilities Turnover Net PP&E/Store Annual Dep. & Amort./Store Stores Sales EBITDA Dep. & Amort EBIT Taxes Net Income Shares Outstanding Earnings per Share Current Assets Current Liabilities Net Working Capital Net PP&E 10.5% 11.1% 9.4% 39.0% 7.0 10.5 6.7 0.94 400 14,351 1,352 376 976 381 596 372 450 1.00 311 10,108 859 311 548 209 339 350 0.97 1,453 880 573 1,997 335 11,699 1,055 311 744 286 458 364 1.26 362 12,917 1,222 339 883 343 540 372 1.45 16,360 1,600 423 1,176 459 717 372 1.93 2,304 1,406 898 3,018 1.60 2,103 977 1,126 2,193 1,980 1,088 892 2.428 2,050 1,238 812 2.680 Return on Capital 13.2% 13.8% 16.3% 17.1% 18.3% s)