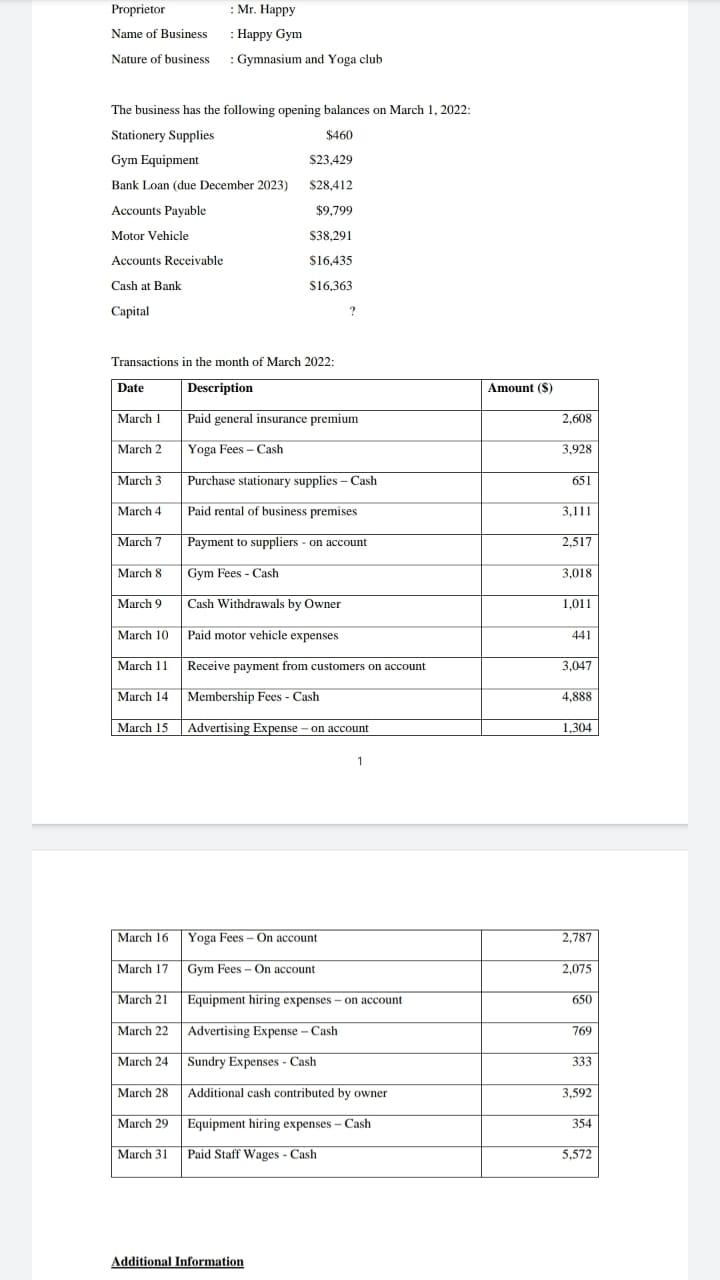

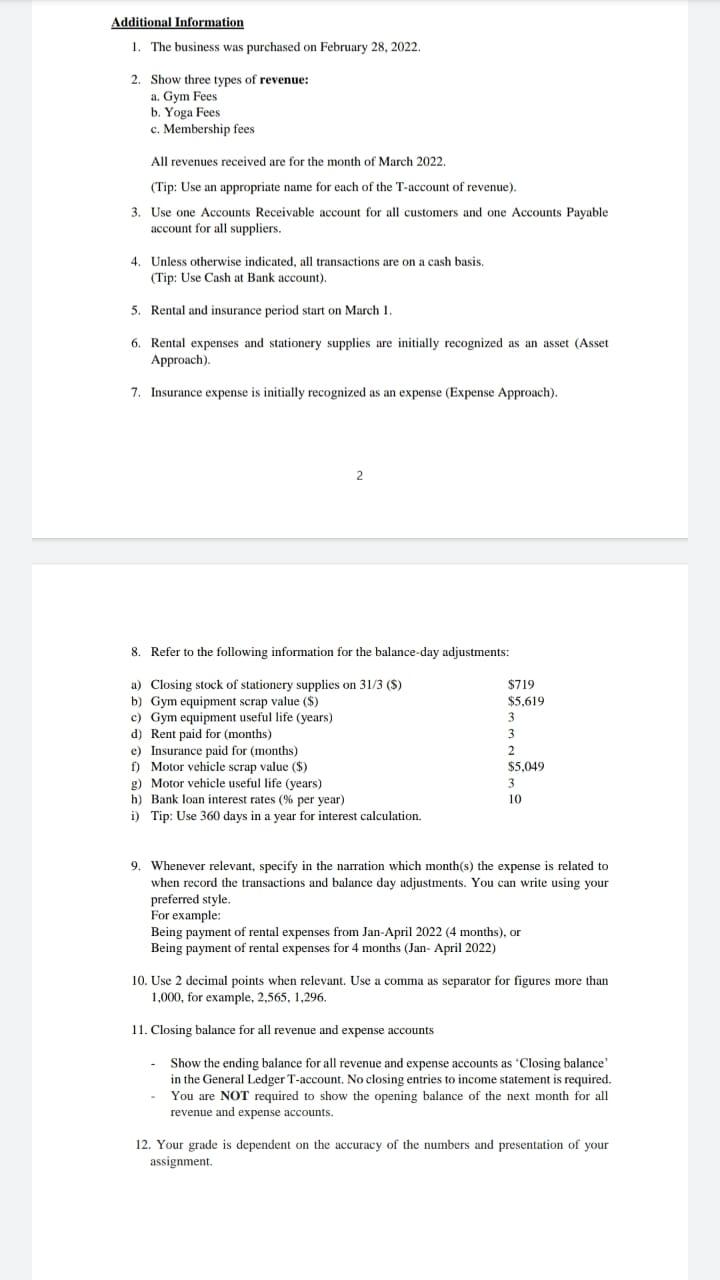

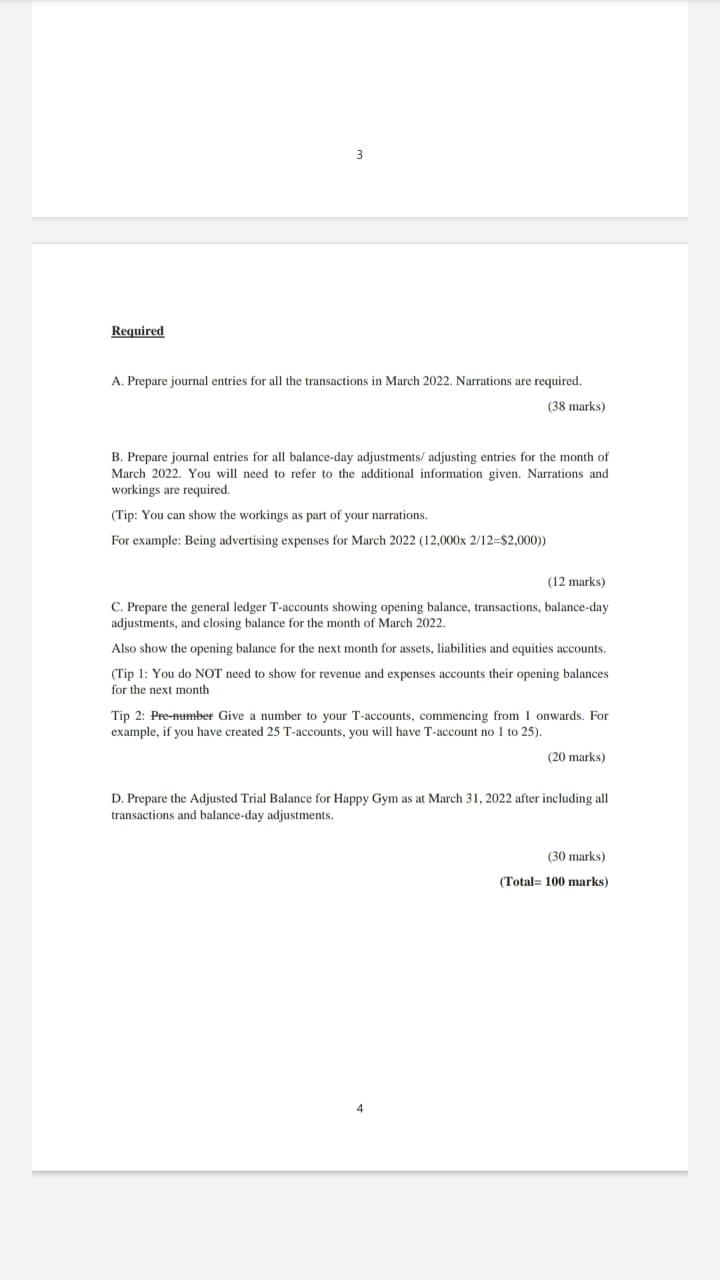

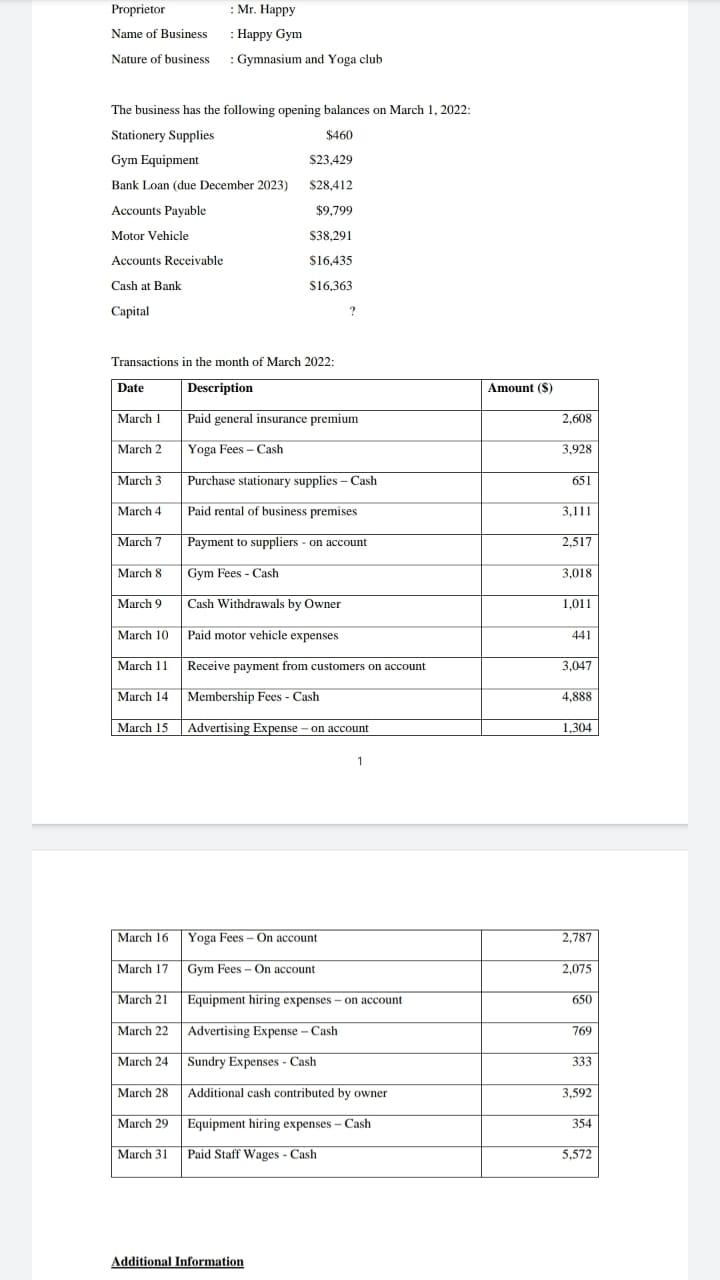

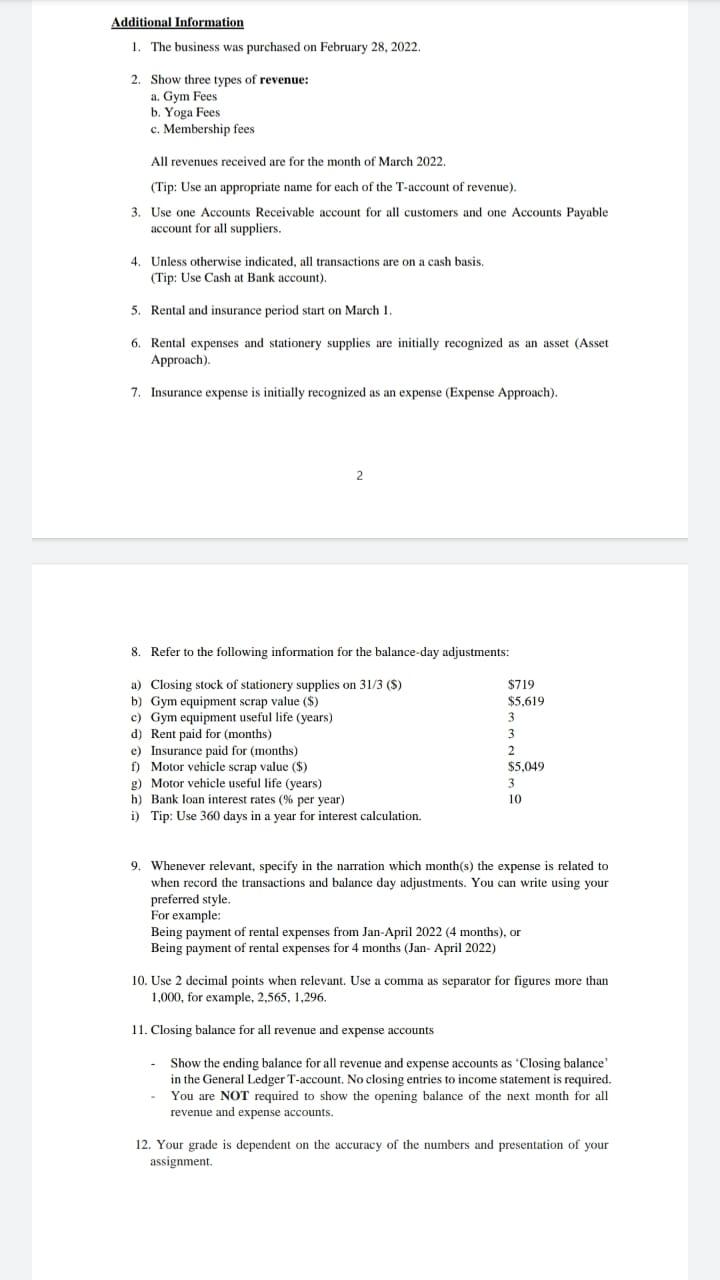

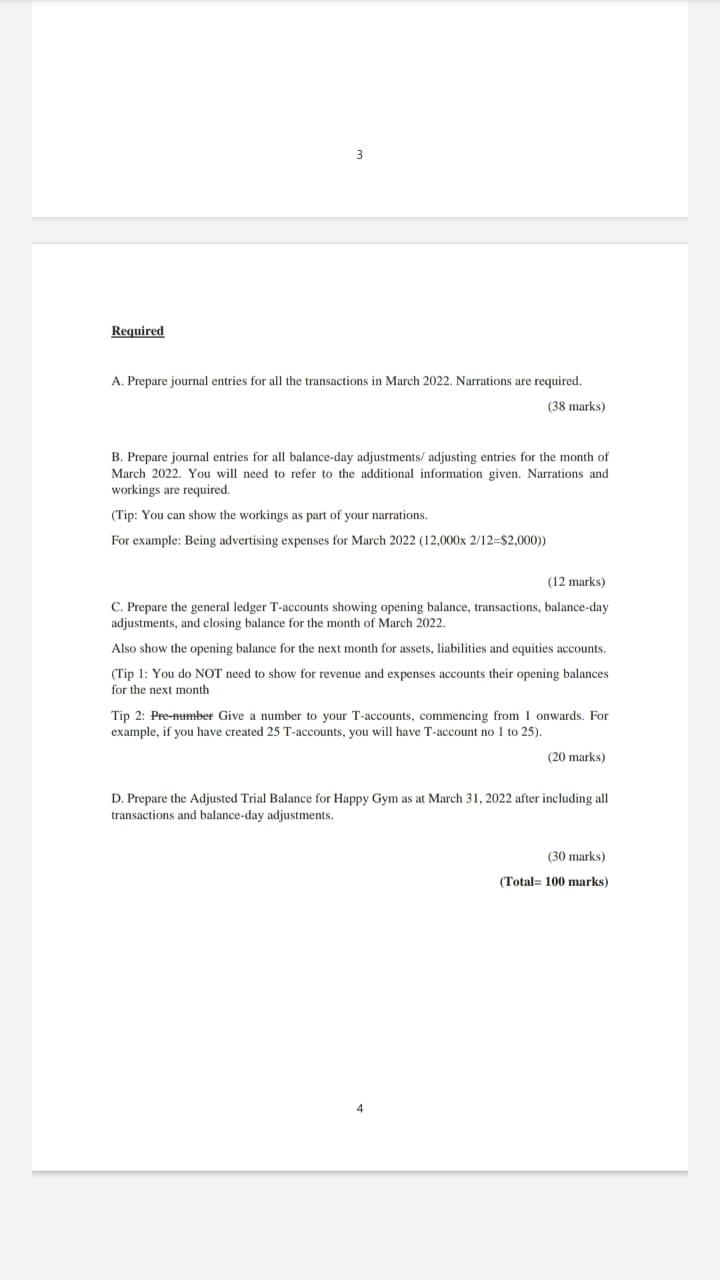

Proprietor : Mr. Happy Name of Business : Happy Gym Nature of business Gymnasium and Yoga club The business has the following opening balances on March 1. 2022: Stationery Supplies $460 Gym Equipment $23,429 Bank Loan (due December 2023) $28,412 ) Accounts Payable $9,799 Motor Vehicle S38,291 Accounts Receivable $16,435 Cash at Bank $16.363 Capital ? Transactions in the month of March 2022: Date Description Amount (S March 1 Paid general insurance premium 2,608 March 2 Yoga Fees -Cash 3,928 March 3 Purchase stationary supplies - Cash 651 March 4 Paid rental of business premises 3,111 March 7 Payment to suppliers - on account 2.517 March 8 Gym Fees - Cash 3,018 March 9 Cash Withdrawals by Owner 1.011 March 10 Paid motor vehicle expenses 441 March 11 Receive payment from customers on account 3,047 4.888 March 14 Membership Fees - Cash March 15 Advertising Expense - on account - 1.304 1 March 16 Yoga Fees - On account 2,787 March 17 Gym Fees - On account 2.075 March 21 Equipment hiring expenses - on account 650 769 333 March 22 Advertising Expense - Cash March 24 Sundry Expenses - Cash March 28 Additional cash contributed by owner March 29 Equipment hiring expenses - Cash 3,592 354 March 31 Paid Staff Wages - Cash 5.572 Additional Information Additional Information 1. The business was purchased on February 28, 2022. 2. Show three types of revenue: a. Gym Fees b. Yoga Fees c. Membership fees All revenues received are for the month of March 2022. (Tip: Use an appropriate name for each of the T-account of revenue). 3. Use one Accounts Receivable account for all customers and one Accounts Payable account for all suppliers. 4. Unless otherwise indicated, all transactions are on a cash basis, (Tip: Use Cash at Bank account), 5. Rental and insurance period start on March 1. 6. Rental expenses and stationery supplies are initially recognized as an asset (Asset Approach). 7. Insurance expense is initially recognized as an expense (Expense Approach). 2 2 8. Refer to the following information for the balance-day adjustments a) Closing stock of stationery supplies on 31/3 ($) b) Gym equipment scrap value ($) c) Gym equipment useful life (years) d) Rent paid for months) e) Insurance paid for (months) D Motor vehicle scrap value ($) Motor vehicle useful life (years) b) Bank loan interest rates (% per year) i) Tip: Use 360 days in a year for interest calculation. $719 $5,619 3 3 2 2 $5,049 3 10 9. Whenever relevant, specify in the narration which month(s) the expense is related to when record the transactions and balance day adjustments. You can write using your preferred style. For example: Being payment of rental expenses from Jan-April 2022 (4 months), or Being payment of rental expenses for 4 months (Jan-April 2022) 10. Use 2 decimal points when relevant. Use a comma as separator for figures more than 1,000, for example, 2,565, 1.296. 11. Closing balance for all revenue and expense accounts Show the ending balance for all revenue and expense accounts as "Closing balance in the General Ledger T-account. No closing entries to income statement is required. You are NOT required to show the opening balance of the next month for all revenue and expense accounts. 12. Your grade is dependent on the accuracy of the numbers and presentation of your assignment. 3 Required A. Prepare journal entries for all the transactions in March 2022. Narrations are required. (38 marks) B. Prepare journal entries for all balance-day adjustments/ adjusting entries for the month of March 2022. You will need to refer to the additional information given. Narrations and workings are required. (Tip: You can show the workings as part of your narrations, For example: Being advertising expenses for March 2022 (12,000x 2/12-$2,000)) (12 marks) C. Prepare the general ledger T-accounts showing opening balance, transactions, balance-day adjustments, and closing balance for the month of March 2022. Also show the opening balance for the next month for assets, liabilities and equities accounts. (Tip 1: You do NOT need to show for revenue and expenses accounts their opening balances for the next month Tip 2: Pre-number Give a number to your T-accounts, commencing from 1 onwards. For example, if you have created 25 T-accounts, you will have T-account no 1 to 25). (20 marks) D. Prepare the Adjusted Trial Balance for Happy Gym as at March 31, 2022 after including all transactions and balance-day adjustments. (30 marks) (Total= 100 marks) 4