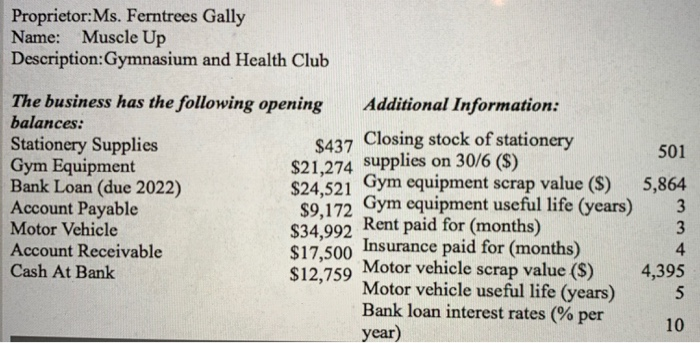

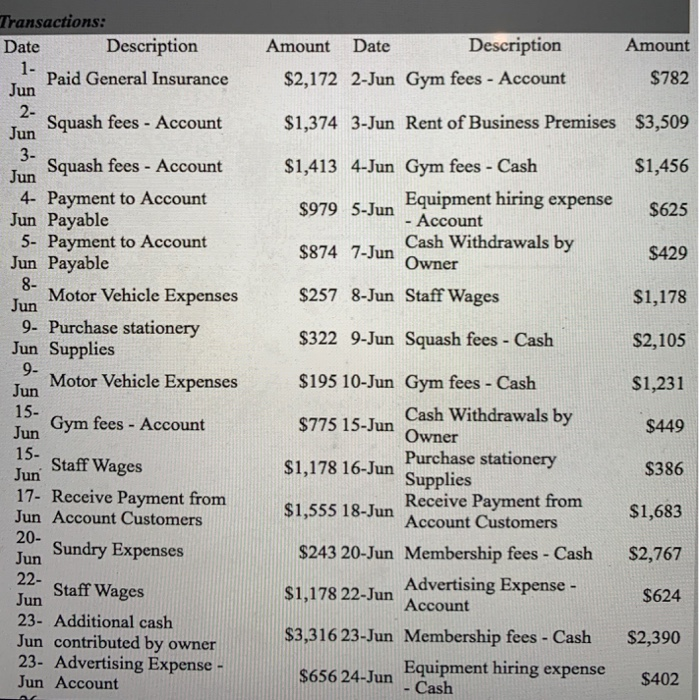

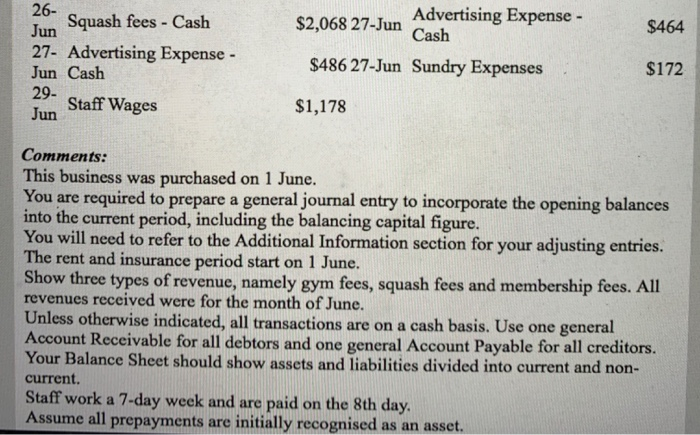

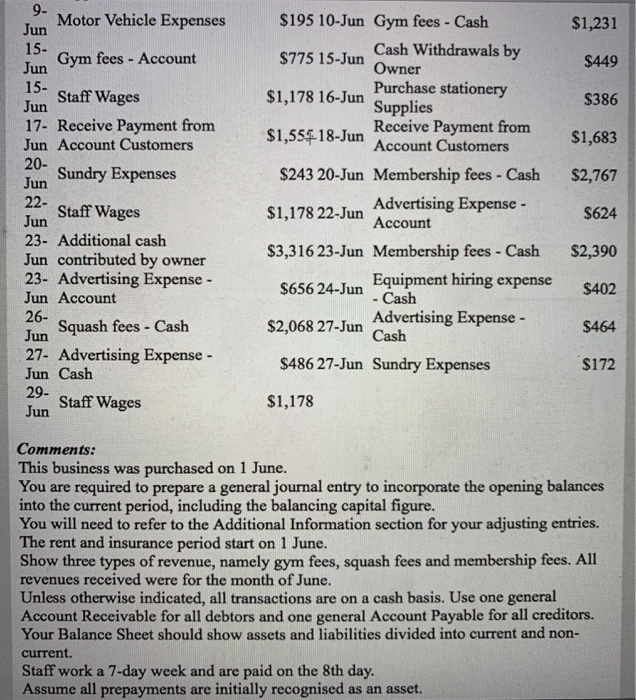

Proprietor:Ms. Ferntrees Gally Name: Muscle Up Description: Gymnasium and Health Club The business has the following opening balances: Stationery Supplies Gym Equipment Bank Loan (due 2022) Account Payable Motor Vehicle Account Receivable Cash At Bank Additional Information: $437 Closing stock of stationery $21,274 supplies on 30/6 (s) so 172 Gym equipment useful life (years)3 S34,992 Rent paid for (months) 501 $24,521 Gym equipment scrap value (S) 5,864 $17.500 Insurance paid for (months) 4 $12,759 Motor vehicle scrap value (S) 4,395 useful life (years) 5 Bank loan interest rates (% per 10 year) Transactions: Date Description Description Amount $782 $3,509 $1,456 S625 $429 $1,178 $2,105 $1,231 $449 $386 $1,683 $2,767 $624 $2,390 $402 Amount Date 1: Paid General Insurance $2,172 2-Jun Gym fees - Account 2- Squash fees - Account $1,374 3-Jun Rent of Business Premises un 3- Squash fees - Account $1,413 4-Jun Gym fees - Cash un Equipment hiring expense 4- Payment to Account $979 5-Jun Account $874 7-Jun owner $257 8-Jun Staff Wages S322 9-Jun Squash fees - Cash $195 10-Jun Gym fees - Cash S77515-Jun Cash Withdrawals by Jun Payable 5- Payment to Account Cash Withdrawals by Jun Payable Motor Vehicle Expenses 9- Purchase stationery 9- Jun Supplies Motor Vehicle Expenses un 15- Jun Gym fees- Account 15- un 17- Receive Payment from Jun Account Customers 20- Purchase stationery $1,178 16-Jun Supplies $1,555 18-Jun Receive Payment from Staff Wages Account Customers Sundry Expenses $243 20-Jun Membership fees - Cash un 22- Staff Wages $1,178 22-Jun Advertising Expense un 23- Additional cash Jun contributed by owner 23- Advertising Expense Jun Account Account $3,316 23-Jun Membership fees - Cash s656 24-Jun Equipment hiring expense Cash $2,068 27-Jun Advertising Expense Cash 26- Jun Squash fees - Cash 27- Advertising Expense - Jun Cash 29- Jun $464 $486 27-Jun Sundry Expenses $172 Staff Wages $1,178 Comments: This business was purchased on 1 June. You are required to prepare a general journal entry to incorporate the opening balances into the current period, including the balancing capital figure. You will need to refer to the Additional Information section for your adjusting entries. The rent and insurance period start on 1 June. Show three types of revenue, namely gym fees, squash fees and membership fees. All revenues received were for the month of June. Unless otherwise indicated, all transactions are on a cash basis. Use one general count Receivable for all debtors and one general Account Payable for all creditors. Your Balance Sheet should show assets and liabilities divided into current and non- current. Staff work a 7-day week and are paid on the 8th day Assume all prepayments are initially recognised as an asset 9- Jun Motor Vehicle Expenses $195 10-Jun Gym fees - Cash $1,231 $449 $386 $1,683 $2,767 $624 $2,390 $775 15-Jun Cash Withdrawals by Owner Jun Gym fees- 15- Staff Wages In Gym fees- Account $1,178 16-Jun Purchase stationery un 17- Receive Payment from Jun Account Customers 18-Jun Receive Payment from $1,55 Account Customers 20- Sundry Expenses $243 20-Jun Membership fees - Cash un $1,178 22-Jun Advertising Expense Staff Wages un 23- Additional cash Jun contributed by owner 23- Advertising Expense Jun Account 6 sqpine S3,316 23-Jun Membership fees - Cash $656 24-Jun Equipment hiring expense - Cash $2,068 27-Jun Advertising Expense Cash 26- Squash fees Cash $464 27- Advertising Expense - Jun Cash $172 S486 27-Jun Sundry Expenses 29- Staff Wages $1,178 un Comments: This business was purchased on 1 June. You are required to prepare a general journal entry to incorporate the opening balances into the current period, including the balancing capital figure. You will need to refer to the Additional Information section for your adjusting entries. The rent and insurance period start on 1 June. Show three types of revenue, namely gym fees, squash fees and membership fees. All revenues received were for the month of June. Unless otherwise indicated, all transactions are on a cash basis. Use one general Account Receivable for all debtors and one general Account Payable for all creditors. Your Balance Sheet should show assets and liabilities divided into current and non- current. Staff work a 7-day week and are paid on the 8th day Assume all prepayments are initially recognised as an asset