Answered step by step

Verified Expert Solution

Question

1 Approved Answer

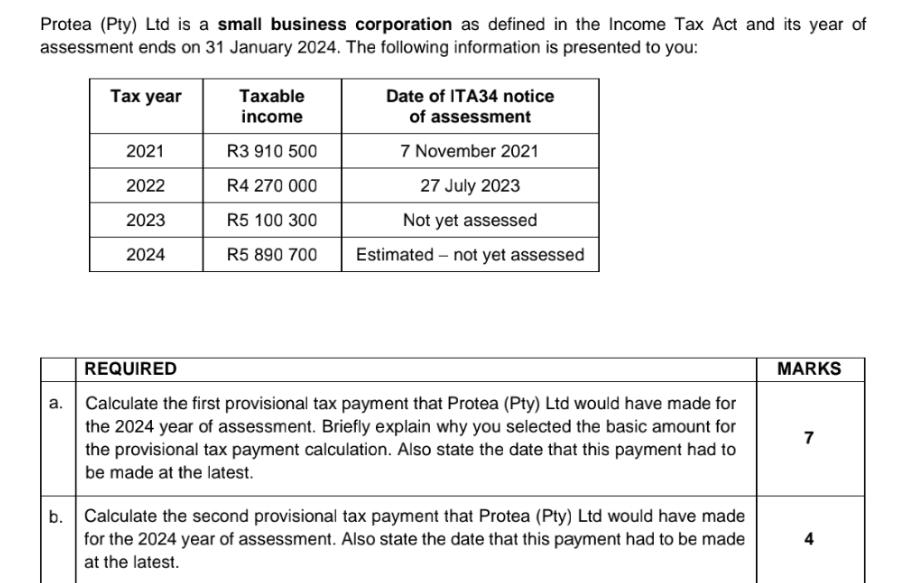

Protea (Pty) Ltd is a small business corporation as defined in the Income Tax Act and its year of assessment ends on 31 January

Protea (Pty) Ltd is a small business corporation as defined in the Income Tax Act and its year of assessment ends on 31 January 2024. The following information is presented to you: Tax year Taxable income Date of ITA34 notice of assessment 2021 R3 910 500 7 November 2021 2022 R4 270 000 2023 R5 100 300 27 July 2023 Not yet assessed 2024 R5 890 700 Estimated not yet assessed REQUIRED MARKS a. Calculate the first provisional tax payment that Protea (Pty) Ltd would have made for the 2024 year of assessment. Briefly explain why you selected the basic amount for the provisional tax payment calculation. Also state the date that this payment had to be made at the latest. 7 b. Calculate the second provisional tax payment that Protea (Pty) Ltd would have made for the 2024 year of assessment. Also state the date that this payment had to be made at the latest. 4

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the first provisional tax payment for Protea Pty Ltd for the 2024 year of assessment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started