Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Protect Ltd is an Australian leisure clothing company. It imports materials from Asia to produce high quality clothing used by walkers and joggers. It

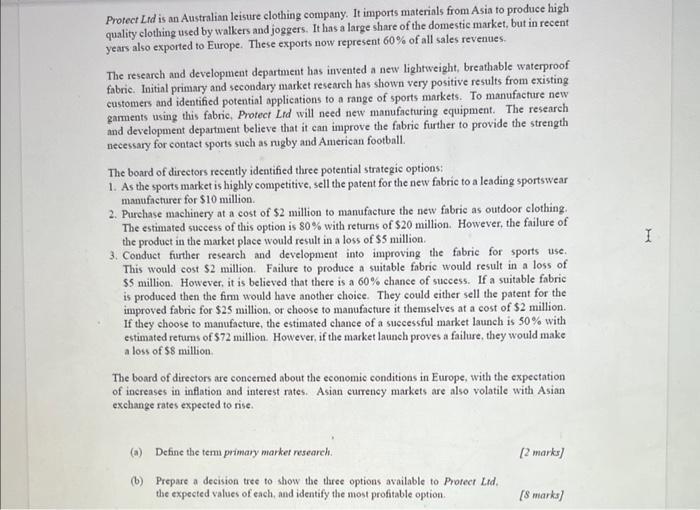

Protect Ltd is an Australian leisure clothing company. It imports materials from Asia to produce high quality clothing used by walkers and joggers. It has a large share of the domestic market, but in recent years also exported to Europe. These exports now represent 60% of all sales revenues. The research and development department has invented a new lightweight, breathable waterproof fabric. Initial primary and secondary market research has shown very positive results from existing customers and identified potential applications to a range of sports markets. To manufacture new garments using this fabric, Protect Ltd will need new manufacturing equipment. The research and development department believe that it can improve the fabric further to provide the strength necessary for contact sports such as rugby and American football. The board of directors recently identified three potential strategic options: 1. As the sports market is highly competitive, sell the patent for the new fabric to a leading sportswear manufacturer for $10 million. 2. Purchase machinery at a cost of $2 million to manufacture the new fabric as outdoor clothing. The estimated success of this option is 80% with returns of $20 million. However, the failure of the product in the market place would result in a loss of $5 million. 3. Conduct further research and development into improving the fabric for sports use. This would cost $2 million. Failure to produce a suitable fabric would result in a loss of $5 million. However, it is believed that there is a 60% chance of success. If a suitable fabric is produced then the firm would have another choice. They could either sell the patent for the improved fabric for $25 million, or choose to manufacture it themselves at a cost of $2 million. If they choose to manufacture, the estimated chance of a successful market launch is 50% with estimated returns of $72 million. However, if the market launch proves a failure, they would make a loss of $8 million. The board of directors are concerned about the economic conditions in Europe, with the expectation of increases in inflation and interest rates. Asian currency markets are also volatile with Asian exchange rates expected to rise. (a) Define the term primary market research. (b) Prepare a decision tree to show the three options available to Protect Ltd. the expected values of each, and identify the most profitable option. [2 marks] [8 marks] I

Step by Step Solution

★★★★★

3.57 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started