Question

Protecto Corporation purchased 60 percent of Strand Companys outstanding shares on January 1, 20X1, for $31,100 more than book value. At that date, the fair

Protecto Corporation purchased 60 percent of Strand Companys outstanding shares on January 1, 20X1, for $31,100 more than book value. At that date, the fair value of the noncontrolling interest was $16,900 more than 40 percent of Strands book value. The full amount of the differential is considered related to patents and is being amortized over an eight-year period. In 20X1, Strand purchased a piece of land for $54,000 and later in the year sold it to Protecto for $77,000. Protecto is still holding the land as an investment. During 20X3, Protecto bonds with a value of $150,000 were exchanged for equipment valued at $150,000.

On January 1, 20X3, Protecto held inventory purchased previously from Strand for $47,500. During 20X3, Protecto purchased an additional $101,000 of goods from Strand and held $56,500 of this inventory on December 31, 20X3. Strand sells merchandise to the parent at cost plus a 25 percent markup.

Strand also purchases inventory items from Protecto. On January 1, 20X3, Strand held inventory it had previously purchased from Protecto for $15,400, and on December 31, 20X3, it held goods it had purchased from Protecto for $7,000 during 20X3. Strands total purchases from Protecto in 20X3 were $33,000. Protecto sells inventory to Strand at cost plus a 40 percent markup.

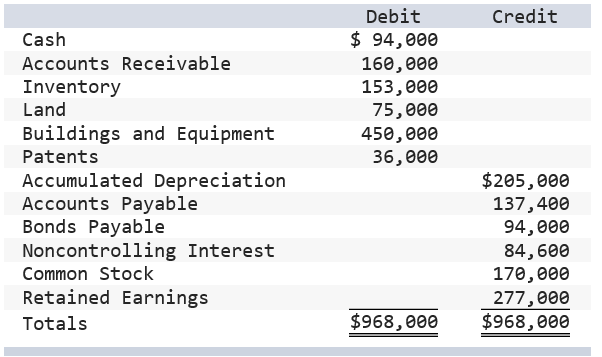

The consolidated balance sheet at December 31, 20X2, contained the following amounts:

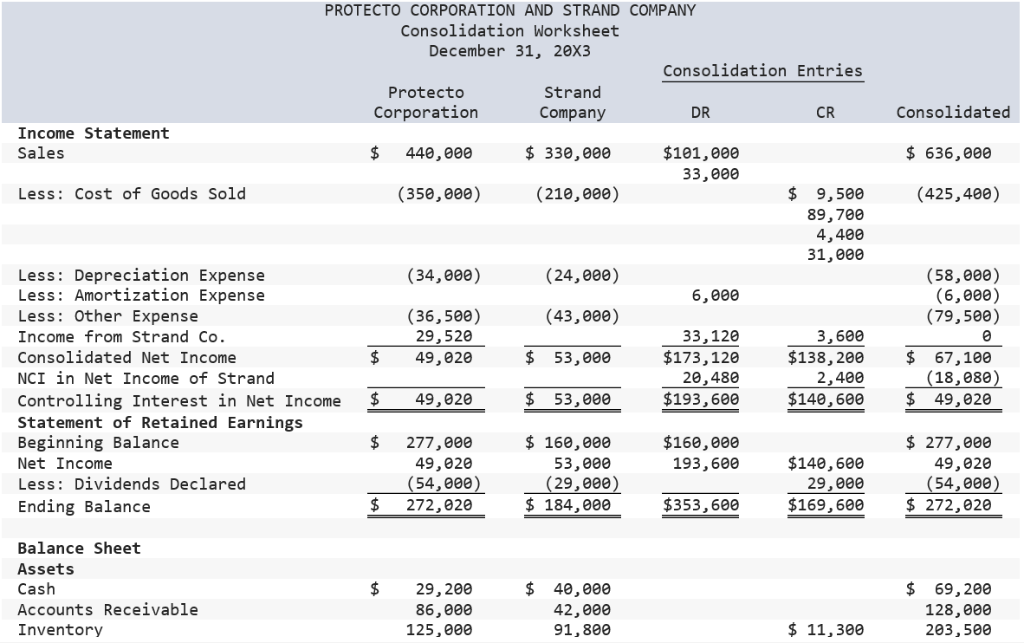

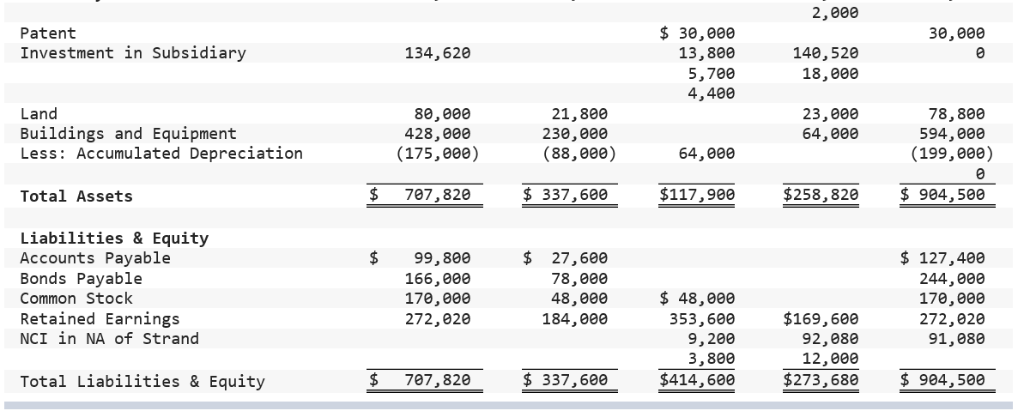

The consolidation worksheet below was prepared on December 31, 20X3. All consolidation entries and adjustments have been entered properly in the worksheet. Protecto accounts for its investment in Strand using the fully adjusted equity method.

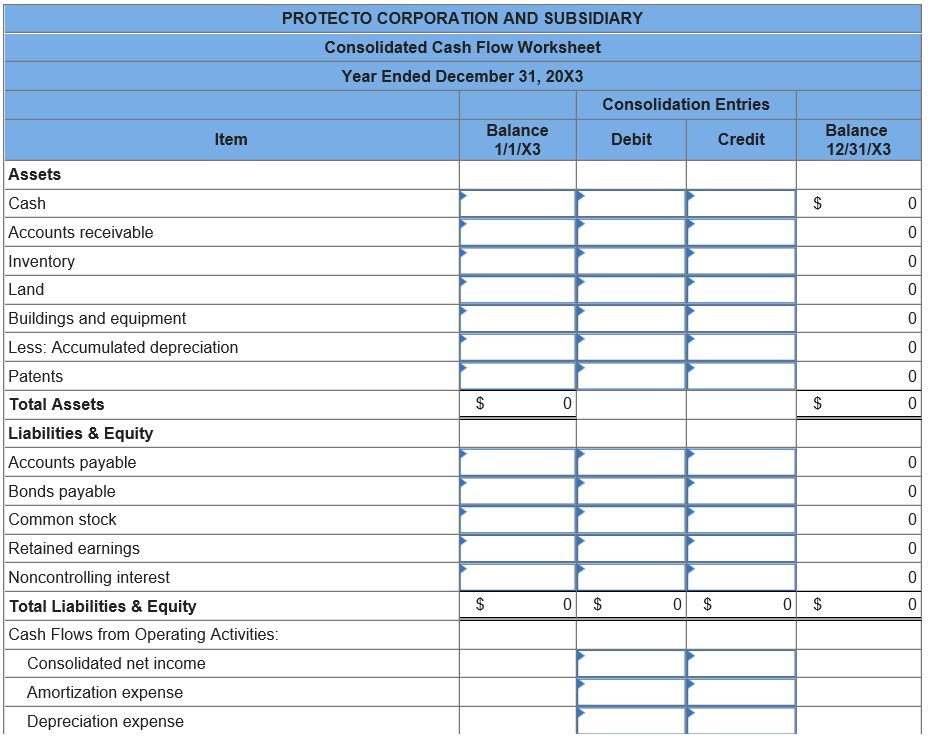

a. Prepare a worksheet for a consolidated statement of cash flows for 20X3 using the indirect method. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.)

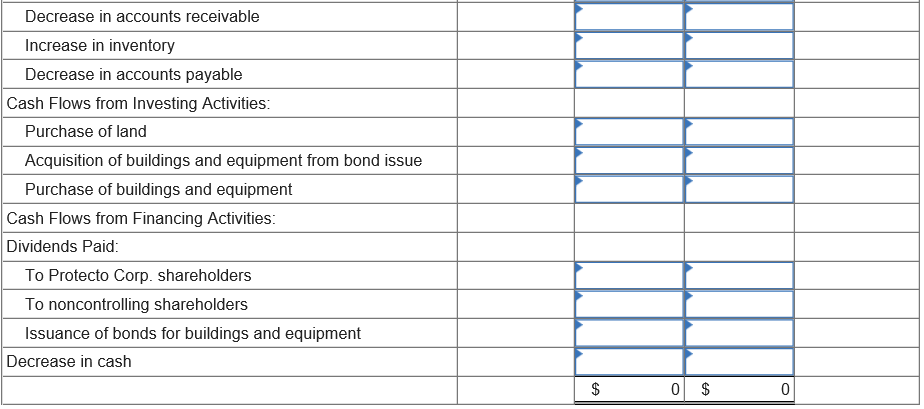

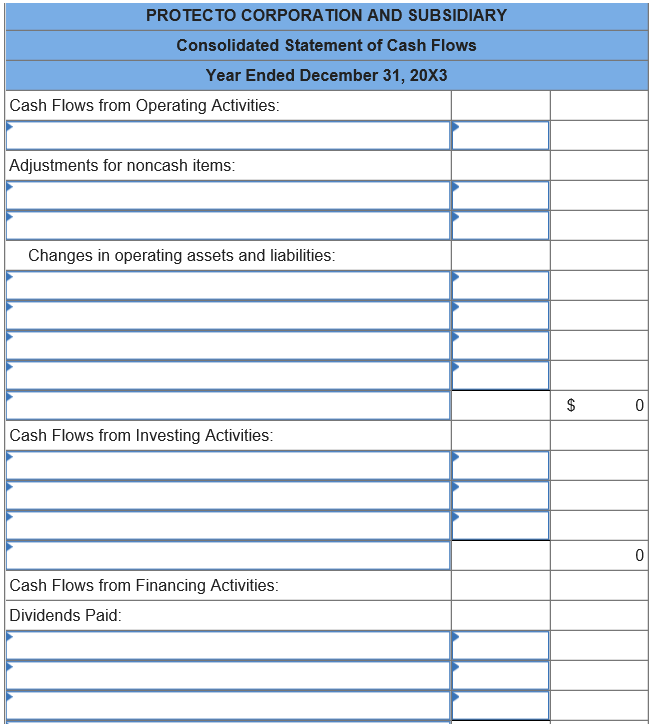

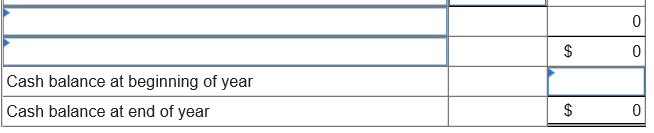

b. Prepare a consolidated statement of cash flows for 20X3. (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started