Question

Protek Company Income Statements (000,000s) Sales 20X1 COGS Gross Margin Expenses Common Common Size Growth 20X4 Size Marketing R&D Admin Total EBIT Interest EBT Tax

Protek Company Income Statements (000,000s) Sales 20X1 COGS Gross Margin Expenses Common Common Size Growth 20X4 Size Marketing R&D Admin Total EBIT Interest EBT Tax Net Income Protek Balance Sheets (000,0005) Cash AR Inventory Current Assets Fixed assets Gross Acc Depn Net Total Assets AP ACC Current Liabilities change in NWC Capital LID Equity Total Liabilities and Equity Common Size Actual 20X2 1578 631 947 Common Size Growth 2106 100% 0.550332 906 43% 1200 57% 20X3 100% 46% 54% 316 158 126 600 347 63 284 97 187 20X1 30 175 90 295 1565 -610 955 1250 56 15 71 630 549 1250 Growth 100% 0.334601 40% 60% 3265 1502 1763 20% 10% 8% 38% 22% 4% 18% 6% 12% 495 211 179 885 315 95 220 75 145 24% 10% 8% 42% 15% 5% 10% 4% 7% 882 327 294 1503 260 143 117 40 7 27% 10% 9% 46% 8% 4% 4% 1% 2% 20x2 Changes X2-XI 10 176 61 247 40 351 use 151 use 542 20X3 Changes X3-X2 22 239 149 410 62 590 use 300 use 952 808 -250 558 2373 use 860 1513 345 -275 70 2718 use -1135 1583 805 2055 480 2535 25 5 30 -207 81 source 20 source 101 53 10 63 -325 134 source 30 source 164 630 145 805 1260 Source 694 Source 2055 340 77 480 1600 source 771 source 2535

Ratios Current Quick ACP Inv Turn FA Turn TA Turn Debt Ratio Debt: Equity TIE ROS ROA ROE Industry 4.5 3.2 42 7.5 1.6 1.2 53% 1 4 5 9% 10.80% 22.80% 20X1 4.15 2.89 39.92 7.01 1.65 1.26 0.56 1.15 5.51 12% 15% 34% 20X2 5.37 3 87 60.00 6.00 1.39 1.02 0.66 1.82 3.32 7% 7% 21% 20x3 5.80 3.98 65.05 5.01 2.06 888 1.82 2% 3% 10% 20X4

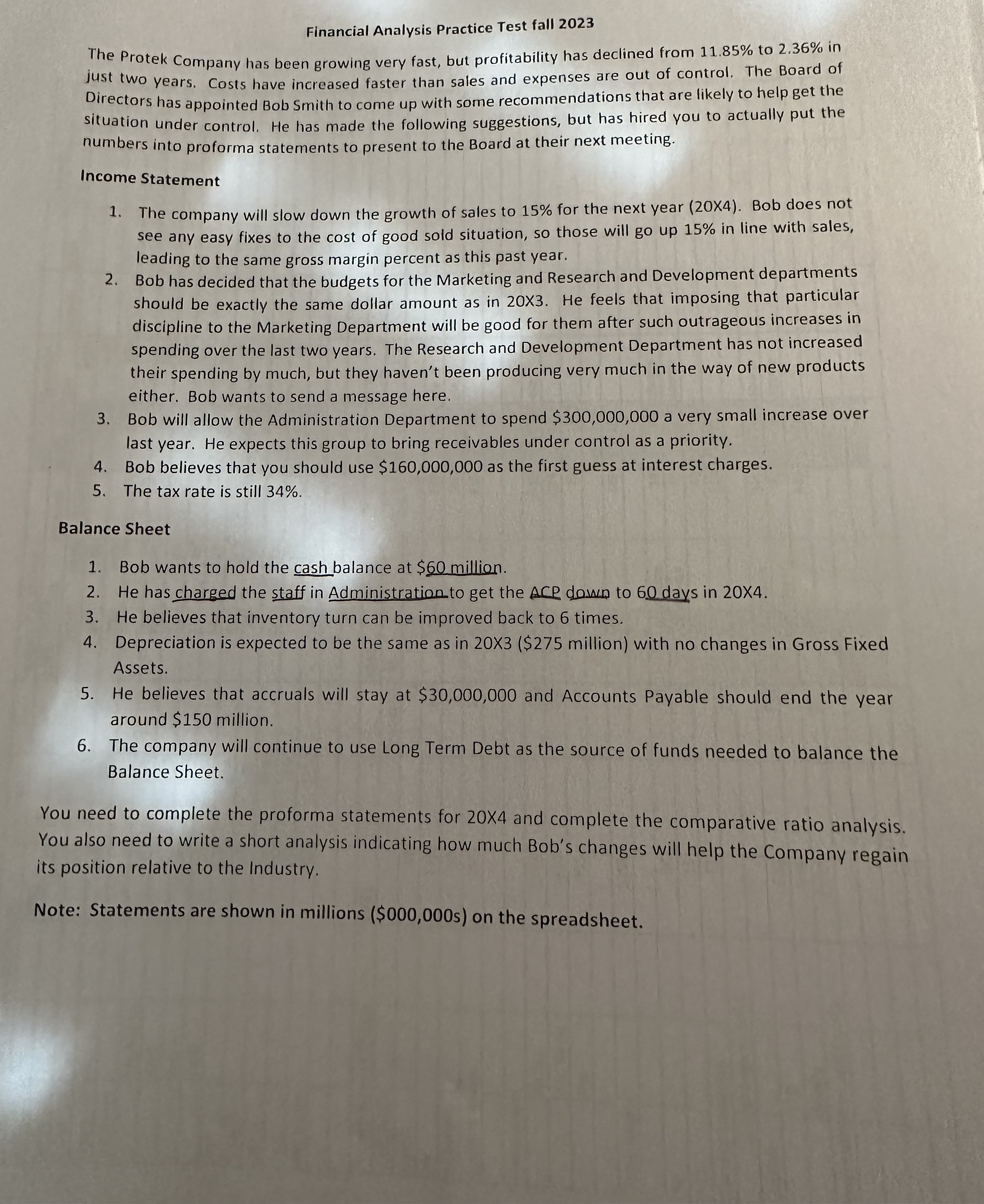

Financial Analysis Practice Test fall 2023 The Protek Company has been growing very fast, but profitability has declined from 11.85% to 2.36% in just two years. Costs have increased faster than sales and expenses are out of control. The Board of Directors has appointed Bob Smith to come up with some recommendations that are likely to help get the situation under control. He has made the following suggestions, but has hired you to actually put the numbers into proforma statements to present to the Board at their next meeting. Income Statement 1. The company will slow down the growth of sales to 15% for the next year (20x4). Bob does not see any easy fixes to the cost of good sold situation, so those will go up 15% in line with sales, leading to the same gross margin percent as this past year. 2. Bob has decided that the budgets for the Marketing and Research and Development departments should be exactly the same dollar amount as in 20x3. He feels that imposing that particular discipline to the Marketing Department will be good for them after such outrageous increases in spending over the last two years. The Research and Development Department has not increased their spending by much, but they haven't been producing very much in the way of new products either. Bob wants to send a message here. 3. Bob will allow the Administration Department to spend $300,000,000 a very small increase over last year. He expects this group to bring receivables under control as a priority. 4. Bob believes that you should use $160,000,000 as the first guess at interest charges. 5. The tax rate is still 34%. Balance Sheet 1. Bob wants to hold the cash balance at $60 million. 2. He has charged the staff in Administration to get the ACP down to 60 days in 204. 3. He believes that inventory turn can be improved back to 6 times. 4. Depreciation is expected to be the same as in 203 ( $275 million) with no changes in Gross Fixed Assets. 5. He believes that accruals will stay at $30,000,000 and Accounts Payable should end the year around $150 million. 6. The company will continue to use Long Term Debt as the source of funds needed to balance the Balance Sheet. You need to complete the proforma statements for 204 and complete the comparative ratio analysis. You also need to write a short analysis indicating how much Bob's changes will help the Company regain its position relative to the Industry. Note: Statements are shown in millions ($000,000 s) on the spreadsheet. Financial Analysis Practice Test fall 2023 The Protek Company has been growing very fast, but profitability has declined from 11.85% to 2.36% in just two years. Costs have increased faster than sales and expenses are out of control. The Board of Directors has appointed Bob Smith to come up with some recommendations that are likely to help get the situation under control. He has made the following suggestions, but has hired you to actually put the numbers into proforma statements to present to the Board at their next meeting. Income Statement 1. The company will slow down the growth of sales to 15% for the next year (20x4). Bob does not see any easy fixes to the cost of good sold situation, so those will go up 15% in line with sales, leading to the same gross margin percent as this past year. 2. Bob has decided that the budgets for the Marketing and Research and Development departments should be exactly the same dollar amount as in 20x3. He feels that imposing that particular discipline to the Marketing Department will be good for them after such outrageous increases in spending over the last two years. The Research and Development Department has not increased their spending by much, but they haven't been producing very much in the way of new products either. Bob wants to send a message here. 3. Bob will allow the Administration Department to spend $300,000,000 a very small increase over last year. He expects this group to bring receivables under control as a priority. 4. Bob believes that you should use $160,000,000 as the first guess at interest charges. 5. The tax rate is still 34%. Balance Sheet 1. Bob wants to hold the cash balance at $60 million. 2. He has charged the staff in Administration to get the ACP down to 60 days in 204. 3. He believes that inventory turn can be improved back to 6 times. 4. Depreciation is expected to be the same as in 203 ( $275 million) with no changes in Gross Fixed Assets. 5. He believes that accruals will stay at $30,000,000 and Accounts Payable should end the year around $150 million. 6. The company will continue to use Long Term Debt as the source of funds needed to balance the Balance Sheet. You need to complete the proforma statements for 204 and complete the comparative ratio analysis. You also need to write a short analysis indicating how much Bob's changes will help the Company regain its position relative to the Industry. Note: Statements are shown in millions ($000,000 s) on the spreadsheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started