Provide a background and summary of your idea

including estimates for revenue, net operating gash flows, sales, earnings, investment costs,

expenses over 5-year time horizon. Justify your assumptions based on similar industry trends and

summarize in a table.

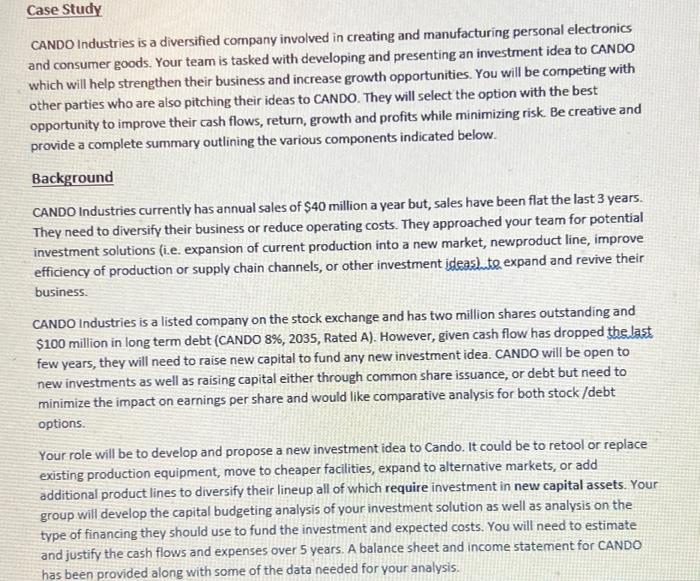

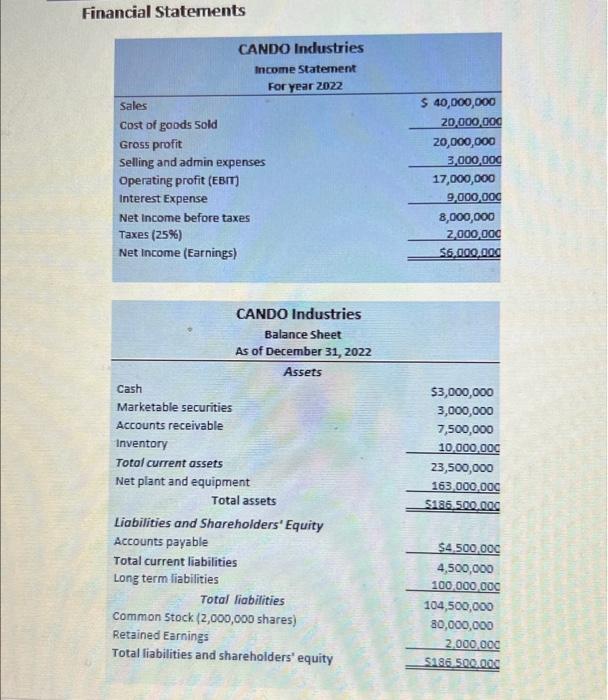

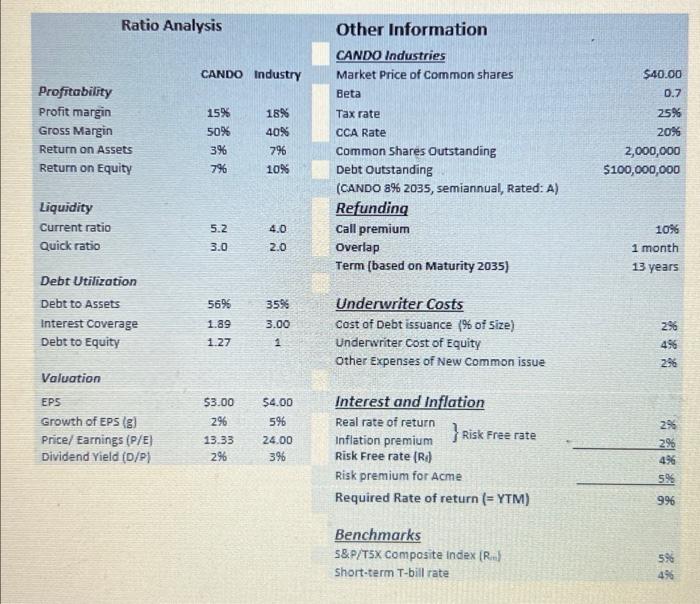

Case Study CANDO Industries is a diversified company involved in creating and manufacturing personal electronics and consumer goods. Your team is tasked with developing and presenting an investment idea to CANDO which will help strengthen their business and increase growth opportunities. You will be competing with other parties who are also pitching their ideas to CANDO. They will select the option with the best opportunity to improve their cash flows, return, growth and profits while minimizing risk Be creative and provide a complete summary outlining the various components indicated below. Background CANDO Industries currently has annual sales of $40 million a year but, sales have been flat the last 3 years. They need to diversify their business or reduce operating costs. They approached your team for potential investment solutions (i.e. expansion of current production into a new market, newproduct line, improve efficiency of production or supply chain channels, or other investment ideas to expand and revive their business. CANDO Industries is a listed company on the stock exchange and has two million shares outstanding and $100 million in long term debt (CANDO 8%, 2035, Rated A). However, given cash flow has dropped the last few years, they will need to raise new capital to fund any new investment idea. CANDO will be open to new investments as well as raising capital either through common share issuance, or debt but need to minimize the impact on earnings per share and would like comparative analysis for both stock /debt options. Your role will be to develop and propose a new investment idea to Cando. It could be to retool or replace existing production equipment, move to cheaper facilities, expand to alternative markets, or add additional product lines to diversify their lineup all of which require investment in new capital assets. Your group will develop the capital budgeting analysis of your investment solution as well as analysis on the type of financing they should use to fund the investment and expected costs. You will need to estimate and justify the cash flows and expenses over 5 years. A balance sheet and income statement for CANDO has been provided along with some of the data needed for your analysis. Financial Statements CANDO Industries Income Statement For year 2022 Sales Cost of goods Sold Gross profit Selling and admin expenses Operating profit (EBIT) Interest Expense Net Income before taxes Taxes (25%) Net Income (Earnings) $ 40,000,000 20,000,000 20,000,000 3,000,000 17,000,000 9,000,000 8,000,000 2,000,000 $6,000,000 CANDO Industries Balance sheet As of December 31, 2022 Assets Cash Marketable securities Accounts receivable Inventory Total current assets Net plant and equipment Total assets Liabilities and Shareholders' Equity Accounts payable Total current liabilities Long term liabilities Total liabilities Common Stock (2,000,000 shares) Retained Earnings Total liabilities and shareholders' equity $3,000,000 3,000,000 7,500,000 10,000,000 23,500,000 163,000,000 5186.500.000 $4,500,000 4,500,000 100,000,000 104,500,000 80,000,000 2.000.000 5186.500.000 Ratio Analysis Other Information CANDO Industries Market Price of common shares Beta CANDO Industry Profitability Profit margin Gross Margin 18% Tax rate 15% 50% 3% 796 $40.00 0.7 25% 20 2,000,000 $100,000,000 Return on Assets 40% 796 10% Return on Equity Liquidity Current ratio Quick ratio CCA Rate Common Shares Outstanding Debt Outstanding (CANDO 8% 2035, semiannual, Rated: A) Refunding Call premium Overlap Term (based on Maturity 2035) 5.2 3.0 4.0 2.0 1096 1 month 13 years 569 Debt Utilization Debt to Assets Interest Coverage Debt to Equity 35% 3.00 1 1.89 1.27 296 Underwriter Costs Cost of Debt issuance 1% of size) Underwriter cost of Equity Other Expenses of New common issue 496 296 Valuation EPS Growth of EPS (8) Price/ Earnings (P/E) Dividend Yield (D/P) $3.00 296 13.33 2% $4.00 596 24.00 396 Interest and Inflation Real rate of return Inflation premium } Risk Free rate Risk Free rate Rd Risk premium for Acme Required Rate of return (=YTM) 296 296 496 59 996 Benchmarks 5&P/T5X Composite Index (R) Short-term T-bill rate 5% 496 Case Study CANDO Industries is a diversified company involved in creating and manufacturing personal electronics and consumer goods. Your team is tasked with developing and presenting an investment idea to CANDO which will help strengthen their business and increase growth opportunities. You will be competing with other parties who are also pitching their ideas to CANDO. They will select the option with the best opportunity to improve their cash flows, return, growth and profits while minimizing risk Be creative and provide a complete summary outlining the various components indicated below. Background CANDO Industries currently has annual sales of $40 million a year but, sales have been flat the last 3 years. They need to diversify their business or reduce operating costs. They approached your team for potential investment solutions (i.e. expansion of current production into a new market, newproduct line, improve efficiency of production or supply chain channels, or other investment ideas to expand and revive their business. CANDO Industries is a listed company on the stock exchange and has two million shares outstanding and $100 million in long term debt (CANDO 8%, 2035, Rated A). However, given cash flow has dropped the last few years, they will need to raise new capital to fund any new investment idea. CANDO will be open to new investments as well as raising capital either through common share issuance, or debt but need to minimize the impact on earnings per share and would like comparative analysis for both stock /debt options. Your role will be to develop and propose a new investment idea to Cando. It could be to retool or replace existing production equipment, move to cheaper facilities, expand to alternative markets, or add additional product lines to diversify their lineup all of which require investment in new capital assets. Your group will develop the capital budgeting analysis of your investment solution as well as analysis on the type of financing they should use to fund the investment and expected costs. You will need to estimate and justify the cash flows and expenses over 5 years. A balance sheet and income statement for CANDO has been provided along with some of the data needed for your analysis. Financial Statements CANDO Industries Income Statement For year 2022 Sales Cost of goods Sold Gross profit Selling and admin expenses Operating profit (EBIT) Interest Expense Net Income before taxes Taxes (25%) Net Income (Earnings) $ 40,000,000 20,000,000 20,000,000 3,000,000 17,000,000 9,000,000 8,000,000 2,000,000 $6,000,000 CANDO Industries Balance sheet As of December 31, 2022 Assets Cash Marketable securities Accounts receivable Inventory Total current assets Net plant and equipment Total assets Liabilities and Shareholders' Equity Accounts payable Total current liabilities Long term liabilities Total liabilities Common Stock (2,000,000 shares) Retained Earnings Total liabilities and shareholders' equity $3,000,000 3,000,000 7,500,000 10,000,000 23,500,000 163,000,000 5186.500.000 $4,500,000 4,500,000 100,000,000 104,500,000 80,000,000 2.000.000 5186.500.000 Ratio Analysis Other Information CANDO Industries Market Price of common shares Beta CANDO Industry Profitability Profit margin Gross Margin 18% Tax rate 15% 50% 3% 796 $40.00 0.7 25% 20 2,000,000 $100,000,000 Return on Assets 40% 796 10% Return on Equity Liquidity Current ratio Quick ratio CCA Rate Common Shares Outstanding Debt Outstanding (CANDO 8% 2035, semiannual, Rated: A) Refunding Call premium Overlap Term (based on Maturity 2035) 5.2 3.0 4.0 2.0 1096 1 month 13 years 569 Debt Utilization Debt to Assets Interest Coverage Debt to Equity 35% 3.00 1 1.89 1.27 296 Underwriter Costs Cost of Debt issuance 1% of size) Underwriter cost of Equity Other Expenses of New common issue 496 296 Valuation EPS Growth of EPS (8) Price/ Earnings (P/E) Dividend Yield (D/P) $3.00 296 13.33 2% $4.00 596 24.00 396 Interest and Inflation Real rate of return Inflation premium } Risk Free rate Risk Free rate Rd Risk premium for Acme Required Rate of return (=YTM) 296 296 496 59 996 Benchmarks 5&P/T5X Composite Index (R) Short-term T-bill rate 5% 496