Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide a brief discussion of approximately 300 words detailing the risks inherent in stock returns in a portfolio of shares using the concepts of

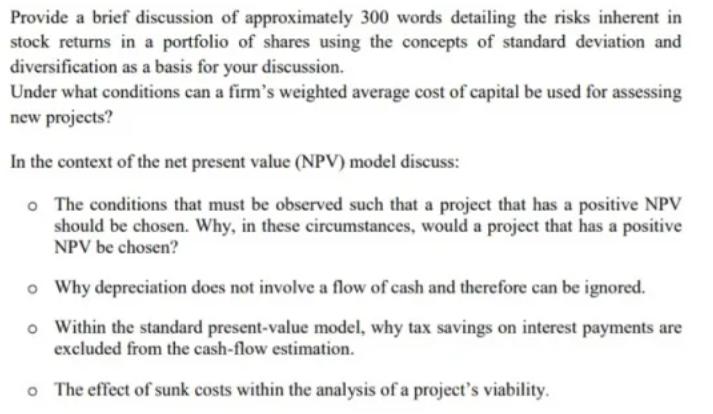

Provide a brief discussion of approximately 300 words detailing the risks inherent in stock returns in a portfolio of shares using the concepts of standard deviation and diversification as a basis for your discussion. Under what conditions can a firm's weighted average cost of capital be used for assessing new projects? In the context of the net present value (NPV) model discuss: o The conditions that must be observed such that a project that has a positive NPV should be chosen. Why, in these circumstances, would a project that has a positive NPV be chosen? o Why depreciation does not involve a flow of cash and therefore can be ignored. o Within the standard present-value model, why tax savings on interest payments are excluded from the cash-flow estimation. o The effect of sunk costs within the analysis of a project's viability.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Risks in Stock Returns and the Importance of Diversification When investing in a portfolio of shares there are inherent risks associated with stock returns One common measure of risk is standard devia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started