PROVIDE A DECLINING MARGIN VERSION.

PROVIDE A DECLINING MARGIN VERSION.

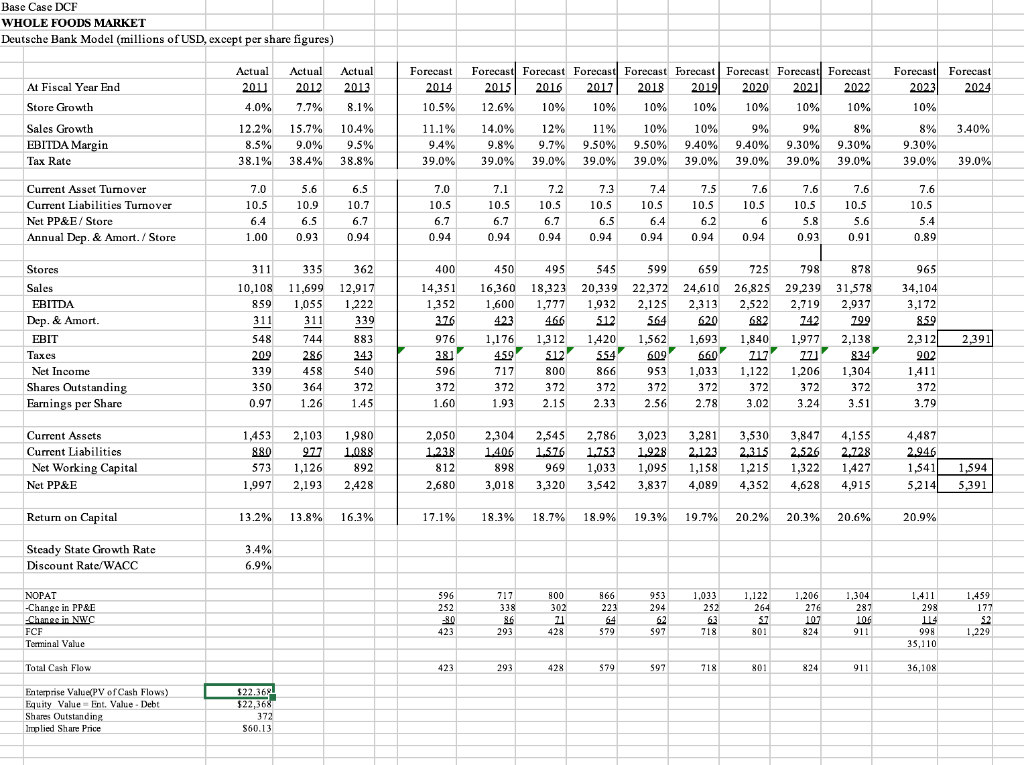

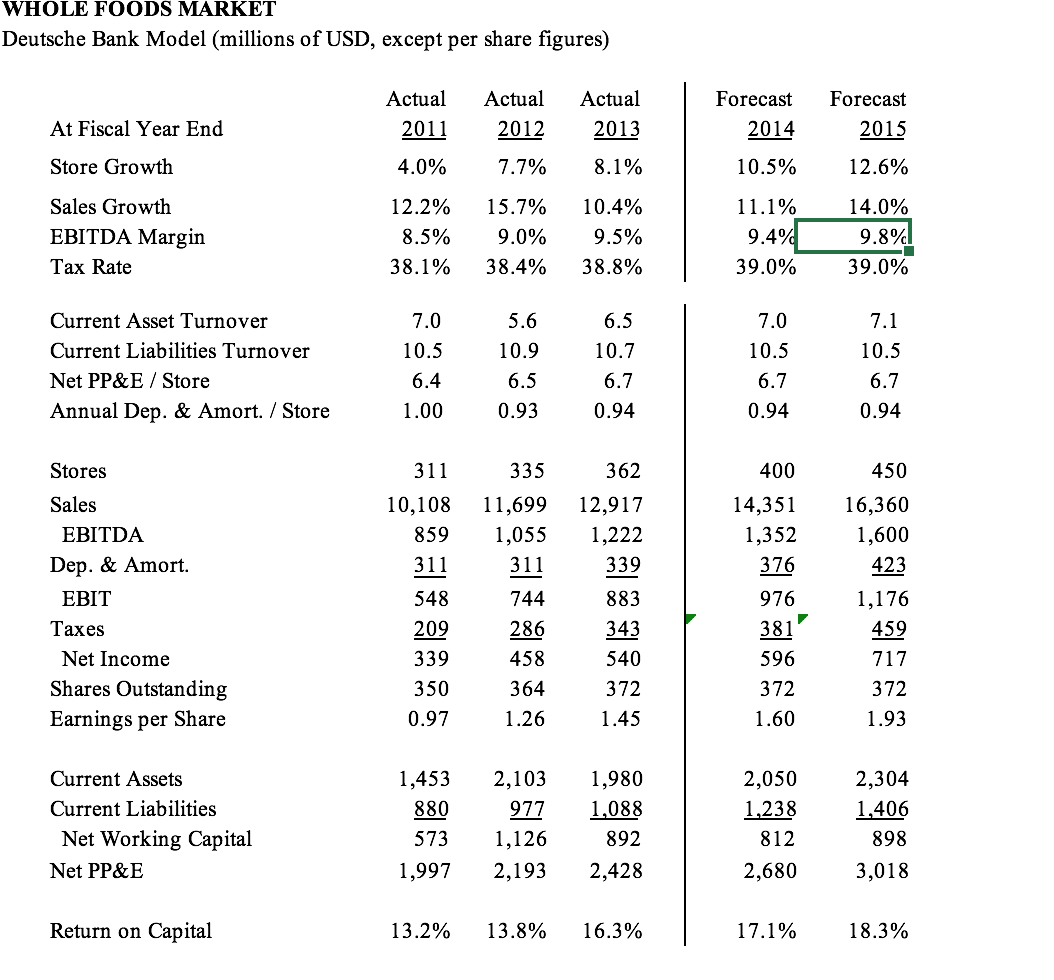

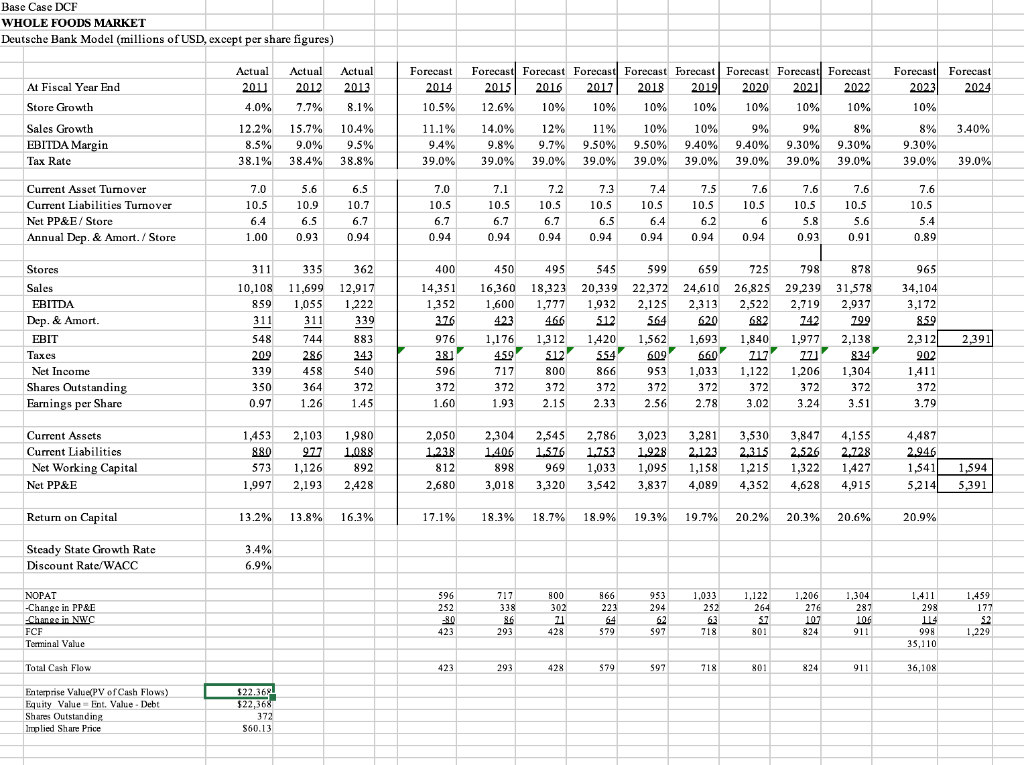

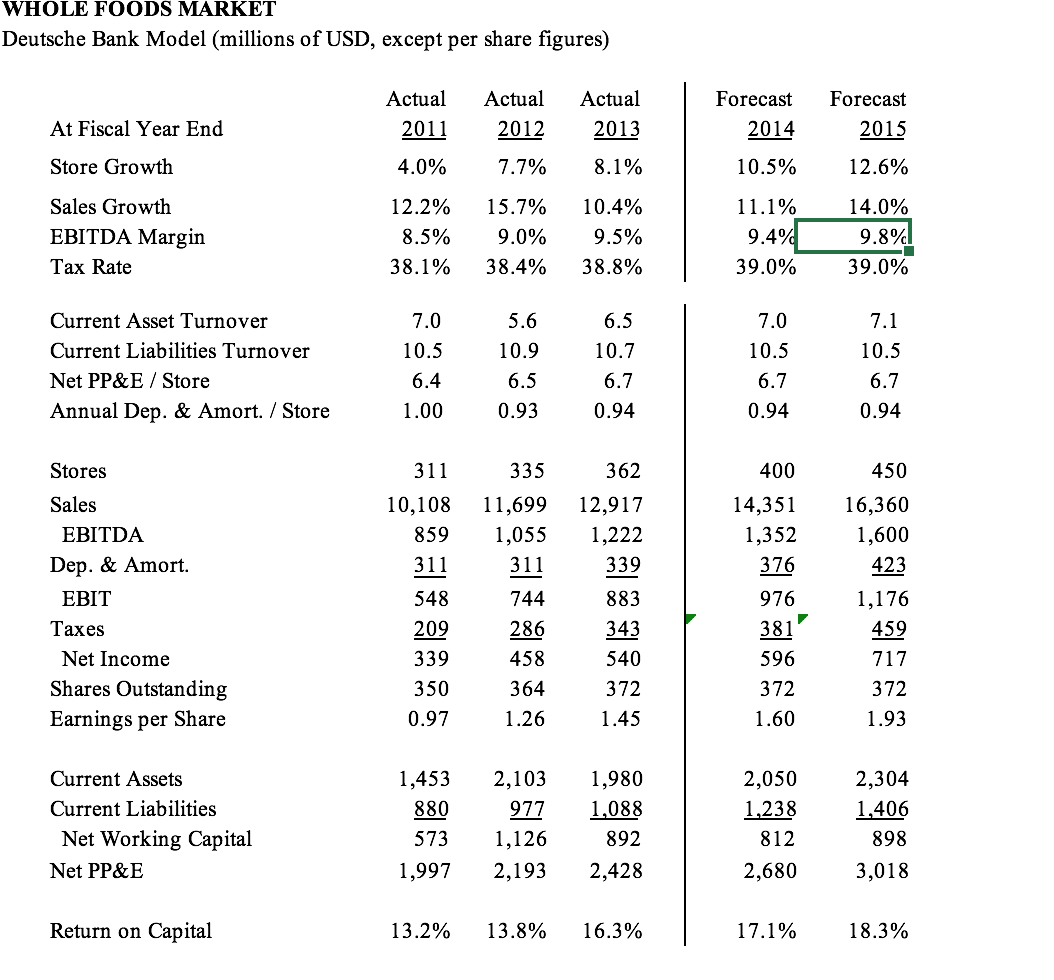

Provide a declining margin version of the NPV analysis, using the Exhibit 7 values and forecasting cash-flows thru 2023, include the terminal value in 2023. Comment on your results. The EBITDA margin declines by 0.5% each year. In the terminal year, the EBITDA margin is estimated at 4.9%, a level that is consistent with the EBITDA margins of conventional grocers. For the steady state growth rate use 3.4%, the real growth rate of 2% plus a rate of expected long-term inflation of 1.4% based on the prevailing 30-year government bond yield. Base Case DCF WHOLE FOODS MARKET Deutsche Bank Model (millions of USD, except per share figures) Actual 2011 4. 0 Actual 2012 .7% Actual 2013 8.1% 7 At Fiscal Year End Store Growth Sales Growth EBITDA Margin Tax Rate Forecast 2014 10.5% 11.1% 9,4% 39-0% Forecast Forecast Forecase Forecast forecast | Forecast Forecast Forecast 2015 2016 2017 2018 2019 2020 2021 2022 12,6% 10% 10% 10% 10% 10% 10% 10% 14-0% 12%| 11 10%| 10% 9% 9% 8% 9.8% 9.7% 9,50 9,50% 9,40% 9.40% 9.30% 9.30% 39-0%| 39.0% 39.0% 39.0%| 39.0% 39.0% 39.0% 39.0% Forecast Forecast 2023 2024 10% 8% 3.40 9.30% 39, 0 39.0% 12.2 % 8,5% 38.1 15,7% 9,0% 38.4% 1 ],4% 9,5% 38.8% 10.5 Current Asset Tumover Current Liabilities Turnover Net PP&E/ Store Annual Dep. & Amort / Store 7. 0 5 .6 10.5 10.9 6.4 6.5 1.000.93 6.5 10.7 6.7 0.94 7.0 7.1 7.2 7. 3 7 .4 7. 57. 67.6 10.5 10.5 10.5 10.5 10.5 10.5 10.5 10.5 10.5 6. 76. 76.7 6. 56. 46. 265. 85.6 0.94 0.94 0.94 0.94 0.94 0.94 0.94 0.920.91 0 ,89 965 Stores Sales EBITDA Dep. & Amort. EBIT Taxes Net Income Shares Outstanding Earnings per Share 311335 362 10,1 08 11,69q 12,917 8591 ,0551,222 311 31 1 339 548 744 209 286 343 339 458 540 350 364 0.97 1.26 1,45 400 45049555599 (659725798878 14,351 16,360 18,323 20,339 22,372 24,610 26,825 29,239 31,578 1.1521,600 1,777 1,9322.1252 .3132.5222,7192,917 76 423465513564520682742799 976 1,176 1,3121,420 1,562 1,6931,840 1,9772,138 38 459512 55460966071 7771834 596 800 866 9531,0331,122 1,2061,304 72 372 72 72 72 72372372172 1.50 1.93 2.152.332.562.783.023.243.51 34,104 ,172 B59 2,312[ 902 883 2,391 17 1,411 372 72 ,79 Current Assets Current Liabilities Net Working Capital Net PP&E 1,4532,1031 ,980 880977 1,088 5731,126 1,997 2,1932,428 2,050 23 042.5452,786 3,0233,281 3,530 3,847 4,155 1738 1,40$ 1,575 1,7531,928 1,123 2,3152,5262.728 898 969 1,0331,095 1,158 1,215 1,322 1,427 2,6803,018 3,3203,542 3,837 4,0894,352 4,6284 ,915 4,487 2.946 1,541] 5,214 126892 812 1,594 5,391| Return on Capital 13.2 % 13.8% 16.39% 17. 1 18.7% 19. 7 20.2 % 203% Steady State Growth Rate Discount Rate/WACC 3.4% 6.9% 1,459 1,411| 29 NOPAT -Change in PP&E -Change in NWC FCF Terminal Value 596 !7 B66 1,033 _1,122 1,206 252 338 276 -30 423293428579 59771830 1824 1,304 28? [0/ 911 1,229 | 99 35, 110 Total Cash Flow 42293428 37959771880 1824911/ 36,1 [8 ??,36 22,365 Enterprise Value PV of Cash Flows) Equity Value Ent. Value - Debt Shares Outstanding Implied Share Price 72 $50.13 WHOLE FOODS MARKET Deutsche Bank Model (millions of USD, except per share figures) Forecast 2014 Forecast 2015 12.6% 10.5% At Fiscal Year End Store Growth Sales Growth EBITDA Margin Tax Rate Actual 2011 4.0% 12.2% 8.5% 38.1% Actual 2012 7.7% 15.7% 9.0% 38.4% Actual 2013 8.1% 10.4% 9.5% 38.8% 11.1% 9.4% 39.0% 14.0% 9.8% 39.0% 7.0 5.6 7.0 10.5 7.1 10.5 Current Asset Turnover Current Liabilities Turnover Net PP&E / Store Annual Dep. & Amort. / store 6.5 10.5 10.9 10.7 6.4 6.5 6.7 1.000.930.94 6.7 6.7 0.94 0.94 335 400 362 12,917 1,222 311 339 Stores Sales EBITDA Dep. & Amort. EBIT Taxes Net Income Shares Outstanding Earnings per Share 311 10,108 11,699 859 _1,055 311 548 744 209 286 339 458 350 364 0.97 1.26 883 343 540 372 1.45 14,351 1,352 376 976 381 596 372 1.60 450 16,360 1,600 423 1,176 459 717 372 1.93 2,304 1,406 Current Assets Current Liabilities Net Working Capital Net PP&E 1,4532,103 1,980 880977 1,088 573 1,126 892 1,9972,1932,428 2,050 1,238 812 2,680 898 3,018 Return on Capital 13.2% 13.8% 16.3% 17.1% 18.3% Provide a declining margin version of the NPV analysis, using the Exhibit 7 values and forecasting cash-flows thru 2023, include the terminal value in 2023. Comment on your results. The EBITDA margin declines by 0.5% each year. In the terminal year, the EBITDA margin is estimated at 4.9%, a level that is consistent with the EBITDA margins of conventional grocers. For the steady state growth rate use 3.4%, the real growth rate of 2% plus a rate of expected long-term inflation of 1.4% based on the prevailing 30-year government bond yield. Base Case DCF WHOLE FOODS MARKET Deutsche Bank Model (millions of USD, except per share figures) Actual 2011 4. 0 Actual 2012 .7% Actual 2013 8.1% 7 At Fiscal Year End Store Growth Sales Growth EBITDA Margin Tax Rate Forecast 2014 10.5% 11.1% 9,4% 39-0% Forecast Forecast Forecase Forecast forecast | Forecast Forecast Forecast 2015 2016 2017 2018 2019 2020 2021 2022 12,6% 10% 10% 10% 10% 10% 10% 10% 14-0% 12%| 11 10%| 10% 9% 9% 8% 9.8% 9.7% 9,50 9,50% 9,40% 9.40% 9.30% 9.30% 39-0%| 39.0% 39.0% 39.0%| 39.0% 39.0% 39.0% 39.0% Forecast Forecast 2023 2024 10% 8% 3.40 9.30% 39, 0 39.0% 12.2 % 8,5% 38.1 15,7% 9,0% 38.4% 1 ],4% 9,5% 38.8% 10.5 Current Asset Tumover Current Liabilities Turnover Net PP&E/ Store Annual Dep. & Amort / Store 7. 0 5 .6 10.5 10.9 6.4 6.5 1.000.93 6.5 10.7 6.7 0.94 7.0 7.1 7.2 7. 3 7 .4 7. 57. 67.6 10.5 10.5 10.5 10.5 10.5 10.5 10.5 10.5 10.5 6. 76. 76.7 6. 56. 46. 265. 85.6 0.94 0.94 0.94 0.94 0.94 0.94 0.94 0.920.91 0 ,89 965 Stores Sales EBITDA Dep. & Amort. EBIT Taxes Net Income Shares Outstanding Earnings per Share 311335 362 10,1 08 11,69q 12,917 8591 ,0551,222 311 31 1 339 548 744 209 286 343 339 458 540 350 364 0.97 1.26 1,45 400 45049555599 (659725798878 14,351 16,360 18,323 20,339 22,372 24,610 26,825 29,239 31,578 1.1521,600 1,777 1,9322.1252 .3132.5222,7192,917 76 423465513564520682742799 976 1,176 1,3121,420 1,562 1,6931,840 1,9772,138 38 459512 55460966071 7771834 596 800 866 9531,0331,122 1,2061,304 72 372 72 72 72 72372372172 1.50 1.93 2.152.332.562.783.023.243.51 34,104 ,172 B59 2,312[ 902 883 2,391 17 1,411 372 72 ,79 Current Assets Current Liabilities Net Working Capital Net PP&E 1,4532,1031 ,980 880977 1,088 5731,126 1,997 2,1932,428 2,050 23 042.5452,786 3,0233,281 3,530 3,847 4,155 1738 1,40$ 1,575 1,7531,928 1,123 2,3152,5262.728 898 969 1,0331,095 1,158 1,215 1,322 1,427 2,6803,018 3,3203,542 3,837 4,0894,352 4,6284 ,915 4,487 2.946 1,541] 5,214 126892 812 1,594 5,391| Return on Capital 13.2 % 13.8% 16.39% 17. 1 18.7% 19. 7 20.2 % 203% Steady State Growth Rate Discount Rate/WACC 3.4% 6.9% 1,459 1,411| 29 NOPAT -Change in PP&E -Change in NWC FCF Terminal Value 596 !7 B66 1,033 _1,122 1,206 252 338 276 -30 423293428579 59771830 1824 1,304 28? [0/ 911 1,229 | 99 35, 110 Total Cash Flow 42293428 37959771880 1824911/ 36,1 [8 ??,36 22,365 Enterprise Value PV of Cash Flows) Equity Value Ent. Value - Debt Shares Outstanding Implied Share Price 72 $50.13 WHOLE FOODS MARKET Deutsche Bank Model (millions of USD, except per share figures) Forecast 2014 Forecast 2015 12.6% 10.5% At Fiscal Year End Store Growth Sales Growth EBITDA Margin Tax Rate Actual 2011 4.0% 12.2% 8.5% 38.1% Actual 2012 7.7% 15.7% 9.0% 38.4% Actual 2013 8.1% 10.4% 9.5% 38.8% 11.1% 9.4% 39.0% 14.0% 9.8% 39.0% 7.0 5.6 7.0 10.5 7.1 10.5 Current Asset Turnover Current Liabilities Turnover Net PP&E / Store Annual Dep. & Amort. / store 6.5 10.5 10.9 10.7 6.4 6.5 6.7 1.000.930.94 6.7 6.7 0.94 0.94 335 400 362 12,917 1,222 311 339 Stores Sales EBITDA Dep. & Amort. EBIT Taxes Net Income Shares Outstanding Earnings per Share 311 10,108 11,699 859 _1,055 311 548 744 209 286 339 458 350 364 0.97 1.26 883 343 540 372 1.45 14,351 1,352 376 976 381 596 372 1.60 450 16,360 1,600 423 1,176 459 717 372 1.93 2,304 1,406 Current Assets Current Liabilities Net Working Capital Net PP&E 1,4532,103 1,980 880977 1,088 573 1,126 892 1,9972,1932,428 2,050 1,238 812 2,680 898 3,018 Return on Capital 13.2% 13.8% 16.3% 17.1% 18.3%

PROVIDE A DECLINING MARGIN VERSION.

PROVIDE A DECLINING MARGIN VERSION.