Answered step by step

Verified Expert Solution

Question

1 Approved Answer

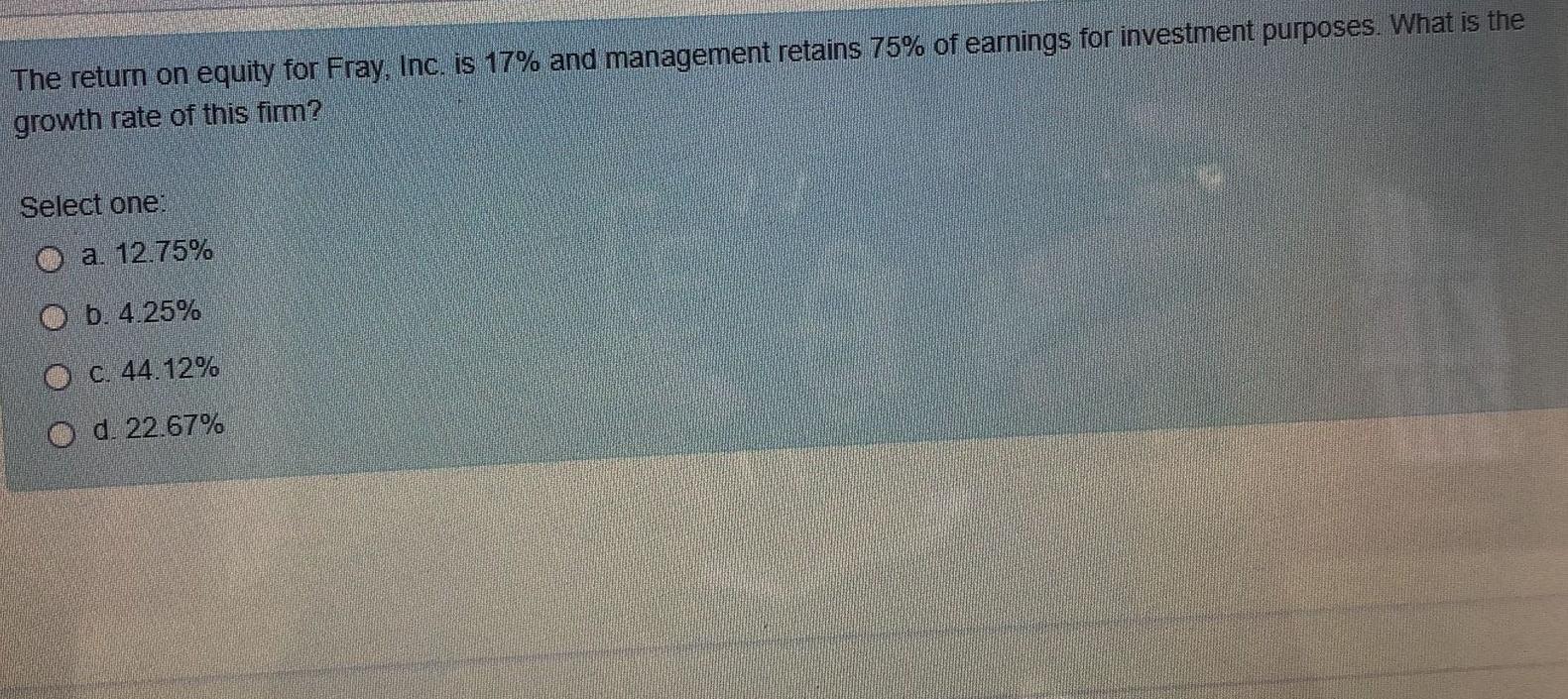

provide answers and working ASAP. The return on equity for Fray, Inc. is 17% and management retains 75% of earnings for investment purposes. What is

provide answers and working ASAP.

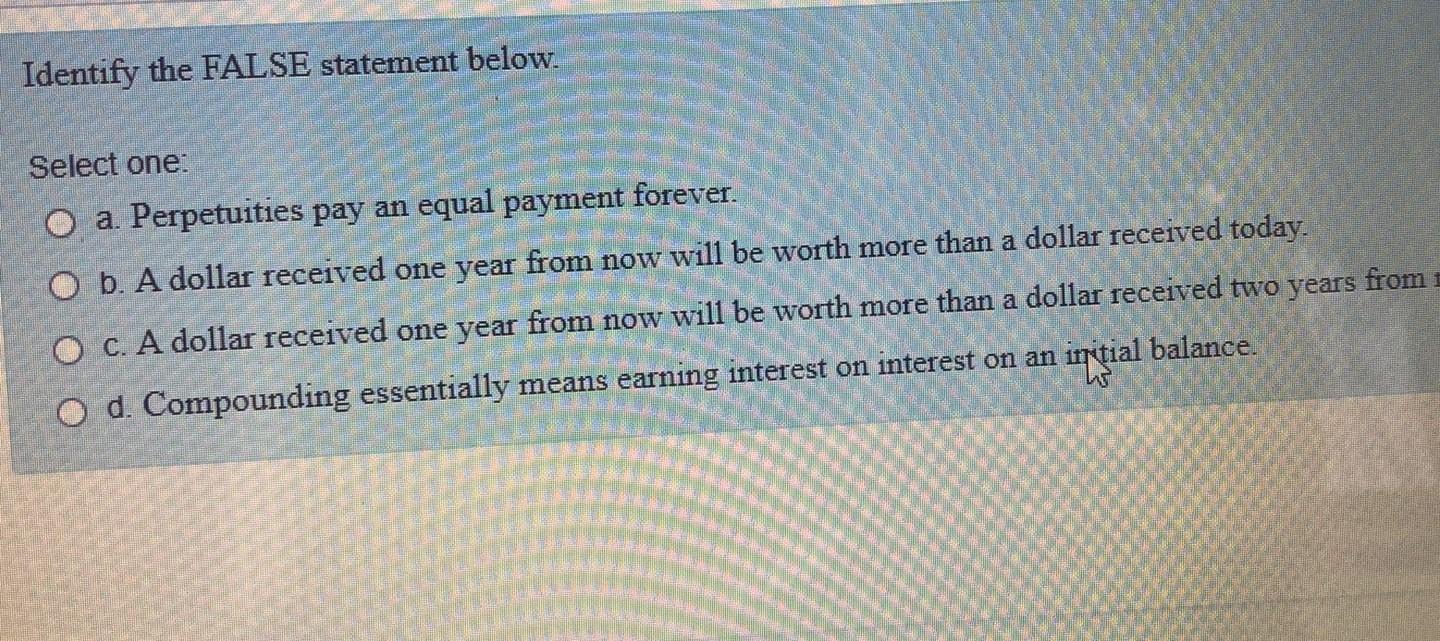

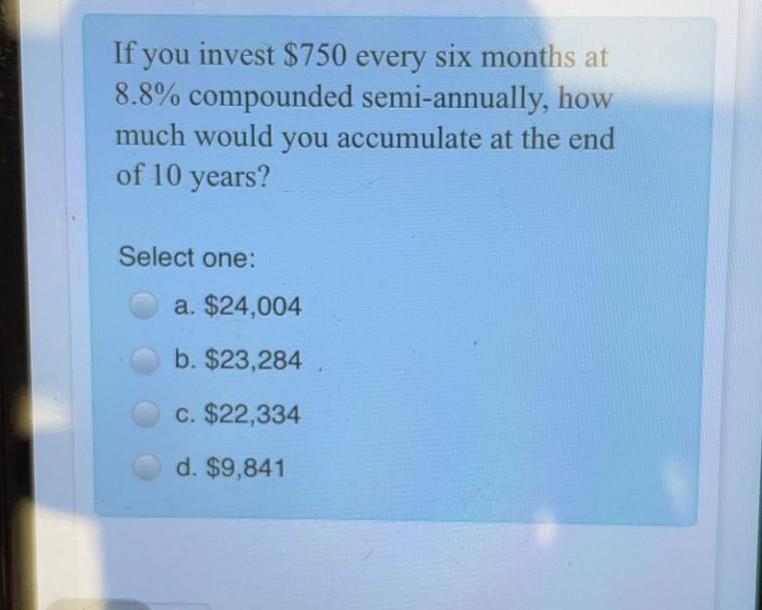

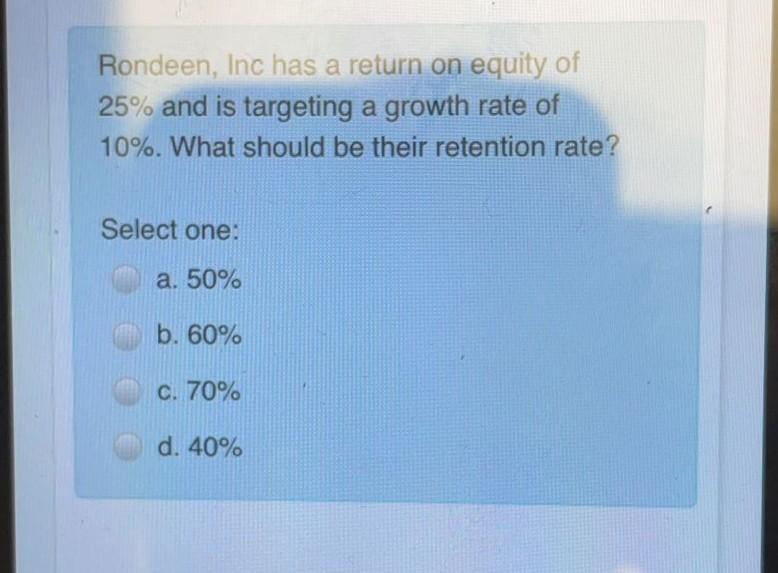

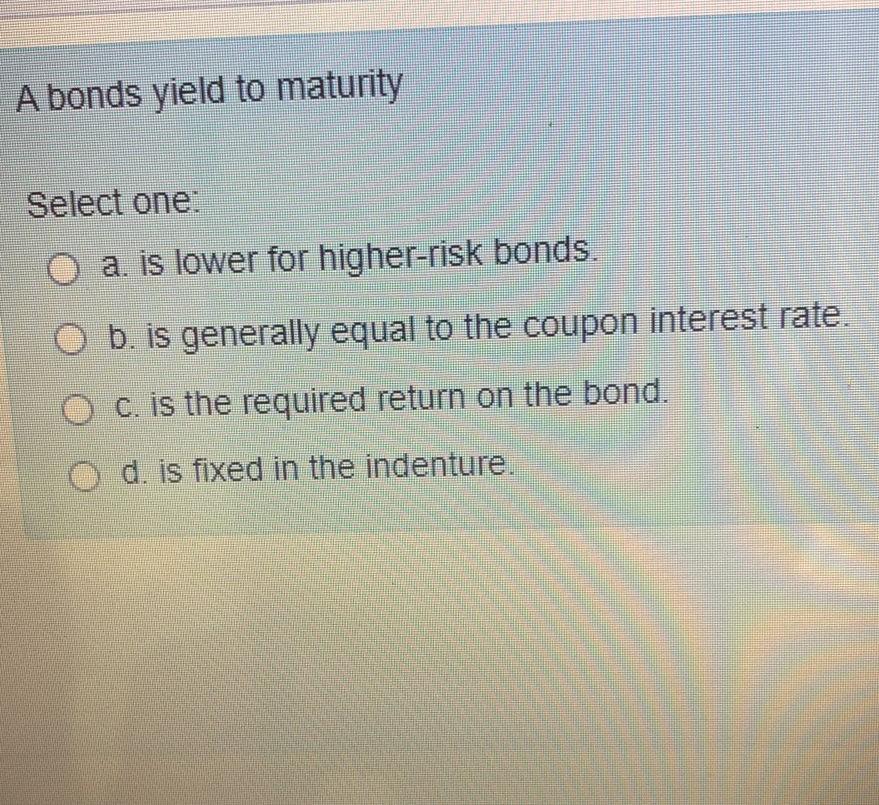

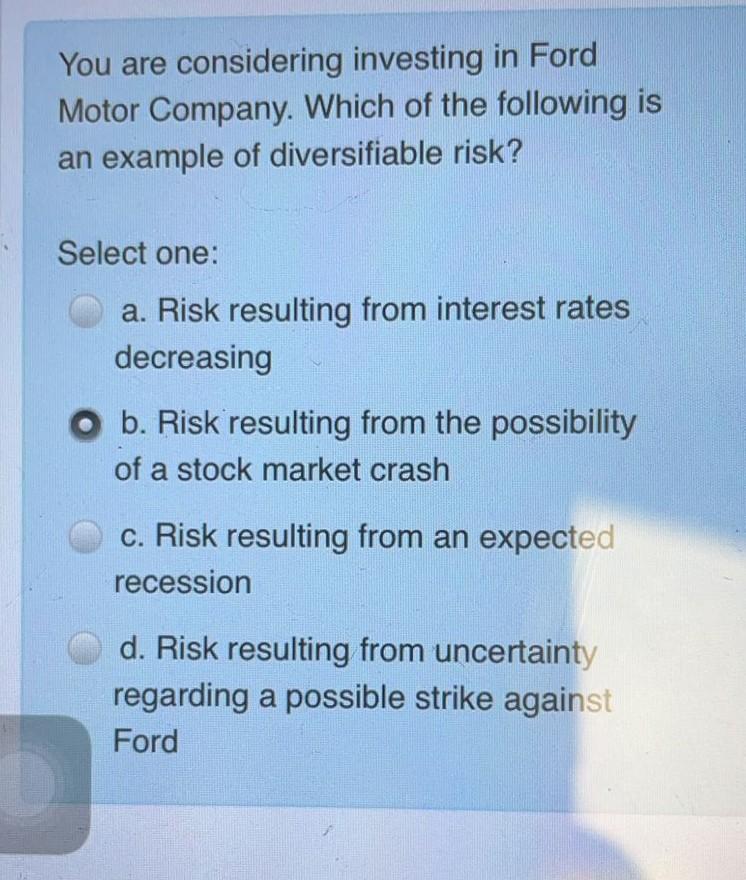

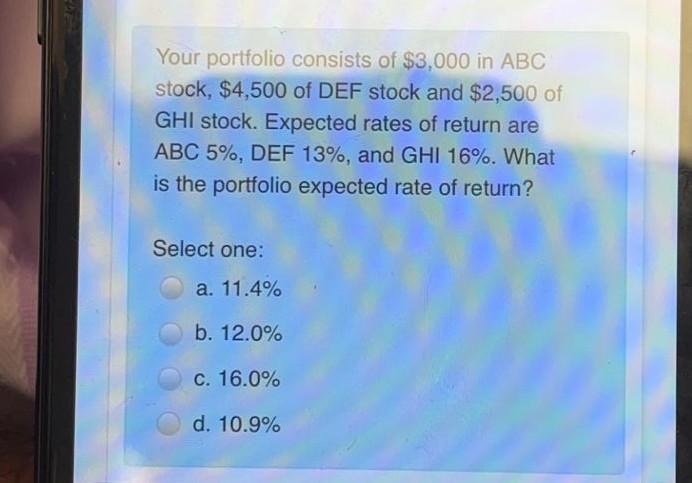

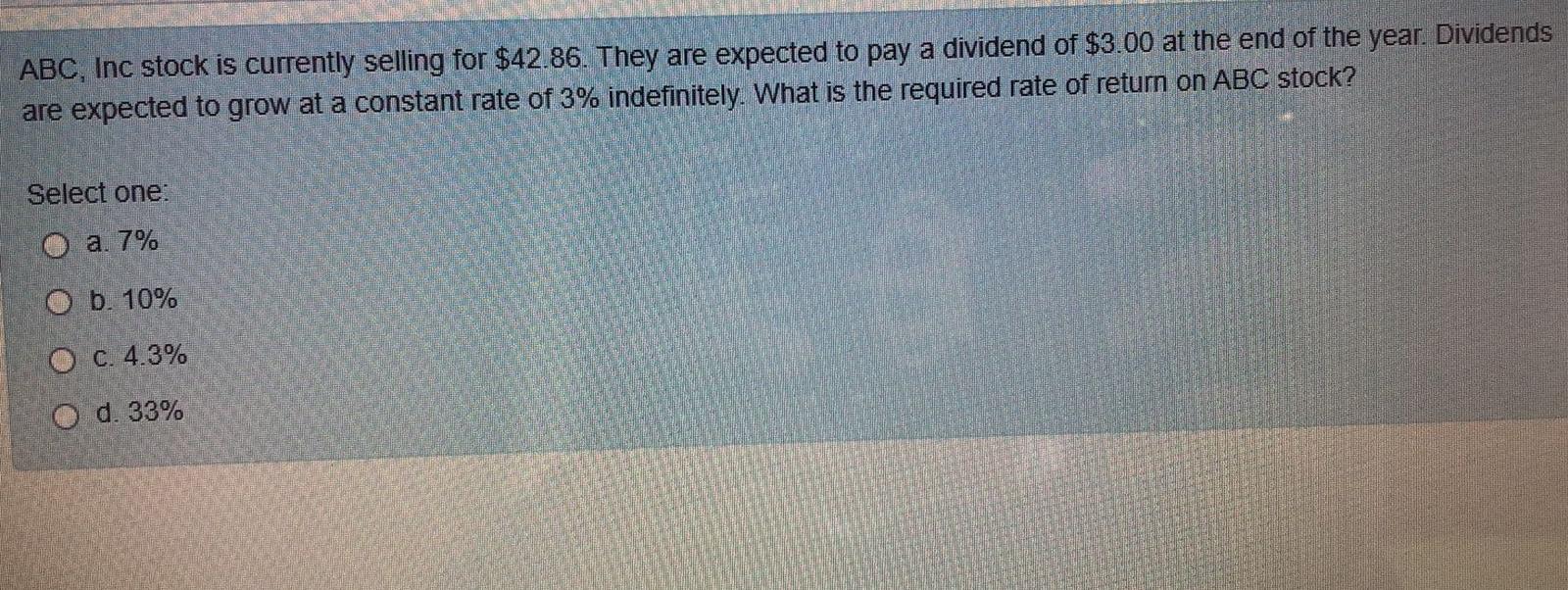

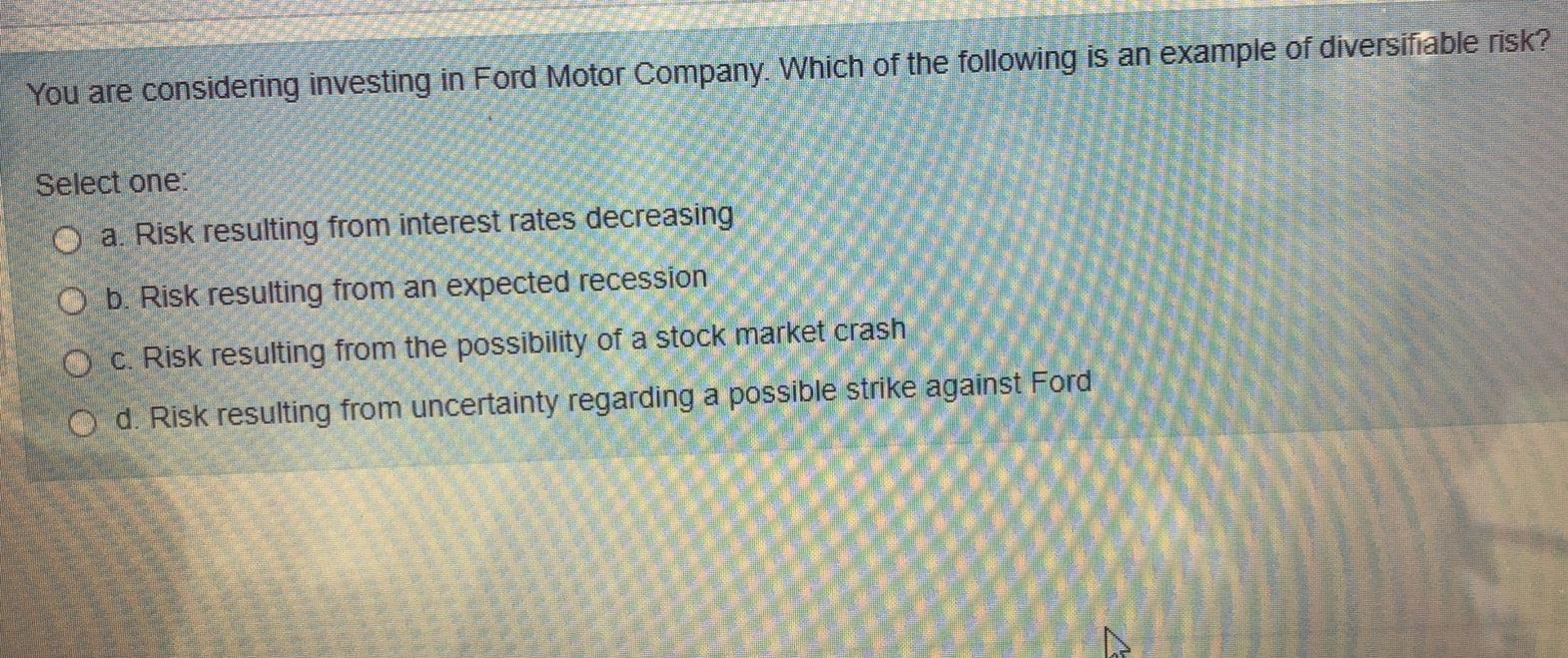

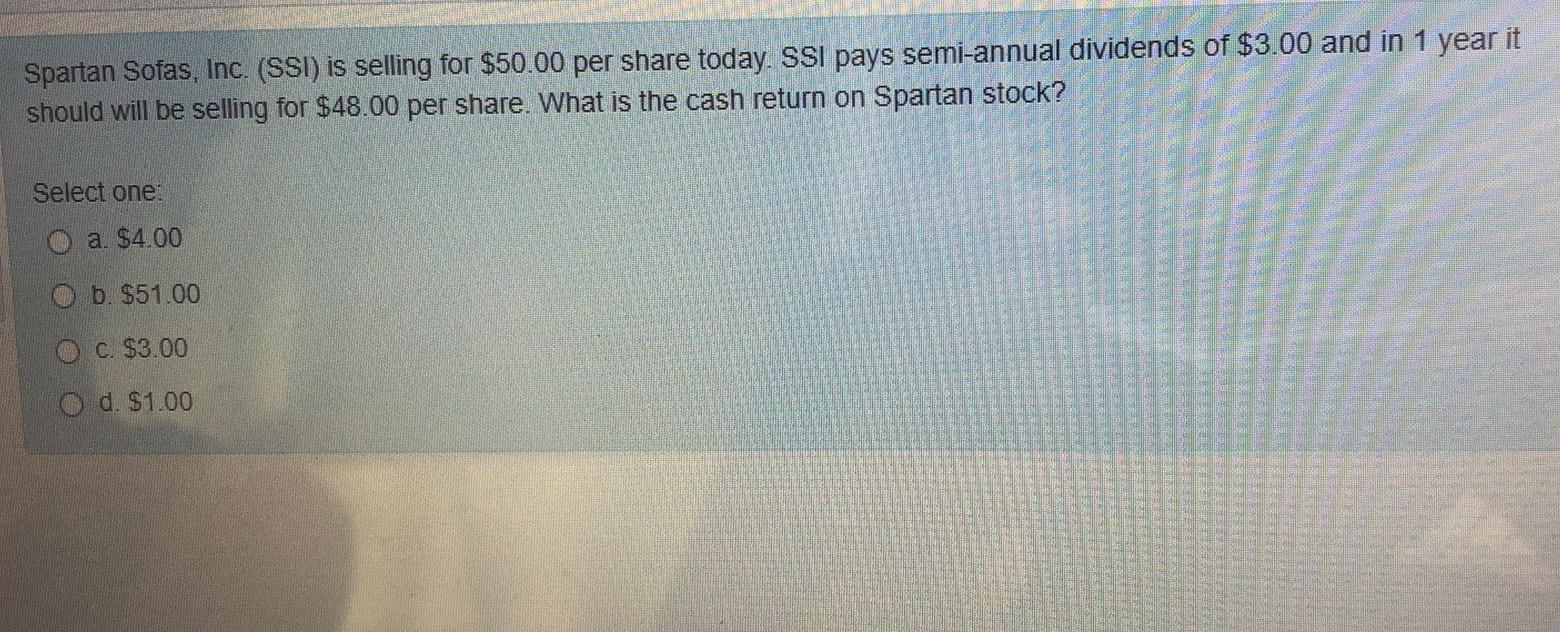

The return on equity for Fray, Inc. is 17% and management retains 75% of earnings for investment purposes. What is the growth rate of this firm? Select one: o a 12.75% b. 4.25% C. 44.12% d. 22.67% Identify the FALSE statement below. Select one: O a. Perpetuities pay an equal payment forever. O b. A dollar received one year from now will be worth more than a dollar received today. O c. A dollar received one year from now will be worth more than a dollar received two years from O d. Compounding essentially means earning interest on interest on an initial balance. If you invest $750 every six months at 8.8% compounded semi-annually, how much would you accumulate at the end of 10 years? Select one: a. $24,004 b. $23,284 c. $22,334 d. $9,841 Rondeen, Inc has a return on equity of 25% and is targeting a growth rate of 10%. What should be their retention rate? Select one: a. 50% b. 60% C. 70% d. 40% A bonds yield to maturity Select one: a. is lower for higher-risk bonds. b. is generally equal to the coupon interest rate. c. is the required return on the bond. d. is fixed in the indenture. You are considering investing in Ford Motor Company. Which of the following is an example of diversifiable risk? Select one: a. Risk resulting from interest rates decreasing O b. Risk resulting from the possibility of a stock market crash c. Risk resulting from an expected recession d. Risk resulting from uncertainty regarding a possible strike against Ford Your portfolio consists of $3,000 in ABC stock, $4,500 of DEF stock and $2,500 of GHI stock. Expected rates of return are ABC 5%, DEF 13%, and GHI 16%. What is the portfolio expected rate of return? Select one: a. 11.4% b. 12.0% c. 16.0% d. 10.9% ABC, Inc stock is currently selling for $42.86. They are expected to pay a dividend of $3.00 at the end of the year. Dividends are expected to grow at a constant rate of 3% indefinitely. What is the required rate of return on ABC stock? Select one: O a. 7% O b. 10% O C. 4.3% O d. 33% You are considering investing in Ford Motor Company. Which of the following is an example of diversifiable risk? Select one: O a. Risk resulting from interest rates decreasing O b. Risk resulting from an expected recession O c. Risk resulting from the possibility of a stock market crash O d. Risk resulting from uncertainty regarding a possible strike against Ford Spartan Sofas, Inc. (SSI) is selling for $50.00 per share today. SSI pays semi-annual dividends of $3.00 and in 1 year it should will be selling for $48.00 per share. What is the cash return on Spartan stock? Select one: a. $4.00 b. $51.00 C. $3.00 O d. $1.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started