Answered step by step

Verified Expert Solution

Question

1 Approved Answer

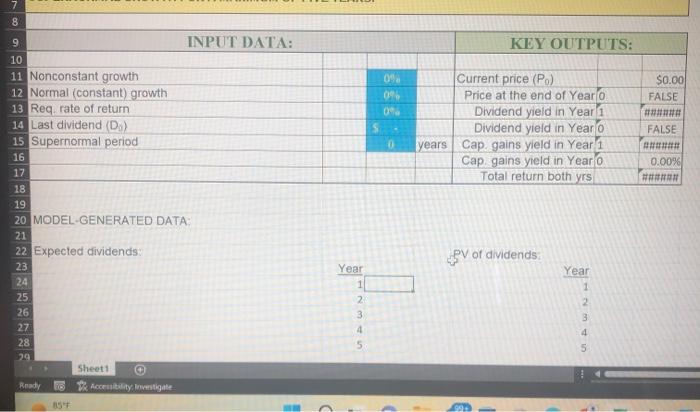

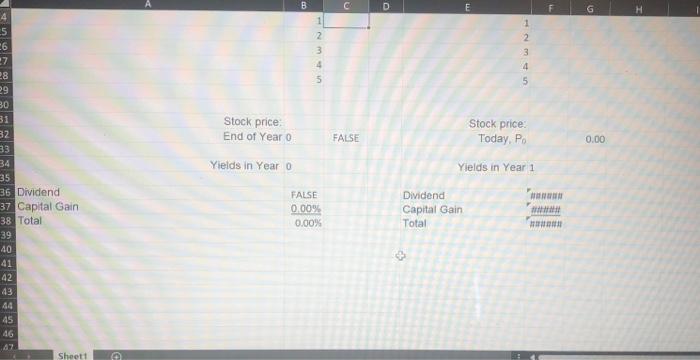

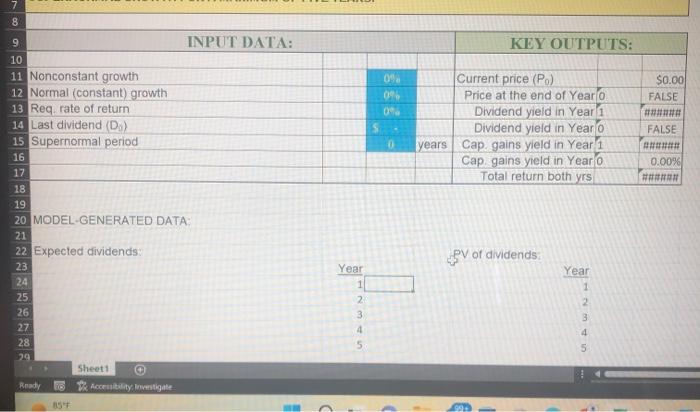

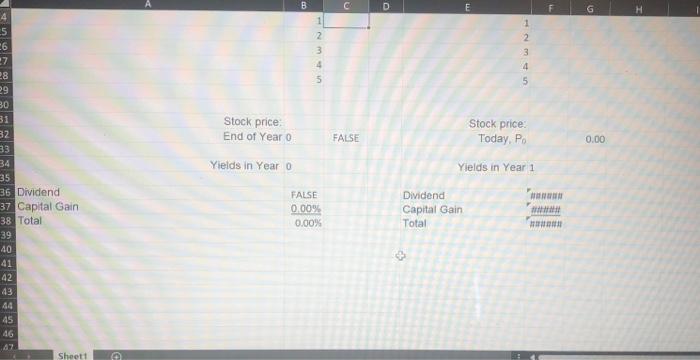

provide data that would go into blue cells for each question and answer questions. please make simple MODEL-GENERATED DATA: Expected dividends: 1. Microweb Company has

provide data that would go into blue cells for each question and answer questions. please make simple

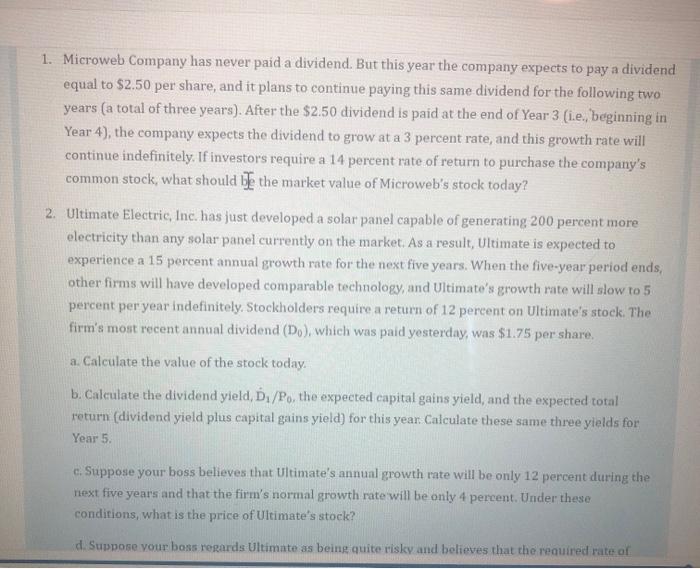

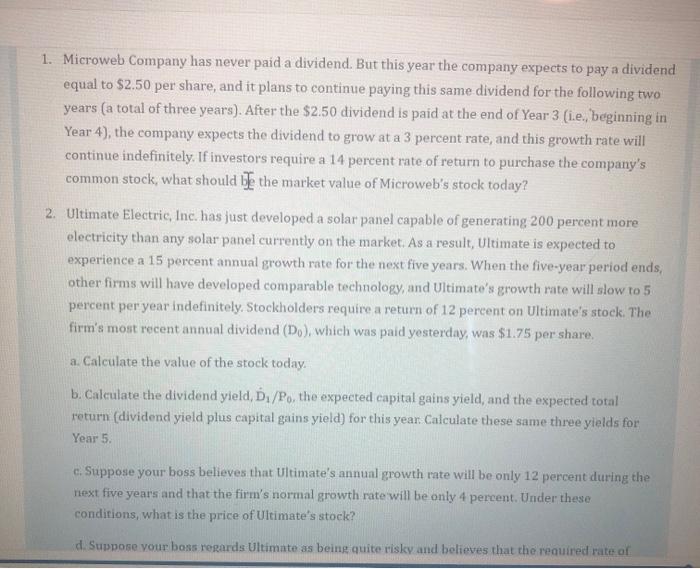

MODEL-GENERATED DATA: Expected dividends: 1. Microweb Company has never paid a dividend. But this year the company expects to pay a dividend equal to $2.50 per share, and it plans to continue paying this same dividend for the following two years (a total of three years). After the $2.50 dividend is paid at the end of Year 3 (i.e., beginning in Year 4 ), the company expects the dividend to grow at a 3 percent rate, and this growth rate will continue indefinitely. If investors require a 14 percent rate of return to purchase the company's common stock, what should be the market value of Microweb's stock today? percent per year indefinitely. Stockholders require a return of 12 percent on Ultimate's stock. The firm's most recent annual dividend (D0), which was paid yesterday, was $1.75 per share. a. Calculate the value of the stock today. b. Calculate the dividend yield, D1/P0, the expected capital gains yield, and the expected total return (dividend yield plus chpital gains yield) for this year: Calculate these same three yields for Year 5. c. Suppose your boss believes that Ultimate's annual growth rate will be only 12 percent during the next five years and that the firm's normal growth rate will be only 4 percent. Under these conditions, what is the price of Ultimate's stock? d. Suppose your boss regards Ultimate as being quite risky and believes that the required rate of return should be higher than the 12 percent originally specified. Rework the problem under the conditions originally given, except change the required rate of return to (1) 13 percent, (2) 15 percent, and (3) 20 percent to determine the effects of the higher required rates of return on Ultimate's stock price. MODEL-GENERATED DATA: Expected dividends: 1. Microweb Company has never paid a dividend. But this year the company expects to pay a dividend equal to $2.50 per share, and it plans to continue paying this same dividend for the following two years (a total of three years). After the $2.50 dividend is paid at the end of Year 3 (i.e., beginning in Year 4 ), the company expects the dividend to grow at a 3 percent rate, and this growth rate will continue indefinitely. If investors require a 14 percent rate of return to purchase the company's common stock, what should be the market value of Microweb's stock today? percent per year indefinitely. Stockholders require a return of 12 percent on Ultimate's stock. The firm's most recent annual dividend (D0), which was paid yesterday, was $1.75 per share. a. Calculate the value of the stock today. b. Calculate the dividend yield, D1/P0, the expected capital gains yield, and the expected total return (dividend yield plus chpital gains yield) for this year: Calculate these same three yields for Year 5. c. Suppose your boss believes that Ultimate's annual growth rate will be only 12 percent during the next five years and that the firm's normal growth rate will be only 4 percent. Under these conditions, what is the price of Ultimate's stock? d. Suppose your boss regards Ultimate as being quite risky and believes that the required rate of return should be higher than the 12 percent originally specified. Rework the problem under the conditions originally given, except change the required rate of return to (1) 13 percent, (2) 15 percent, and (3) 20 percent to determine the effects of the higher required rates of return on Ultimate's stock price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started