Answered step by step

Verified Expert Solution

Question

1 Approved Answer

provide detail ans Daniel Johnson owns and operates a regional chain of bowling alleys in Ontario cottage country and is looking to expand into the

provide detail ans

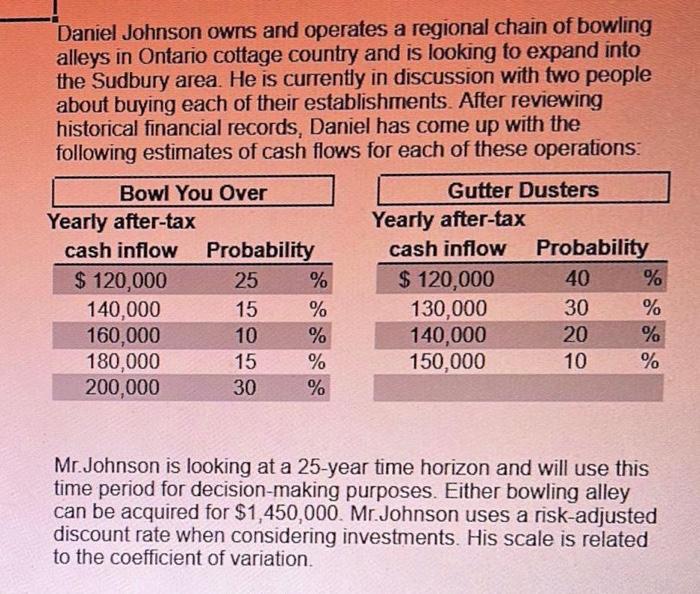

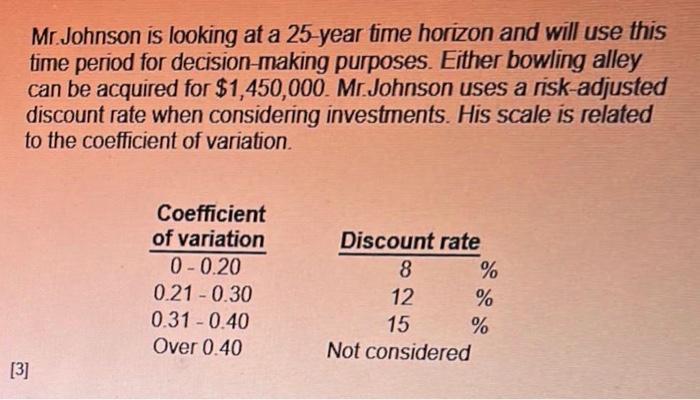

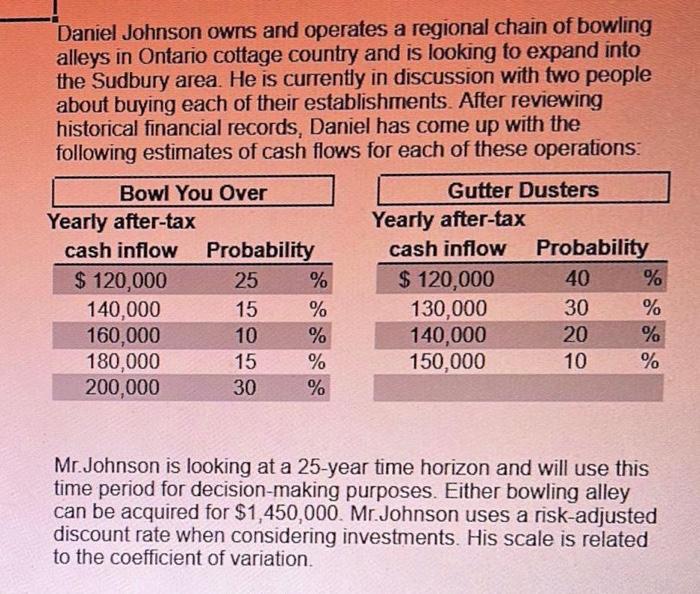

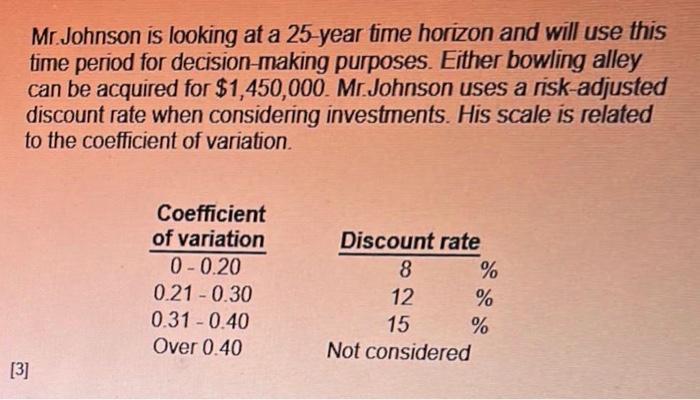

Daniel Johnson owns and operates a regional chain of bowling alleys in Ontario cottage country and is looking to expand into the Sudbury area. He is currently in discussion with two people about buying each of their establishments. After reviewing historical financial records, Daniel has come up with the following estimates of cash flows for each of these operations: Mr.Johnson is looking at a 25-year time horizon and will use this time period for decision-making purposes. Either bowling alley can be acquired for $1,450,000. Mr.Johnson uses a risk-adjusted discount rate when considering investments. His scale is related to the coefficient of variation. Mr. Johnson is looking at a 25-year time horizon and will use this time period for decision-making purposes. Either bowling alley can be acquired for $1,450,000. Mr.Johnson uses a risk-adjusted discount rate when considering investments. His scale is related to the coefficient of variation. Required: A. Compute the risk-adjusted net present value for each motel. (Do not round intermediate calculations. Round the final enswers to nairest wht B. Which investment should Mr. Johnson accept if the two A. Compute the risk-adjusted net present value for each motel. (Do not round intermediate calcull B. Which investment should Mr. Johnson accept if the two C. Should Mr. Johnson accept both investments if there was no capital ra

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started