Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide equations to show your calculation & understanding and explain the meaning of your results ! FB_IFM_workshopdata.xls/5Estimating currency risk is following photo **Plase, leave me

Provide equations to show your calculation & understanding and explain the meaning of your results !

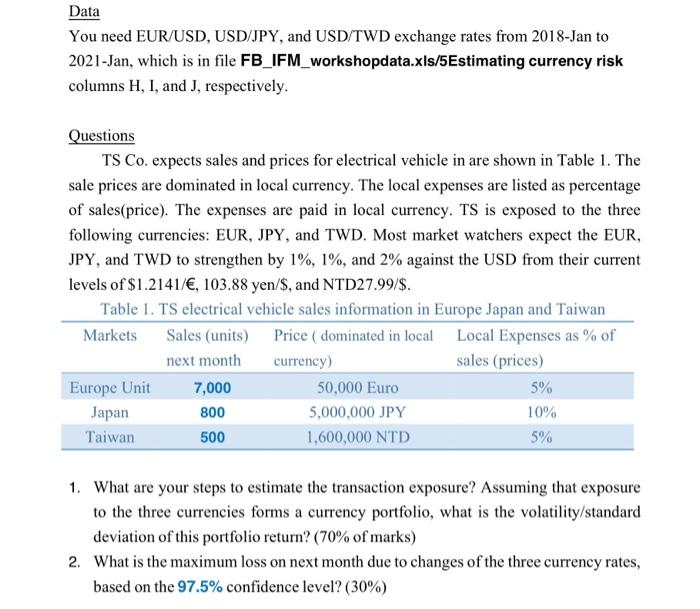

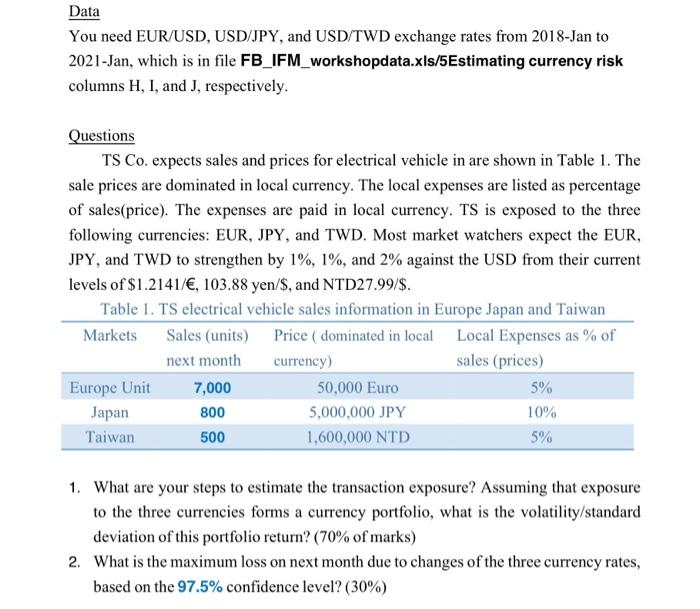

Data You need EUR/USD, USD/JPY, and USD/TWD exchange rates from 2018-Jan to 2021-Jan, which is in file FB_IFM_workshopdata.xls/5Estimating currency risk columns H, I, and J, respectively. Questions TS Co. expects sales and prices for electrical vehicle in are shown in Table 1. The sale prices are dominated in local currency. The local expenses are listed as percentage of sales(price). The expenses are paid in local currency. TS is exposed to the three following currencies: EUR, JPY, and TWD. Most market watchers expect the EUR, JPY, and TWD to strengthen by 1%, 1%, and 2% against the USD from their current levels of $1.2141/, 103.88 yen/$, and NTD27.99/$. Table 1. TS electrical vehicle sales information in Europe Japan and Taiwan Markets Sales (units) Price ( dominated in local Local Expenses as % of next month currency) sales (prices) Europe Unit 7,000 50,000 Euro 5% Japan 800 5,000,000 JPY 10% Taiwan 500 1,600,000 NTD 5% 1. What are your steps to estimate the transaction exposure? Assuming that exposure to the three currencies forms a currency portfolio, what is the volatility standard deviation of this portfolio return? (70% of marks) 2. What is the maximum loss on next month due to changes of the three currency rates, based on the 97.5% confidence level? (30%) Data You need EUR/USD, USD/JPY, and USD/TWD exchange rates from 2018-Jan to 2021-Jan, which is in file FB_IFM_workshopdata.xls/5Estimating currency risk columns H, I, and J, respectively. Questions TS Co. expects sales and prices for electrical vehicle in are shown in Table 1. The sale prices are dominated in local currency. The local expenses are listed as percentage of sales(price). The expenses are paid in local currency. TS is exposed to the three following currencies: EUR, JPY, and TWD. Most market watchers expect the EUR, JPY, and TWD to strengthen by 1%, 1%, and 2% against the USD from their current levels of $1.2141/, 103.88 yen/$, and NTD27.99/$. Table 1. TS electrical vehicle sales information in Europe Japan and Taiwan Markets Sales (units) Price ( dominated in local Local Expenses as % of next month currency) sales (prices) Europe Unit 7,000 50,000 Euro 5% Japan 800 5,000,000 JPY 10% Taiwan 500 1,600,000 NTD 5% 1. What are your steps to estimate the transaction exposure? Assuming that exposure to the three currencies forms a currency portfolio, what is the volatility standard deviation of this portfolio return? (70% of marks) 2. What is the maximum loss on next month due to changes of the three currency rates, based on the 97.5% confidence level? (30%) FB_IFM_workshopdata.xls/5Estimating currency risk is following photo

**Plase, leave me a massage on your gmail, and i will send you excal data file, because only photo can uploaded here, then you put the answer here, thanks you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started