Answered step by step

Verified Expert Solution

Question

1 Approved Answer

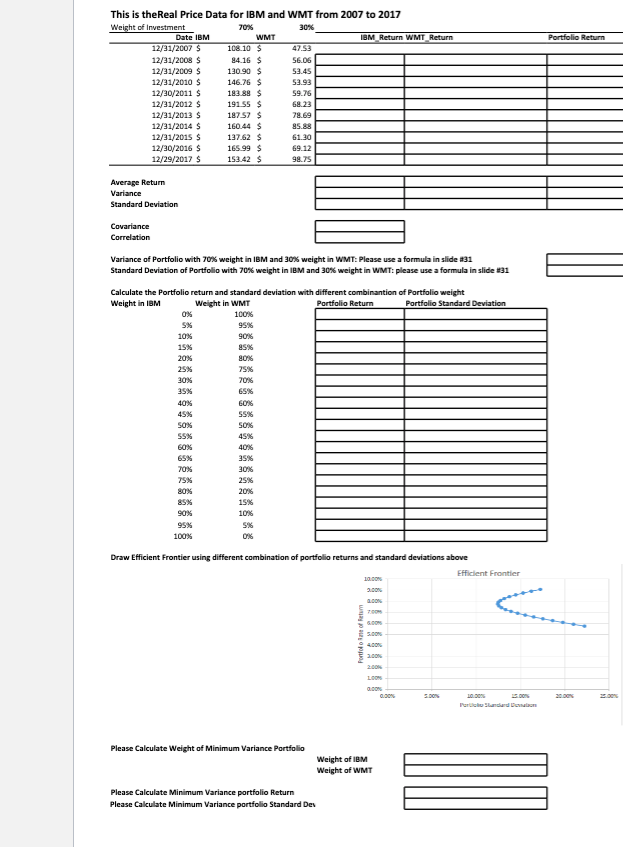

Provide formula This is theReal Price Data for IRM and WMT from 2007 to 2017 Average Return Variance Standard Deviation Covariance Correlation begin{tabular}{|l|l|} hline &

Provide formula

This is theReal Price Data for IRM and WMT from 2007 to 2017 Average Return Variance Standard Deviation Covariance Correlation \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} Variance of Portfolio with 70% weight in IBM and 3005 weight in WMT: Please use a formula in slide a31 Standard Deviation of Portfolio with 70% weight in IBM and 30% weight in WMT: please use a formula in slide 131 Calculate the Portfolio return and standard deviation with different combinantion of Portfolio weight 1 Draw Efficient Frontier using different combination of portfolio returns and standard deviations above Please Calculate Weight of Minimum Variance Portfolio Weight of IBM Weight of WMT Please Calculate Minimum Variance portfolio Return Please Calculate Minimum Variance portfolio Standard DesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started