Provide solution.

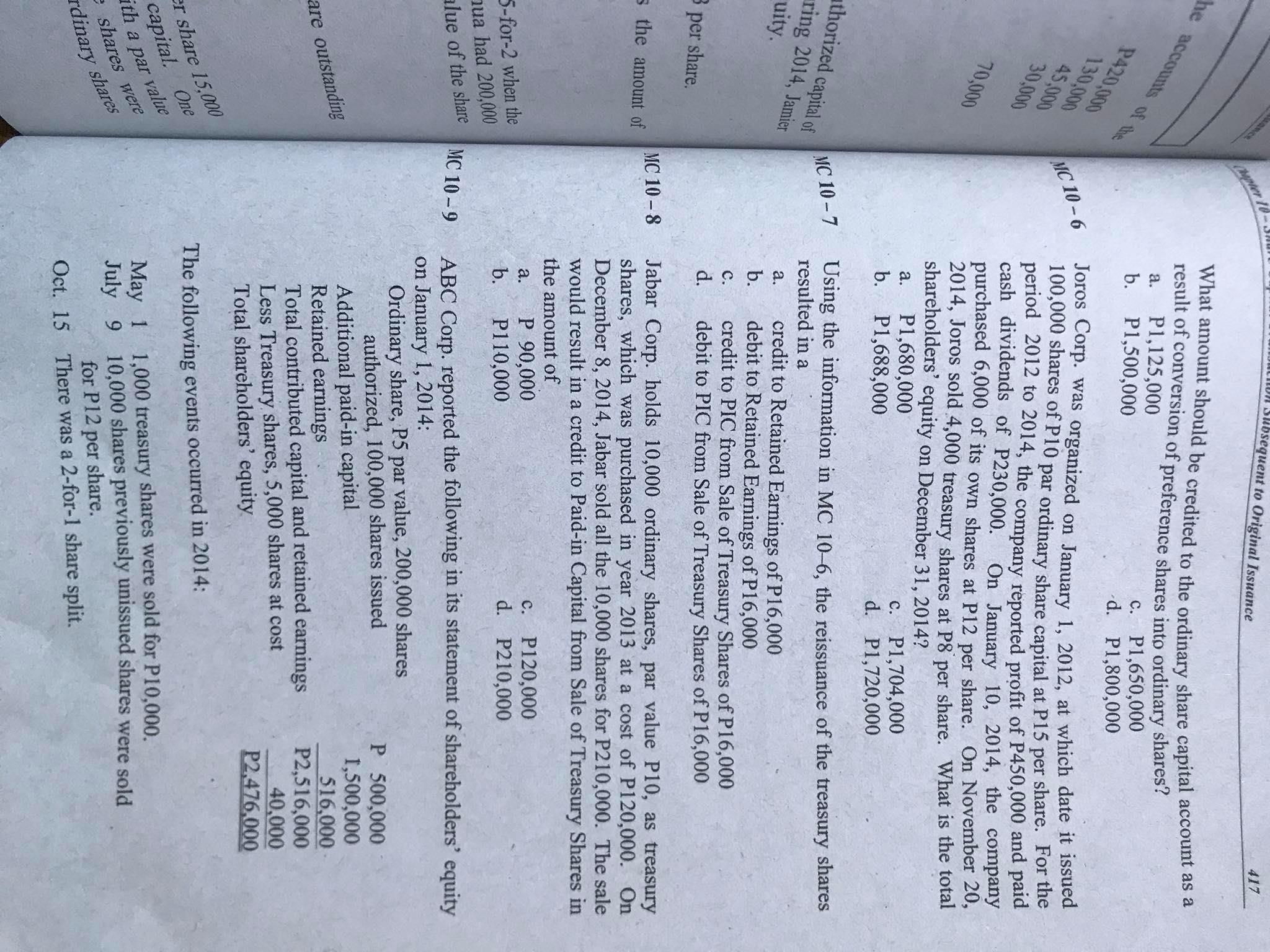

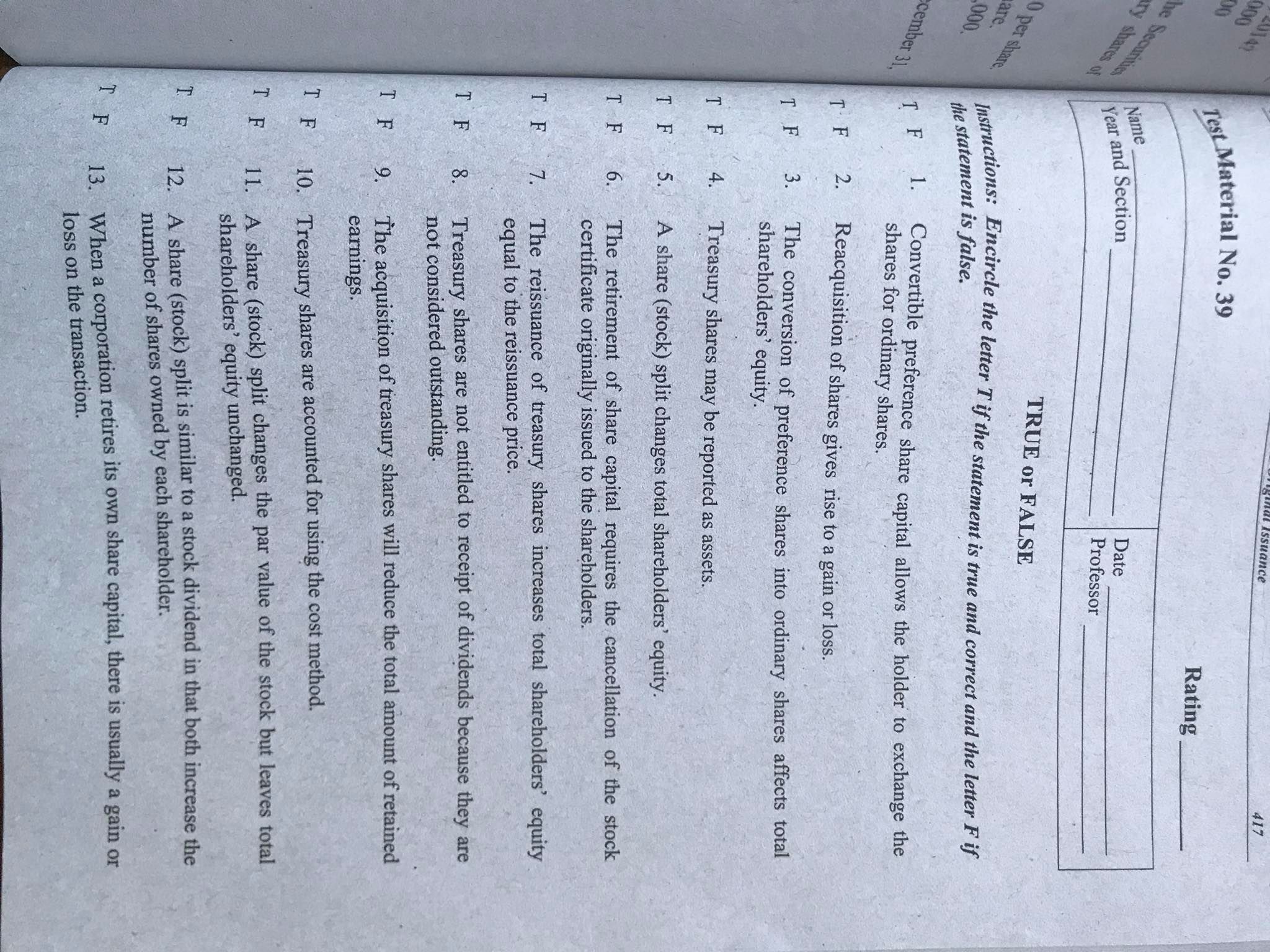

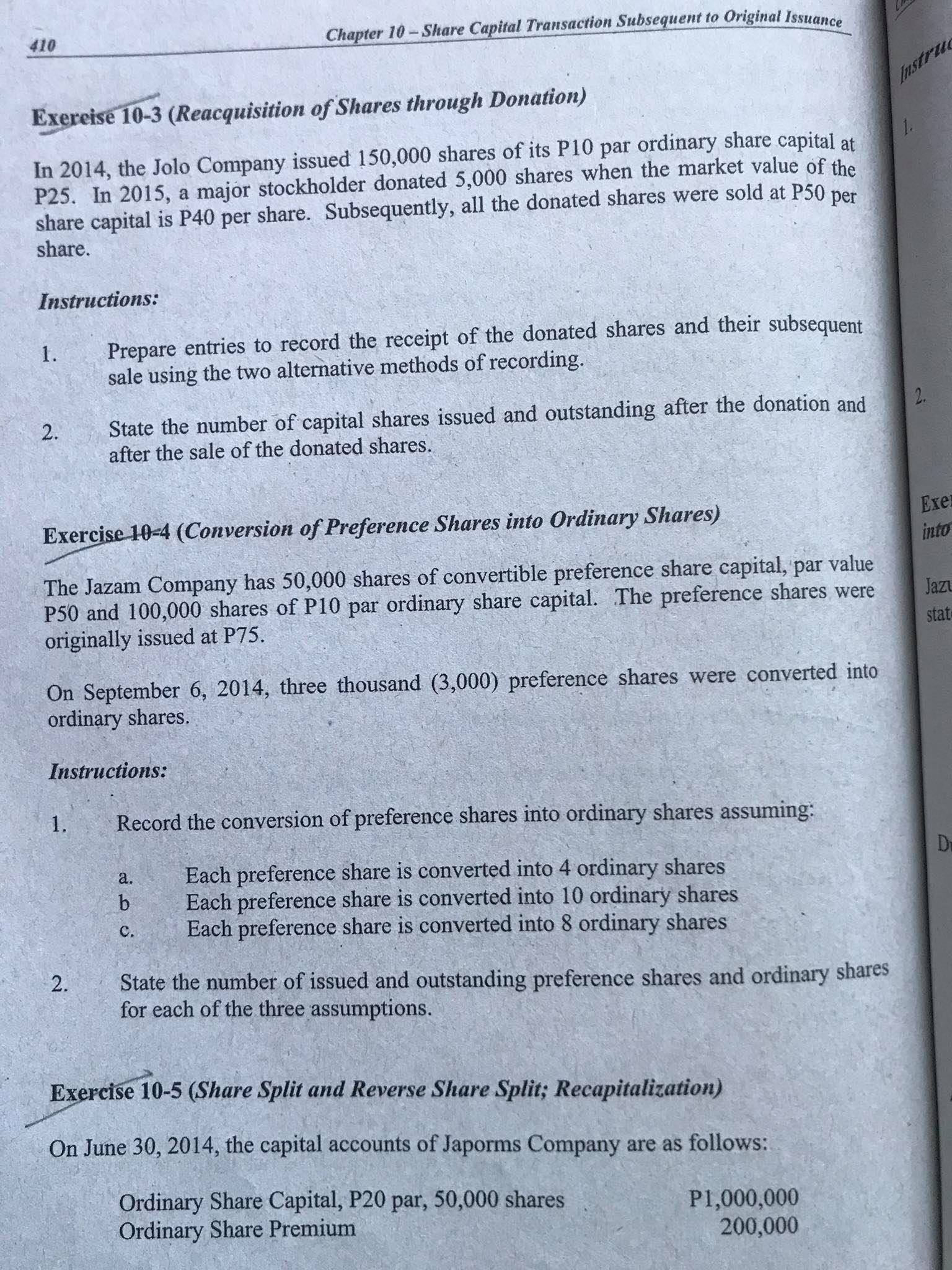

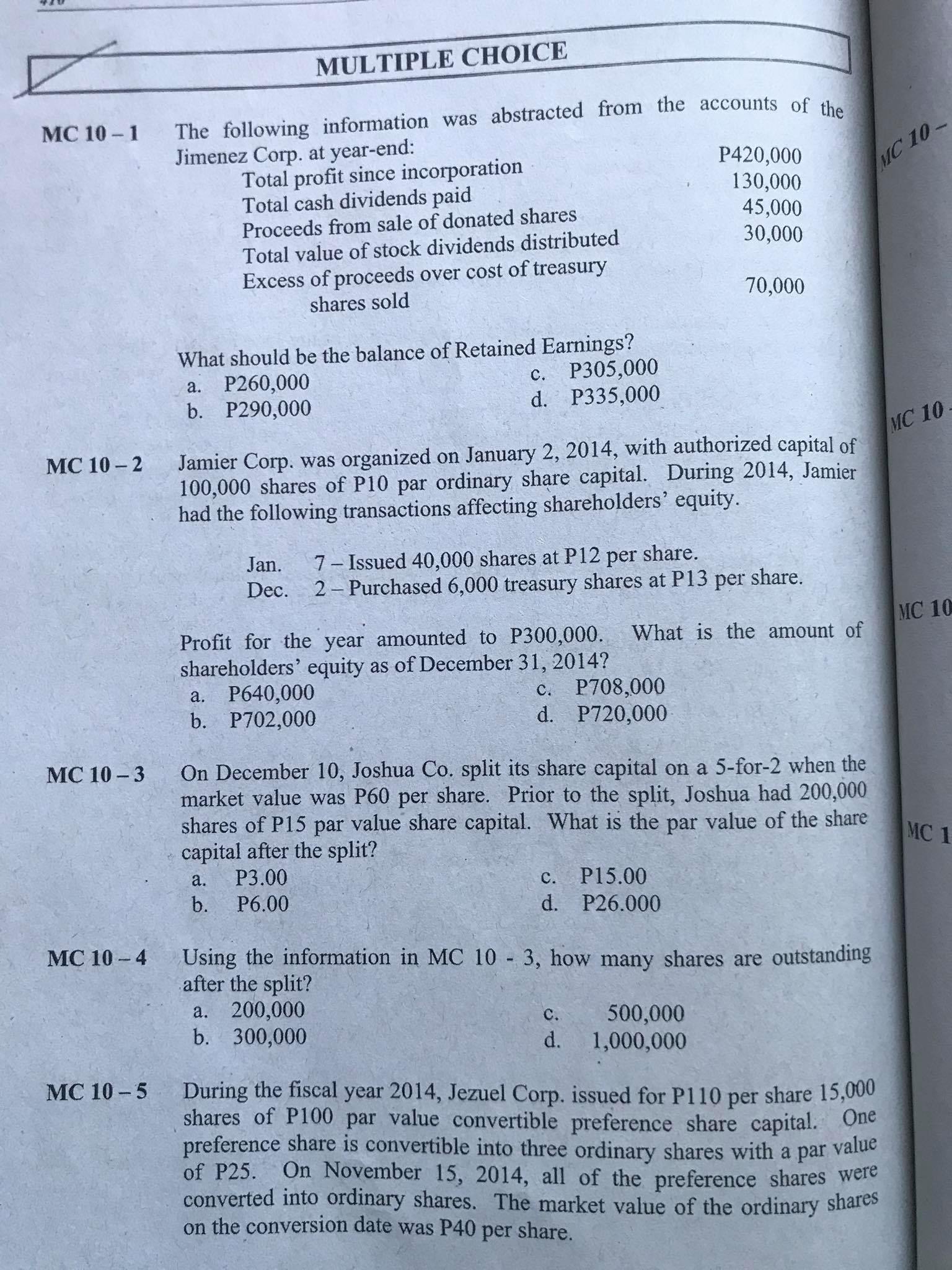

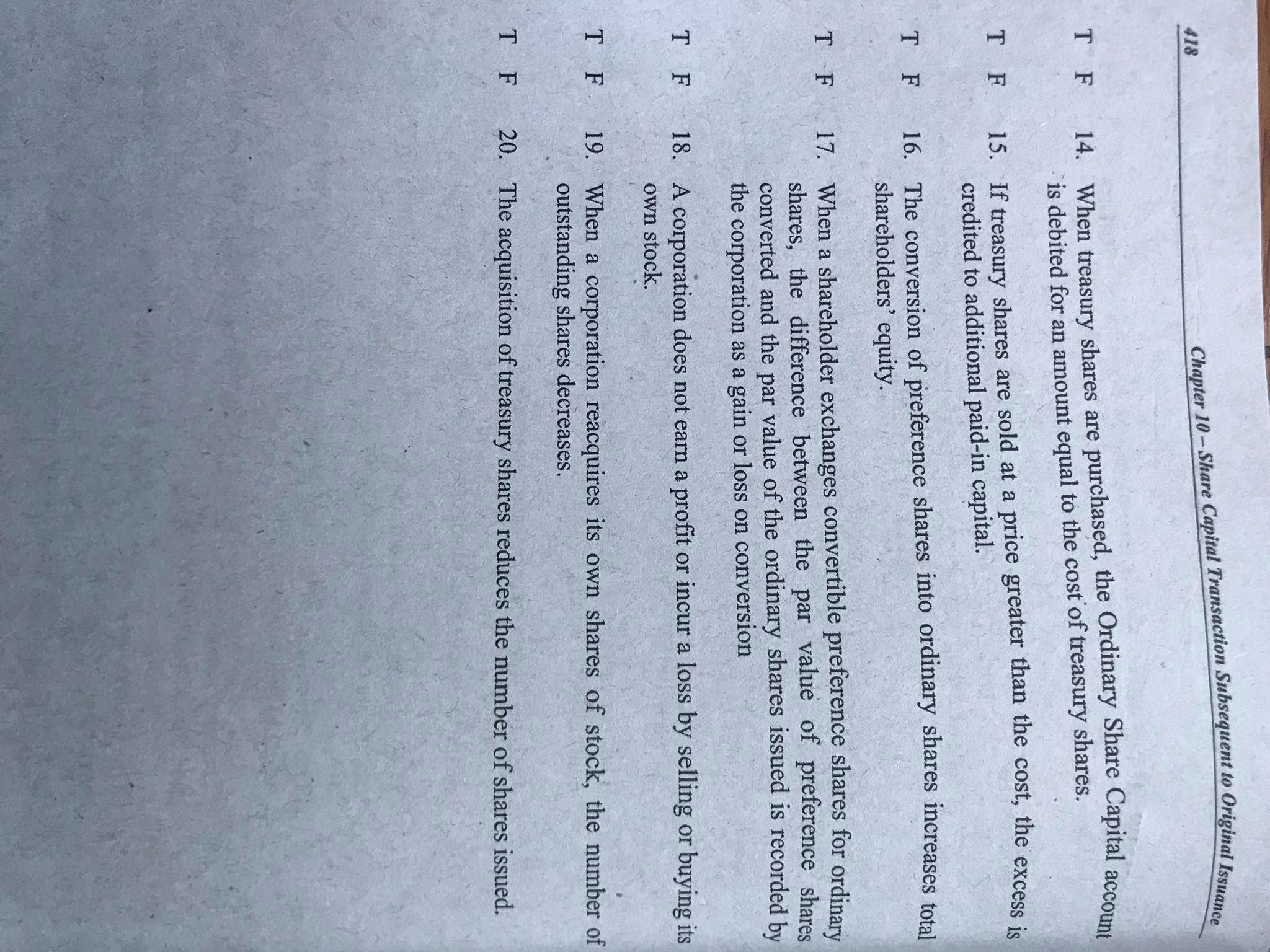

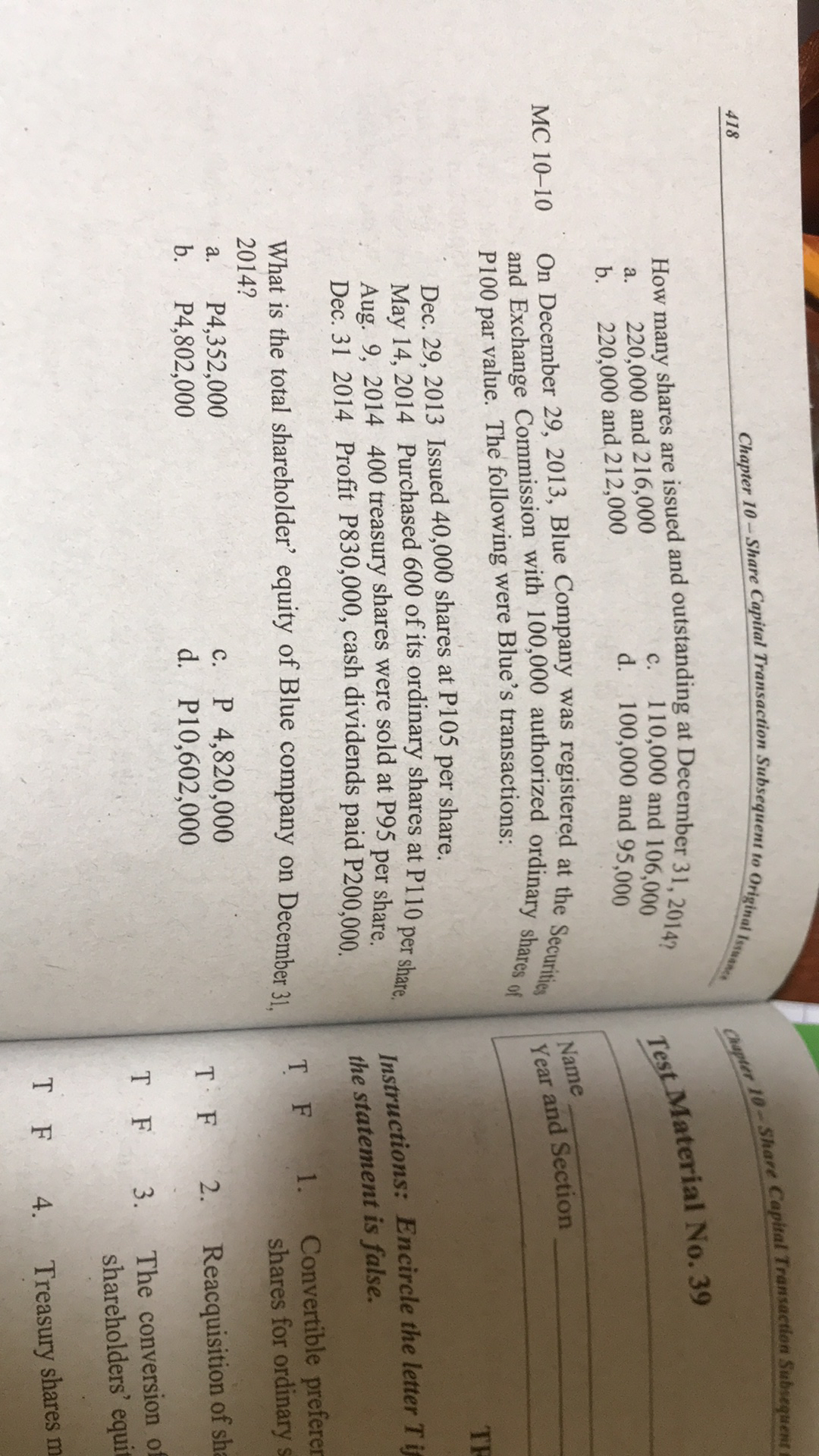

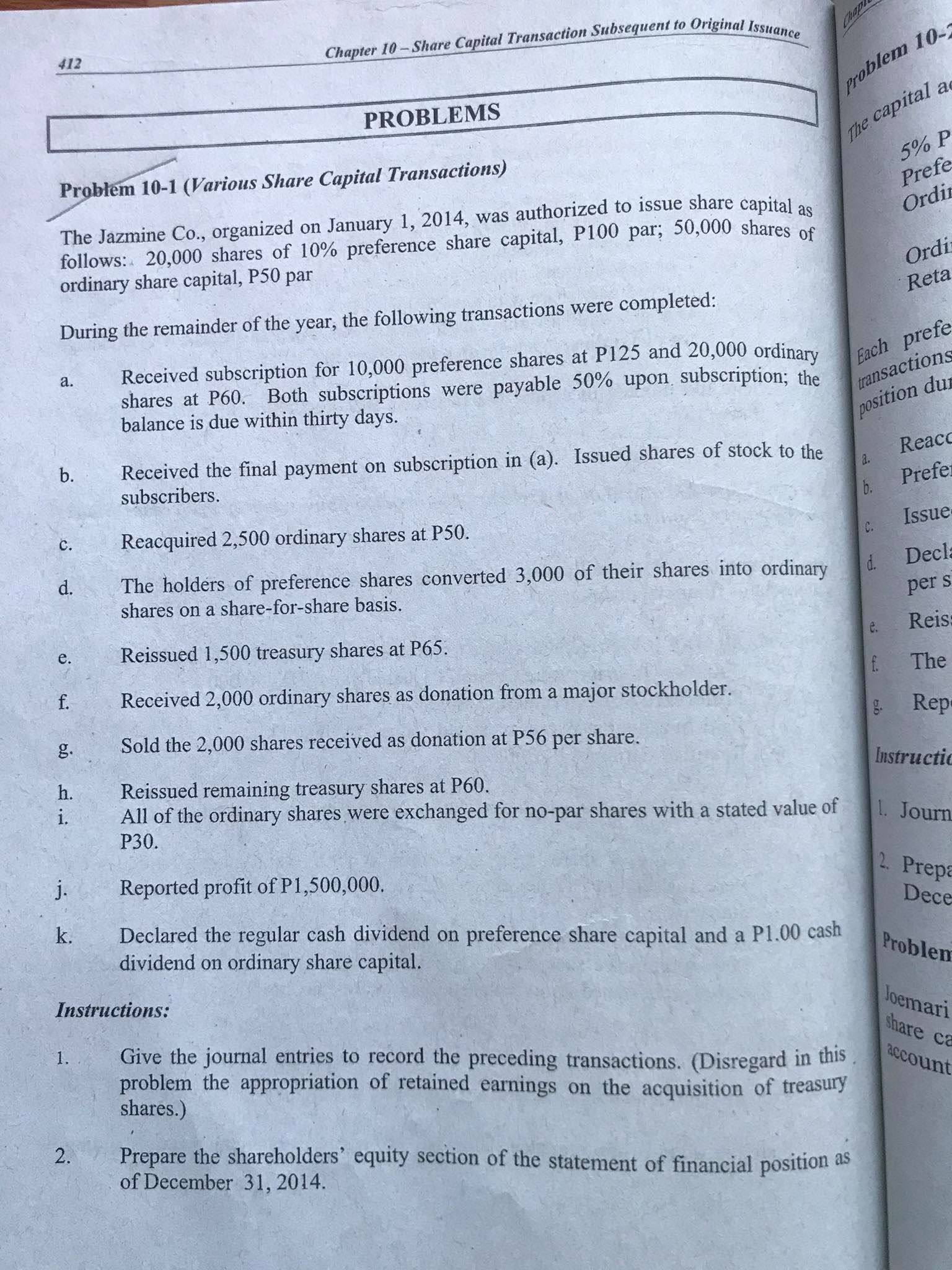

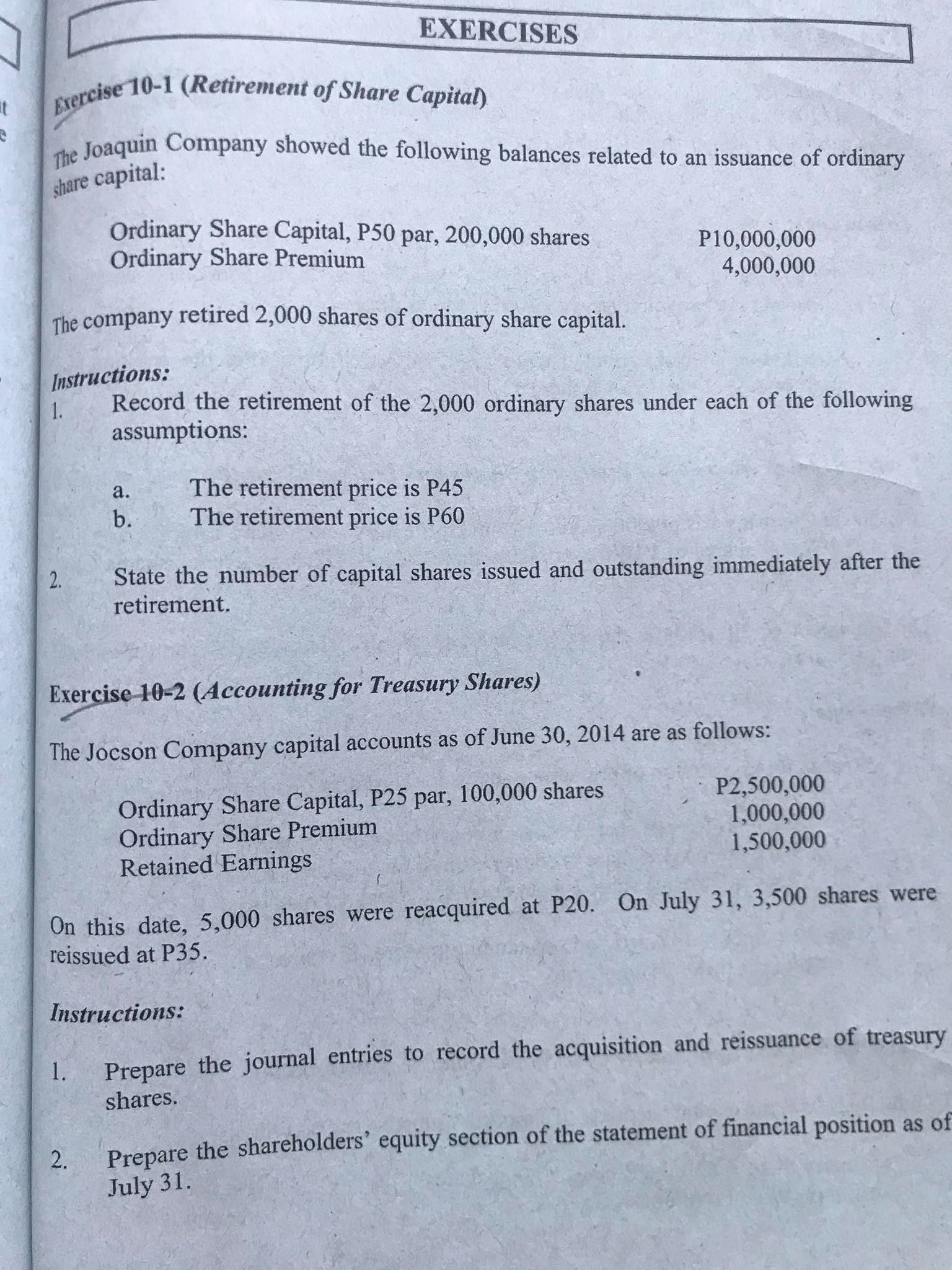

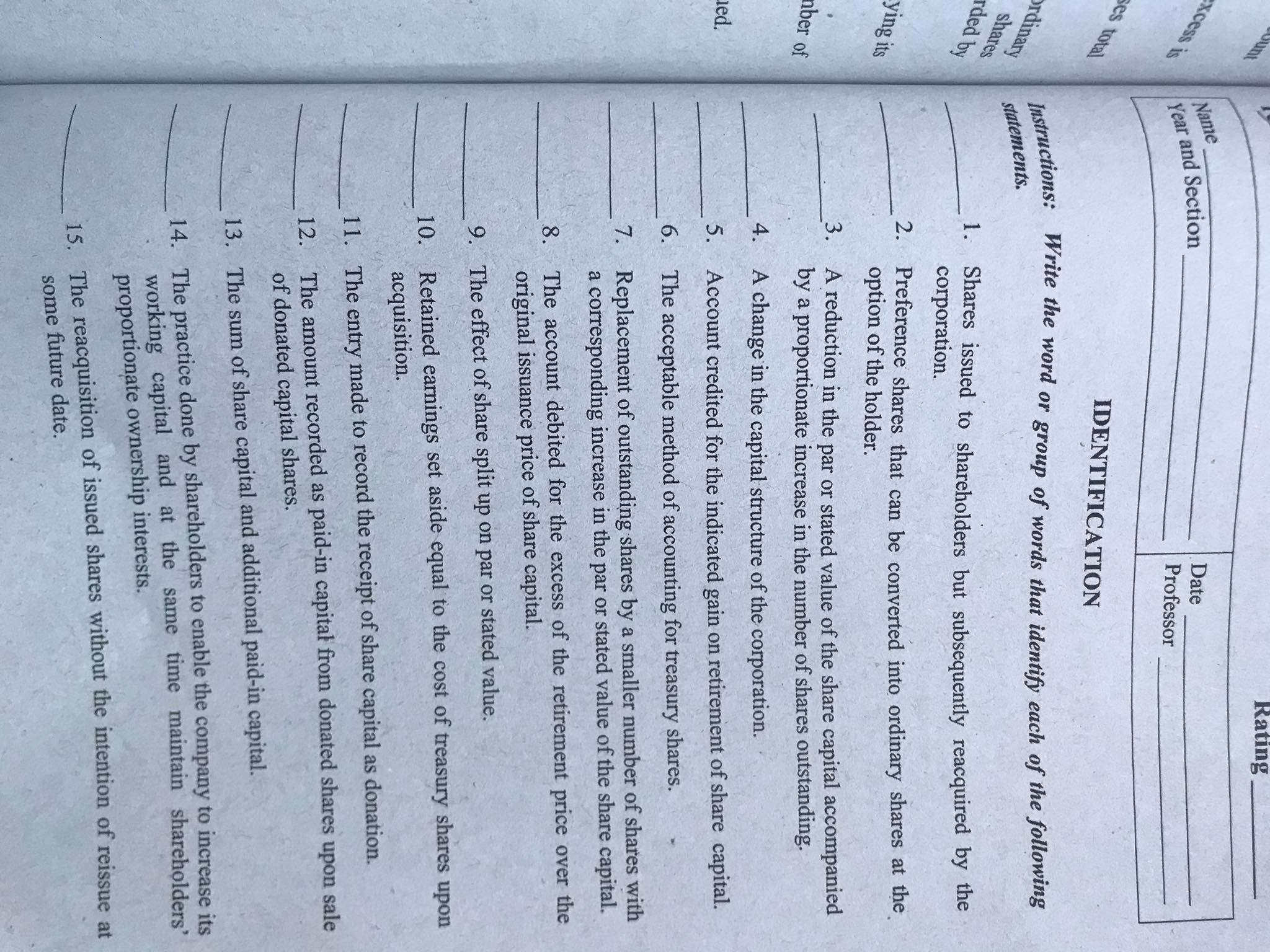

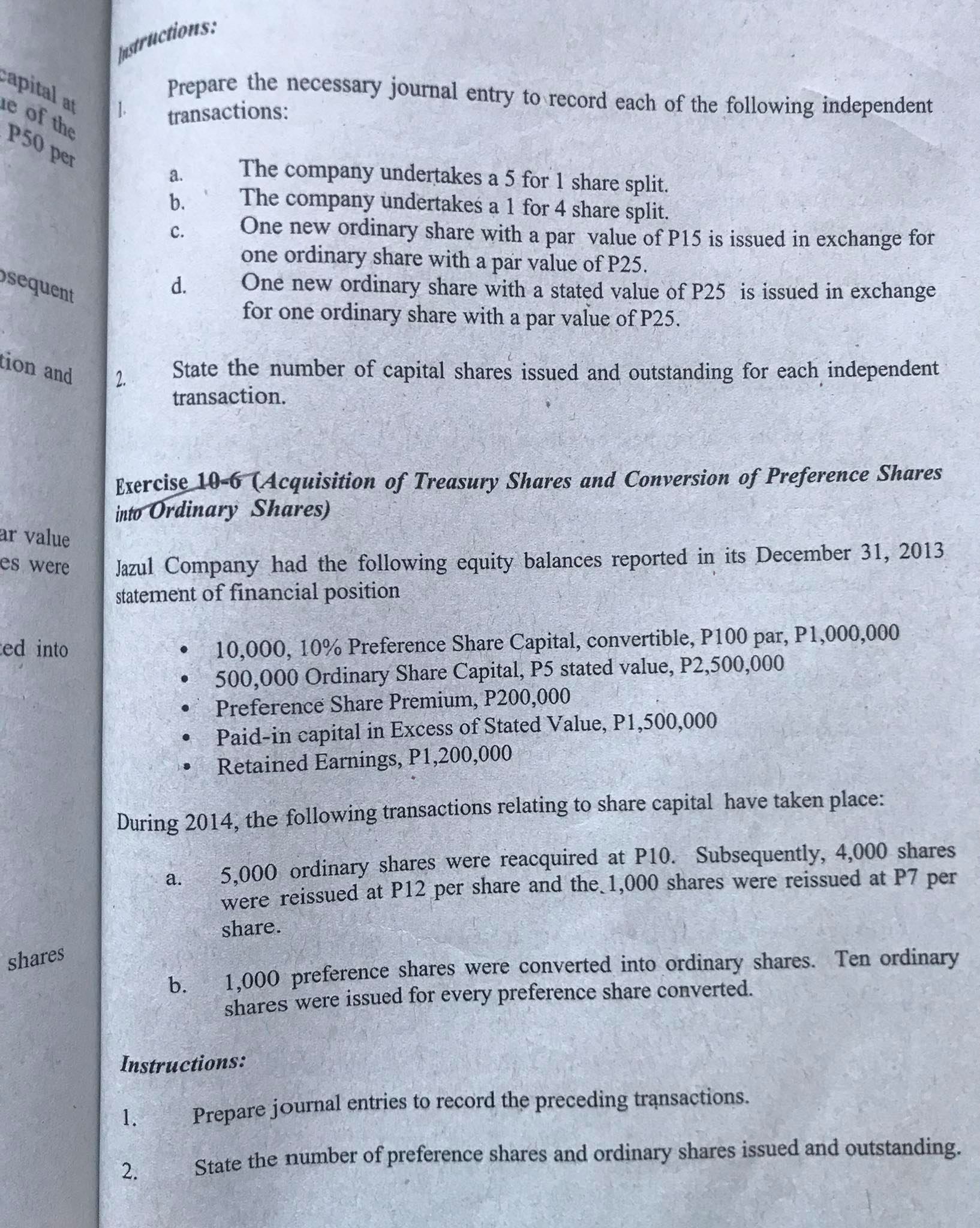

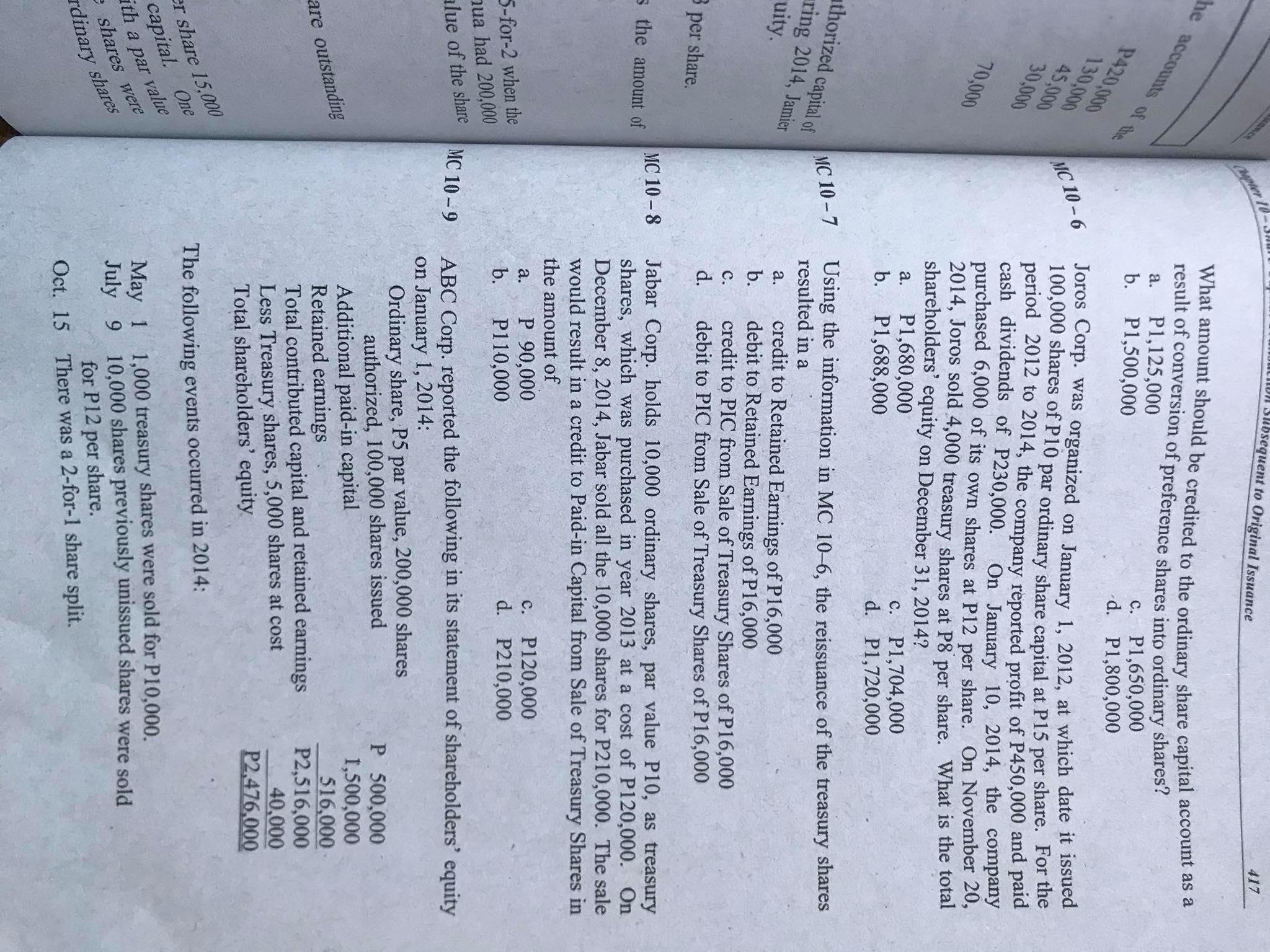

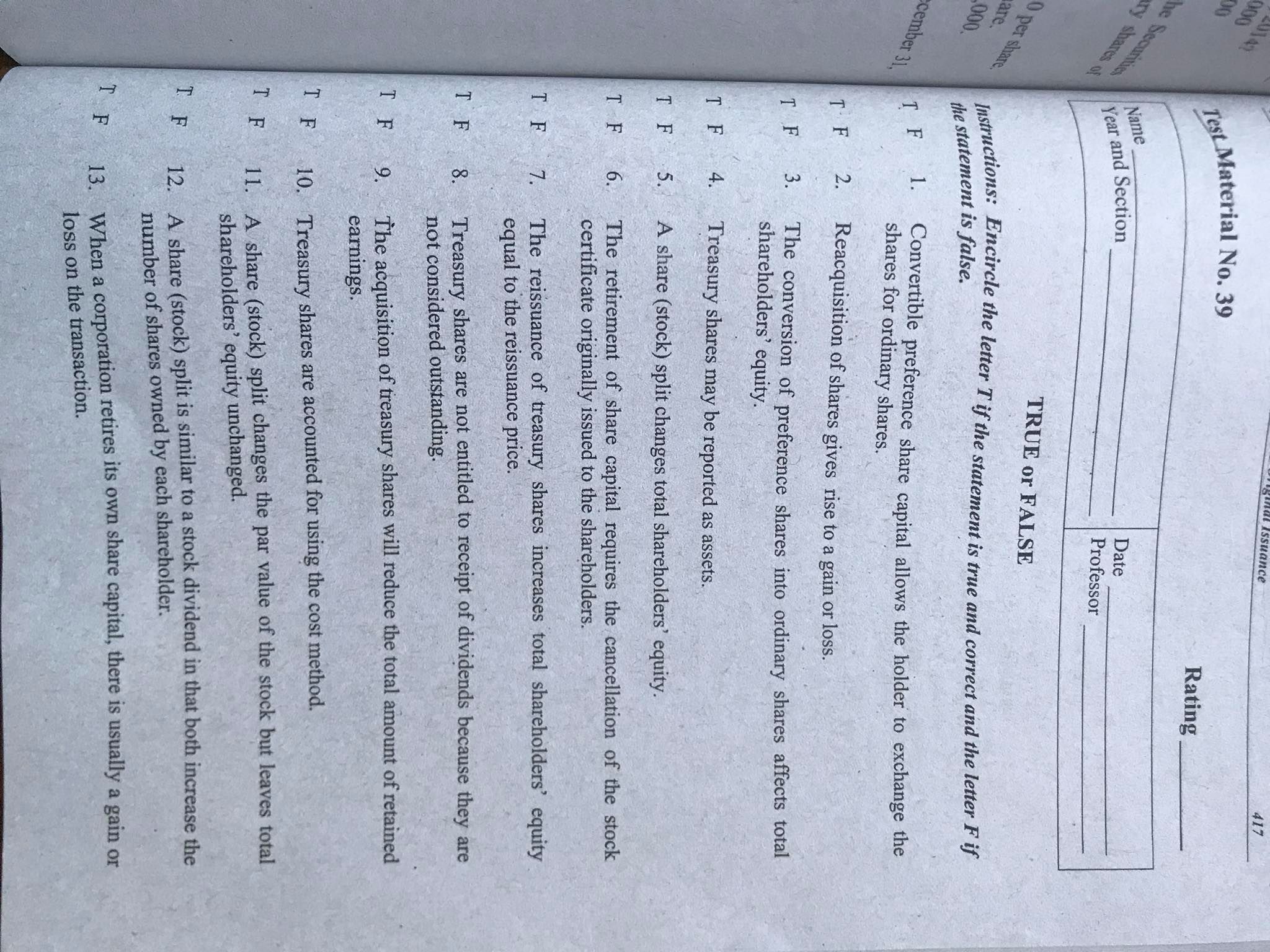

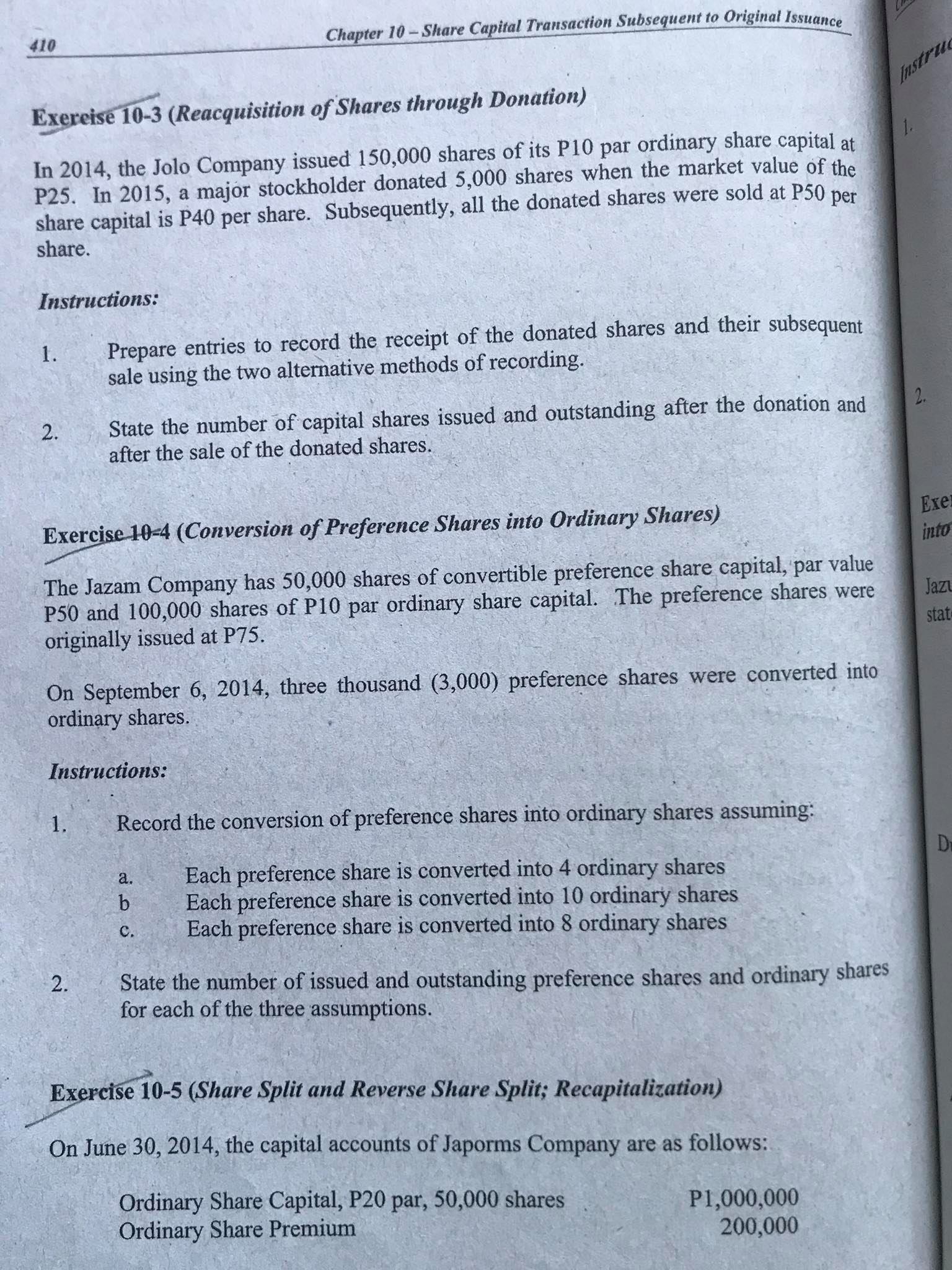

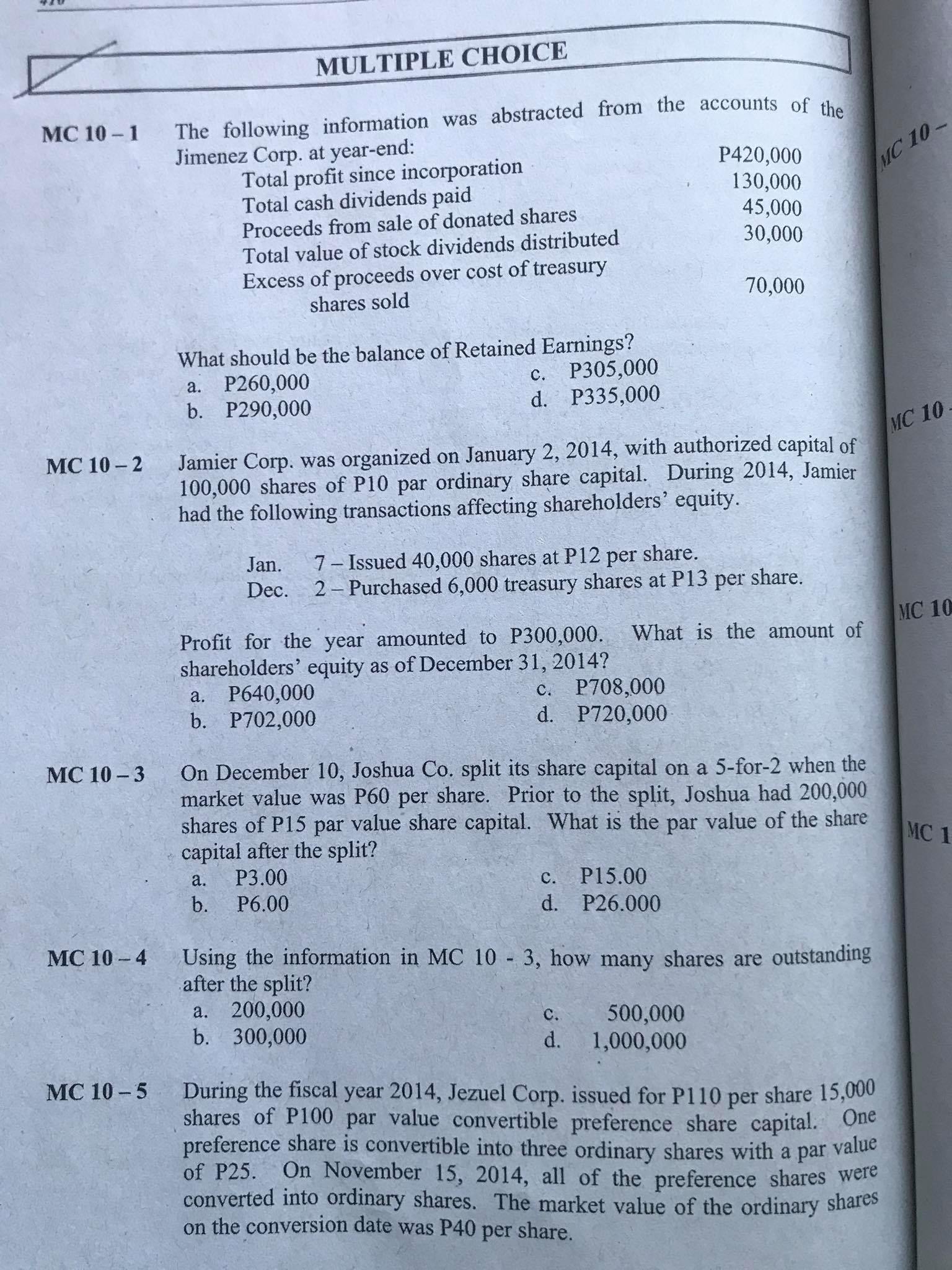

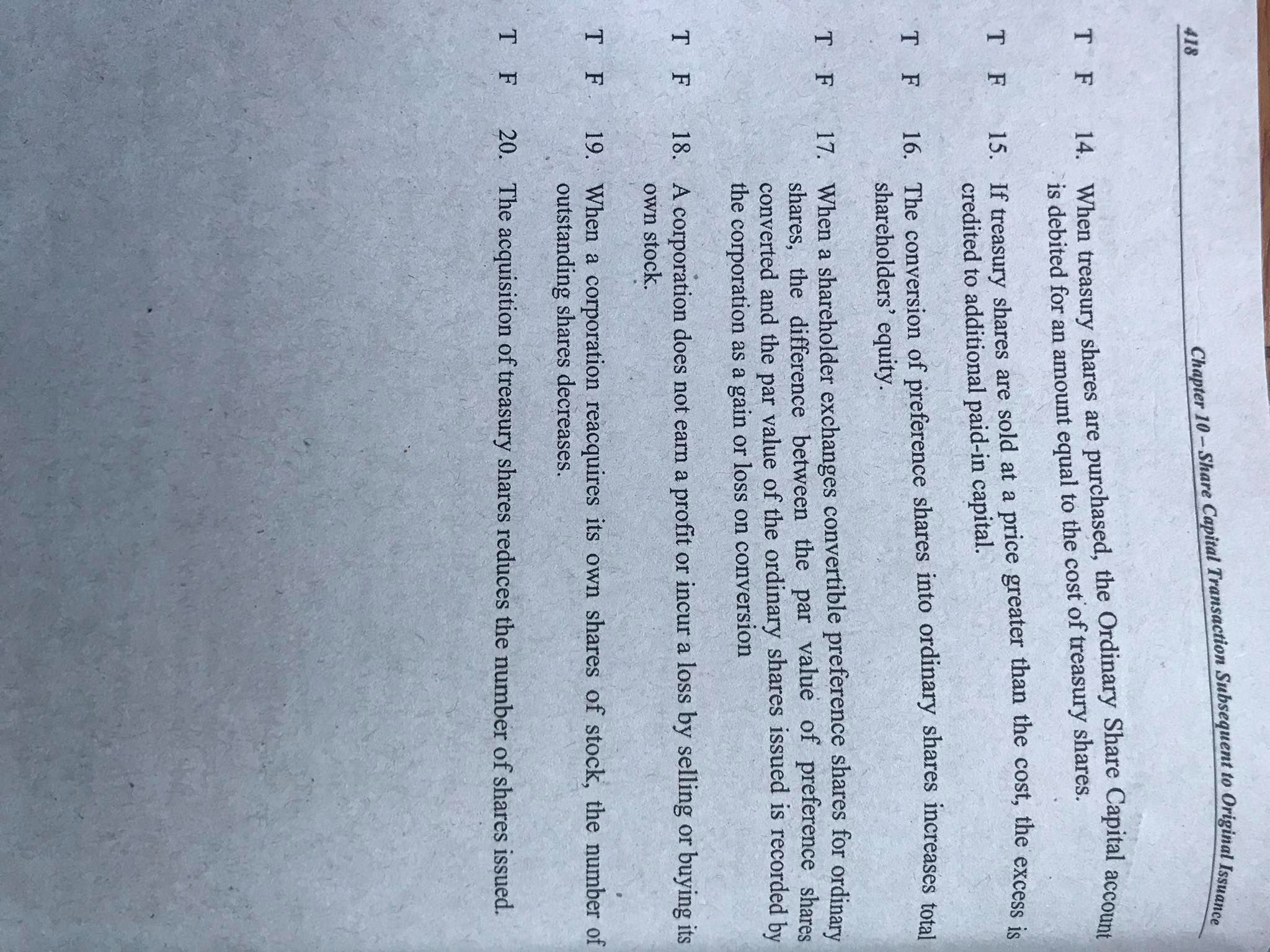

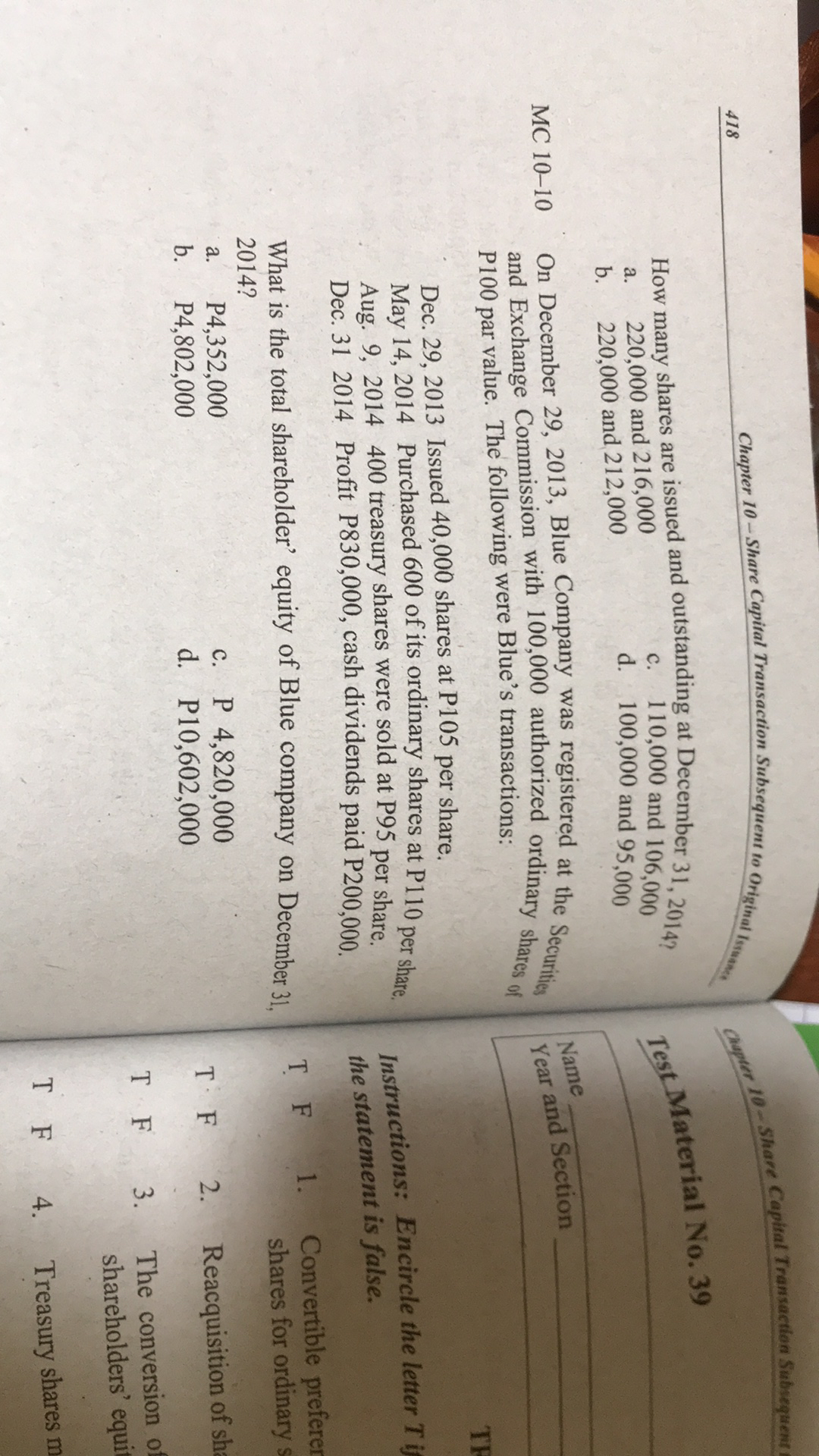

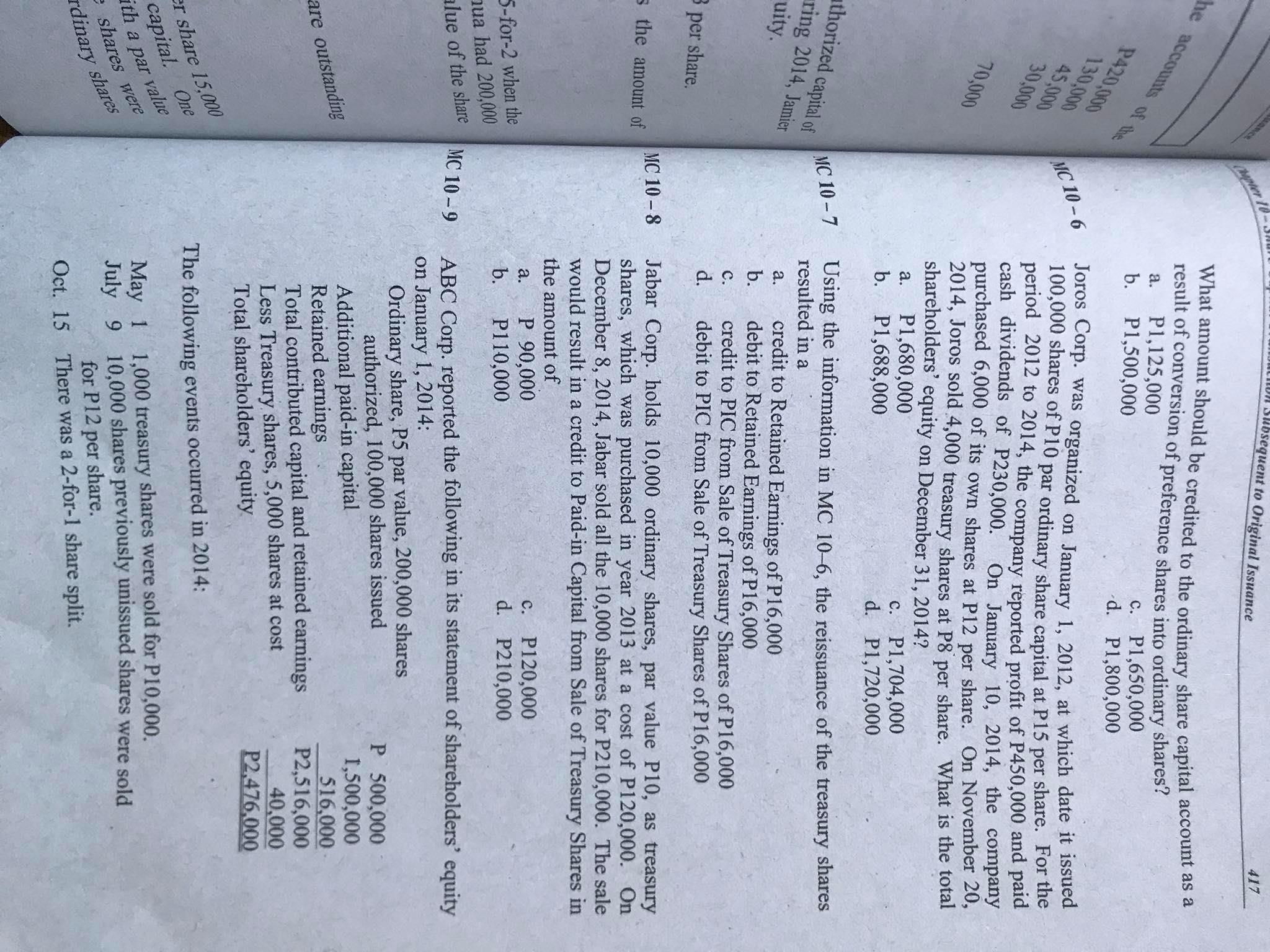

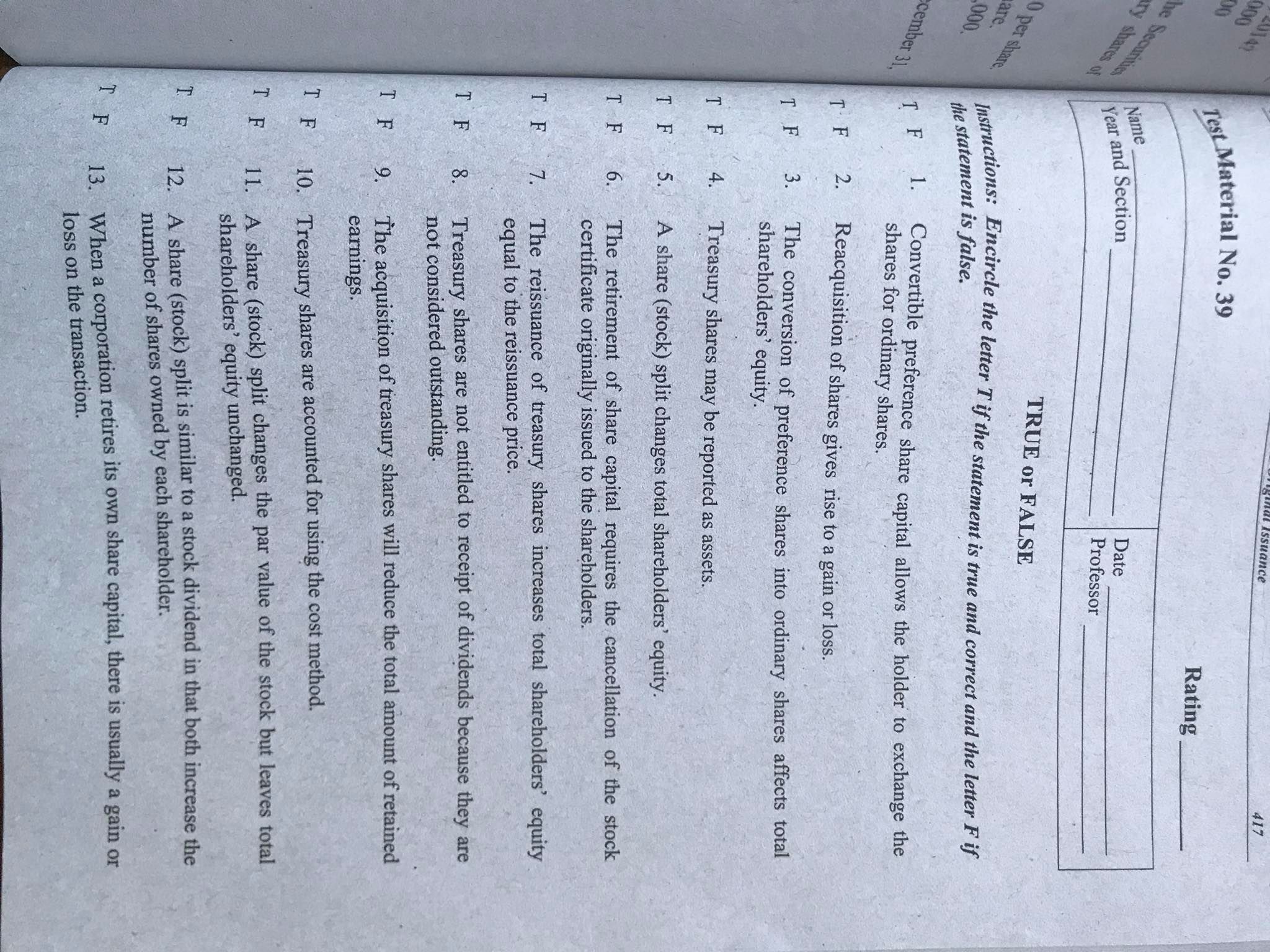

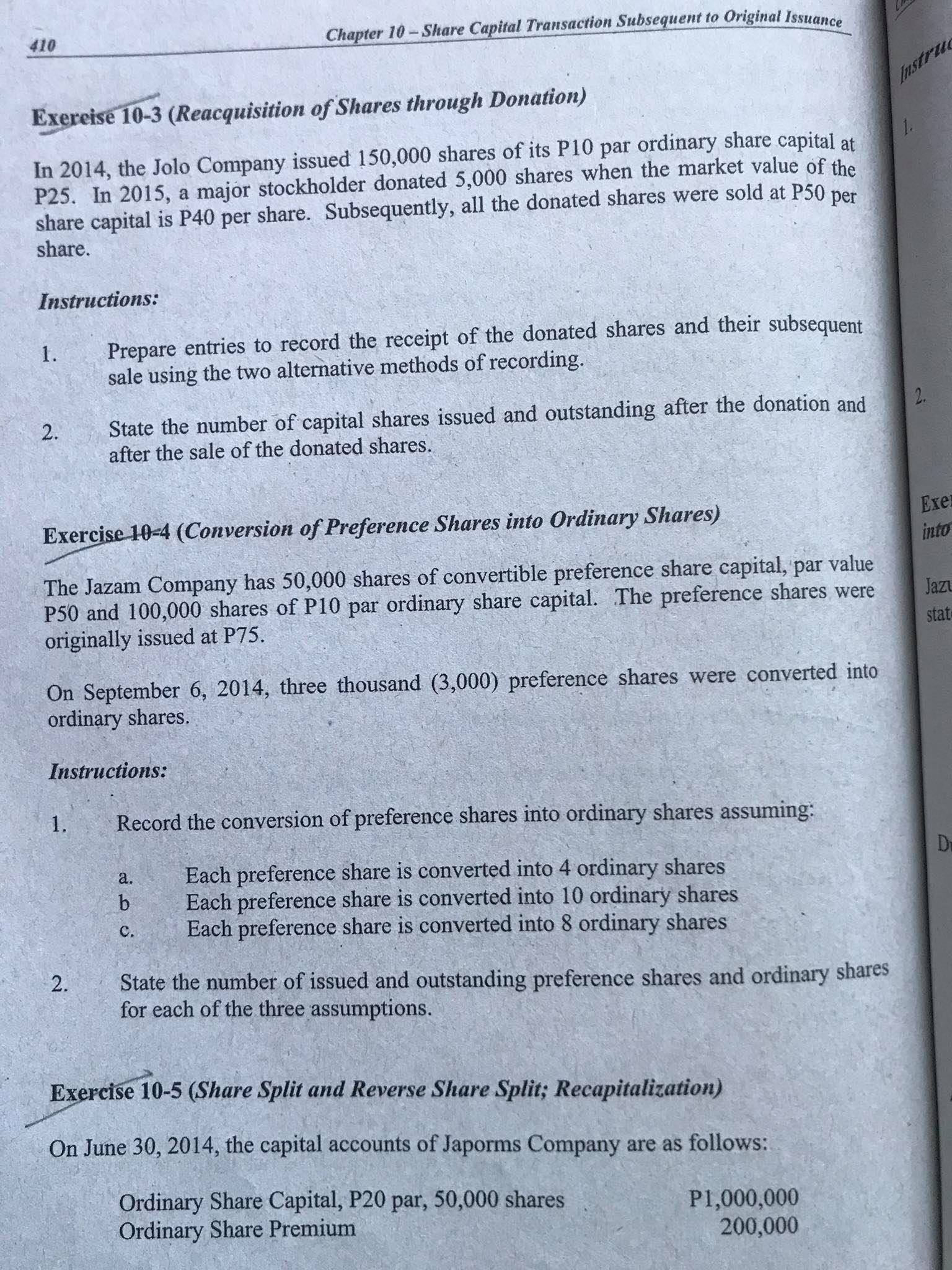

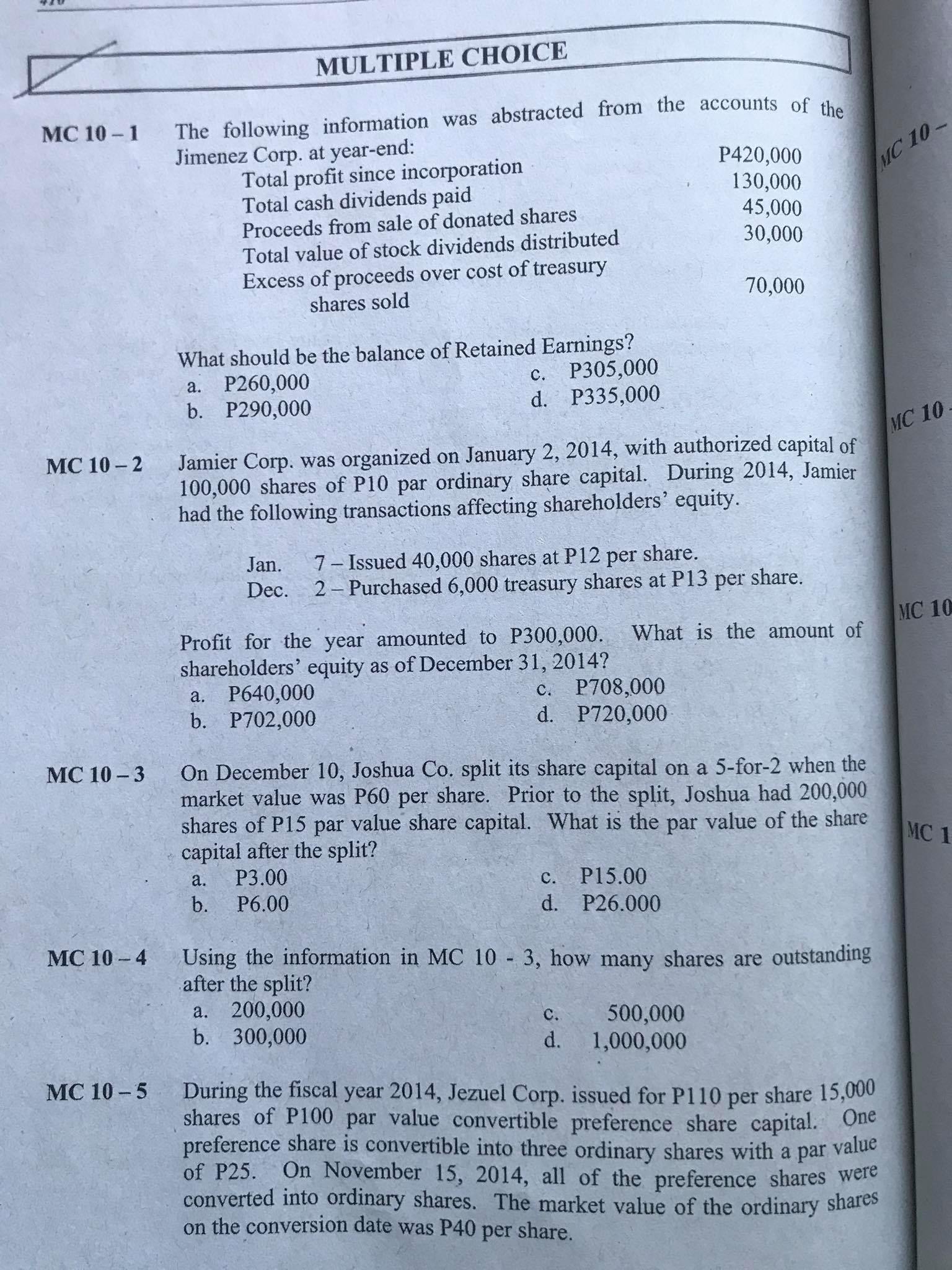

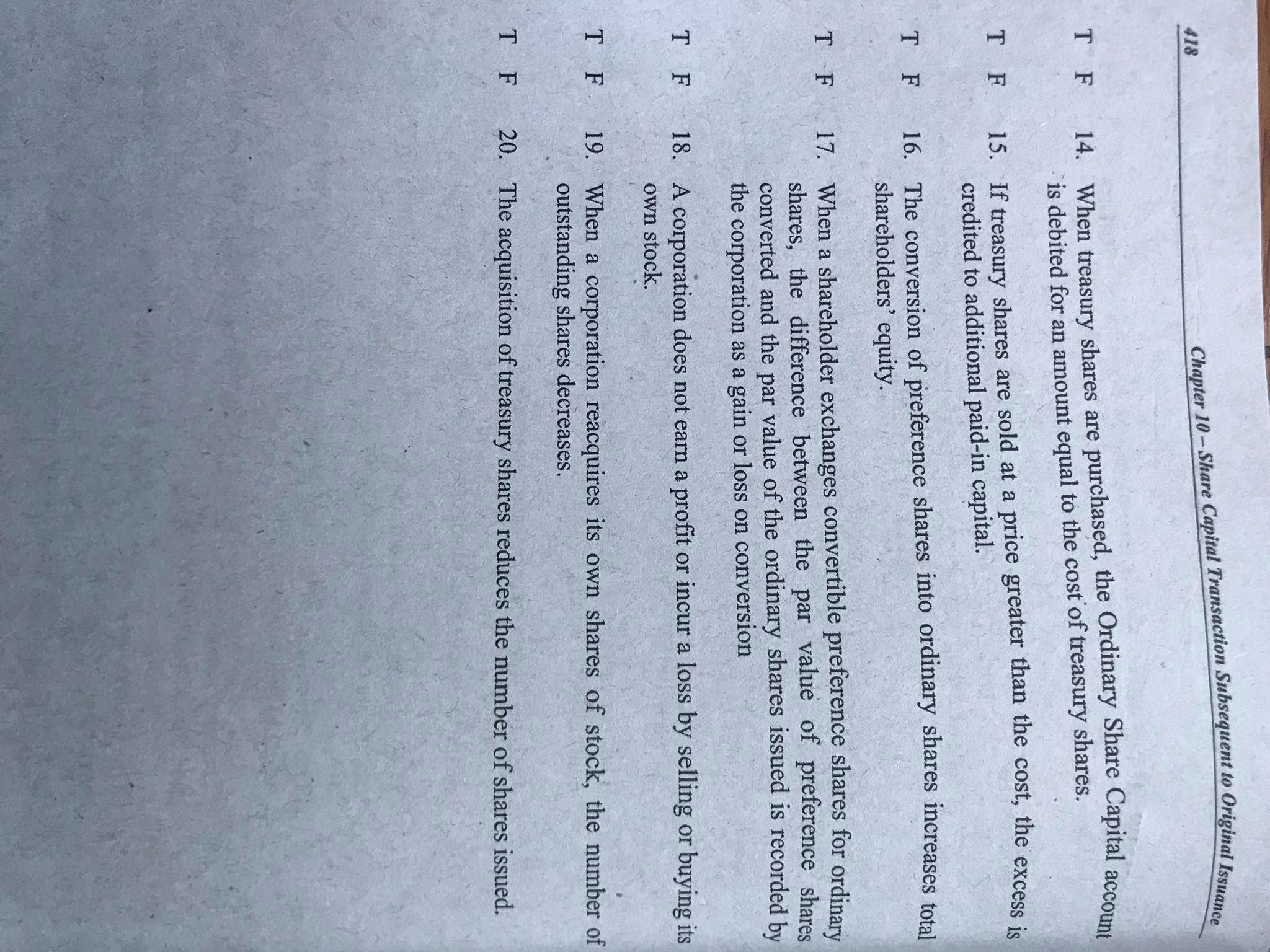

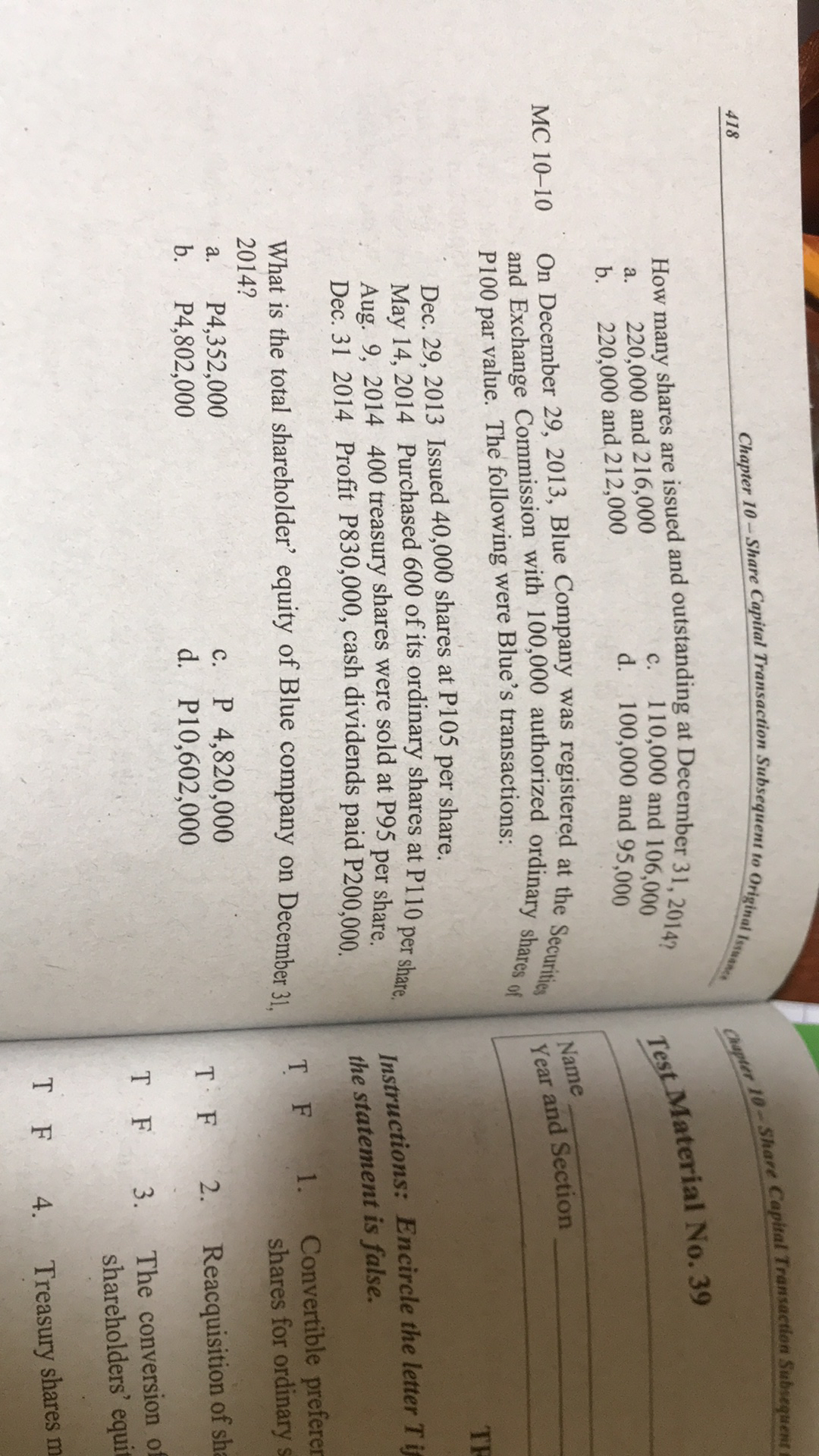

412 Chapter 10 - Share Capital Transaction Subsequent to Original Issuance problem 10- PROBLEMS The capital a Problem 10-1 (Various Share Capital Transactions) 5% P Prefe The Jazmine Co., organized on January 1, 2014, was authorized to issue share capital as Ordi follows: 20,000 shares of 10% preference share capital, P100 par; 50,000 shares of ordinary share capital, P50 par Ordi During the remainder of the year, the following transactions were completed: Reta a. Received subscription for 10,000 preference shares at P125 and 20,000 ordinary Each prefe shares at P60. Both subscriptions were payable 50% upon subscription; the transaction. balance is due within thirty days. position du b. Received the final payment on subscription in (a). Issued shares of stock to the a. Reac subscribers. b. Prefe C. Reacquired 2,500 ordinary shares at P50. C. Issue d. The holders of preference shares converted 3,000 of their shares into ordinary d. Decl shares on a share-for-share basis. per s e. Reissued 1,500 treasury shares at P65. e. Reis f. Received 2,000 ordinary shares as donation from a major stockholder. f. The g. Sold the 2,000 shares received as donation at P56 per share. g. Rep h. Reissued remaining treasury shares at P60. Instructi All of the ordinary shares were exchanged for no-par shares with a stated value of P30. 1. Journ j. Reported profit of P1,500,000. 2. Prep k. Declared the regular cash dividend on preference share capital and a P1.00 cash Dec dividend on ordinary share capital. Problen Instructions: 1 . Joemari Give the journal entries to record the preceding transactions. (Disregard in this share c problem the appropriation of retained earnings on the acquisition of treasury shares.) account 2. Prepare the shareholders' equity section of the statement of financial position as of December 31, 2014.EXERCISES Exercise 10-1 (Retirement of Share Capital) share capital: The Joaquin Company showed the following balances related to an issuance of ordinary Ordinary Share Capital, P50 par, 200,000 shares Ordinary Share Premium P10,000,000 4,000,000 The company retired 2,000 shares of ordinary share capital. Instructions: 1 . assumptions: Record the retirement of the 2,000 ordinary shares under each of the following b . The retirement price is P45 The retirement price is P60 2. State the number of capital shares issued and outstanding immediately after the retirement. Exercise 10-2 (Accounting for Treasury Shares) The Jocson Company capital accounts as of June 30, 2014 are as follows: Ordinary Share Capital, P25 par, 100,000 shares P2,500,000 Ordinary Share Premium 1,000,000 Retained Earnings 1,500,000 On this date, 5,000 shares were reacquired at P20. On July 31, 3,500 shares were reissued at P35. Instructions: 1. Prepare the journal entries to record the acquisition and reissuance of treasury shares. 2. Prepare the shareholders' equity section of the statement of financial position as of July 31.xcess is Name Year and Section Date Professor es total IDENTIFICATION ordinary instructions: Write the word or group of words that identify each of the following statements. shares rded by 1. Shares issued to shareholders but subsequently reacquired by the corporation. ying its 2. Preference shares that can be converted into ordinary shares at the option of the holder. nber of A reduction in the par or stated value of the share capital accompanied by a proportionate increase in the number of shares outstanding. + A change in the capital structure of the corporation. led. in . Account credited for the indicated gain on retirement of share capital. The acceptable method of accounting for treasury shares. 7. Replacement of outstanding shares by a smaller number of shares with a corresponding increase in the par or stated value of the share capital. 8. The account debited for the excess of the retirement price over the original issuance price of share capital. 9. The effect of share split up on par or stated value. 10. Retained earnings set aside equal to the cost of treasury shares upon acquisition. 1 1. The entry made to record the receipt of share capital as donation. 12. The amount recorded as paid-in capital from donated shares upon sale of donated capital shares. 13. The sum of share capital and additional paid-in capital. 14. The practice done by shareholders to enable the company to increase its working capital and at the same time maintain shareholders' proportionate ownership interests. 15. The reacquisition of issued shares without the intention of reissue at some future date.Instructions: capital at re of the 1. Prepare the necessary journal entry to record each of the following independent transactions: P50 per The company undertakes a 5 for 1 share split. C. The company undertakes a 1 for 4 share split. One new ordinary share with a par value of P15 is issued in exchange for sequent d. one ordinary share with a par value of P25. One new ordinary share with a stated value of P25 is issued in exchange for one ordinary share with a par value of P25. tion and 2. State the number of capital shares issued and outstanding for each independent transaction. Exercise 10-6 (Acquisition of Treasury Shares and Conversion of Preference Shares ar value into Ordinary Shares) es were Jazul Company had the following equity balances reported in its December 31, 2013 statement of financial position ed into 10,000, 10% Preference Share Capital, convertible, P100 par, P1,000,000 500,000 Ordinary Share Capital, P5 stated value, P2,500,000 Preference Share Premium, P200,000 Paid-in capital in Excess of Stated Value, P1,500,000 Retained Earnings, P1,200,000 During 2014, the following transactions relating to share capital have taken place: a. 5,000 ordinary shares were reacquired at P10. Subsequently, 4,000 shares were reissued at P12 per share and the. 1,000 shares were reissued at P7 per share. shares b. 1,000 preference shares were converted into ordinary shares. Ten ordinary shares were issued for every preference share converted. Instructions: 1. Prepare journal entries to record the preceding transactions. 2. State the number of preference shares and ordinary shares issued and outstanding.nut to Original Issuance 417 What amount should be credited to the ordinary share capital account as a he accounts of the result of conversion of preference shares into ordinary P1,125,000 P1,500,000 C. P1,650,000 P420,000 d. P1,800,000 130,000 45,000 MC 10 - 6 Joros Corp. was organized on January 1, 2012, at which date it issued 30,000 100,000 shares of P10 par ordinary share capital at P15 per share. For the period 2012 to 2014, the company reported profit of P450,000 and paid cash dividends of P230,000. On January 10, 2014, the company 70,000 purchased 6,000 of its own shares at P12 per share. On November 20, 2014, Joros sold 4,000 treasury shares at P8 per share. What is the total shareholders' equity on December 31, 2014? P1,680,000 b. P1,688,000 c. P1,704,000 1. P1,720,000 thorized capital of MC 10- 7 Using the information in MC 10-6, the reissuance of the treasury shares ring 2014, Jamier resulted in a uity. credit to Retained Earnings of P16,000 debit to Retained Earnings of P16,000 credit to PIC from Sale of Treasury Shares of P16,000 per share. debit to PIC from Sale of Treasury Shares of P16,000 the amount of MC 10-8 Jabar Corp. holds 10,000 ordinary shares, par value P10, as treasury shares, which was purchased in year 2013 at a cost of P120,000. On December 8, 2014, Jabar sold all the 10,000 shares for P210,000. The sale would result in a credit to Paid-in Capital from Sale of Treasury Shares in the amount of 5-for-2 when the P 90,000 C. P120,000 lua had 200,000 P1 10,000 d. P210,000 lue of the share MC 10 -9 ABC Corp. reported the following in its statement of shareholders' equity on January 1, 2014: Ordinary share, P5 par value, 200,000 shares authorized, 100,000 shares issued P 500,000 Additional paid-in capital 1,500,000 are outstanding Retained earnings 516,000 Total contributed capital and retained earnings P2,516,000 Less Treasury shares, 5,000 shares at cost 40,000 Total shareholders' equity P2,476,000 r share 15,000 The following events occurred in 2014: capital. One ith a par value May 1 1,000 treasury shares were sold for P10,000. shares were July 9 10,000 shares previously unissued shares were sold rdinary shares for P12 per share. Oct. 15 There was a 2-for-1 share split.417 Test Material No. 39 Rating Securities Name ry shares of Year and Section Date Professor 0 per share TRUE or FALSE are 000 Instructions: Encircle the letter T if the statement is true and correct and the letter F if the statement is false. cember 31. TF 1. Convertible preference share capital allows the holder to exchange the shares for ordinary shares. T F Reacquisition of shares gives rise to a gain or loss. I F The conversion of preference shares into ordinary shares affects total shareholders' equity. TF 4. Treasury shares may be reported as assets. T F 5. A share (stock) split changes total shareholders' equity. T F 6. The retirement of share capital requires the cancellation of the stock certificate originally issued to the shareholders. T F 7. The reissuance of treasury shares increases total shareholders' equity equal to the reissuance price. I F 8. Treasury shares are not entitled to receipt of dividends because they are not considered outstanding. IF 9 The acquisition of treasury shares will reduce the total amount of retained earnings. I F 10. Treasury shares are accounted for using the cost method. I F 11. A share (stock) split changes the par value of the stock but leaves total shareholders' equity unchanged. F 12. A share (stock) split is similar to a stock dividend in that both increase the number of shares owned by each shareholder. F 13. When a corporation retires its own share capital, there is usually a gain or loss on the transaction.410 Chapter 10 - Share Capital Transaction Subsequent to Original Issuance Instru Exercise 10-3 (Reacquisition of Shares through Donation) In 2014, the Jolo Company issued 150,000 shares of its P10 par ordinary share capital at 1. P25. In 2015, a major stockholder donated 5,000 shares when the market value of the share capital is P40 per share. Subsequently, all the donated shares were sold at P50 per share. Instructions: 1. Prepare entries to record the receipt of the donated shares and their subsequent sale using the two alternative methods of recording. 2. State the number of capital shares issued and outstanding after the donation and 2. after the sale of the donated shares. Exercise 10-4 (Conversion of Preference Shares into Ordinary Shares) Exe into The Jazam Company has 50,000 shares of convertible preference share capital, par value P50 and 100,000 shares of P10 par ordinary share capital. The preference shares were Jaz originally issued at P75. stat On September 6, 2014, three thousand (3,000) preference shares were converted into ordinary shares. Instructions: 1. Record the conversion of preference shares into ordinary shares assuming: a. b Each preference share is converted into 4 ordinary shares C . Each preference share is converted into 10 ordinary shares Each preference share is converted into 8 ordinary shares 2. State the number of issued and outstanding preference shares and ordinary shares for each of the three assumptions. Exercise 10-5 (Share Split and Reverse Share Split; Recapitalization) On June 30, 2014, the capital accounts of Japorms Company are as follows: Ordinary Share Capital, P20 par, 50,000 shares Ordinary Share Premium P1,000,000 200,000MULTIPLE CHOICE MC 10-1 The following information was abstracted from the accounts of the Jimenez Corp. at year-end: Total profit since incorporation P420,000 MC 10 Total cash dividends paid 130,000 Proceeds from sale of donated shares 45,000 Total value of stock dividends distributed 30,000 Excess of proceeds over cost of treasury shares sold 70,000 What should be the balance of Retained Earnings? a. P260,000 C . P305,000 b. P290,000 d. P335,000 MC 10 MC 10-2 Jamier Corp. was organized on January 2, 2014, with authorized capital of 100,000 shares of P10 par ordinary share capital. During 2014, Jamier had the following transactions affecting shareholders' equity. Jan. 7 - Issued 40,000 shares at P12 per share. Dec. 2 - Purchased 6,000 treasury shares at P13 per share. Profit for the year amounted to P300,000. What is the amount of MC 10 shareholders' equity as of December 31, 2014? a. P640,000 c. P708,000 b. P702,000 d. P720,000 MC 10-3 On December 10, Joshua Co. split its share capital on a 5-for-2 when the market value was P60 per share. Prior to the split, Joshua had 200,000 shares of P15 par value share capital. What is the par value of the share capital after the split? MC 1 a. P3.00 b. P6.00 C. P15.00 d. P26.000 MC 10 -4 Using the information in MC 10 - 3, how many shares are outstanding after the split? a. 200,000 b. 300,000 C. 500,000 d. 1,000,000 MC 10-5 During the fiscal year 2014, Jezuel Corp. issued for P1 10 per share 15,000 shares of P100 par value convertible preference share capital. One preference share is convertible into three ordinary shares with a par value of P25. On November 15, 2014, all of the preference shares were converted into ordinary shares. The market value of the ordinary shares on the conversion date was P40 per share.418 Chapter 10 - Share Capital Transaction Subsequent to Original Issuance T F 14. When treasury shares are purchased, the Ordinary Share Capital account is debited for an amount equal to the cost of treasury shares. T F 15. If treasury shares are sold at a price greater than the cost, the excess is credited to additional paid-in capital. T F 16. The conversion of preference shares into ordinary shares increases total shareholders' equity. T F 17. When a shareholder exchanges convertible preference shares for ordinary shares, the difference between the par value of preference shares converted and the par value of the ordinary shares issued is recorded by the corporation as a gain or loss on conversion T F 18. A corporation does not earn a profit or incur a loss by selling or buying its own stock. T F 19. When a corporation reacquires its own shares of stock, the number of outstanding shares decreases. T F 20. The acquisition of treasury shares reduces the number of shares issued.418 Chapter 10 - Share Capital Transaction Subsequent to Original Issuance Chapter 10- Share Capital Transaction Subsequent How many shares are issued and outstanding at December 31, 20142 220,000 and 216,000 c. 110,000 and 106,000 Test Material No. 39 220,000 and 212,000 d. 100,000 and 95,000 MC 10-10 On December 29, 2013, Blue Company was registered at the Securities and Exchange Commission with 100,000 authorized ordinary shares of Name Year and Section P100 par value. The following were Blue's transactions: Dec. 29, 2013 Issued 40,000 shares at P105 per share. May 14, 2014 Purchased 600 of its ordinary shares at P110 per share Aug. 9, 2014 400 treasury shares were sold at P95 per share. Dec. 31 2014 Profit P830,000, cash dividends paid P200,000. Instructions: Encircle the letter Ti the statement is false. 2014? What is the total shareholder' equity of Blue company on December 31. 1. Convertible preferer shares for ordinary s P4,352,000 P4,802,000 C. P 4,820,000 d. P10,602,000 T F Reacquisition of sh E The conversion o shareholders' equi + Treasury shares m