Answered step by step

Verified Expert Solution

Question

1 Approved Answer

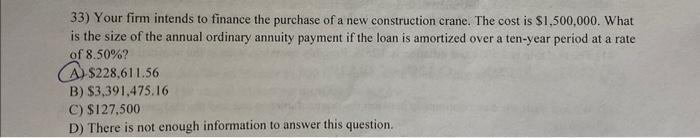

provide solutions 33) Your firm intends to finance the purchase of a new construction crane. The cost is $1,500,000. What is the size of the

provide solutions

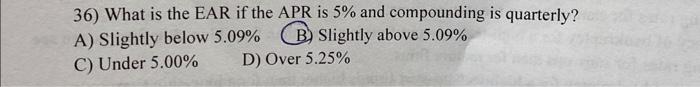

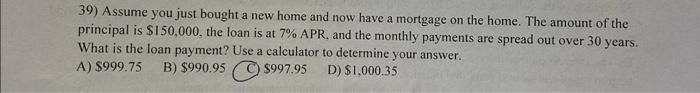

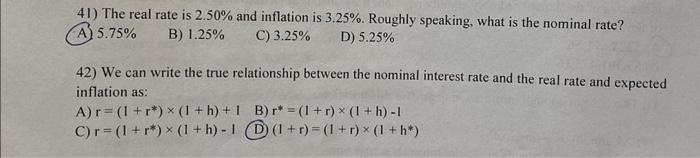

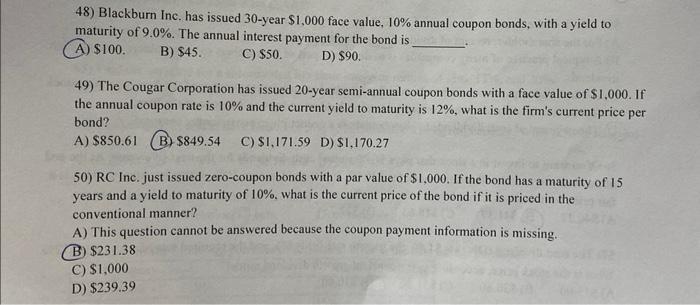

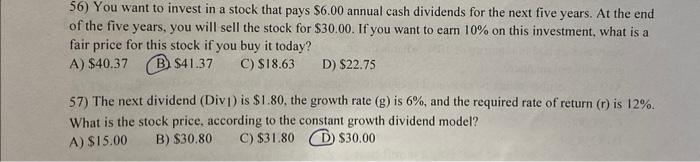

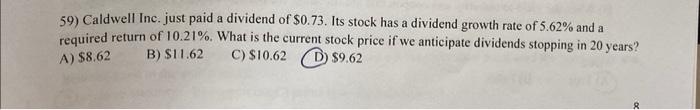

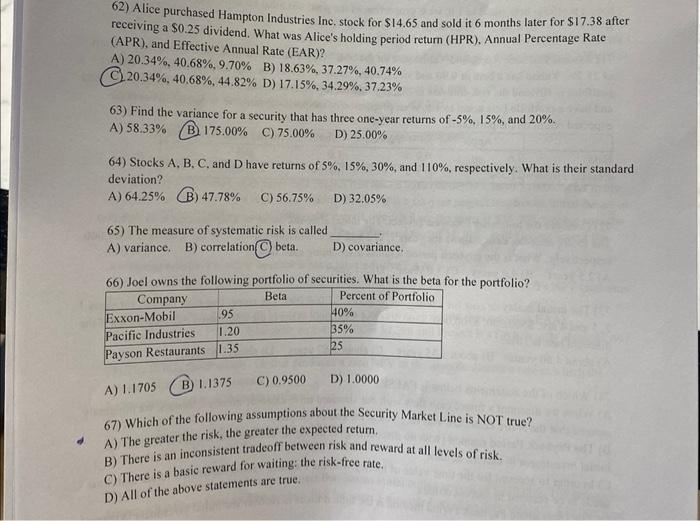

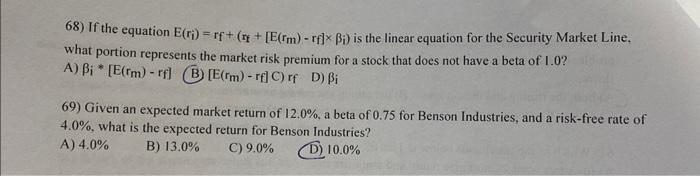

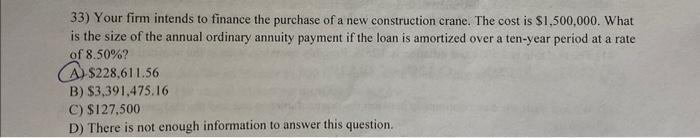

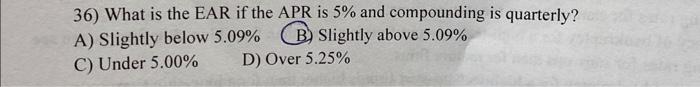

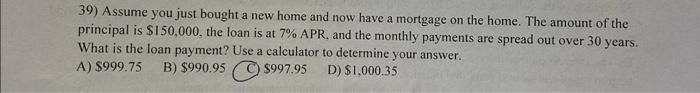

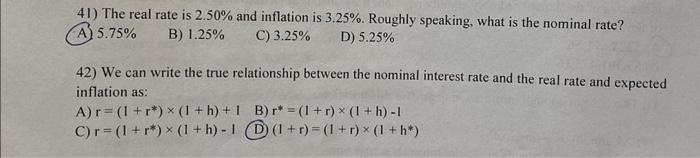

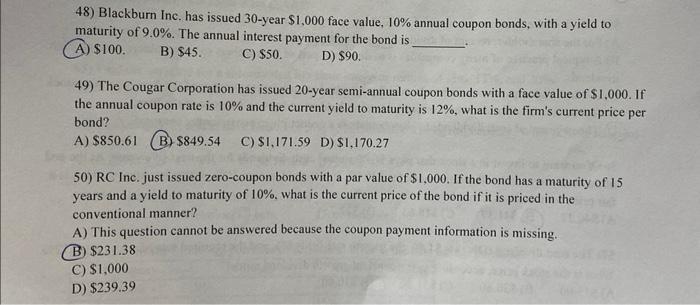

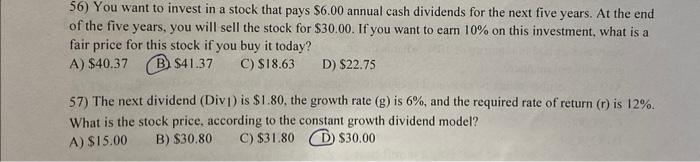

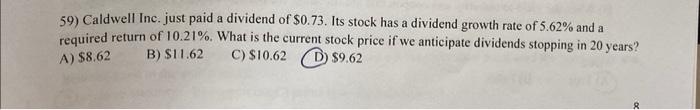

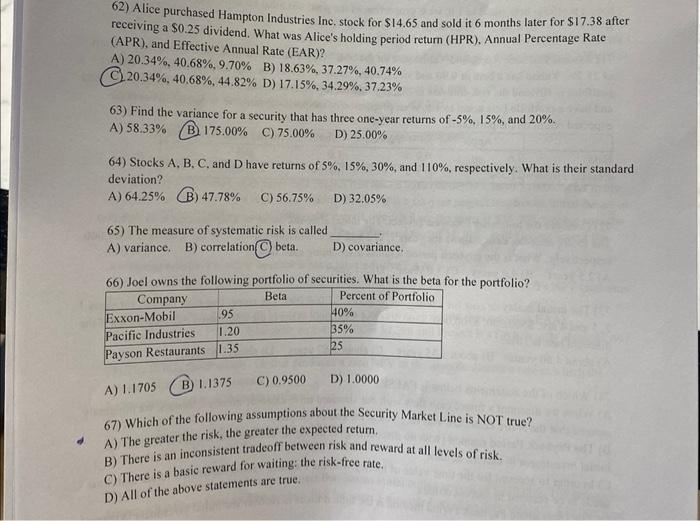

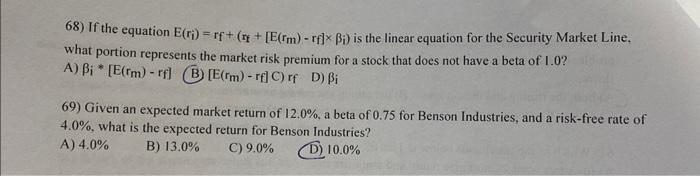

33) Your firm intends to finance the purchase of a new construction crane. The cost is $1,500,000. What is the size of the annual ordinary annuity payment if the loan is amortized over a ten-year period at a rate of 8.50% ? A) $228,611.56 B) $3,391,475,16 C) $127,500 D) There is not enough information to answer this question. 36) What is the EAR if the APR is 5% and compounding is quarterly? A) Slightly below 5.09% (B) Slightly above 5.09% C) Under 5.00% D) Over 5.25% 39) Assume you just bought a new home and now have a mortgage on the home. The amount of the principal is $150,000, the loan is at 7% APR, and the monthly payments are spread out over 30 years. What is the loan payment? Use a calculator to determine your answer. A) $999.75 B) $990.95 (C) $997.95 D) $1,000.35 41) The real rate is 2.50% and inflation is 3.25%. Roughly speaking, what is the nominal rate? A) 5.75% B) 1.25% C) 3.25% D) 5.25% 42) We can write the true relationship between the nominal interest rate and the real rate and expected inflation as: A) r=(1+r)(1+h)+1 B) r=(1+r)(1+h)1 C) r=(1+r)(1+h)1 (D) (1+r)=(1+r)(1+h) 48) Blackburn Inc. has issued 30-year $1,000 face value, 10% annual coupon bonds, with a yield to maturity of 9.0%. The annual interest payment for the bond is (A) $100. B) $45. C) $50. D) $90. 49) The Cougar Corporation has issued 20-year semi-annual coupon bonds with a face value of $1,000. If the annual coupon rate is 10% and the current yield to maturity is 12%, what is the firm's current price per bond? A) $850.61 (B) $849.54 C) $1,171.59 D) $1,170.27 50) RC Inc. just issued zero-coupon bonds with a par value of $1,000. If the bond has a maturity of 15 years and a yield to maturity of 10%, what is the current price of the bond if it is priced in the conventional manner? A) This question cannot be answered because the coupon payment information is missing. (B) $231.38 C) $1,000 D) $239.39 56) You want to invest in a stock that pays $6.00 annual cash dividends for the next five years. At the end of the five years, you will sell the stock for $30.00. If you want to earn 10% on this investment, what is a fair price for this stock if you buy it today? A) $40.37 B $41.37 C) $18.63 D) $22.75 57) The next dividend (Div1) is $1.80, the growth rate (g) is 6%, and the required rate of return (r) is 12%. What is the stock price, according to the constant growth dividend model? A) $15.00 B) $30.80 C) $31.80 $30.00 59) Caldwell Inc. just paid a dividend of $0.73. Its stock has a dividend growth rate of 5.62% and a required return of 10.21%. What is the current stock price if we anticipate dividends stopping in 20 years? A) $8.62 B) $11.62 C) $10.62 (D) $9.62 62) Alice purchased Hampton Industries Inc, stock for $14.65 and sold it 6 months later for $17.38 after receiving a $0.25 dividend. What was Alice's holding period return (HPR). Annual Percentage Rate (APR), and Effective Annual Rate (EAR)? A) 20.34%,40.68%,9.70% (C) 20.34%,40.68%,44.82% B) 18.63%,37.27%,40.74% D) 17.15%,34.29%,37.23% 63) Find the variance for a security that has three one-year returns of 5%,15%, and 20%. A) 58.33% (B) 175.00% C) 75.00% D) 25.00% 64) Stocks A, B, C, and D have returns of 5%,15%,30%, and 110%, respectively. What is their standard deviation? A) 64.25% (B) 47.78% C) 56.75% D) 32.05% 65) The measure of systematic risk is called A) variance. B) correlation(C) beta. D) covariance. 66) Joel owns the following portfolio of securities. What is the beta for the portfolio? A) 1.1705 (B) 1.1375 C) 0.9500 D) 1.0000 67) Which of the following assumptions about the Security Market Line is NOT true? A) The greater the risk, the greater the expected return. B) There is an inconsistent tradeoff between risk and reward at all levels of risk. C) There is a basic reward for waiting: the risk-free rate. D) All of the above statements are true. 68) If the equation E(ri)=rf+(ri+[E(rm)rffi) is the linear equation for the Security Market Line, what portion represents the market risk premium for a stock that does not have a beta of 1.0 ? A) i[E(rm)rf] (B) [E(rm)rf]C)rf D) i 69) Given an expected market return of 12.0%, a beta of 0.75 for Benson Industries, and a risk-free rate of 4.0%, what is the expected return for Benson Industries? A) 4.0% B) 13.0% C) 9.0% (D) 10.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started