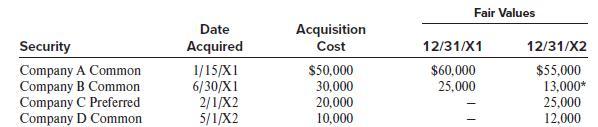

Second National Insurance Company provided this information for its minority-passive equity securities: Required: 1. Provide the journal entries to record the fair value adjustment on

Required:

1. Provide the journal entries to record the fair value adjustment on December 31, 20X1. Assume that Second National uses an account entitled Fair value adjustment minority- passive equity securities to adjust the cost of the portfolio to year-end fair values. Show supporting calculations in good form.

2. Provide the entry to record the sale of Company B’s common shares on July 1, 20X2. Assume that the last fair value adjustment for these shares was on December 31, 20X1.

3. Provide the journal entry and supporting calculations for the fair value adjustment on December 31, 20X2.

Security Company A Common Company B Common Company C Preferred Company D Common Date Acquired 1/15/X1 6/30/X1 2/1/X2 5/1/X2 Acquisition Cost $50,000 30,000 20,000 10,000 Fair Values 12/31/X1 $60,000 25,000 12/31/X2 $55,000 13,000* 25,000 12,000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Required solution of all parts is given below Note Assuming it to be trading securities for the requirement 1 to 4 Security Acquisition cost Fair valu...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started