Question

Provide Year-end adjusting journal entries for CDC Inc. and complete the adjusted trial balance 1.A cheque that was issued to company Mani ltd, Cheque number

Provide Year-end adjusting journal entries for CDC Inc. and complete the adjusted trial balance

1.A cheque that was issued to company Mani ltd, Cheque number 556 were misplaced and now the company found it and will be deposited shortly. (Amount was $1000)

2.Amortization expense on capital assets must be recorded. A van purchased in December is estimated to have a residual value of $15,000 and depreciates at a rate of 20% per year.

3.The outstanding A/R from ABC ltd is uncollectible. The business ( CDC inc) uses the allowance method to determine bad debt expense. An appropriate allowance for the year ended December 31, 2020, would be 4% of the balance in accounts receivable as of December 31, 2020. (Balance of A/R at Dec 31st, 2020 is 55,000)

4.CDC inc has not received an invoice for December telephone or utilities. Estimated amounts will be similar to November's invoices. No entry is required for GST. (November amount is $5k)

5.On December 31, 2020, CDC Inc. Counted raw materials with a cost of $71,000 and merchandise with a retail value of $22,200. All inventories were found to be in good condition

6. Staff are owed wages for the last week of the year. Estimated wages and payroll withholdings are one-half of the December 22, 2020 amounts.( Dec 22 amount is $12000

7. CDC inc has not received an invoice for December telephone or utilities. Estimated amounts will be similar to November's invoices. No entry is required for GST. (November amount is $5k)

8. CDC Inc records income taxes payable at a rate of 10% of net income before tax. If the company experiences a net loss, the taxes paid in the previous 3 years are recoverable at a rate of 10% of the current year's net loss before tax. ( previous year tax paid $45000) ( Current year net loss $105,000)

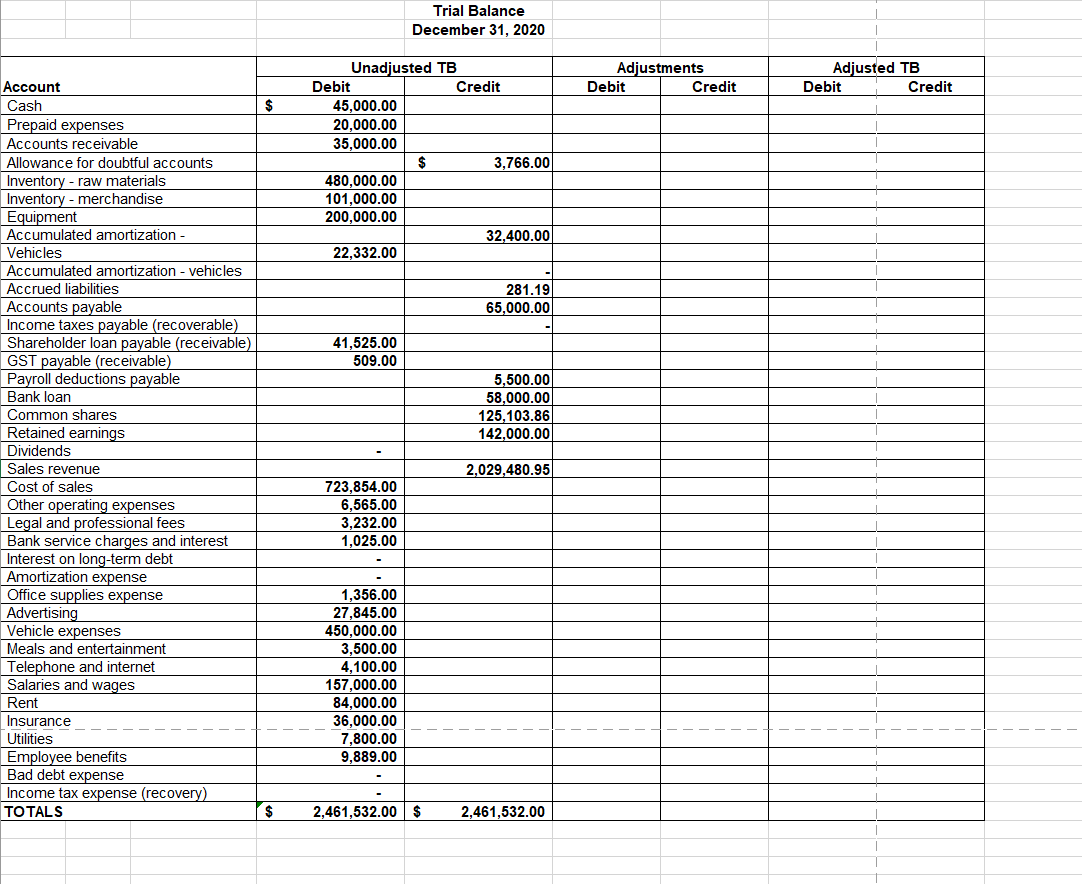

Trial Balance December 31, 2020 Adjustments Debit Credit Adjusted TB Debit Credit $ Unadjusted TB Debit Credit 45,000.00 20,000.00 35,000.00 $ 3,766.00 480,000.00 101,000.00 200,000.00 32,400.00 22,332.00 281.19 65,000.00 41,525.00 509.00 5,500.00 58,000.00 125,103.86 142,000.00 Account Cash Prepaid expenses Accounts receivable Allowance for doubtful accounts Inventory - raw materials Inventory - merchandise Equipment Accumulated amortization - Vehicles Accumulated amortization - vehicles Accrued liabilities Accounts payable Income taxes payable (recoverable) Shareholder loan payable (receivable) GST payable (receivable) Payroll deductions payable Bank loan Common shares Retained earnings Dividends Sales revenue Cost of sales Other operating expenses Legal and professional fees Bank service charges and interest Interest on long-term debt Amortization expense Office supplies expense Advertising Vehicle expenses Meals and entertainment Telephone and internet Salaries and wages Rent Insurance Utilities Employee benefits Bad debt expense Income tax expense (recovery) TOTALS 2,029,480.95 723,854.00 6,565.00 3,232.00 1,025.00 1,356.00 27,845.00 450,000.00 3,500.00 4,100.00 157,000.00 84,000.00 36,000.00 7,800.00 9.889.00 $ 2,461,532.00 $ 2,461,532.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started