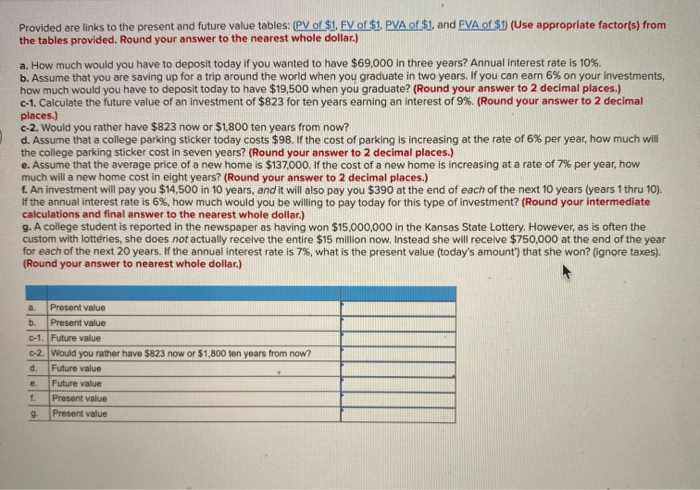

Provided are links to the present and future value tables: (PV of $1, FV of $1. PVA of $1, and FVA of $1 (Use appropriate factor(s) from the tables provided. Round your answer to the nearest whole dollar.) a. How much would you have to deposit today if you wanted to have $69,000 in three years? Annual interest rate is 10% b. Assume that you are saving up for a trip around the world when you graduate in two years. If you can earn 6% on your investments, how much would you have to deposit today to have $19,500 when you graduate? (Round your answer to 2 decimal places.) C-1. Calculate the future value of an investment of $823 for ten years earning an interest of 9% (Round your answer to 2 decimal places.) c-2. Would you rather have $823 now or $1,800 ten years from now? d. Assume that a college parking sticker today costs $98. If the cost of parking is increasing at the rate of 6% per year, how much will the college parking sticker cost in seven years? (Round your answer to 2 decimal places.) e. Assume that the average price of a new home is $137.000. If the cost of a new home is increasing at a rate of 7% per year, how much will a new home cost in eight years? (Round your answer to 2 decimal places.) 1. An investment will pay you $14,500 in 10 years, and it will also pay you $390 at the end of each of the next 10 years (years 1 thru 10). If the annual interest rate is 6%, how much would you be willing to pay today for this type of investment? (Round your intermediate calculations and final answer to the nearest whole dollar.) 9. A college student is reported in the newspaper as having won $15.000.000 in the Kansas State Lottery. However, as is often the custom with lotteries, she does not actually receive the entire $15 million now. Instead she will receive $750,000 at the end of the year for each of the next 20 years. If the annual interest rate is 7%, what is the present value (today's amount') that she won? ignore taxes). (Round your answer to nearest whole dollar.) a. Present value b. Present value C-1. Future value 0-2. Would you rather have $823 now or $1,800 ten years from now? d. Future value e. Future value Present value g. Present value Provided are links to the present and future value tables: (PV of $1, FV of $1. PVA of $1, and FVA of $1 (Use appropriate factor(s) from the tables provided. Round your answer to the nearest whole dollar.) a. How much would you have to deposit today if you wanted to have $69,000 in three years? Annual interest rate is 10% b. Assume that you are saving up for a trip around the world when you graduate in two years. If you can earn 6% on your investments, how much would you have to deposit today to have $19,500 when you graduate? (Round your answer to 2 decimal places.) C-1. Calculate the future value of an investment of $823 for ten years earning an interest of 9% (Round your answer to 2 decimal places.) c-2. Would you rather have $823 now or $1,800 ten years from now? d. Assume that a college parking sticker today costs $98. If the cost of parking is increasing at the rate of 6% per year, how much will the college parking sticker cost in seven years? (Round your answer to 2 decimal places.) e. Assume that the average price of a new home is $137.000. If the cost of a new home is increasing at a rate of 7% per year, how much will a new home cost in eight years? (Round your answer to 2 decimal places.) 1. An investment will pay you $14,500 in 10 years, and it will also pay you $390 at the end of each of the next 10 years (years 1 thru 10). If the annual interest rate is 6%, how much would you be willing to pay today for this type of investment? (Round your intermediate calculations and final answer to the nearest whole dollar.) 9. A college student is reported in the newspaper as having won $15.000.000 in the Kansas State Lottery. However, as is often the custom with lotteries, she does not actually receive the entire $15 million now. Instead she will receive $750,000 at the end of the year for each of the next 20 years. If the annual interest rate is 7%, what is the present value (today's amount') that she won? ignore taxes). (Round your answer to nearest whole dollar.) a. Present value b. Present value C-1. Future value 0-2. Would you rather have $823 now or $1,800 ten years from now? d. Future value e. Future value Present value g. Present value