Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provided below are an analysts forecasts of revenue, net operating profit after tax (NOPAT), and net operating assets (NOA) as of 12/31/2020 for 3M. ($

Provided below are an analysts forecasts of revenue, net operating profit after tax (NOPAT), and net operating assets (NOA) as of 12/31/2020 for 3M.

| ($ millions) | Reported 2020 | Forecast Horizon Period | Terminal Period | |||

|---|---|---|---|---|---|---|

| 2021 | 2022 | 2023 | 2024 | |||

| Revenue: | $32,184.0 | $33,149.5 | $34,144.0 | $35,168.3 | $36,223.4 | $36,947.8 |

| NOPAT: | $5,744.0 | $5,916.3 | $6,093.8 | $6,276.6 | $6,464.9 | $6,594.2 |

| NOA: | $26,688.0 | $27,488.6 | $28,313.3 | $29,162.7 | $30,037.6 | $30,638.3 |

The following additional information is provided (dollar and share amounts in millions).

- Common shares outstanding: 577.750

- Net nonoperating obligations (NNO): $13,757.0

- Noncontrolling interest (NCI): $64.0

- Preferred stock: $0.0

- WACC: 6.5%

- Terminal period growth rate: 2.0%

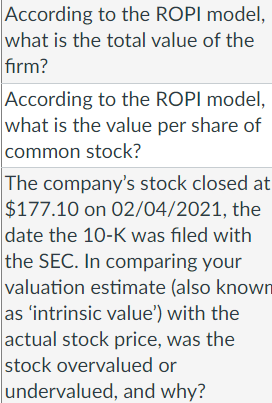

Use the residual operating income (ROPI) method to answer the following questions. Do not round intermediate calculations. All values other than per-share amounts are shown in millions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started