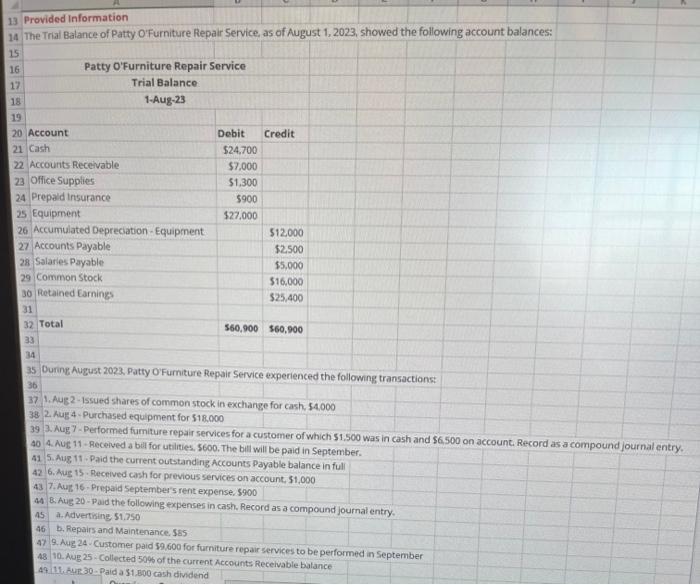

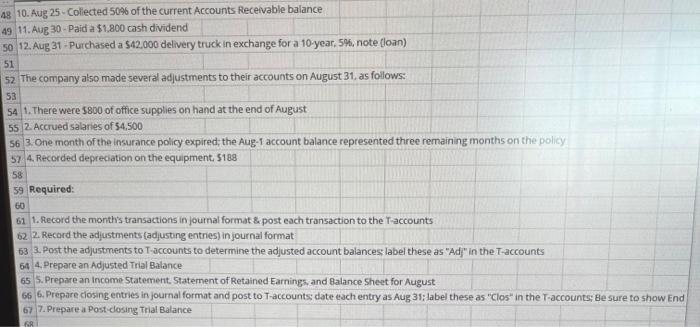

Provided Information The Tral Balance of Patty OFurniture Repair Service, as of August 1, 2023, showed the following account balances: 35 During August 2023, Patty OFumiture Repair Service experienced the followng transactions: 1. Aug 2 - 1ssued shares of common stock in exchange for cash, 54,000 2. Aug 4-Purchased equipment for $18,000 3. Aug 7- Performed fumiture repair services for a customer of which $1.500 was in cash and $6.500 on account. Record as a compound journal entry. 4. Aug 11 - Recelved a bal for utilities, $600. The bill will be paid in September. 5. Aug 11 - Paid the current outstanding Accounts Payable balance in full 6. Aus 15. Decenved cash for previous services on account, $1.000 7. Aut 16 . Prepaid September's rent expense, $900 8. Aug 20 - paud the following expenses in cash, Record as a compound journal entry. a. Advertising 51,750 b. Repairs and Maintenance, 585 9. Aug 24-Customer paid 59,600 for furniture repair services to be performed in September 10. Aug 25 - Collected 509% of the corrent Accounts Recelvable balance 49. 11. Aur: 30 - Paid a 31.800 cash dividenid 10. Aug 25 - Coliected 50% of the current Accounts feceivable balance 11. Aug 30 - Paid a $1,800 cash dividend 12. Aug 31 - Purchased a $42,000 delivery truck in exchange for a 10 year, 5%, note (loan) The company also made several adjustments to their accounts on August 31, as follows: 1. There were 5800 of office supplies on hand at the end of August 2. Accrued salaries of 54.500 3. One month of the insurance policy expired, the Aug-1 account balance represented three remaining months on the policy 4. Recorded depreciation on the equipment, $188 Required: 1. Record the month's transactions in journal format \& post each transaction to the T-accounts 2. Record the adjustments (adjusting entries) in journal format 3. Post the adjustments to T-accounts to determine the adjusted account balances label these as "Adj" in the T-accounts 4.Prepare an Adjusted Trial Balance 5. Prepare an Income Statement. Statement of Retained Earnings, and Balance Sheet for August 6. Prepare closing entries in journal format and post to T-accounts; date each entry as Aug 31; label these as "Clos" in the T-accounts; Ble sure to show End 7. Prepare a Post-closing Trial Balance Provided Information The Tral Balance of Patty OFurniture Repair Service, as of August 1, 2023, showed the following account balances: 35 During August 2023, Patty OFumiture Repair Service experienced the followng transactions: 1. Aug 2 - 1ssued shares of common stock in exchange for cash, 54,000 2. Aug 4-Purchased equipment for $18,000 3. Aug 7- Performed fumiture repair services for a customer of which $1.500 was in cash and $6.500 on account. Record as a compound journal entry. 4. Aug 11 - Recelved a bal for utilities, $600. The bill will be paid in September. 5. Aug 11 - Paid the current outstanding Accounts Payable balance in full 6. Aus 15. Decenved cash for previous services on account, $1.000 7. Aut 16 . Prepaid September's rent expense, $900 8. Aug 20 - paud the following expenses in cash, Record as a compound journal entry. a. Advertising 51,750 b. Repairs and Maintenance, 585 9. Aug 24-Customer paid 59,600 for furniture repair services to be performed in September 10. Aug 25 - Collected 509% of the corrent Accounts Recelvable balance 49. 11. Aur: 30 - Paid a 31.800 cash dividenid 10. Aug 25 - Coliected 50% of the current Accounts feceivable balance 11. Aug 30 - Paid a $1,800 cash dividend 12. Aug 31 - Purchased a $42,000 delivery truck in exchange for a 10 year, 5%, note (loan) The company also made several adjustments to their accounts on August 31, as follows: 1. There were 5800 of office supplies on hand at the end of August 2. Accrued salaries of 54.500 3. One month of the insurance policy expired, the Aug-1 account balance represented three remaining months on the policy 4. Recorded depreciation on the equipment, $188 Required: 1. Record the month's transactions in journal format \& post each transaction to the T-accounts 2. Record the adjustments (adjusting entries) in journal format 3. Post the adjustments to T-accounts to determine the adjusted account balances label these as "Adj" in the T-accounts 4.Prepare an Adjusted Trial Balance 5. Prepare an Income Statement. Statement of Retained Earnings, and Balance Sheet for August 6. Prepare closing entries in journal format and post to T-accounts; date each entry as Aug 31; label these as "Clos" in the T-accounts; Ble sure to show End 7. Prepare a Post-closing Trial Balance