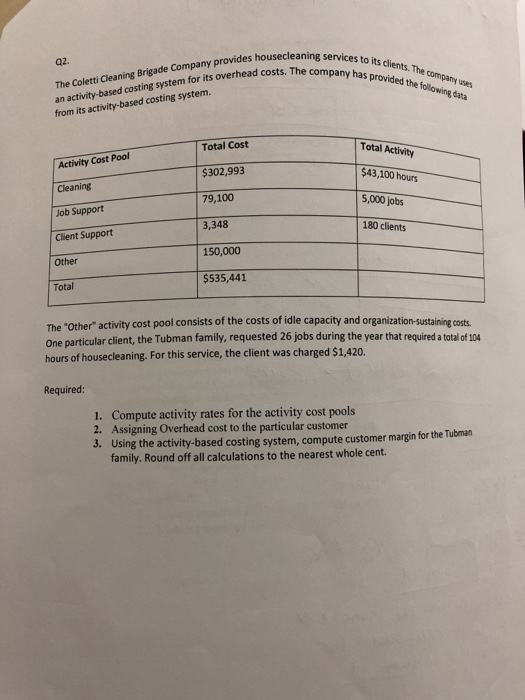

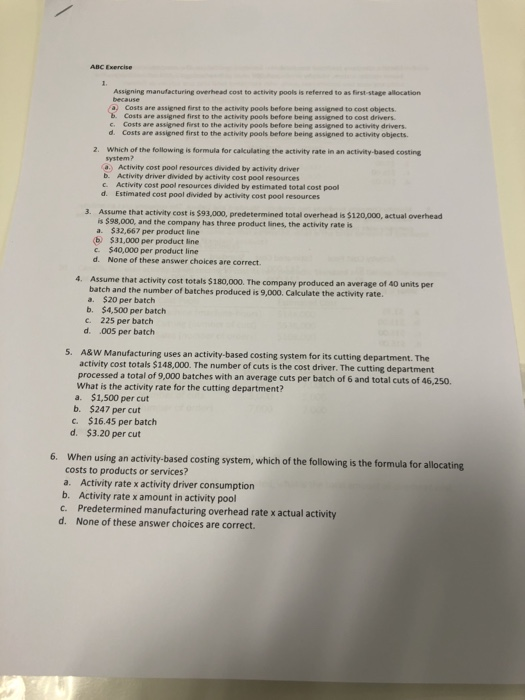

provides housecleaning services to its verhead costs. The company has provided services to its Chients. The company uses has provided the following data The Coletti Cleaning Brigade Company provides housecleani an activity-based costing system for its overhead cos from its activity-based costing system. Total Cost Total Activity Activity Cost Pool $302,993 $43,100 hours Cleaning 79,100 Job Support 5,000 jobs 180 clients 3,348 Client Support 150,000 Other $535,441 Total The "Other activity cost pool consists of the costs of idle capacity and organization-sustaining coste One particular client, the Tubman family, requested 26 jobs during the year that required a total hours of housecleaning. For this service, the client was charged $1,420. Required: 1. Compute activity rates for the activity cost pools 2. Assigning Overhead cost to the particular customer 3. Using the activity-based costing system, compute customer margin for the Tubman family. Round off all calculations to the nearest whole cent. Assigning manufacturing overhead cost to activity pools is referred to as first stage allocation a Costs are assigned first to the activity pools before being assigned to cost objects. b. Costs are assigned first to the activity pools before being asigned to cost drivers. c. Costs are assigned first to the activity pools before being assigned to activity drivers. d. Costs are assigned first to the activity pools before being assigned to activity objects 2. Which of the following is formula for calculating the activity rate in an activity-based costing system? a.) Activity cost pool resources divided by activity driver b. Activity driver divided by activity cost pool resources c. Activity cost pool resources divided by estimated total cost pool d Estimated cost pool divided by activity cost pool resources 3. Assume that activity cost is $93.000, predetermined total overhead is $120,000, actual overhead is $98,000, and the company has three product lines, the activity rate is a $32,667 per product line (b) $31,000 per product line c. $40,000 per product line d. None of these answer choices are correct. 4. Assume that activity cost totals $180,000. The company produced an average of 40 units per batch and the number of batches produced is 9,000. Calculate the activity rate. a $20 per batch b. $4,500 per batch c. 225 per batch d. 005 per batch 5. A&W Manufacturing uses an activity-based costing system for its cutting department. The activity cost totals $148,000. The number of cuts is the cost driver. The cutting department processed a total of 9,000 batches with an average cuts per batch of 6 and total cuts of 46,250. What is the activity rate for the cutting department? a. $1,500 per cut b. $247 per cut c. $16.45 per batch d. $3.20 per cut 6. When using an activity-based costing system, which of the following is the formula for allocating costs to products or services? a. Activity rate x activity driver consumption b. Activity rate x amount in activity pool C. Predetermined manufacturing overhead rate x actual activity d. None of these answer choices are correct