Answered step by step

Verified Expert Solution

Question

1 Approved Answer

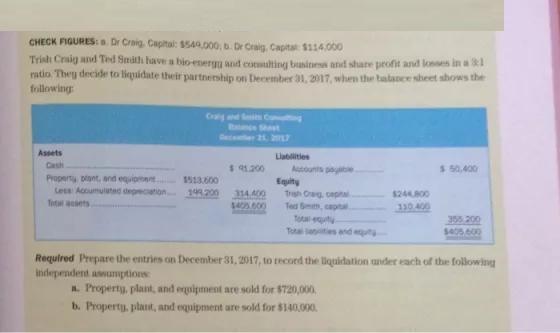

CHECK FIGURES:a. Dr Craig. Capitai: $549.000, b. Dr Craig. Capitat 1114.000 Trisht Craig and Ted Smith have a bio-energu and eotuulting buninesi and share

CHECK FIGURES:a. Dr Craig. Capitai: $549.000, b. Dr Craig. Capitat 1114.000 Trisht Craig and Ted Smith have a bio-energu and eotuulting buninesi and share proft and lonses in aR ratio. They decider to liquidate their partnership on Derember 31, 2017, whm the talanee sheet shows the frillowing C d Cong Assets Cash Liablities $1.200 $ 50,400 00e5 drba pue utod fdd 314 400 wfed sunoy Equity Less Accumulated depecation 149200 $2400 Tita aets Ted Sm, capt Totat 330 400 355 200 Tota aties and t Required Prepare the entries on December 31, 2017, to tecord the llquidation under each of the following Independent aswuptions A. Property, plant, and egpipment are sold for $720,000 b. Property, plat, and equipment are sold for $140.000.

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Solution Naming convention is not available can be slightly different Ignore the Explanation in blue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started