Question

Pruitt Corporation acquired all of the voting stock of Soto Corporation on January 1, 2010, for $210,000 when Soto had common stock of $150,000 and

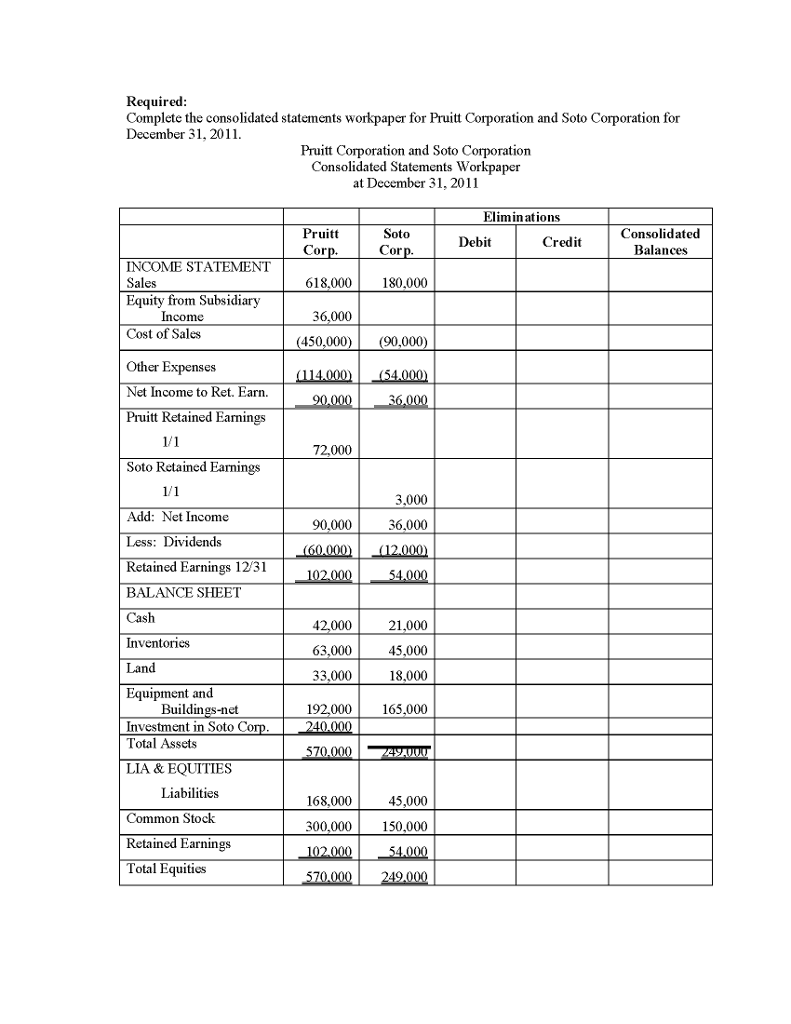

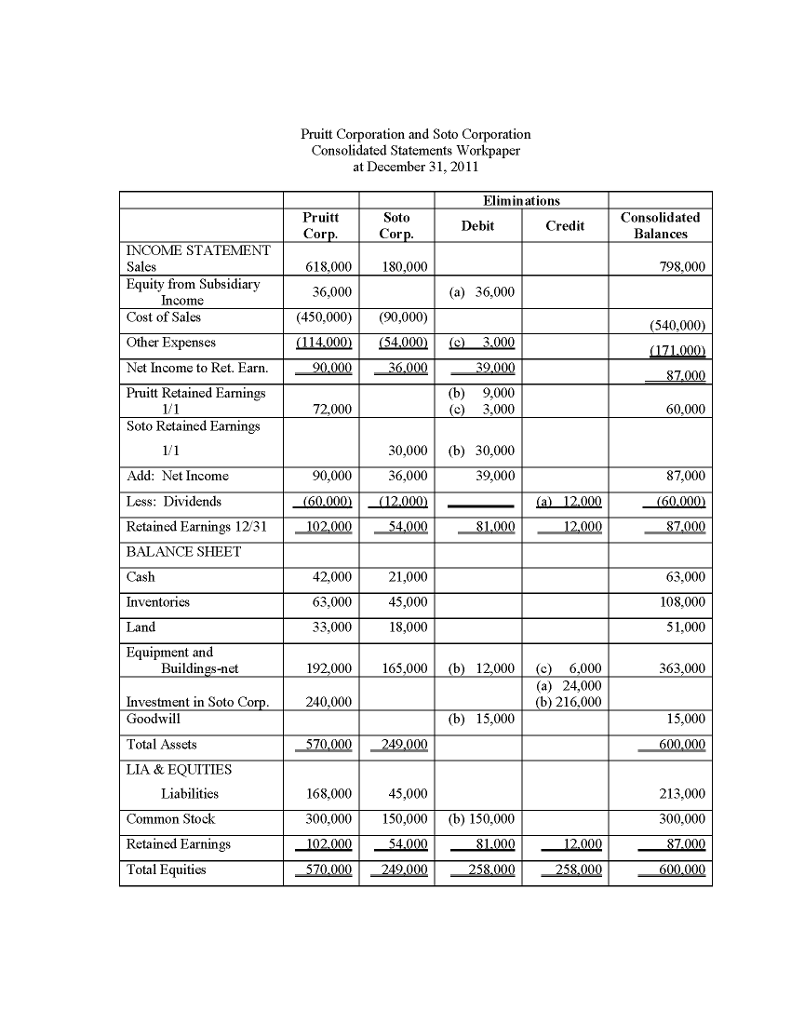

Pruitt Corporation acquired all of the voting stock of Soto Corporation on January 1, 2010, for $210,000 when Soto had common stock of $150,000 and retained earnings of $24,000. The excess of implied over book value was allocated $9,000 to inventories that were sold in 2010, $12,000 to equipment with a 4-year remaining useful life under the straight-line method, and the remainder to goodwill. Financial statements for Pruitt and Soto Corporations at the end of the fiscal year ended December 31, 2011 (two years after acquisition), appear in the first two columns of the partially completed consolidated statements workpaper. Pruitt Corp. has accounted for its investment in Soto using the partial equity method of accounting.

Required: Complete the consolidated statements workpaper for Pruitt Corporation and Soto Corporation for December 31, 2011.

I already have the answer below . What I would like to know is the correct entries for (a),(b) and (c) and explanations and calculations of them.

Also please post a correct answer if it is wrong.

Thank you very much in advance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started