Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ps M Gmail Current Students .... veronicajackson 198... Chapter 13 Homework Saved LO Dixie Dynamite Company is evaluating two methods of blowing up old buildings

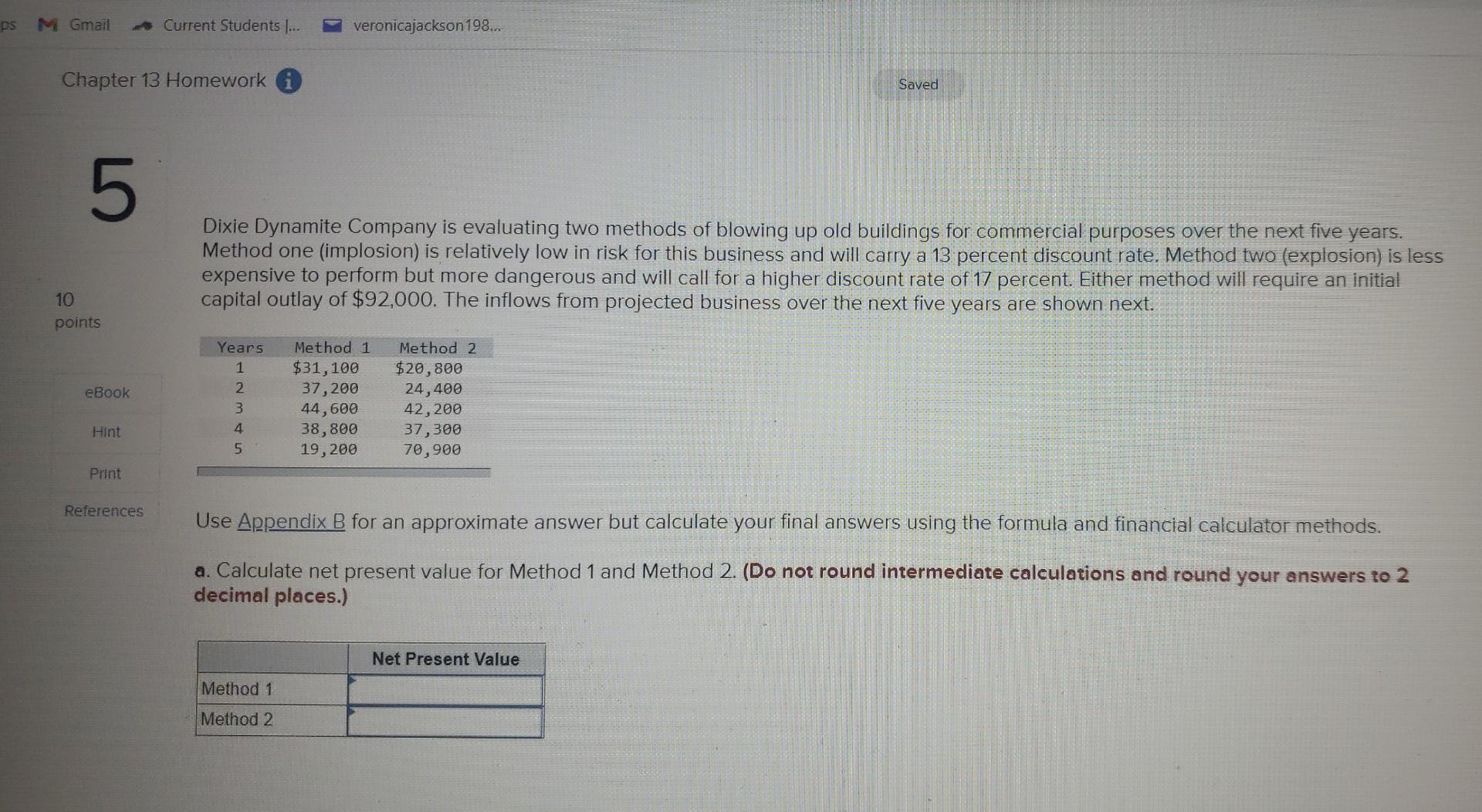

ps M Gmail Current Students .... veronicajackson 198... Chapter 13 Homework Saved LO Dixie Dynamite Company is evaluating two methods of blowing up old buildings for commercial purposes over the next five years. Method one (implosion) is relatively low in risk for this business and will carry a 13 percent discount rate. Method two (explosion) is less expensive to perform but more dangerous and will call for a higher discount rate of 17 percent. Either method will require an initial capital outlay of $92,000. The inflows from projected business over the next five years are shown next. 10 points Years 1 eBook Nm 2 3 4 5 Method 1 $31,100 37,200 44,600 38,800 19,200 Method 2 $20,800 24,400 42,200 37,300 70,900 Hint Print References Use Appendix B for an approximate answer but calculate your final answers using the formula and financial calculator methods. a. Calculate net present value for Method 1 and Method 2. (Do not round intermediate calculations and round your answers to 2 decimal places.) Net Present Value Method 1 Method 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started