Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ps. please indicate the formula. Thanks im advance. Godbless Armour Corporation has the following information for the current month: Units started Beginning Work in Process:

ps. please indicate the formula. Thanks im advance. Godbless

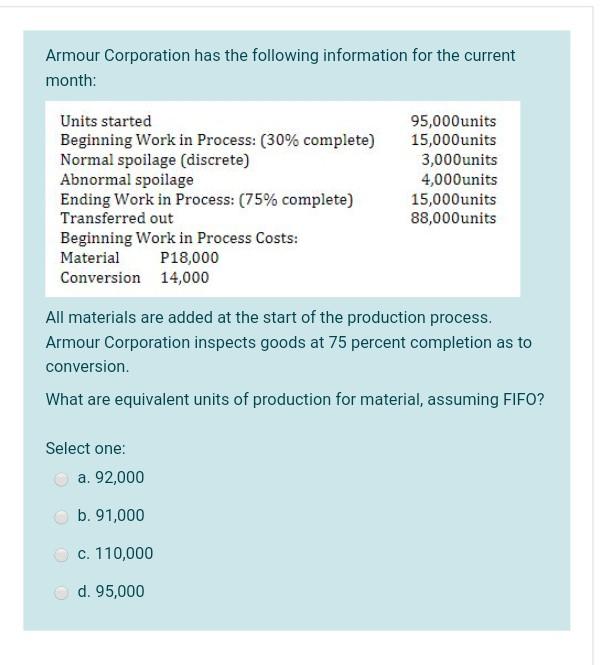

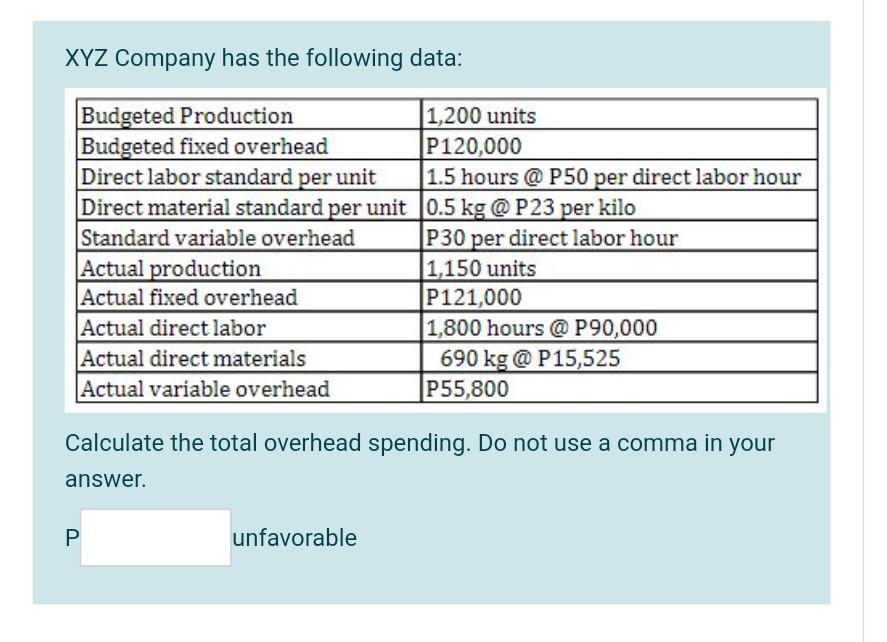

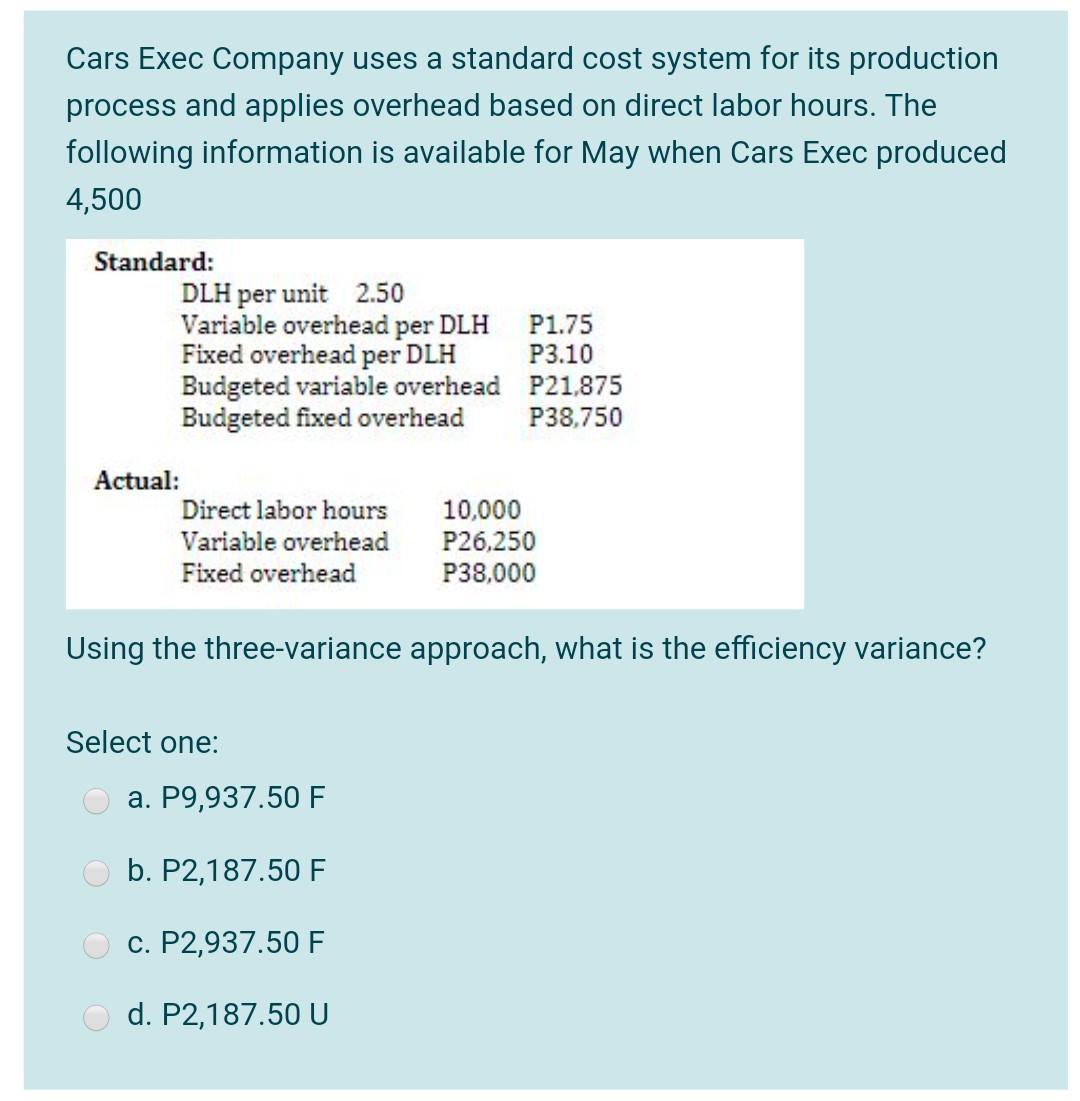

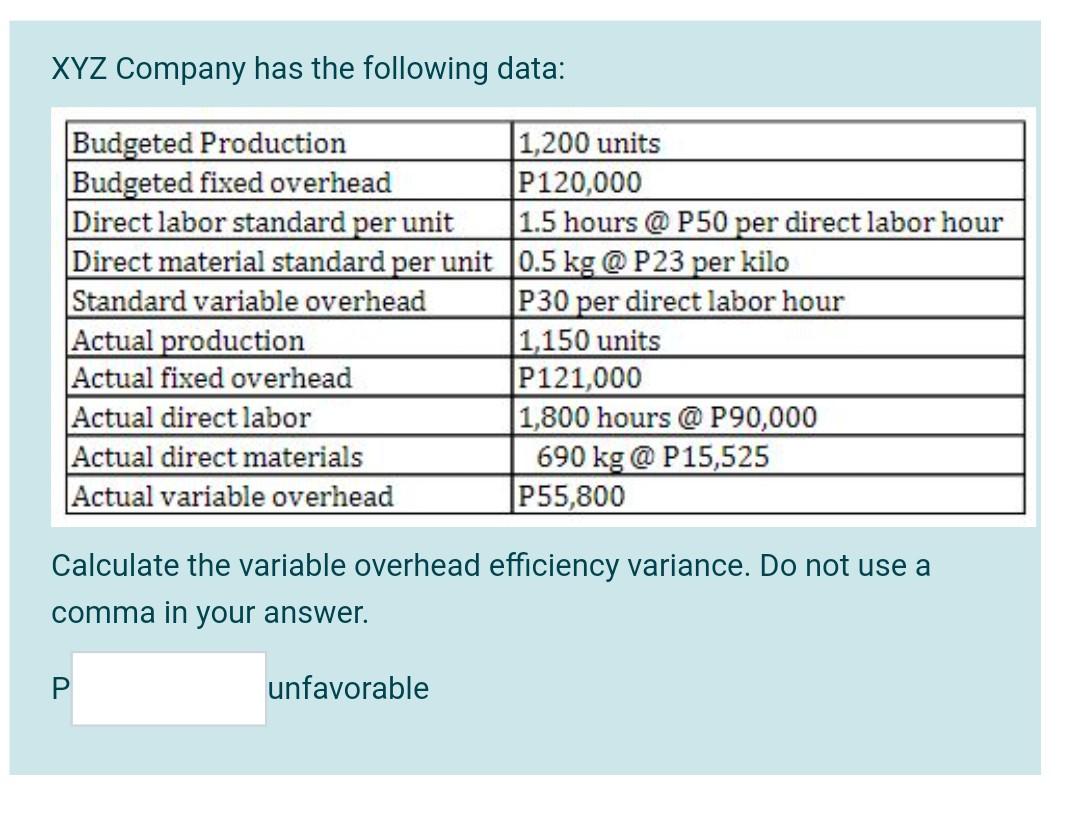

Armour Corporation has the following information for the current month: Units started Beginning Work in Process: (30% complete) Normal spoilage (discrete) Abnormal spoilage Ending Work in Process: (75% complete) Transferred out Beginning Work in Process Costs: Material P18,000 Conversion 14,000 95,000 units 15,000 units 3,000 units 4,000 units 15,000 units 88,000 units All materials are added at the start of the production process. Armour Corporation inspects goods at 75 percent completion as to conversion What are equivalent units of production for material, assuming FIFO? Select one: a. 92,000 b. 91,000 c. 110,000 ed. 95,000 XYZ Company has the following data: Budgeted Production 1,200 units Budgeted fixed overhead P120,000 Direct labor standard per unit 1.5 hours @ P50 per direct labor hour Direct material standard per unit 0.5 kg @ P23 per kilo Standard variable overhead P30 per direct labor hour Actual production 1,150 units Actual fixed overhead P121,000 Actual direct labor 1,800 hours @ P90,000 Actual direct materials 690 kg @ P15,525 Actual variable overhead P55,800 Calculate the total overhead spending. Do not use a comma in your answer. unfavorable Cars Exec Company uses a standard cost system for its production process and applies overhead based on direct labor hours. The following information is available for May when Cars Exec produced 4,500 Standard: DLH per unit 2.50 Variable overhead per DLH P1.75 Fixed overhead per DLH P3.10 Budgeted variable overhead P21,875 Budgeted fixed overhead P38.750 Actual: Direct labor hours Variable overhead Fixed overhead 10,000 P26.250 P38,000 Using the three-variance approach, what is the efficiency variance? Select one: a. P9,937.50 F b. P2,187.50 F c. P2,937.50 F d. P2,187.50 U XYZ Company has the following data: Budgeted Production 1,200 units Budgeted fixed overhead P120,000 Direct labor standard per unit 1.5 hours @ P50 per direct labor hour Direct material standard per unit 0.5 kg @ P23 per kilo Standard variable overhead P30 per direct labor hour Actual production 1,150 units Actual fixed overhead P121,000 Actual direct labor 1,800 hours @ P90,000 Actual direct materials 690 kg @ P15,525 Actual variable overhead P55,800 Calculate the variable overhead efficiency variance. Do not use a comma in your answer. unfavorableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started