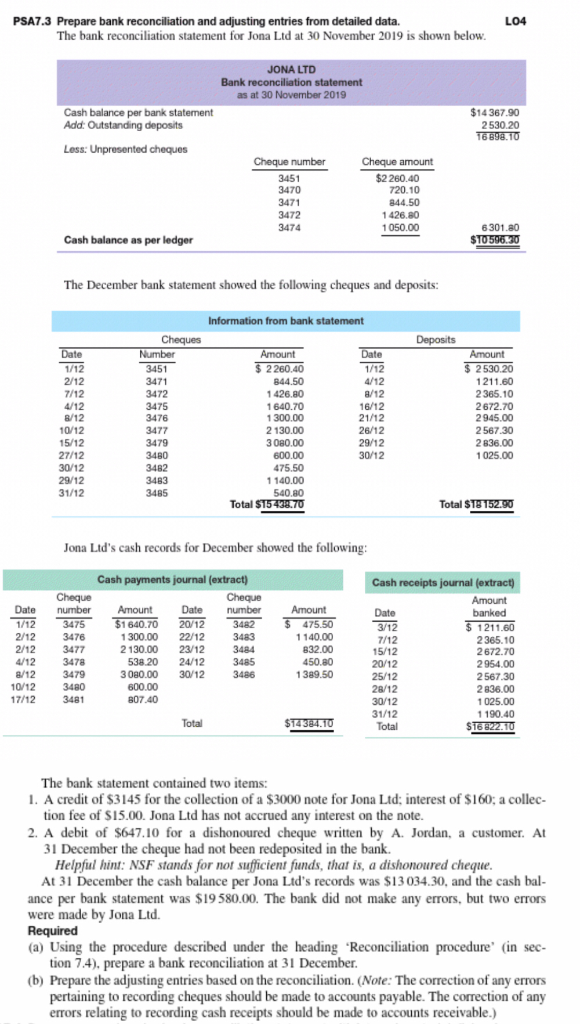

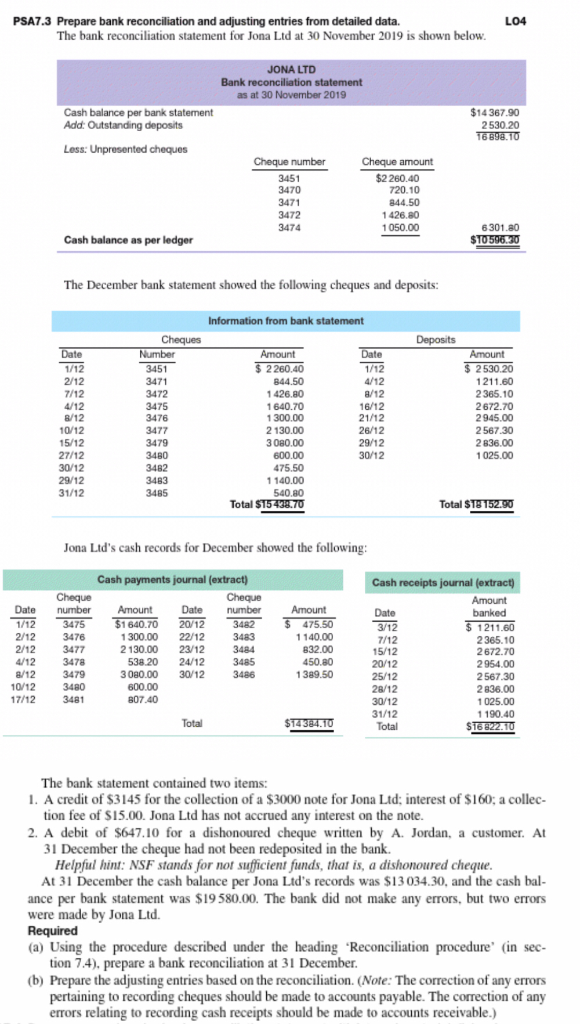

PSA7.3 Prepare bank reconciliation and adjusting entries from detailed data. LO4 The bank reconciliation statement for Jona Ltd at 30 November 2019 is shown below JONA LTD Bank reconciliation statement as at 30 November 2019 Cash balance per bank statement Add Outstanding deposits $14367.90 2530.20 Less: Unpresented cheques Cheque number Cheque amount $2260.40 3470 3471 3472 844.50 1 426.80 1 050.00 6301.80 Cash balance as per ledger The December bank statement showed the following cheques and deposits: Information from bank statement 3471 3472 3475 3476 3477 3479 3480 3482 3483 3485 2 260.40 844.50 1426.80 1640.70 300.00 2130.00 3080.00 600.00 475.50 1 140.00 540.80 2 530.20 1211.60 2365.10 2672.70 2945.00 2 567.30 2 836.00 1 025.00 2/12 16/12 26/12 29/12 30/12 15/12 30/12 31/12 Total 513 Total $T8152.90 ona Ltd's cash records for December showed the following Cash payments journal (extract) Cash receipts journal (extract) Cheque Amount Date number Amount Date number Date banked 1/12 3475 $1 640.70 12482 47550 312 3476 2/12 3477 3478 8/12 3479 3480 17/12 3481 1211.60 2365.10 2672.70 2954.00 2567.30 2 836.00 1 300.00 22/12 2130.00 23/12 3483 3484 1 140.00 832.00 450.80 1389.50 7/12 15/12 20/12 25/12 28/12 4/12 538.20 24/1 00.00 30/12 3486 10/12 600.00 807.40 31/12 1 190.40 Total I. A credit of $3145 for the collection of a $3000 note for Jona Ltd: interest of $160; a collec 2. A debit of S647.10 for a dishonoured cheque written by A. Jordan, a customer. A At 31 December the cash balance per Jona Ltd's records was $13 034.30, and the cash bal The bank statement contained two items: tion fee of S15.00. Jona Ltd has not accrued any interest on the note 31 December the cheque had not been redeposited in the bank. Helpful hint: NSF stands for not sufficient funds, that is, a dishonoured cheque ance per bank statement was $19 580.00. The bank did not make any errors, but two errors (a) Using the procedure described under the heading Reconciliation procedure in sec (b) Prepare the adjusting entries based on the reconlon (Note: The correction of any errors were made by Jona Ltd tion 7.4), prepare a bank reconciliation at 31 December pertaining to recording cheques should be made to accounts payable. The correction of any errors relating to recording cash receipts should be made to accounts receivable.)