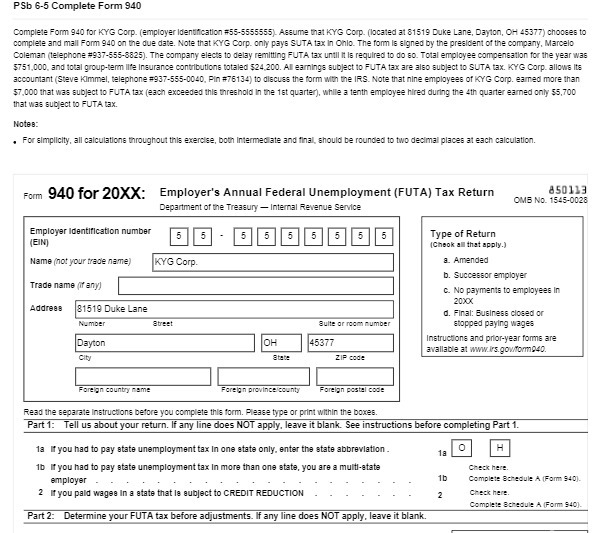

PSb 6-5 Complete Form 940 Complete Form 940 for KYG Corp. ( employer Identification #55-5555555). Assume that KYG Corp. (located at 81519 Duke Lane, Dayton, OH 45377) chooses to complete and mall Form 940 on the due date. Note that KYG Corp. only pays SUTA tax In Onlo. The form is signed by the president of the company, Marcelo Coleman (telephone #937-$55-8825). The company elects to delay remitting FUTA tax until It Is required to do co. Total employee compensation for the year was $751,000, and total group-term life Insurance contributions totaled $24,200. All eaimings subject to FUTA tax are also subject to SUTA tax. KYG Corp. allows It: accountant (Steve Kimmel, telephone #937-555-0040, PIn #76134) to discuss the form with the IR.S. Note that nine employees of KYG Corp. eaimed more than $7,000 that was subject to FUTA tax (each exceeded this threshold In the 1at quarter), while a tenth employee hired during the 4th quarter eaimed only $5,700 that was subject to FUTA tax. Notes: For simplicity, all calculations throughout this exercise, both Intermediate and final, should be rounded to two decimal places at each calculation. Form 940 for 20XX: Employer's Annual Federal Unemployment (FUTA) Tax Return 850113 OMB No. 1545-0028 Department of the Treasury - Internal Revenue Service Employer Identification number 5 (EIN] 5 5 5 5 5 5 Type of Return (Chook all that apply.) Name (not your trade name) KYG Corp. 8. Amended b. Successor employer Trade name (any) . No payments to employees In 20XX Address 81519 Duke Lane d. Final: Business closed or Number atrest Butte or room number stopped paying wages Dayton OH 45377 Instructions and prior-year forms are awallable at www.is.gowform040. atube ZIP code Foreign country name Foreign province county Foreign postal code Read the separate Instructions before you complete this form. Please type or print within the boxes. Part 1: Tell us about your return. If any line does NOT apply, leave it blank. See instructions before completing Part 1. la If you had to pay state unemployment tax In one etate only. enter the state abbreviation . H 18 1b If you had to pay state unemployment tax In more than one state, you are a multi-etate Check here. employer 1b Complete 8chedule A [Form 940). 2 If you pald wages In a state that le subject to CREDIT REDUCTION 2 Check here. Complete Bchedule A (Form 840]. Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank