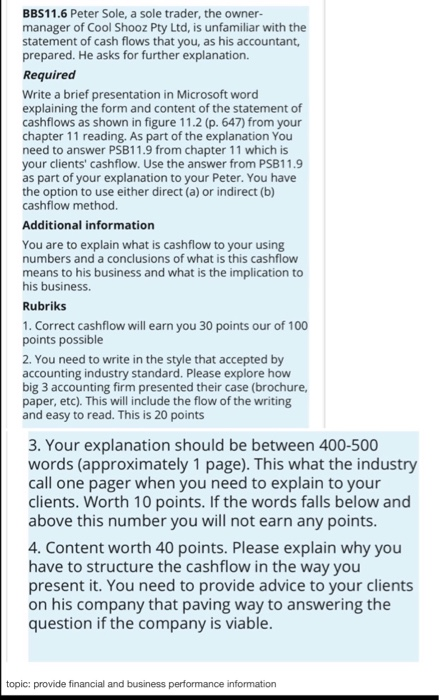

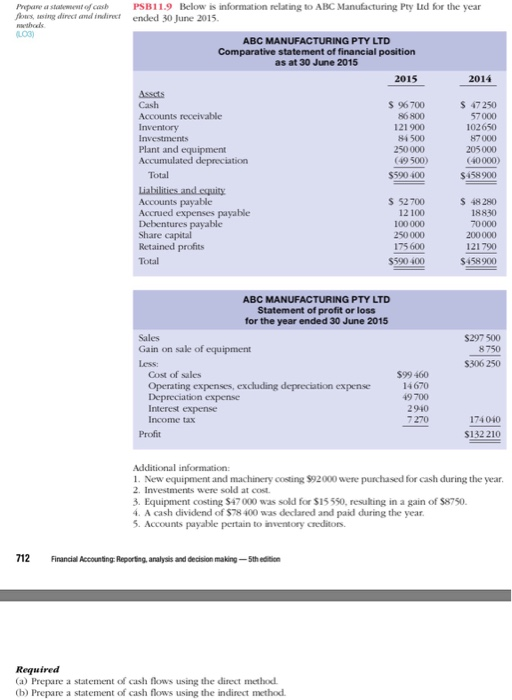

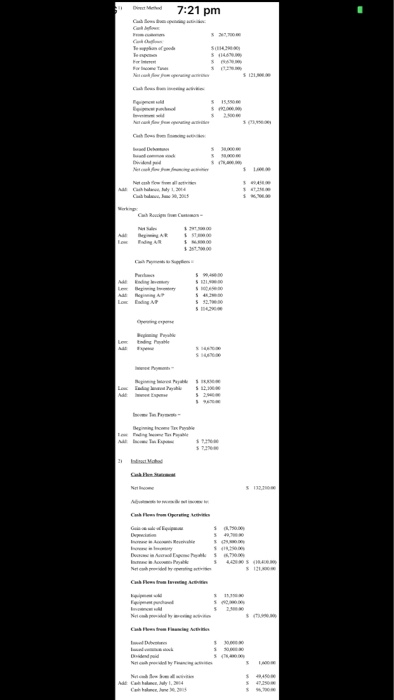

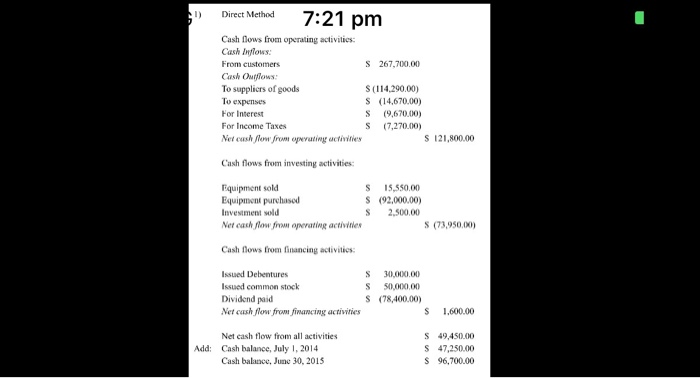

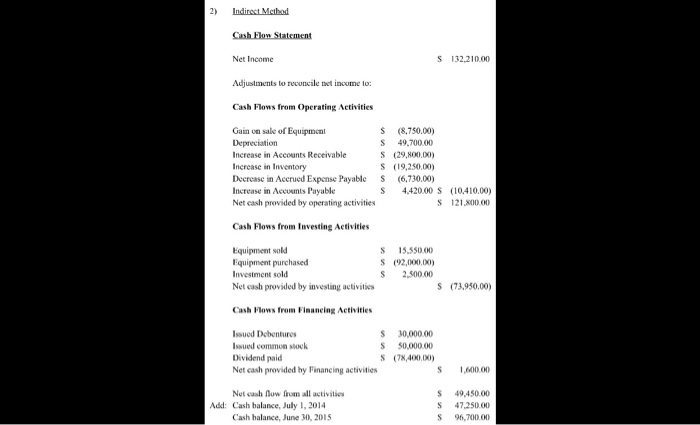

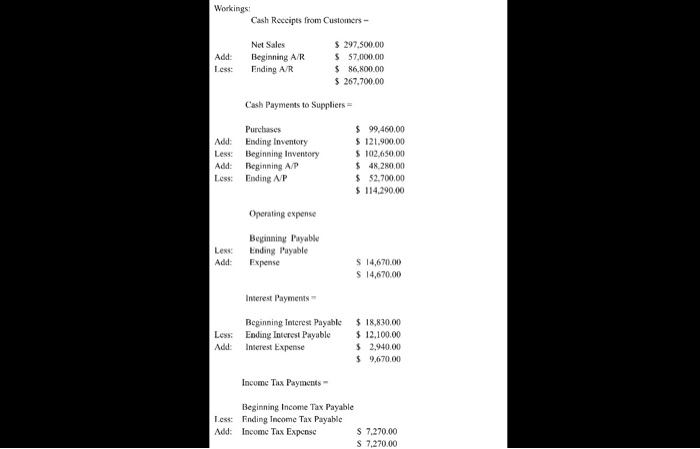

PSB11.9 Below is information relating to ABC Manufacturing Pty Ltd for the year ended 30 June 2015 Prpare a statewent of cash fows, eing dinect and indirect wthods (LO3) ABC MANUFACTURING PTY LTD Comparative statement of finaneial position as at 30 June 2015 2015 2014 Assets Cash $ 96700 86800 47250 57000 102650 Accounts receivable Inventory Investments Plant and equipment Accumulated depreciation 121 900 84500 87000 250000 205000 (49500) (40000) Total $590 400 $458900 Liabilitics and equity Accounts payable Accrued expenses payable Debentures payable Share capital Retained profits S 52700 S 48 280 18830 70000 12 100 100 000 250000 200000 175 600 121790 Total $590 400 $458900 ABC MANUFACTURING PTY LTD Statement of profit or loss for the year ended 30 June 2015 Sales Gain on sale of equipment $297 500 8750 Less: $306 250 Cost of sales $99 460 Operating expenses, excluding depreciation expense Depreciation expense Interest expense 14670 49700 2940 Income tax 7270 174040 Profit $132210 Additional information: 1. New equipment and machinery costing $92000 were purchased for cash during the year. 2. Investments were sold at cost. 3. Equipment costing $47000 was sold for $15 550, resuking in a gain of $8750. 4. A cash dividend of $78 400 was declared and paid during the year. 5. Accounts payable pertain to inventory creditors. 712 Financial Accounting: Reporting, analysis and decision making-5th edition Required (a) Prepare a statement of cash flows using the direct method (b) Prepare a statement of cash flows using the indirect method. FORMAT OF THE STATEMENT OF CASH FLOWS The three activities discussed previously-operating, investing and financing -make up the general format of the statement of cash flows. A widely used form of the statement of cash flows is shown in figure 11.2 COMPANY NAME Statement of cash flows Period covered Cash flows from operating activities (List of individual items) xx Net cash provided (used) by operating activities Cash flows from investing activities (List of individual inflows and outflows) XXX Xx Net cash provided (used) by investing activities Cash flows from financing activities (List of individual inflows and outflows) Net cash provided (used) by financing activities Xxx XX XXx Net increase (decrease) in cash Cash at beginning of period Cash at end of period Xxx Figure 11.2 Format of the statement of cash flows Xxx There are two methods of presenting cash provided (used) by operating activities: the direct method and the indirect method. The direct method presents cash payments as deductions from cash receipts to determine 'Net cash provided (used) by operating activities. The cash receipts and payments may be determined by adjusting items in the statement of profit or loss from the accrual basis to the cash basis. The indirect method starts with profit and adjusts it for timing differences, non-cash items, and any investing or financing items included in profit, to determine 'Net cash provided (used) by operating activities. The indirect method recconciles profit to net cash pro- vided (used) by operating activities. Both methods arrive at the same result for Net cash provided (used) by operating activities, but differ in the disclosure of items on the face of the statement of cash flows. The direct method is more consistent with the objective of a statement of cash flows because it shows operating cash receipts and payments. Note that the two different methods affect only the operating activities section; the sections of the statement of cash flows pertaining to investing activities and financing activities are not affected by the choice of method for the operating activities section. 647 Chapter 11: Statement of cash flows D M 7:21 pm C ods s 04 Tep Pr T Nm S121 Ca oas inga s 590 200 w g Nk a uan cm e Dekd pd Nto he enn Ntsh Ghulavs dy 2a4 C bul Ju30, 205 1 4tt1ea Cah Rig C s B AR d A 272000 S1 L Beging Lo Eading A Opeing p Peac s gg Py L a Pay Ep 2 T P dg Aa T ap 572 2 dct Mhod Ntome C ring s Do i Aaratw k Py Set e g 6T000 4420 Re Ac Ceb Fle fr 2 s T Net by oin ed pid N d by te N edwv 450 7:21 pm Direct Method Cash flows from operating activities Cash Inflows S 267,700.00 From customers Cash Outflows To supplicrs of goods S (114,290.00) To expenses S 14,670.00) For Interest S (9,670.00) For Income Taxes S (7,270.00) Net cash flow from operating activities S 121,800.00 Cash flows from investing activities Equipment sold Equipment purchased 15,550.00 s (92.000.00) 2,500.00 S Invesment sold Net cash flow frm aperating activities S (73,950.00) Cash flows from financing activitics 30,000.00 50,000.00 s (78,400.00) Issued Debentures S Issued common stock Dividend paid Net cash flow from financing activities 1600.00 S S 49,450,00 S 47,250.00 s 96,700,00 Net cash flow from all activities Cash balance, July 1, 2014 Add: Cash balance, June 30, 2015 Indirect Method 21 Cash Flow Statement Net Income S 132,210.00 Adjustments to reconcile net income to: Cash Flows from Operating Activities Gain on sale of Equipment S (8,750.00) 49,700.00 S (29,800,00) S (19,250.00) Depreciation S Increase in Accounts Receivable Increase in Inventory Decrease in Acerued Expense Payable Increase in Accounts Payable Net cash provided by operating activities S (6,730.00) 4,420.00 S (10,410.00) S 121,800 00 Cash Flows from Investing Activities Equipment sold Equipment purchased 15.550.00 S S (2,000.00) Investment sold 2,500.00 S (73,950.00) Net cash provided by investing activities Cash Flows from Financing Activities Issued Debentures S 30,000.00 Issued common stock Dividend paid Net cash provided hy Financing activities 50,000.00 s (78,400.00) S 1,600.00 Net cash low from all activitios 49,450.00 47,250.00 96.700.00 Add: Cash balance, July 1, 2014 Cash balance, June 30, 2015 S Workings: Cash Reccipts from Customers Net Sales S297,500.00 Beginning A/R Ending A/R S 57,000.00 S 86.800.00 $ 267,700.00 Add: Less Cash Payments to Suppliers S99,460.00 Purchases Add: Ending Inventory Beginning Inventory Beginning A/P Ending A/P $121.900.00 $102.650.00 $48,280,00 Less Add Less 52,700.00 S114,290.00 Operating expense Beginning Payable Ending Payable Expense Less S 14.670.00 S 14,670.00 Add Interest Payments Beginning Interest Payable Ending Interest Payable $18,830.00 $ 12.100.00 $ 2,940.00 Less Add: Interest Expense $9,670.00 Income Tax Payments Beginning Income Tax Payable Less: Ending Income Tax Payable S 7.270.00 Add: Income Tax Expense S 7,270.00