Answered step by step

Verified Expert Solution

Question

1 Approved Answer

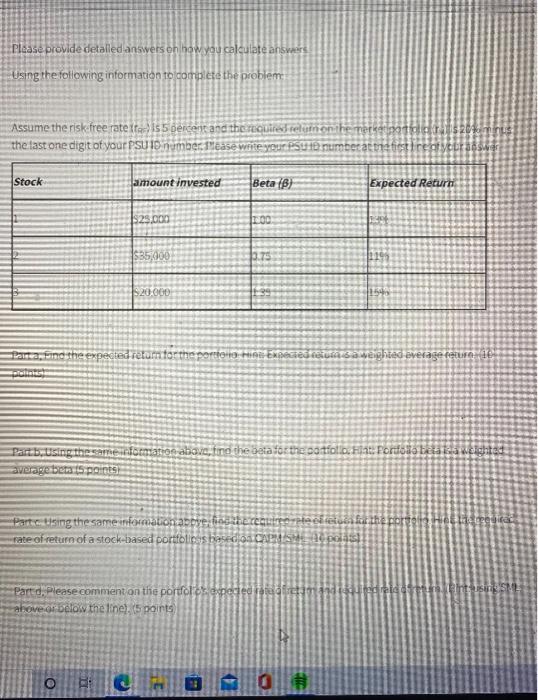

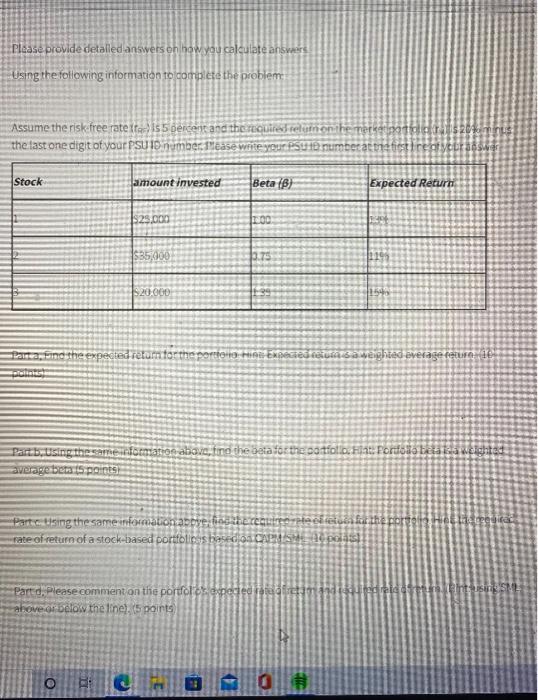

psu id number last digit is 6 Please provide detalled answers on how you calculate answers Using the following information to complete the problem Assume

psu id number last digit is 6

Please provide detalled answers on how you calculate answers Using the following information to complete the problem Assume the risk free rate it is 5 percent and the requires relation the metrotimetadaszok the last one digit of your PSU 10 number. Mease write your number attrictinentettaisies Stock amount invested Beta ) Expected Return $29.000 100 $35,000 119 20.000 154 Panta, find the expected return to the porta Huo: Expected to a weighted average nature de BA Part by using the same formation above ting the best for the patolo. Hat: Forfosa teates wichtad average bets is points 13 HAL route Parto tising the same formation above Goethe regio Hee elu at the rate of return of a stock-based portfolios basedo Splash Partd. Please comment on the portfolenceded detailidelser ahove or below the line, 5 points O RH 4 Please provide detalled answers on how you calculate answers Using the following information to complete the problem Assume the risk free rate it is 5 percent and the requires relation the metrotimetadaszok the last one digit of your PSU 10 number. Mease write your number attrictinentettaisies Stock amount invested Beta ) Expected Return $29.000 100 $35,000 119 20.000 154 Panta, find the expected return to the porta Huo: Expected to a weighted average nature de BA Part by using the same formation above ting the best for the patolo. Hat: Forfosa teates wichtad average bets is points 13 HAL route Parto tising the same formation above Goethe regio Hee elu at the rate of return of a stock-based portfolios basedo Splash Partd. Please comment on the portfolenceded detailidelser ahove or below the line, 5 points O RH 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started