Answered step by step

Verified Expert Solution

Question

1 Approved Answer

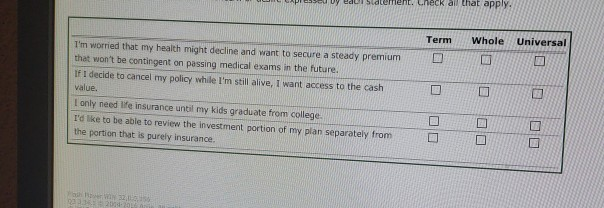

PSuby eau std ment. theck all that apply Term Whole Universal I'm worried that my health might decline and want to secure a steady premium

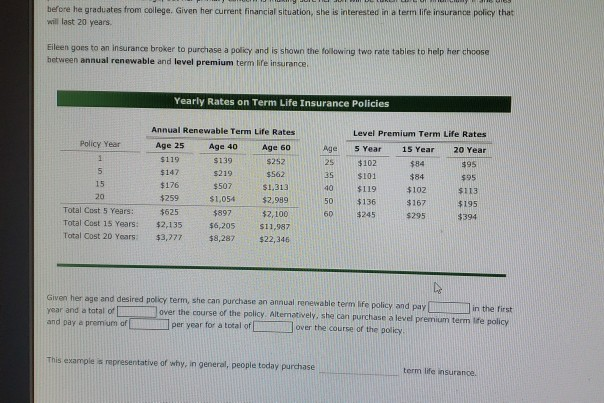

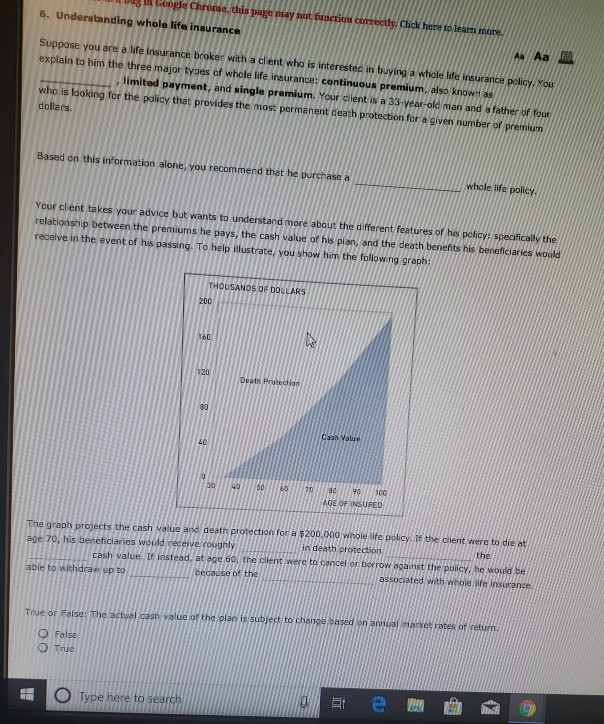

PSuby eau std ment. theck all that apply Term Whole Universal I'm worried that my health might decline and want to secure a steady premium that won't be contingent on passing medical exams in the future. If I decide to cancel my policy while I'm still alive, I want access to the cash value. I only need life insurance until my kids graduate from college I'd lke to be able to review the investment portion of my plan separately from the portion that is purely insurance. before he graduates from college. Given her current financial situation, she is interested in a term life insurance policy that will last 20 years. n goes to an insurance broker to purchase a policy and is shown the following two rate tables to help her chcose between annual renewable and level premium term life insurance, Yearly Rates on Term Life Insurance Policies Annual Renewable Term Life Rates Age 25 Age 40 Age 60 $139 $219 $507 $1,054 $897 Level Premium Term Life Rates Policy Year $252 $562 $1,313 $2,989 $2,100 Total Cost 15 Years:2,135 $6,205 $11,987 Total Cost 20 Years $3,377 $8,287 $22,346 $119 $147 $176 $259 $625 Age 5 Year 15 Year20 Year 25 102 35 40 $119 50$136 60 $245 $84 $84 $102 $167 $295 $95 $95 $113 $195 $394 $101 15 20 Total Cost 5 Years Given her age and desired policy term, she can purchase an annual renewable term life policy and pay rear and a total of and pay a premurnar per year for a total of in the first over the course of the policy Alternatively, she can purchase a level premium term Iife policy lover the course of the poliey This example s representative of why, in general, peoplie today purchase term life insurance. 6. Understanding whole life insurance Suppose you are a life insurance broker with a client who is interested in buying a whole life insurance pelicy. You explain to him the three major types of whole life insurance: continuous premium, also knowras limited payment, and single premium. Your dlient is a 33-year-old man and a father of four who is looking for the policy that provides the most permanent death protection for a given number of premium dollars. Based on this information alone, you recommend thet he purcnase a Your client takes your advice but wants to understand more about the different features of hs policy: speofically the relationship between the premiums he pays, the cash value of his pian, and the death benefits his beneficiaries would receive in the event of his passing. To help ilustrate you show him the folloving graph THOUSANDS OF DOLLARS 200 80 40 0809000 AGE OF INSURED The graph projects the cash value and death Protection for $200.000whole life Pelicy, e the dlent were to die at the cash value. If instead. at ege 60, the dlient werc to concer or borrow against the policy he would be able to withdrav op to t to d O False O True O Type here to sear PSuby eau std ment. theck all that apply Term Whole Universal I'm worried that my health might decline and want to secure a steady premium that won't be contingent on passing medical exams in the future. If I decide to cancel my policy while I'm still alive, I want access to the cash value. I only need life insurance until my kids graduate from college I'd lke to be able to review the investment portion of my plan separately from the portion that is purely insurance. before he graduates from college. Given her current financial situation, she is interested in a term life insurance policy that will last 20 years. n goes to an insurance broker to purchase a policy and is shown the following two rate tables to help her chcose between annual renewable and level premium term life insurance, Yearly Rates on Term Life Insurance Policies Annual Renewable Term Life Rates Age 25 Age 40 Age 60 $139 $219 $507 $1,054 $897 Level Premium Term Life Rates Policy Year $252 $562 $1,313 $2,989 $2,100 Total Cost 15 Years:2,135 $6,205 $11,987 Total Cost 20 Years $3,377 $8,287 $22,346 $119 $147 $176 $259 $625 Age 5 Year 15 Year20 Year 25 102 35 40 $119 50$136 60 $245 $84 $84 $102 $167 $295 $95 $95 $113 $195 $394 $101 15 20 Total Cost 5 Years Given her age and desired policy term, she can purchase an annual renewable term life policy and pay rear and a total of and pay a premurnar per year for a total of in the first over the course of the policy Alternatively, she can purchase a level premium term Iife policy lover the course of the poliey This example s representative of why, in general, peoplie today purchase term life insurance. 6. Understanding whole life insurance Suppose you are a life insurance broker with a client who is interested in buying a whole life insurance pelicy. You explain to him the three major types of whole life insurance: continuous premium, also knowras limited payment, and single premium. Your dlient is a 33-year-old man and a father of four who is looking for the policy that provides the most permanent death protection for a given number of premium dollars. Based on this information alone, you recommend thet he purcnase a Your client takes your advice but wants to understand more about the different features of hs policy: speofically the relationship between the premiums he pays, the cash value of his pian, and the death benefits his beneficiaries would receive in the event of his passing. To help ilustrate you show him the folloving graph THOUSANDS OF DOLLARS 200 80 40 0809000 AGE OF INSURED The graph projects the cash value and death Protection for $200.000whole life Pelicy, e the dlent were to die at the cash value. If instead. at ege 60, the dlient werc to concer or borrow against the policy he would be able to withdrav op to t to d O False O True O Type here to sear

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started