Question

Pt. 1 Pt. 2a Using the budget in part 1; Use as many time lines as you need forecast all your projected savings(investments) to get

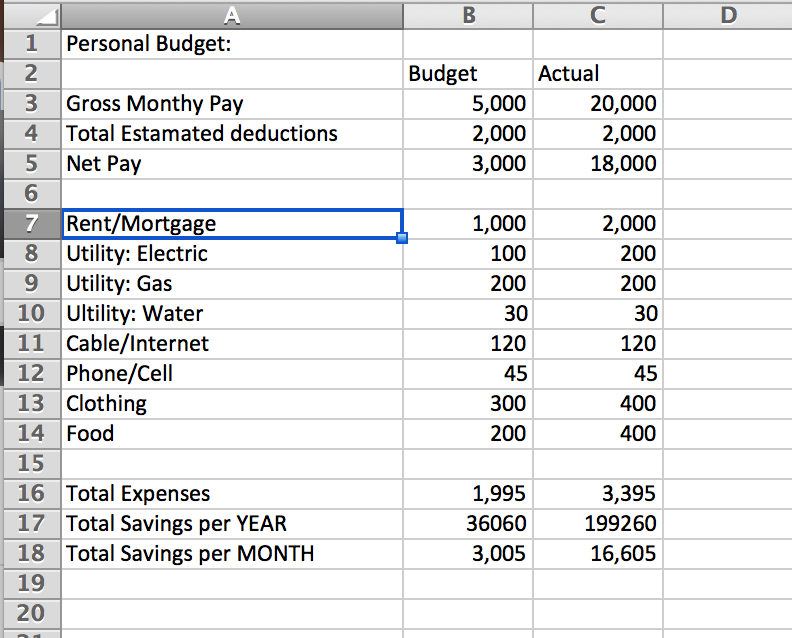

Pt. 1

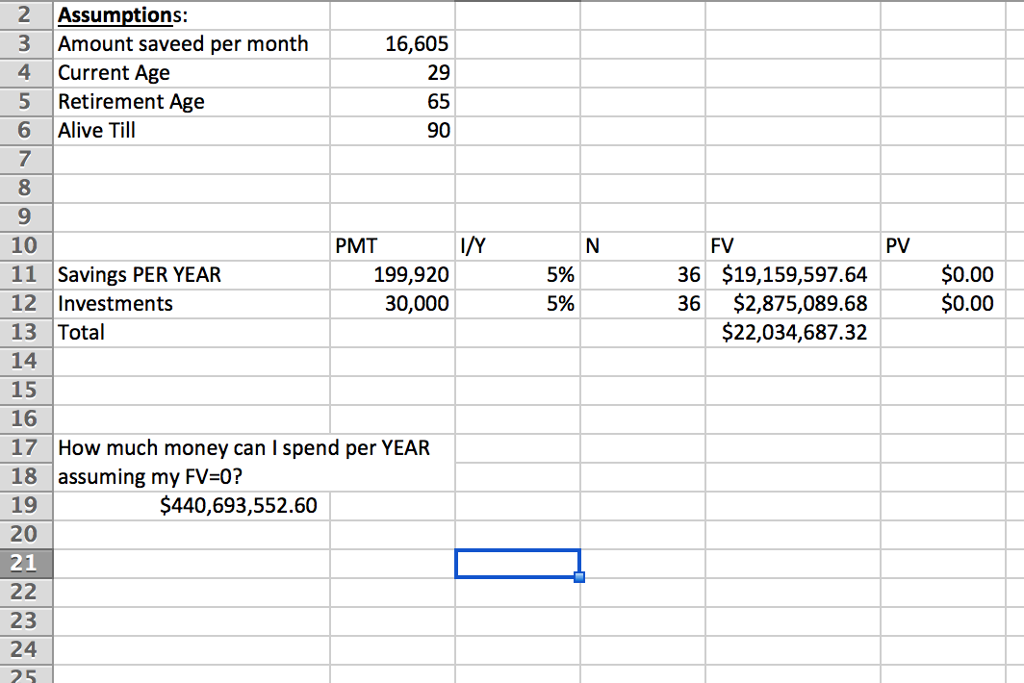

Pt. 2a

Using the budget in part 1; Use as many time lines as you need forecast all your projected savings(investments) to get each investments future value. You will have to determine your PV, I/y, N, PMT then calc FV

Once you add up all the future values from step 2 above, and do a time line to determine how much you will be able to spend each year assuming you are going to spend all your money. I.e. your future value will be 0. To calculate N, you have to make a lot of assumptions. For example, if you are planning on retiring at age 65 and think (hope) you will life until you are 90 (25 years) your N will be 25.

I calculated... BUT, my HOW MUCH MONEY I CAN SPEND IF MY FUTURE VALUE= 0 is wrong, and I don't know why.

Pt. 2B

Scenario Analysis (PLEASE HELP!!!)

1. What happens if you delay start of Savings for 5 years?

2. What happens if you work 3 more years?

3. What if the interest rate is higher/lower?

4. What if you have more to save after student loans are paid off?

1 Personal Budget: 2 3 Gross Monthy Pay 4 Total Estamated deductions 5 Net Pay 6 7 Rent/Mortgage 8 Utility: Electric Budget Actual 5,000 2,000 3,000 20,000 2,000 18,000 1,000 100 200 30 120 45 300 200 2,000 200 200 30 120 45 400 400 9 Utility: Gas 10 Ultility: Water 11 Cable/Internet 12 Phone/Cell 13 Clothing 14 Food 15 16 Total Expenses 17 Total Savings per YEAIR 18Total Savings per MONTH 19 20 1,995 36060 3,005 3,395 199260 16,605 1 Personal Budget: 2 3 Gross Monthy Pay 4 Total Estamated deductions 5 Net Pay 6 7 Rent/Mortgage 8 Utility: Electric Budget Actual 5,000 2,000 3,000 20,000 2,000 18,000 1,000 100 200 30 120 45 300 200 2,000 200 200 30 120 45 400 400 9 Utility: Gas 10 Ultility: Water 11 Cable/Internet 12 Phone/Cell 13 Clothing 14 Food 15 16 Total Expenses 17 Total Savings per YEAIR 18Total Savings per MONTH 19 20 1,995 36060 3,005 3,395 199260 16,605

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started