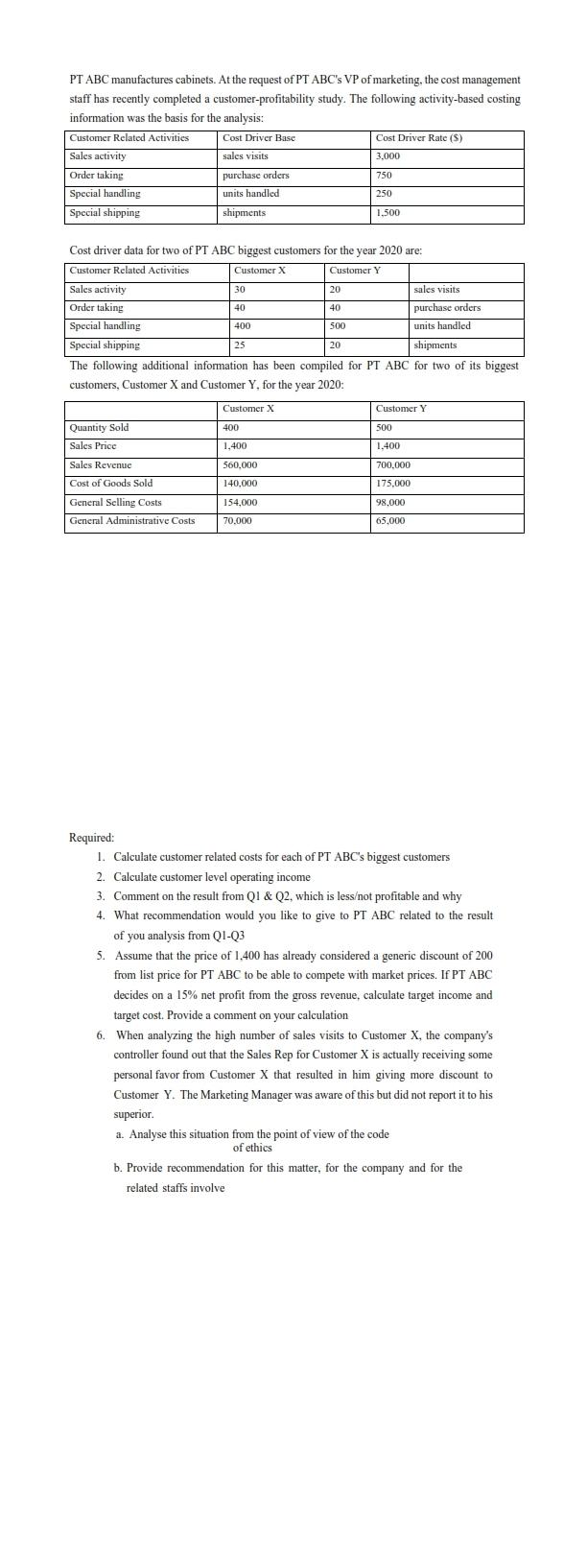

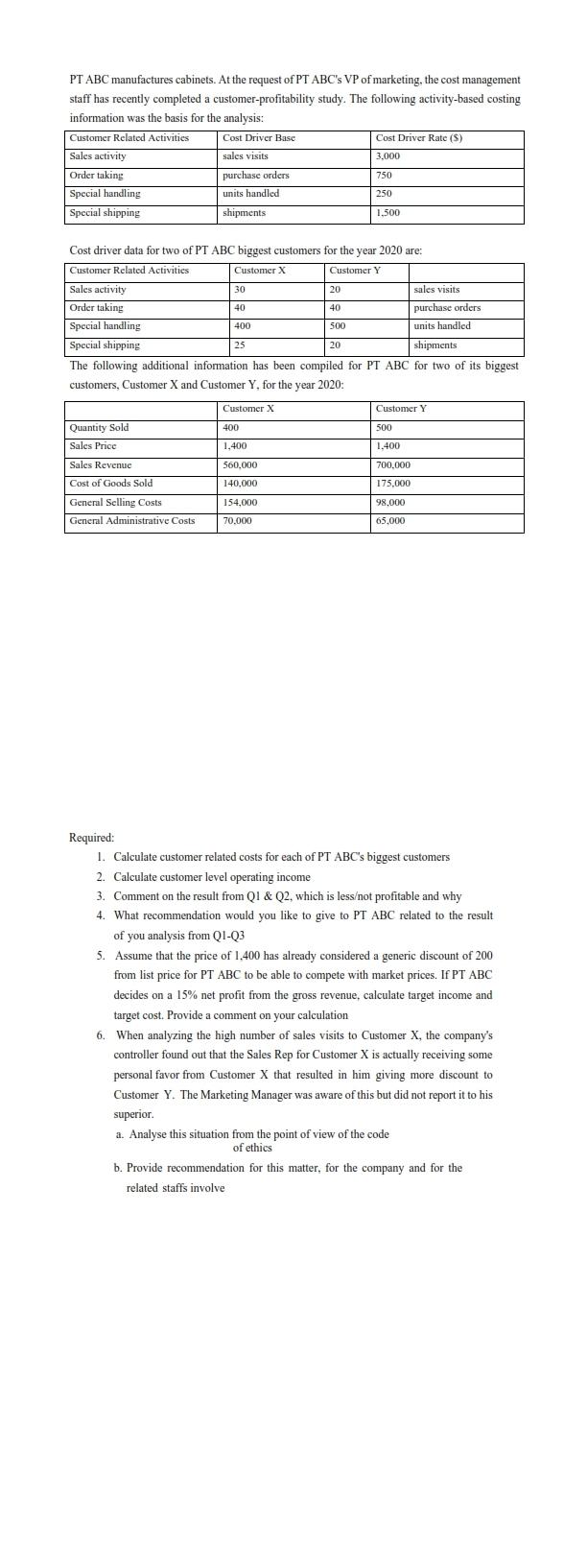

PT ABC manufactures cabinets. At the request of PT ABC's VP of marketing, the cost management staff has recently completed a customer-profitability study. The following activity-based costing information was the basis for the analysis: Cost driver data for two of PT ABC biggest customers for the year 2020 are: The following additional information has been compiled for PT ABC for two of its biggest customers, Customer X and Customer Y, for the year 2020: Required: 1. Calculate customer related costs for each of PT ABC's biggest customers 2. Calculate customer level operating income 3. Comment on the result from Q1&Q2, which is lessot profitable and why 4. What recommendation would you like to give to PT ABC related to the result of you analysis from Q1Q3 5. Assume that the price of 1,400 has already considered a generic discount of 200 from list price for PT ABC to be able to compete with market prices. If PTABC decides on a 15% net profit from the gross revenue, calculate target income and target cost. Provide a comment on your calculation 6. When analyzing the high number of sales visits to Customer X, the company's controller found out that the Sales Rep for Customer X is actually receiving some personal favor from Customer X that resulted in him giving more discount to Customer Y. The Marketing Manager was aware of this but did not report it to his superior. a. Analyse this situation from the point of view of the code of ethics b. Provide recommendation for this matter, for the company and for the related staffs involve PT ABC manufactures cabinets. At the request of PT ABC's VP of marketing, the cost management staff has recently completed a customer-profitability study. The following activity-based costing information was the basis for the analysis: Cost driver data for two of PT ABC biggest customers for the year 2020 are: The following additional information has been compiled for PT ABC for two of its biggest customers, Customer X and Customer Y, for the year 2020: Required: 1. Calculate customer related costs for each of PT ABC's biggest customers 2. Calculate customer level operating income 3. Comment on the result from Q1&Q2, which is lessot profitable and why 4. What recommendation would you like to give to PT ABC related to the result of you analysis from Q1Q3 5. Assume that the price of 1,400 has already considered a generic discount of 200 from list price for PT ABC to be able to compete with market prices. If PTABC decides on a 15% net profit from the gross revenue, calculate target income and target cost. Provide a comment on your calculation 6. When analyzing the high number of sales visits to Customer X, the company's controller found out that the Sales Rep for Customer X is actually receiving some personal favor from Customer X that resulted in him giving more discount to Customer Y. The Marketing Manager was aware of this but did not report it to his superior. a. Analyse this situation from the point of view of the code of ethics b. Provide recommendation for this matter, for the company and for the related staffs involve