Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PT. ABC uses a job-order costing system to produce custom lamps. The predetermined overhead rate is based on the allocation base of the number

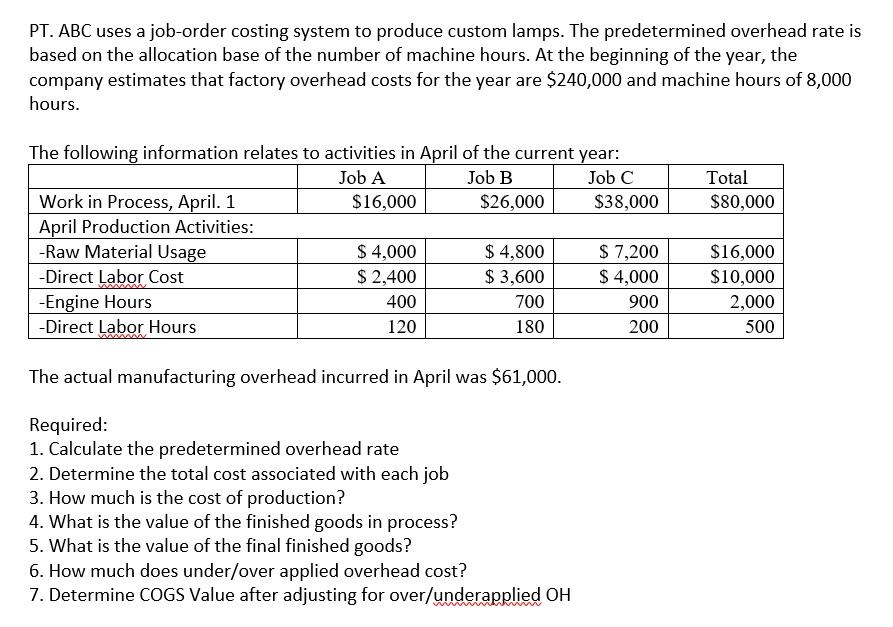

PT. ABC uses a job-order costing system to produce custom lamps. The predetermined overhead rate is based on the allocation base of the number of machine hours. At the beginning of the year, the company estimates that factory overhead costs for the year are $240,000 and machine hours of 8,000 hours. The following information relates to activities in April of the current year: Job A Job B Job C Total Work in Process, April. 1 April Production Activities: -Raw Material Usage $16,000 $26,000 $38,000 $80,000 $ 4,000 $ 2,400 $ 4,800 $ 3,600 $ 7,200 $ 4,000 $16,000 -Direct Labor Cost $10,000 -Engine Hours -Direct Labor Hours 400 700 900 2,000 120 180 200 500 The actual manufacturing overhead incurred in April was $61,000. Required: 1. Calculate the predetermined overhead rate 2. Determine the total cost associated with each job 3. How much is the cost of production? 4. What is the value of the finished goods in process? 5. What is the value of the final finished goods? 6. How much does under/over applied overhead cost? 7. Determine COGS Value after adjusting for over/underapplied OH

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Predetermined overhead rate Estimated factory overheads Estimated machine hours Predetermined over...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started