Question

PT Bag Fashion is a company that produces export quality leather bags. The company has two divisions profit center, namely the Tanning Division and the

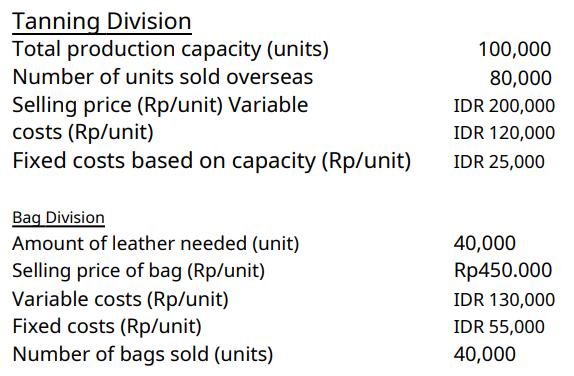

PT Bag Fashion is a company that produces export quality leather bags. The company has two divisions profit center, namely the Tanning Division and the Bag Division. Tanning Division 4 selling tanned cowhide to foreign customers. Currently the Tanning Division still has remaining capacity if it has to sell the leather to the Bag Division. However, if it has to fulfill all the demands of the Bag Division, the Tanning Division will sacrifice some of its overseas customers. The following is data related to the Tanning Division and the Bag Division:

Question:

a. Looking at the situation in the two divisions, what should be the minimum transfer fee that should be set by the Tanning Division? Explain!

b. Perform the calculation of the minimum transfer fee according to the answer to number a.

c. What is the maximum transfer fee that the Tanning Division can charge the Bags Division? Explain why!

d. Suppose it is known that the Bag Division can get a supply of leather at a domestic (local) price of Rp. 175,000 per unit. Does the Tanning Division have to accept the Rp175,000 price tag? Explain why! Is there additional profit? Give the analysis backed by calculations! (7%)

Tanning Division Total production capacity (units) Number of units sold overseas Selling price (Rp/unit) Variable costs (Rp/unit) Fixed costs based on capacity (Rp/unit) Bag Division Amount of leather needed (unit) Selling price of bag (Rp/unit) Variable costs (Rp/unit) Fixed costs (Rp/unit) Number of bags sold (units) 100,000 80,000 IDR 200,000 IDR 120,000 IDR 25,000 40,000 Rp450.000 IDR 130,000 IDR 55,000 40,000

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a The minimum transfer fee should be set by considering the opportunity cost for the Tanning Divisio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started